Trump’s decision to bomb Iran and kill the Supreme Leader of over 200 million Shia Moslems was taken without the consideration and approval of Congress and without the cooperation of other Western countries. It is the typical act of a dictator and has embroiled America in what looks like an unplanned war situation. This may prove to be very difficult to conclude on any reasonable basis, and especially without a significant cost both in money and American lives.

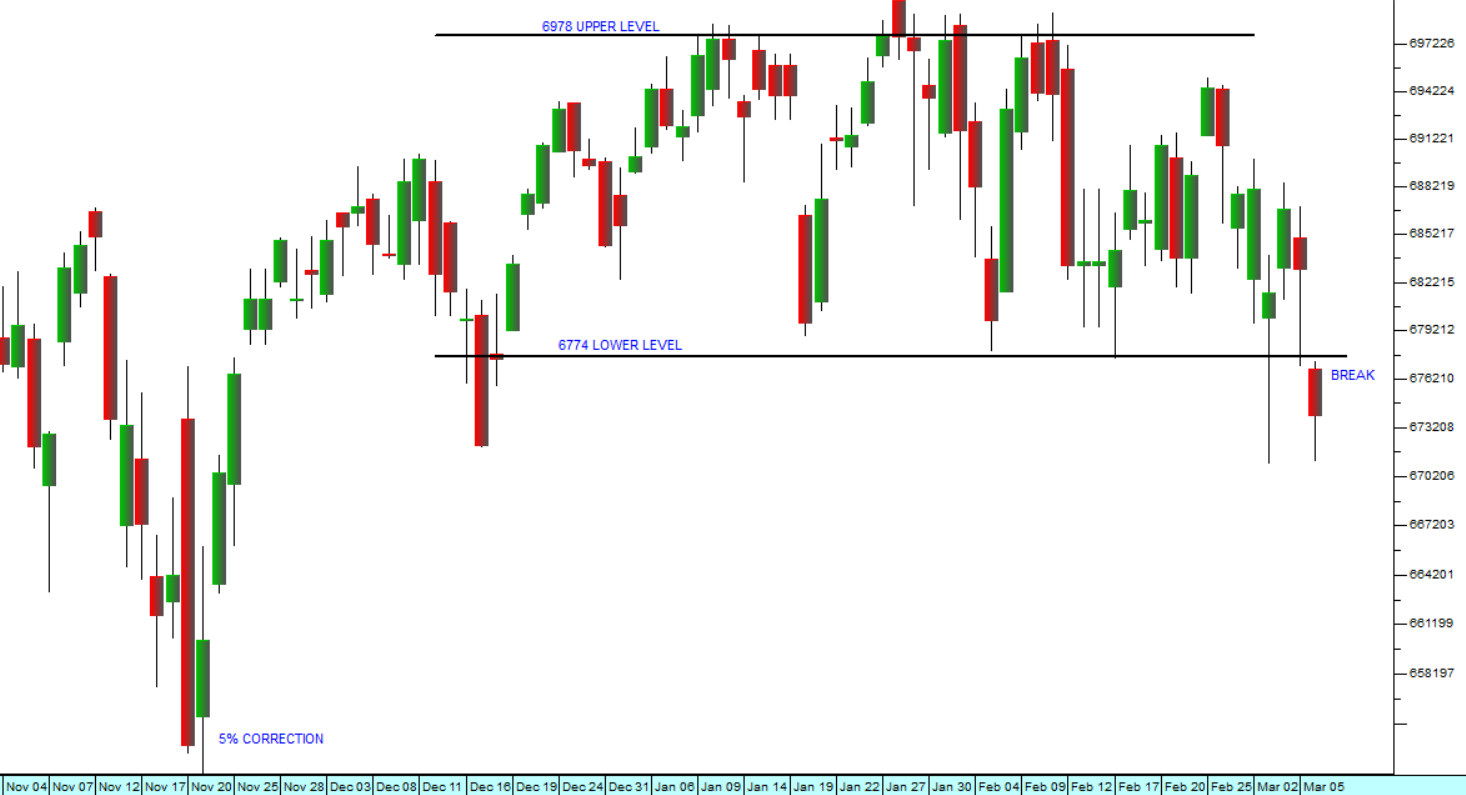

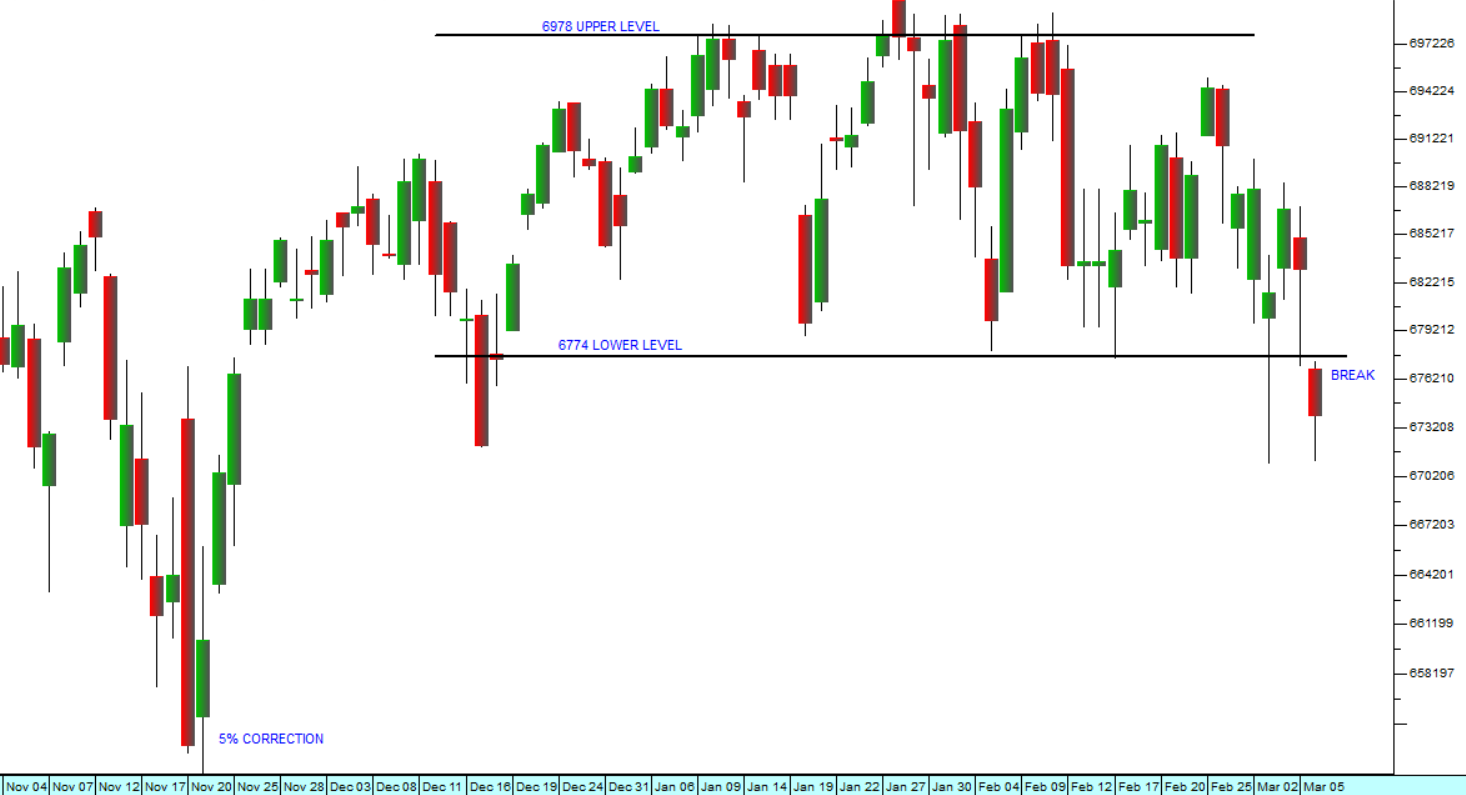

Combined with other disturbing economic data, this has taken Wall Street out of the sideways pattern that it has been in since late last year and put it into a correction. The S&P500 index has so far fallen 3,4% from its all-time record high of 6978.6 on 27th January 2026. Consider the chart:

S&P500 Index: 4th of November 2025 - 6th of March 2026. Chart by ShareFriend Pro.

S&P500 Index: 4th of November 2025 - 6th of March 2026. Chart by ShareFriend Pro.

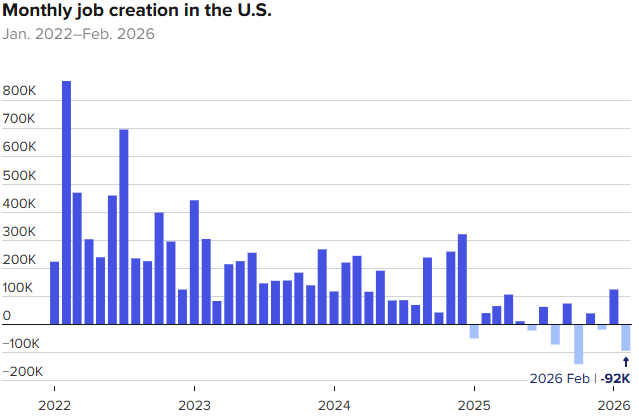

Part of the problem is the increasingly negative data coming out of the US economy, especially in the labour market. The most recent US jobs report showed that the US economy lost 92 000 jobs in February 2026.

Disturbingly, the steadily deteriorating monthly jobs numbers are an indication either that either the economy may be headed into recession or that the spread of artificial intelligence (AI) technologies is putting a large number of Americans out of work. Consider this chart published on Friday last week by CNBC:

Monthly job creation in the US: 2022 - March 2026. Available at:

Monthly job creation in the US: 2022 - March 2026. Available at:

https://www.cnbc.com/2026/03/06/february-2026-jobs-report.html

This shows a pattern of falling job creation going back to the beginning of 2022 and becoming steadily more negative in recent months. Combined with this, the unemployment rate has also been edging up and came in at 4,4% in February. This is somewhat higher than the unemployment rates below 4% which characterised the end of Joe Biden’s presidency, painting a concerning picture.

In our view, the productivity benefits of new technologies like AI should, in the medium term, more than compensate for the inevitable loss of jobs. In effect, the US economy is adjusting rapidly to a radically disruptive force which is reshaping the business environment and causing a sharp re-allocation of capital. Some businesses will benefit and others will disappear for ever.

In the longer term, once the dust settles, the economy should emerge stronger and that is why we believe that this is probably a correction rather than a new bear trend – but you will notice that what looks like a correction right now could develop into a head-and-shoulders formation if the record high of 6978.6 on the S&P is not broken when the market recovers.

At the moment, the positive news coming out of the tech sector is being off-set by the bad news on the political front and Trump’s war in Iran. If we are lucky, the war in Iran will be resolved on some basis - probably because he will probably back down in the face of increasing pressure both at home and abroad. If this happens in a relatively short time, the market will turn its attention back to the rapid progress of new technologies and hopefully recover to make a further new all-time record high in due course.