Top Winning Shares

Last Thursday, the JSE reached a new all-time record high of 114046. This, combined with the fact that the rand went below R17 to the US dollar for the first time since the beginning of 2023 suggests that emerging market investors are increasingly bullish. Consider the chart:

Overview - 10th November 2025

Wall Street

Two weeks ago we suggested in an article that a stock market bubble was developing in AI and predicted that a significant correction was imminent. We repeated that view in the Confidential Report

Bubble

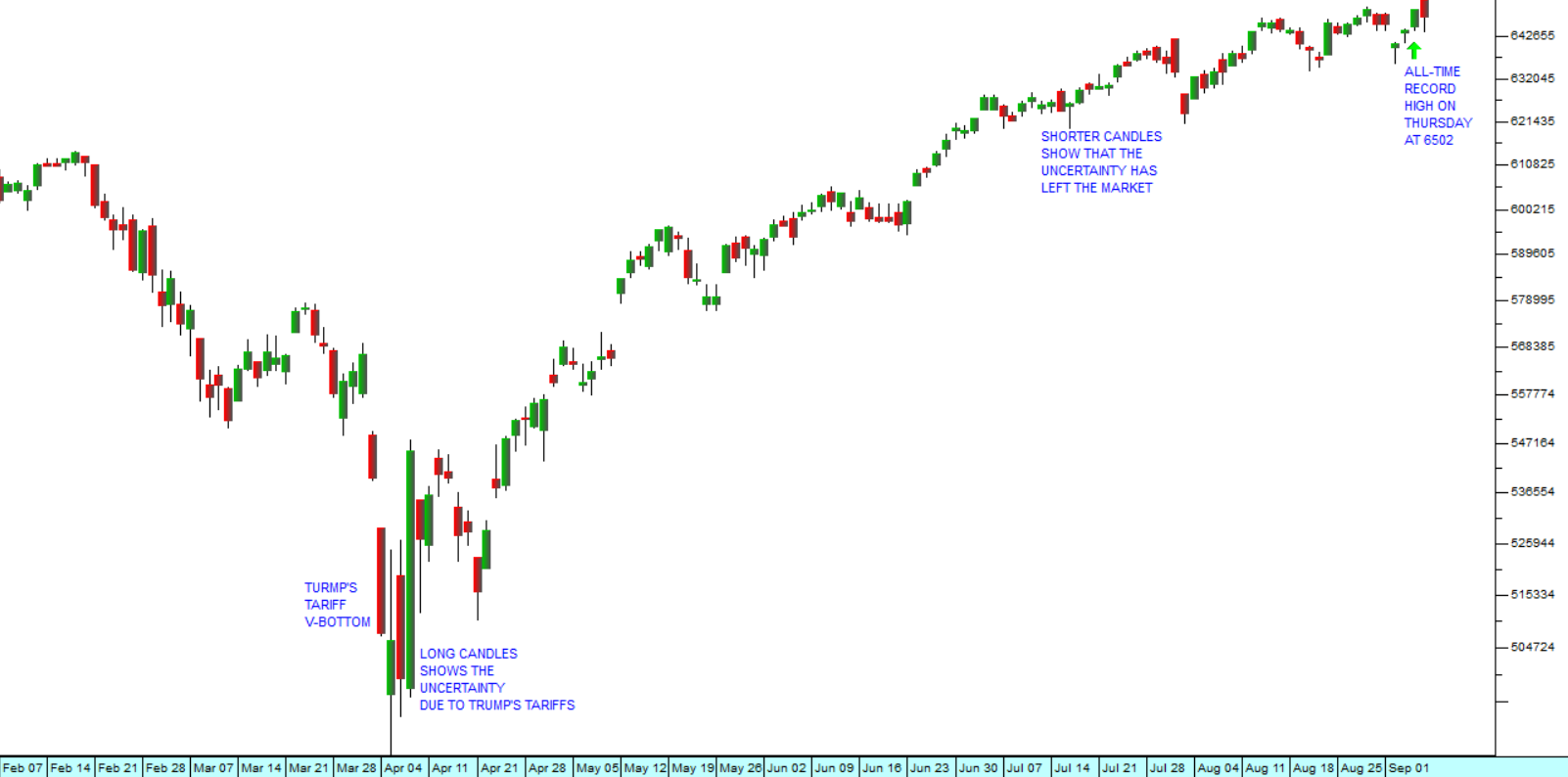

Last Friday the S&P500 reached another new all-time record high, closing at 6791 and reaching a new intra-day record high of 6807. This is obviously an exciting time for private investors, but with each new record high the systematic risk of a bear trend or crash increases. Consider the chart:

The PEG Ratio

Since the government of national unity (GNU) came into power in June 2024, there has been a definite improvement in the South African economy. Perhaps the improvement is not as dramatic as some people were expecting, but the progress cannot be denied.

Possibly the best indicator of that is the 28% rise in the JSE Banking index which, before the GNU had

Rare Earth Elements

Investors worldwide had been of the opinion that Trump’s ability to impact markets was on the decline. His erratic, on-again, off again tariff policies had either disappeared or had been mostly discounted into share prices. His attack on the second largest economy in the world, China, seemed to have been largely resolved, and a meeting with

US Shutdown

There has been much in the media recently about the US government shutdown and the fear among investors that it might begin to affect the stock market, depending on how long it lasts.

A shutdown occurs when the US government reaches its budget limit and requires a bill to be passed through both Houses to extend the government’s spending limits.

New Listings

Two new companies, ASP Isotopes and Greencoat Renewables, have recently come to the JSE. Both are developing companies that have recently made losses and have been funding those losses by raising capital and selling assets. They both have substantial “blue sky” potential but also carry substantial investment risk. This is probably truer of ASP

Exponential Growth

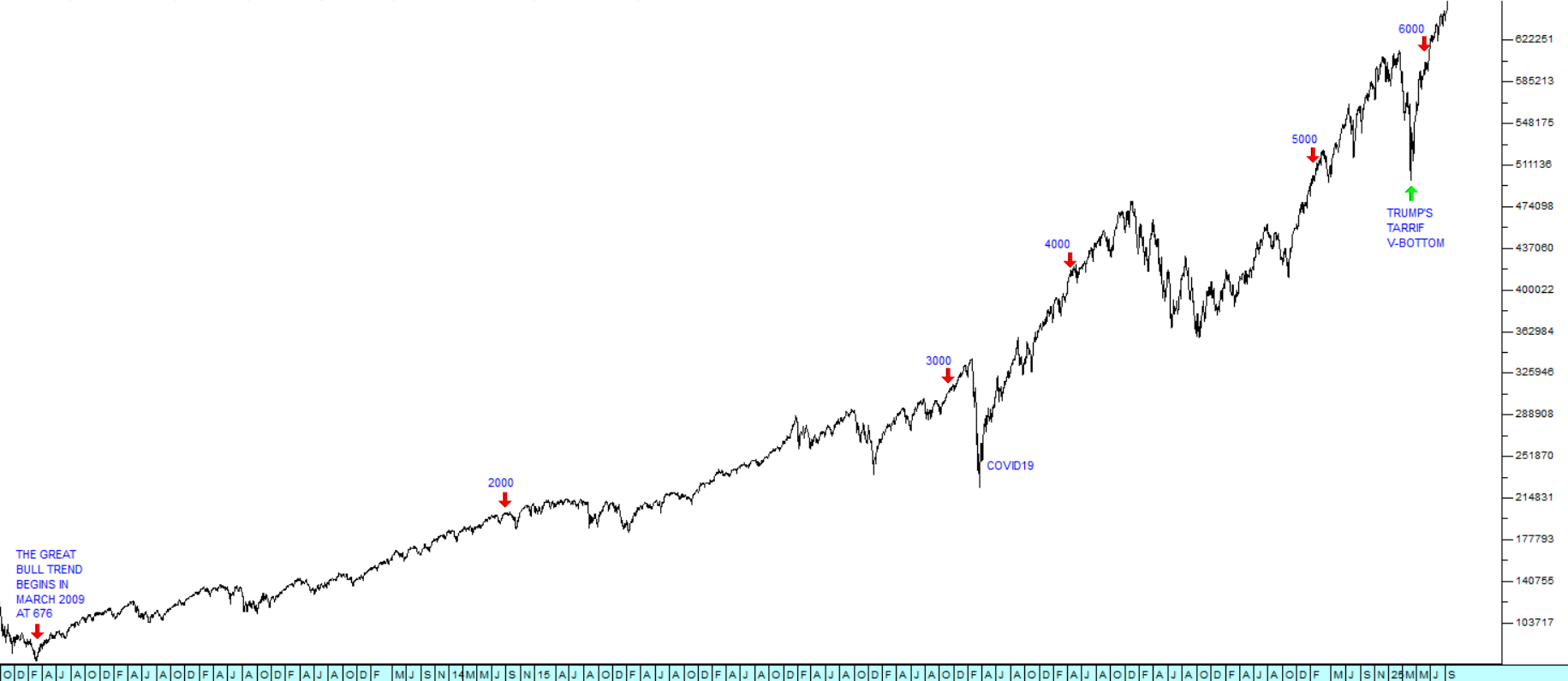

The S&P 500 index is important because all the stock markets around the world tend to follow it. If the S&P is in a bull trend then London, Tokyo and the JSE will also be in a bull trend – and vice versa.

The S&P500 index began 68 years ago on 4 th March 1957 with an initial value of 43,73. It took nearly

The US Jobs Market

International investors who trade on Wall Street are generally negative about any good news from the economy because it tends to make the monetary policy committee (MPC) more hawkish and less likely to reduce interest rates. The opposite is also true. But there comes a point where bad news is so bad that investors begin to fear that the US economy is heading

Jackson Hole

Once a year in late August central bankers and academics congregate in Jackson Hole to discuss the state of the economy and consider the way forward. Traditionally, the Chair of the Federal Reserve Bank (“the Fed”) addresses the meeting and gives direction to its thinking on monetary policy in the US. This year, the comments of Jerome Powell resulted in the