Afrimat

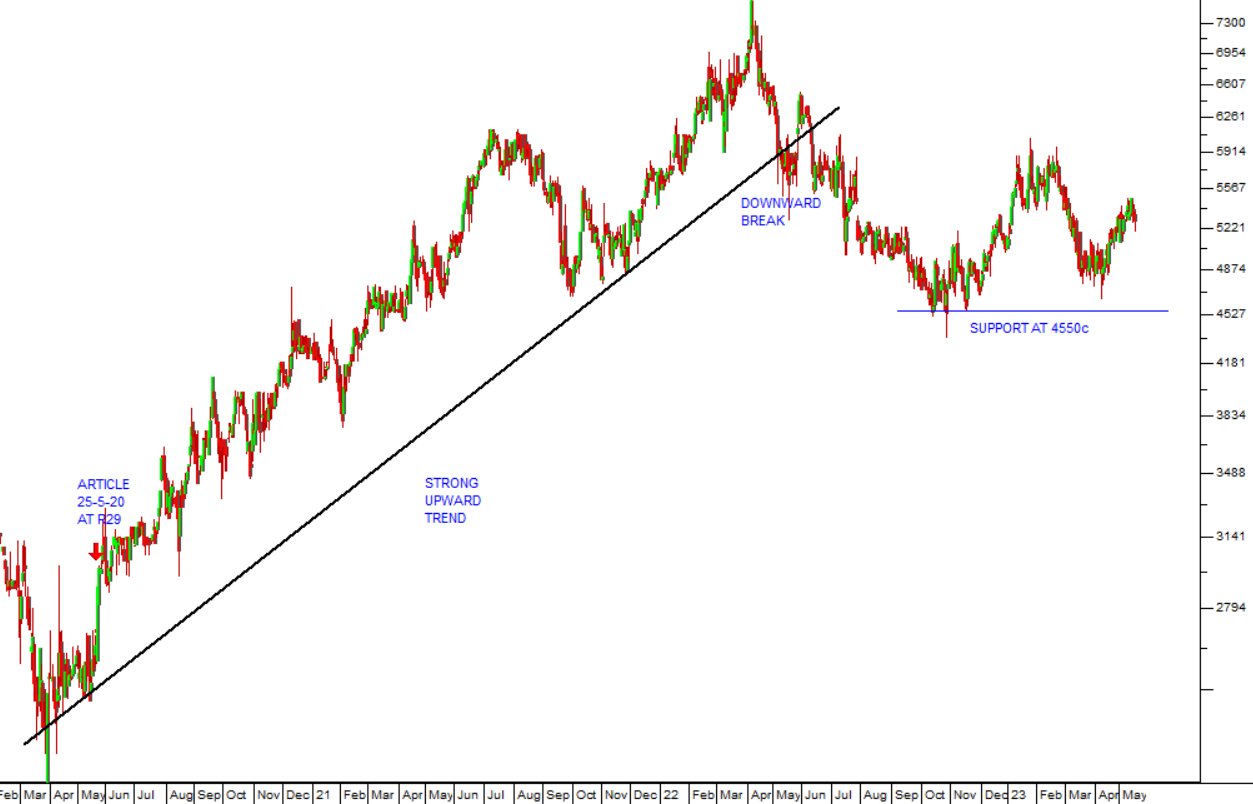

Afrimat has long been a favourite share of ours. Originally a construction company, it reinvented itself into a mining company which produces base metals and minerals. It is now in the General Mining sector of the JSE. We originally suggested that it was a good buy in our article, Afrimat Opportunity, on 25th May 2020 when it was trading for 2900c per share. It now trades for 5284c per share – a gain of 82,2% in 3 years. Obviously, this is a commodity share and as such it tends to be volatile.

We like this company because its management runs a very “tight ship” and has proven itself to be very skilled at making effective bolt-on acquisitions to diversify the business and open new product lines. It has learned to cope very effectively with the difficult environment for mining in South Africa.

In July 2022 the company conducted an over-subscribed capital raise in which they were able to sell 13,4m new shares in an accelerated book-build to raise R680m. This new capital means that the company now has virtually no debt and a debt:equity ratio of just 4,4%. Having such a strong balance sheet means that it is very well positioned to make further acquisitions.

Its bulk commodity division, consisting of Demaneng and Jenkins iron mines and the Nkomati anthracite mine, accounts for almost 82% of the company’s operating profit. Those commodities, especially iron ore, are subject to international commodity pricing – which tends to make the share volatile and unpredictable.

The company has and is diversifying into a variety of other minerals. Its recently-added “Future Materials and Metals” division involves the production of phosphate, vermiculite and other rare earth minerals. These commodities are used in the production of fertilizer and other applications in agriculture as well as the production of magnets and batteries.

In its latest financials for the year to 28th February 2023 the company reported revenue up 4,9% and headline earnings per share (HEPS) down 15,7%. The drop in HEPS was caused by its investment in getting new mines operational and improving operating efficiencies. Obviously, the company’s revenues were adversely impacted by the drop in iron prices during the period.

Technically, the share entered a strong upward trend in March 2020. That trend was discounting its profitable move into iron ore mining at Demaneng. Since then, it has been in a consolidation phase, moving sideways at around 5000c with support at 4550c. In our view it is now ready to break to the upside as the company becomes more diversified and brings more new mines into operation. Consider the chart:

Afrimat is very well positioned to make excellent profits in the current financial period. It has both the capital and the management expertise to take advantage of the many opportunities in the mining industry. Driehoekspan and Doornpan mines will come on stream to replace Demaneng when its resource is exhausted. These operations have an expected life of 15 years.

The Nkomati anthracite operation is opening two new opencast operations as well as an underground operation which should see it ramp up volumes. The anthracite market is local and hence not impacted by international prices.

It is a difficult time to find and evaluate high-quality shares, especially those, like Afrimat with operations in South Africa which are subject to loadshedding and the vagaries of Transnet’s operations. Afrimat offers an interesting opportunity in a diversified and well-managed base metals and minerals operation. The risks are relatively low and the company has good upside potential.

← Back to Articles