On the JSE there are many different types of investors. The purpose of this module is to give you some insight into who they are and what their approach to investment might be.

But to begin with let us look at the rights of shareholders.

THE RIGHTS OF SHAREHOLDERS

When you buy shares, the central securities depository records your name and various other details in an electronic register proving your ownership of the shares.

Owning shares in a company gives you certain important rights:

- You are entitled to attend and vote at the meetings of the shareholders (also called “members”) of the company. Companies are required by the Companies Act to hold an Annual General Meeting (AGM) at which the directors report back to the shareholders on the progress which has been made during the year. Important decisions affecting the future of the company are made at this meeting by a simple majority vote. Each ordinary share of the company entitles the holder to one vote. In some companies, the preference shareholders can also vote. The company can also call a special meeting during the year to decide on a specific issue.

- You are entitled to receive your share of the dividends of the company. At year-end and after six months of the financial year, the directors look at the profits made by the company and decide how much to pay out as a dividend. They can also pay a special dividend if they feel that there is enough cash. Dividends can only be paid if the company passes a “liquidity and solvency test" in terms of the Companies Act (71 of 2008). Usually, the directors will decide to keep some of the profits in the company to plough back for future growth. This money is known as “retained earnings”.

- You are entitled to receive the annual financial statements of the company. In terms of the Companies Act the company must, within six months of the end of its financial year, publish its financial statements which must contain a balance sheet, income statement, cash flow statement, directors' report and the auditors' report. The JSE rules require that a listed company produce and publish its financials within 3 months of the end of their reporting period. Most companies also include a chairman's report with their financial statements, but this is not a requirement of the Act. The financial statements of listed companies are usually available from their website as well as from the JSE and can be downloaded in PDF format.

- If the company is liquidated, you are entitled to receive your share of the remaining assets of the company once the creditors and preference shareholders have all been paid out. It is rare for a listed company to be liquidated. If they have been doing very badly, they will usually be bought out by another company – if only through a reverse takeover for their listing.

- If the controlling shareholders are made an offer for their shares, then you are entitled to be made the same offer for your shares. The controlling shareholders are usually shareholders who own more than 50% of the company’s shares and therefore, control the voting at meetings and consequently also control the composition of the board and the company’s activities. An offer can be made by another company seeking to acquire the company and make it into a subsidiary.

INSTITUTIONS

For many decades, under the National Party and even during the time of the ANC, South African investors have been limited by exchange control regulations to investing mostly inside the country. These regulations to a greater or lesser extent prevented them from investing as much as they would have liked in overseas markets. One effect of this has been to lead to the relative dominance of institutional investors on the JSE. The institutions in this country mainly consist of pension funds, insurance companies, asset managers and unit trusts. And they all work in much the same way. They gather small amounts of money from hundreds of thousands or even millions of individuals each month which they pool into great lump sums and then invest, mostly on the JSE.

These massive lump sums of money are managed by fund managers. A fund manager is usually a very highly qualified individual, with a C.A., an M.B.A. or some other high-level financial qualification. He or she is also very highly paid to take on the responsibility of placing such massive amounts of money on behalf of so many people. It is, however, important to understand that the fund manager is not investing his own money – which changes the way in which he or she responds to the developments in the market.

Approximately 90% of all trades by value done on the JSE are done by the large institutions – and only 10% or less are done by private investors. This means that, as a private investor, it is very useful for you to have some insight into how institutions go about choosing their shares, and more particularly how their fund managers think.

To understand fund managers, you must begin by understanding that while they are highly qualified and highly paid, they are still men and women with jobs. The most important issue for a man person with a job is to keep that job. It is his number one consideration.

Imagine for a moment that you were a fund manager working for, say, Sanlam. One day you attend a Sanlam fund managers’ meeting and you do a presentation on gold. Using a very professional PowerPoint presentation, with plenty of impressive charts and diagrams, you argue that now is the time to invest in gold shares. And let us suppose that you are successful in persuading the other fund managers and a decision is taken to invest heavily into gold shares. Then, let us suppose that, as a result of that decision, Sanlam loses R100m. You would never be able to work in the fund management business again! You would become known as the person who lost R100m for Sanlam in the gold market! Unless, of course, Old Mutual had invested in gold shares at the same time. Then you couldn’t be fired because Old Mutual’s fund managers had made the same mistake at the same time! You would be in good company!

For this reason, and in order to protect their jobs, fund managers tend to be very conservative and, for safety, they almost always move together. When one sheep crosses the bridge, they all cross the bridge. And the worst thing for a fund manager is to be left on this side of the bridge when everyone else is on the other side – because that is how you can lose your job in the fund management business. So, even if they do not fully agree with the rest of the fund managers, they will tend to follow the crowd. In fund management, it is definitely best to follow what everyone else is doing.

An investment analyst once told this story,

“Cast your mind back to 1994, when the ANC has just taken power in South Africa. One of the first things that happened was that there was a massive nation-wide strike at Pick 'n Pay. Everyone knew that the ANC had won support partly because of their alliance with the union movement and the fund managers were very worried about the effect of this strike. They all crossed the bridge together. Pick ‘n Pay shares fell from 1600c to 800c – and they did that in just two weeks. At the time I was lecturing to private investors on investment across the country and as I went on my lecture tour, I asked my audience this question, “Does anyone think that Pick ‘n Pay is going bust? Is that what is happening here?”

They thought about that and decided that because Pick ‘n Pay was the leading retailer in South Africa with about 41% of the retail grocery market and had R1 billion in the bank with almost no debt, it was very unlikely that Pick ‘n Pay was going bust. So, then I asked them, “Does anyone think that Raymond Ackerman (who was then the CEO of Pick ‘n Pay) will be unable to solve his problem with the unions?” Again they thought about that and decided that it was very likely that Ackerman, a clever and very experienced businessman, would find a way to sort this problem out.

So then I said, “Well if you don’t think Pick ‘n Pay is going bust, and you think that they will be able to sort out their problem with the unions, then there is only one question left to be asked, “When will the share price turn and start going up?” – because it must.

I told them that I did not think that Pick ‘n Pay would trade below 800c again for the rest of their lives – and I bought a large parcel at around 800c for myself. Over the next 18 months, Pick ‘n Pay shares went from 800c to 2400c – a 300% gain. I wrote a letter to the trade union to thank them and suggested other shares that we might perhaps co-operate on – I never got a reply!”

This story illustrates very well the way in which private investors can profit from the herd instinct of the big institutions. The secret is to find and buy a high-quality blue-chip share (like Pick 'n Pay) when for some reason it is out of favour with the big institutions and their fund managers. Of course, you must determine whether the company is ultimately going to fail.

The Steinhoff example is relevant. That company fell from a high of over R56 to just R1.25 in six months during the first half of 2018. This did not necessarily make it a good investment because it was facing a deluge of litigation both locally and overseas. So, each case must be considered on its merits.

The COVID-19 pandemic is 2020 brought many high-quality blue-chip shares down to record low prices on the JSE, because the fund managers panicked and sold out. This gave private investors a once-in-a-lifetime opportunity to pick up these high-quality shares at bargain prices.

PROFESSIONAL INVESTORS

A number of private investors have become so skilled at investing in the share market that they are able to make their living from it. We call this exclusive group of investors, “professionals” – and they should not be confused with the fund managers who manage other people’s money. Professional investors tend to be very secretive and quiet. They certainly do not manage funds on behalf of other investors, and they do not like to talk about their approach to investment. Clearly, you should make it your goal to become a professional investor.

WIDOWS AND ORPHANS

This is a group of people who own shares on the JSE, but who are very ignorant of the investments which they own. They are at the opposite extreme from the professional investors. Widows and orphans generally give their money to someone else to manage and know nothing of the companies in which they own shares. They are the last to find out important information and they often lose out on the golden opportunities that come up from time to time in the market. Obviously, by buying this program you are striving to move away from being in the widows and orphans group and towards elite professional investor status. Your objective is to achieve financial independence by taking responsibility for your own investment decisions and to acquire the knowledge and experience that will make this possible.

SPECULATORS

A speculator (sometimes called a “trader”) is trying to make money quickly on the JSE. They are usually only interested in whatever capital gain they can make out of a share rather than the dividends which it might pay. Ideally, they try to buy and sell within a relatively short period of time and make a nice capital gain.

It is very difficult to be a successful speculator in the share market. Jumping in and out of the market is usually the best way to make your stockbroker rich rather than yourself. There are also significant tax implications of buying and selling within time periods of less than three years. If you are successful, the Receiver might decide to declare you to be a “share dealer”. He will say that dealing in shares is your business and then your capital gains will be added to your taxable income and taxed at your marginal tax rate. On the other hand, if you hold the shares for longer than three years you will only be liable for capital gains tax – which for private investors means that they will only end up paying about 18% of any capital gain – even if they are in the marginal 45% tax bracket.

We strongly recommend that you become an investor and not a speculator. Take a long-term approach to your investments and aim to make an inflation-beating return by buying high-quality, blue-chip shares that you can hold for years and years. Speculating is like gambling – you might as well go down to the casino and put your money down on red or black. This course is aimed at investors, not speculators.

Investors can also be divided by the way in which they choose their shares and time their transactions. There are basically two approaches to share assessment.

- FUNDAMENTALISTS

A fundamentalist, as the name suggests, is someone who concentrates on the fundamentals of a company and seeks to answer the question “How good will this company be as a generator of profits and dividends in the future?

To answer this question, the fundamentalist begins with a careful reading and analysis of the company’s latest financial statements. He then goes on to look closely at the industry which the company is in and to examine its competitors. From there he will probably want to study the management of the company to assess their competence. After that he will look to see whether the company is unduly exposed to union action or to a sudden change in the value of the rand – and so on. Everything which might impact on the future profits of the company is relevant. The fundamentalist is a detective, digging and scratching for any information about the company and what makes it effective. - TECHNICIANS

A technician, or chartist, is someone who believes that all the fundamentals of the company, past present and future, are already contained in the share price. He therefore focuses exclusively on searching for patterns which might arise in the share’s price and volume statistics. He plans to exploit those patterns using mathematical formulae (known as “indicators”) which are designed to isolate and identify profitable trading strategies.

So, chartists draw charts and then apply “indicators” to those charts looking for “buy signal” and “sell signal” signals and a confirmation between different indicators.

In this course we will cover both fundamental and technical approaches to share assessment in some detail – but the truth lies somewhere in between them, and both have merit - so you would be well advised to understand both to get a balanced picture.

INSIDERS

These are people who, for one reason or another, have important and relevant information about the direction that a company’s share is going to move. They are prohibited by law from trading on that “inside” information – but the fact remains that insider trading is a part of every stock exchange.

No matter what happens of importance in a company, there is always a small group of people who know about it before many of the investors. Sometimes, they know well in advance of the rest of the market. Inevitably, those people will trade on that information and they will do so in a way that makes it difficult, if not impossible, for them to ever be caught and prosecuted. But they cannot hide their trades from you because they are visible in the share’s price and volume charts if you know what you are looking for.

The best way to illustrate this is by way of an example. Read the following articles:

These articles demonstrate how, in two completely different situations, you can take advantage of the clear signals in the market that are clear indicators of insider trading.

Finally, if you still have any doubt about the existence of insider trading on the JSE, read the following extract from a more recent article, written in November 2020:

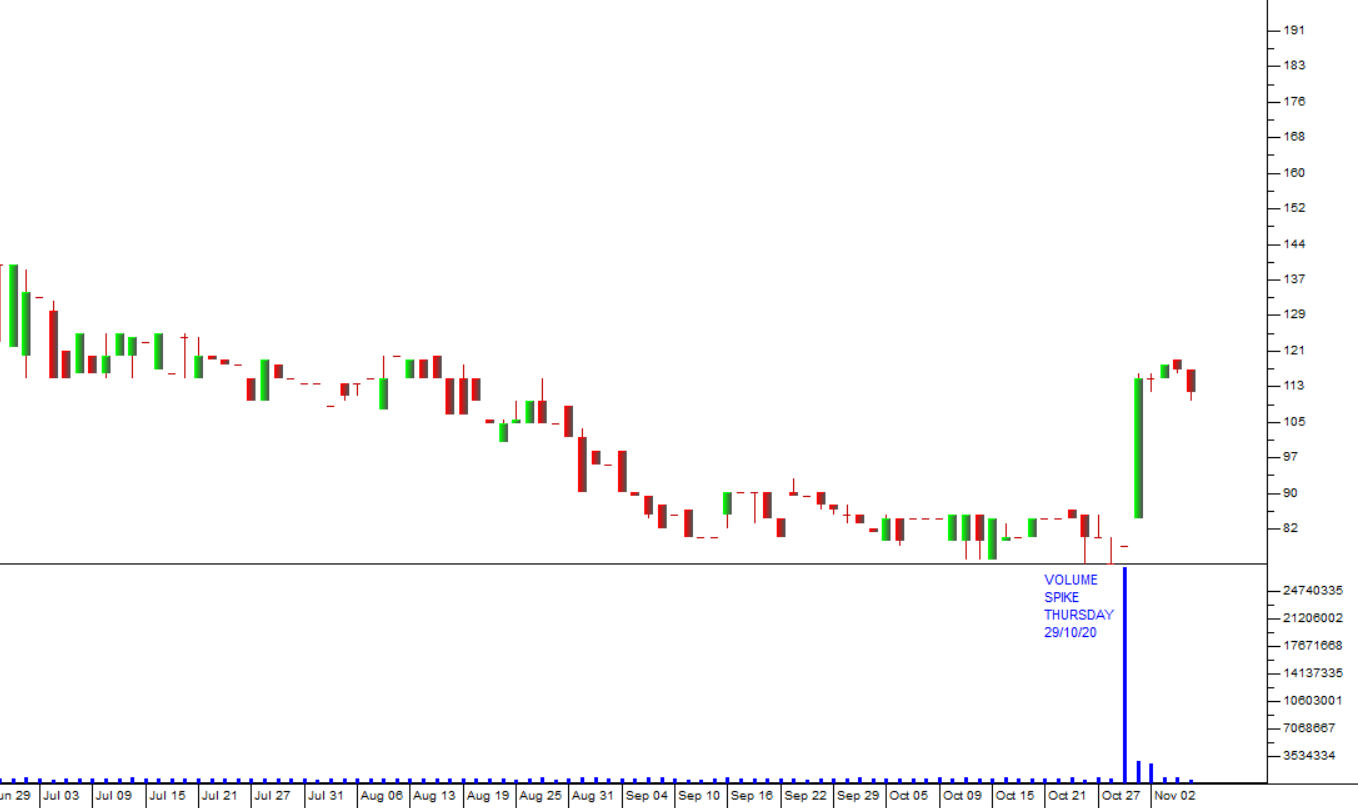

“The JSE has just witnessed one of the most blatant examples of insider trading in many decades. It involved a small real estate investment trust (REIT) called Texton. This company owns 53 properties, 56% of which are in South Africa and the balance in the UK. After it listed on the JSE in August 2011, the share rose to a high of 1235c on 6th March 2015 before beginning a steady fall towards low of 74c on Wednesday, 28th October 2020.

For the 90 trading days prior to that day, the share had been trading and average of 111335 shares per day. Then suddenly, inexplicably, on the next day, Thursday, 29th October 2020, it traded a massive 28,2m shares – at a price 4c higher than the previous day (78c). Then on Friday (30th October 2020) a SENS announcement was published in which Texton disclosed that a consortium of investors who already owned 32% of the company had decided to increase their holding to 40% - thereby triggering a mandatory offer to the remaining shareholders at 120c per share.

The effect of this announcement was that the share closed at 115c on that Friday – giving the insiders who bought the day before (Thursday 29th October 2020) a tidy paper profit of R10,43m, being 28,2m X (115c-78c) – a 47% return in a single day! One can only imagine how those who sold their shares on that Thursday felt when they found out the truth the next day

Consider the chart:

Texton: 29 June 2020-02 November 2020

The point is that whenever there is an event which is likely to move the price of a listed company significantly, it is known to a few insiders before the broader market is informed. Sometimes it is just the day before (as in this case) and sometimes it is a few weeks or even months before, but the result is usually the same. The insiders cannot resist the opportunity to make a quick profit at the expense of those shareholders are ignorant of what is going down. Insiders don’t usually trade in their own names, because insider trading is illegal, but they work though a friend or relative who cannot easily be traced back to them. What they can’t hide from you is the volume traded. That always gives you the clue that something is about to happen. Always be on the lookout for small increases in price accompanied by massive increases in volume”.

GLOSSARY TERMS:

Warning: mysqli_num_rows() expects parameter 1 to be mysqli_result, bool given in C:\inetpub\wwwroot\newage\onlinecourse\content\lecture_modules_content.php on line 21

List Of Lecture Modules