Volume Leads Price

30 January 2017 By PDSNETVOLUME LEADS PRICE

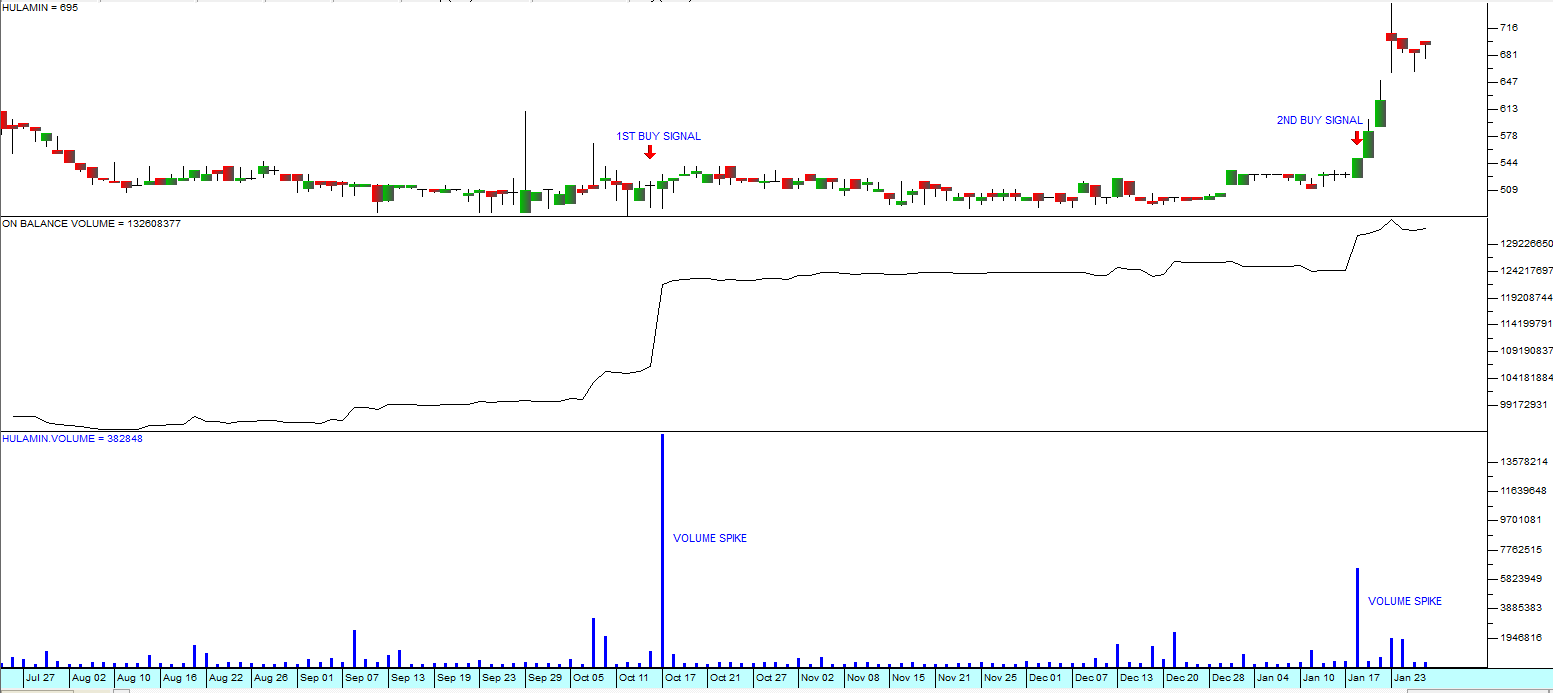

Most private investors who have charting or technical analysis software ignore the volume traded, but volume can often be the key to getting into a stock at the same time as the smart money. Joseph Granville was the first to understand the importance of volume traded and he coined the phrase, "volume leads price", to explain his idea that large increases in volume accompanied by small increases in price usually means that something is going on with the share which is only known to insiders. For example, if one company makes a decision to buy another company, then the board members who attended the meeting at which that decision was made walk out of there with some very important information. They may then phone the uncle in Bloemfontein and say buy some XYZ Ltd. This is insider trading and it is illegal, but it goes on all the time. The point is that insider trading must always be reflected in the volume traded. Usually what happens is that the smart money (i.e. the people who know what is going on) begin buying up all the loosely-held shares available in the market which leads to small increases in price, but huge increases in volume. If you can spot this when it is happening you can capitalize by jumping on the band-wagon. To exploit this idea Granville developed the On Balance Volume (OBV) technique. The OBV begins with an arbitrary figure like 100 000 and then adds the volumes traded on the days when the price rises and subtracts them on the days when the price falls. The result is then plotted in a chart. Consider the chart of Hulamin (HLM):

The chart is divided into a candlestick chart of Hulamin in the top, an OBV chart in the middle and a volume histogram at the bottom. The volume spikes and their impact on the share price can be clearly seen. If you had bought at the second signal you would have got in at 550c and today, just six trading days later the share is trading at around 700c, a gain of 27%!

DISCLAIMER

All information and data contained within the PDSnet Articles is for informational purposes only. PDSnet makes no representations as to the accuracy, completeness, suitability, or validity, of any information, and shall not be liable for any errors, omissions, or any losses, injuries, or damages arising from its display or use. Information in the PDSnet Articles are based on the author’s opinion and experience and should not be considered professional financial investment advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Thoughts and opinions will also change from time to time as more information is accumulated. PDSnet reserves the right to delete any comment or opinion for any reason.

Share this article: