US Shutdown

There has been much in the media recently about the US government shutdown and the fear among investors that it might begin to affect the stock market, depending on how long it lasts.

A shutdown occurs when the US government reaches its budget limit and requires a bill to be passed through both Houses to extend the government’s spending limits. Shutdowns typically happen in October because the government’s fiscal year ends on 30th September.

Once the limit has been reached, the government begins to shut down non-essential services and put government employees on furlough. The US government is the country’s largest employer with over 3 million employees.

Since 1976, there have been 10 shutdowns the worst of which lasted for 35 days when Trump, in his first term as president, wanted approval for additional funding to pay for the erection of a border wall with Mexico. That shutdown lasted from 22nd December 2018 to 25th January 2019. But during that time the S&P500 index rose from 2351 to 2664.

In my experience, US government shutdowns do not have a major negative impact on markets. There have been 19 shutdowns over the past 50 years which have lasted for an average of 8 days.

Generally, a shutdown of longer than 2 weeks is seen as damaging the economy and possibly reducing growth – and this shutdown might influence the monetary policy committee’s (MPC) decision regarding interest rates at the end of October 2025.

Both Republicans and Democrats are motivated not to allow the shutdown to continue for too long because that begins to impact their performance in the polls – but the party which is in power (in this case the Republicans) usually takes the blame if the shutdown begins to impact the lives of citizens.

One of the effects of the current shutdown is that it has delayed the official publication of the figures from the Bureau of Labor Statistics (BLS) which were supposed to have been published last Friday. Unofficial sources, like a report from Challenger, Gray & Christmas said U.S. employers announced fewer layoffs in September but plans for hiring so far this year were the lowest since 2009.

Economists are predicting that the economy created 51,000 new jobs in September and that the unemployment rate remained steady at 4.3%. Investors are also expecting two more 25-basis-point cuts in interest rates before the end of the year.

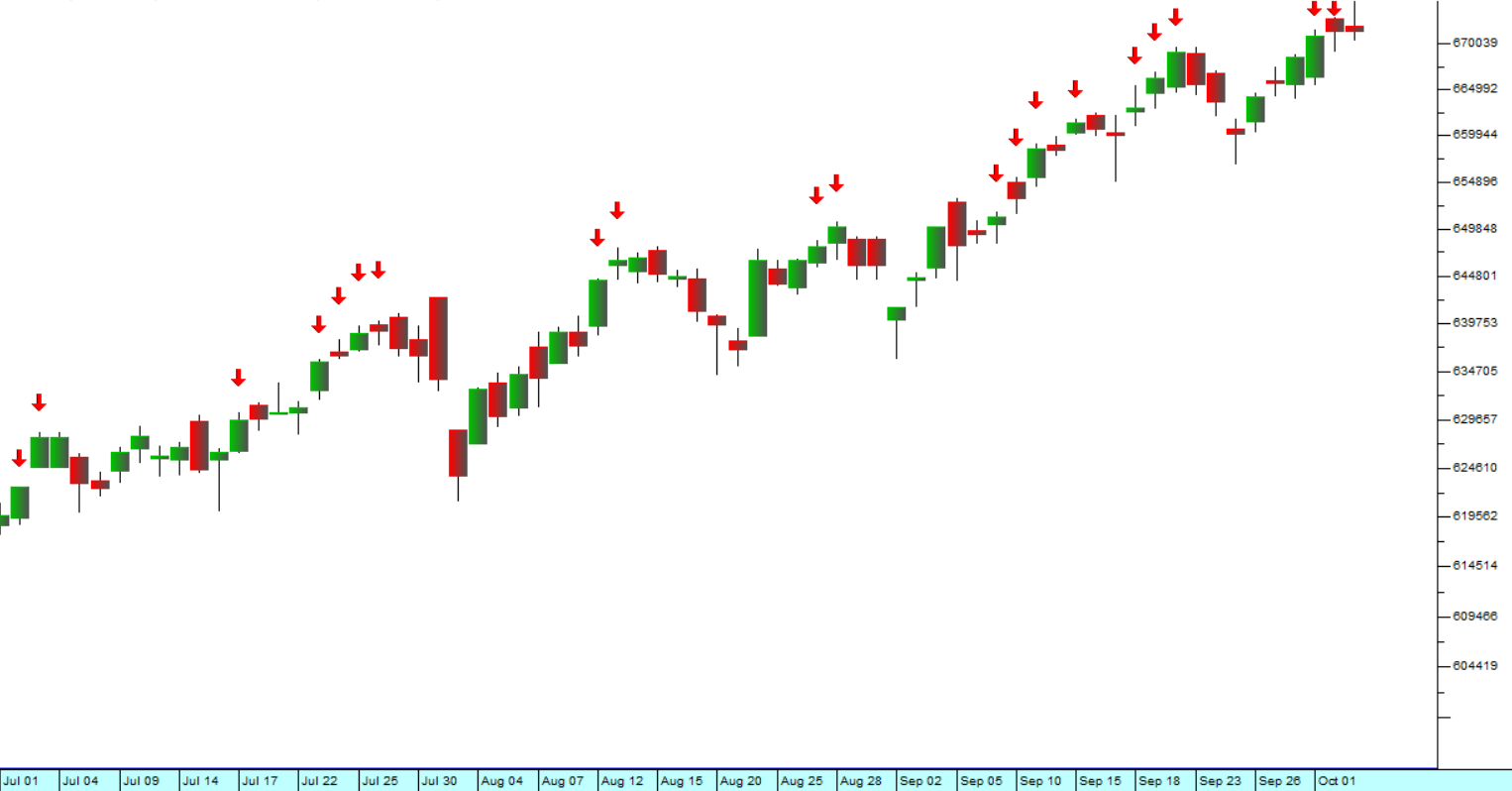

Our opinion is that the US economy is in a strong boom phase based on the productivity gains coming through from artificial intelligence (AI). We also believe that those gains are only just beginning – so we expect the profits of the 500 companies which make up the S&P500 index to continue rising. Consider the chart:

As you can see the S&P500 has been posting a series of new all-time record highs over the past three months, reflecting a surge in investor optimism. As we are fond of saying, however, nothing in the markets moves in a straight line so in all likelihood some type of correction will certainly occur sooner or later. When it does, we do not believe that it will be the start of a new bear trend, but rather a temporary pullback in the bull trend. It should therefore be seen as a buying opportunity.

The powerful shift towards “risk-on” among international investors is also benefiting emerging markets like South Africa and that is reflected in the strength of the rand. It is our expectation that the rand will soon break above its previous cycle high of R17.11 to the US dollar, made a year ago on 27th September 2024. A stronger rand is good for imports and bad for exports, but the rising prices of gold, platinum and other commodities have benefited us, offsetting the strength of the rand.

We reiterate that this is a time when private investors should be fully invested in high-quality blue-chip shares while maintaining a strict stop-loss strategy to protect them from any major reversals.

← Back to Articles