Uncertainty

Most investors would probably agree that there is a considerable amount of uncertainty in equity markets at the moment. From a fundamental perspective, that uncertainty has come about because of:

- The force with which the central banks of the world (especially the US Fed) will “stamp on the brakes” to reduce inflation.

- The war in Ukraine, the outcome of which is dependent on the thinking of a ruthless dictator whose actions are virtually impossible to gauge.

These two factors have created a toxic mix of uncertainty which has the markets of the world jumping up and down like the proverbial “cat on hot bricks”.

Of course, investing in shares has always been about predicting an uncertain future. When you buy a share, you believe it is going to go up, otherwise you would not buy it – and the person who sells it to you believes it is going down – otherwise they would not sell it. But only one of you can be right, and whoever is right will take money away from whoever is wrong.

But there are times, like the one we are living through, when the general level of uncertainty in the market is unusually high.

Consider the following diagram of a typical “sine wave” cycle:

In the upward phase about 80% of investors are bullish and in the downward phase about 80% are bearish. But when the market moves sideways, they are evenly split between bulls and bears. At that point, there is broad uncertainty about what the future holds. This uncertainty causes unusually wide intra-day swings in prices.

It is also true that the further up the cycle you go, the closer you are to the top - and hence the greater your risk. Ironically, at the top of the cycle, when most investors are at their most confident, their risk is at its greatest. And at the bottom of the cycle, when they are at their most fearful, their risk is probably at its lowest.

This is the basis of Warren Buffett’s sage advice: “Be greedy when others are fearful and fearful when others are greedy”.

On 21st April 2022, Jerome Powell, Governor of the Federal Reserve Bank (the Fed), greatly increased the level of uncertainty (and fear) when he said that the monetary policy committee (MPC) would undertake a series of 0,5% interest rate hikes to bring inflation under control. And at the same time, the Fed would suck as much as $95bn a month out of the US economy through “quantitative tightening”.

Usually, interest rates are only changed by 0,25% at a time to give everyone time to adjust their thinking. The 0,5% moves are a clear indication that the US monetary officials are late in their reaction to rising inflation and are now taking radical steps to rectify the situation. Powel’s statement caused the S&P500 index to fall by 5% in two trading days. The S&P then fell back to previous support levels around 4062, but what is noticeable is the size of the daily candles. There have been single-day moves of up to 3%, in both directions showing the degree of uncertainty.

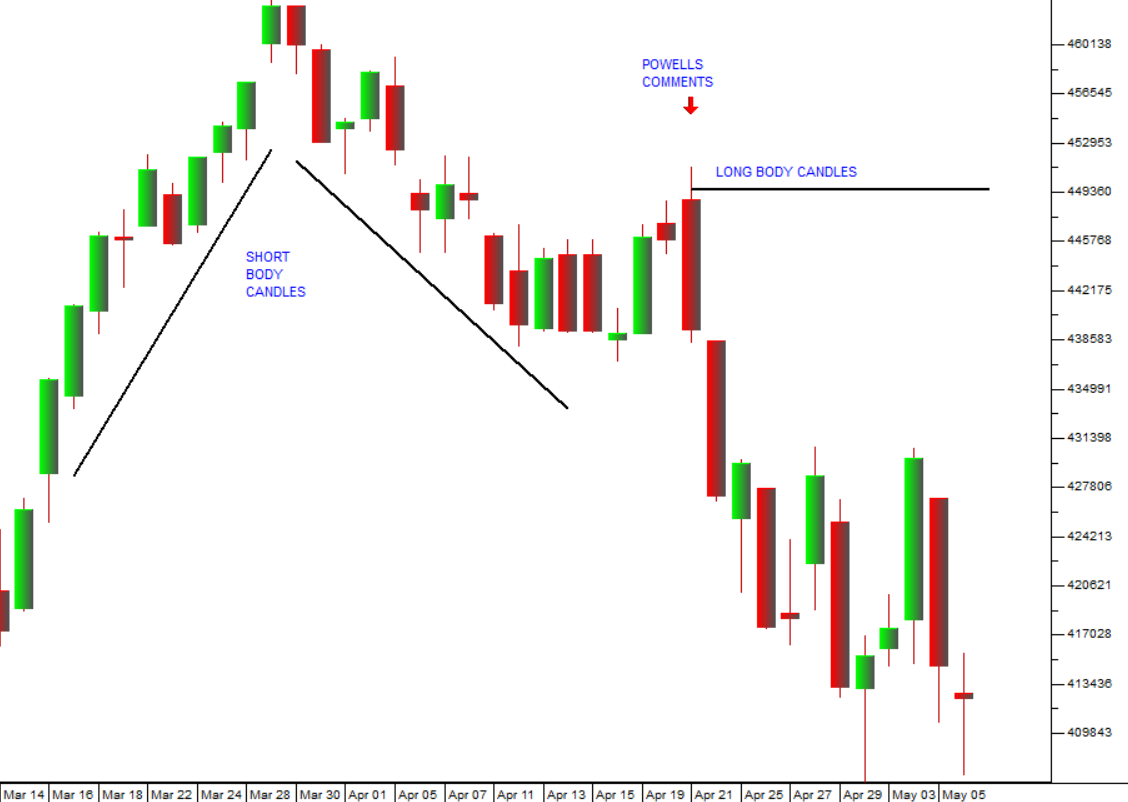

The gaps between the daily opening prices and closing prices on candle stick charts are known as the “bodies” of the candles. Larger bodies indicate a greater range of trade during the day, which is a visible indication of uncertainty. Consider the chart below of the S&P500 index’s daily market action over the last three weeks:

You can see here that when the S&P is trending up or down, the candles are characterized by short bodies. Following Governor Powell’s remarks, on 21st April 2022, however, the bodies of the candles became noticeably longer as investors tried to digest the implications.

Now we have reached a stage where the market is moving approximately sideways. Investors as a group are not at all sure what will happen next. They are vacillating wildly between bouts of optimism and pessimism.

The pattern of rising interest rates in America must be off-set against the fact that the US economy created 428 000 new jobs in April 2022 and about 80% of S&P500 companies have produced profits the latest quarter which are above analysts’ expectations.

Clearly, the economy is still booming. Indeed, that is the understanding on which we base our view that this is a correction and not the start of a bear trend. If we are right, then this is a buying opportunity.

One of our favourite sayings is “If you don’t feel the fear in the market when you buy, then you are probably not going to make very much money”. Right now, we can certainly feel the fear in the US markets.

← Back to Articles