The US Debt Ceiling

America is like a rich person who has fallen on hard times. She has a penchant for expensive overseas products which she can no longer afford, she has an aversion to hard work, and she is living off her credit rating.

Especially since World War II, the US government’s debt has been climbing steadily. This steady rise has occurred under both Republican and Democrat administrations. Perhaps the best way to get a feel for this is to go to the web site: https://www.usdebtclock.org/

This site maintains a real-time picture of the national debt and breaks it down into its various components. It is truly horrifying. The total debt is now $31,8 trillion – and rising rapidly.

In an effort to limit the borrowing, the US Congress established legislation in 1917 to place a ceiling on the debt. Since then, it has been necessary for congress to raise or modify that debt limit more than one hundred times – in other words, roughly once a year. In recent decades and especially since the Trump presidency, politics in America has become excessively partisan making it increasingly difficult to achieve a bi-partisan agreement on raising the ceiling.

However, experience shows that eventually, and often with some hair-raising brinkmanship, the ceiling is always raised. This is because, when push comes to shove, it is not in the interests of either party to be the cause of America defaulting on its debt repayments.

Right now, America’s national debt is more than 20% of its gross domestic product. This is one of the highest debt levels of any country in the world. In 2011 Standard and Poors down-graded US debt from their highest rating because of this.

In recent years, America has had to increase debt substantially to pay for COVID-19 and the war in Ukraine among other problems. Prior to that the government had to spend heavily to counter the impact of the 2008 sub-prime crisis.

In this regard it is important to realise that these extremely high debt levels are sustainable partly because of the US dollar’s role as the international currency of choice in most trade and central bank reserves worldwide. There is always a strong demand for dollars and, in our opinion, the recent reporting on efforts to replace the dollar as the currency of choice for international trade are almost certain to fail.

Janet Yellen has said that the current debt ceiling is only sufficient to allow the US government to meet its obligations until 5th June 2023. We expect therefore that an agreement will be reached within the next two weeks at the most.

In the meantime, and until the debt crisis is resolved, it has the tendency to unnerve international markets. The S&P500 has alternately been depressed by the prospect of a debt default and then boosted by the prospect of a bipartisan agreement.

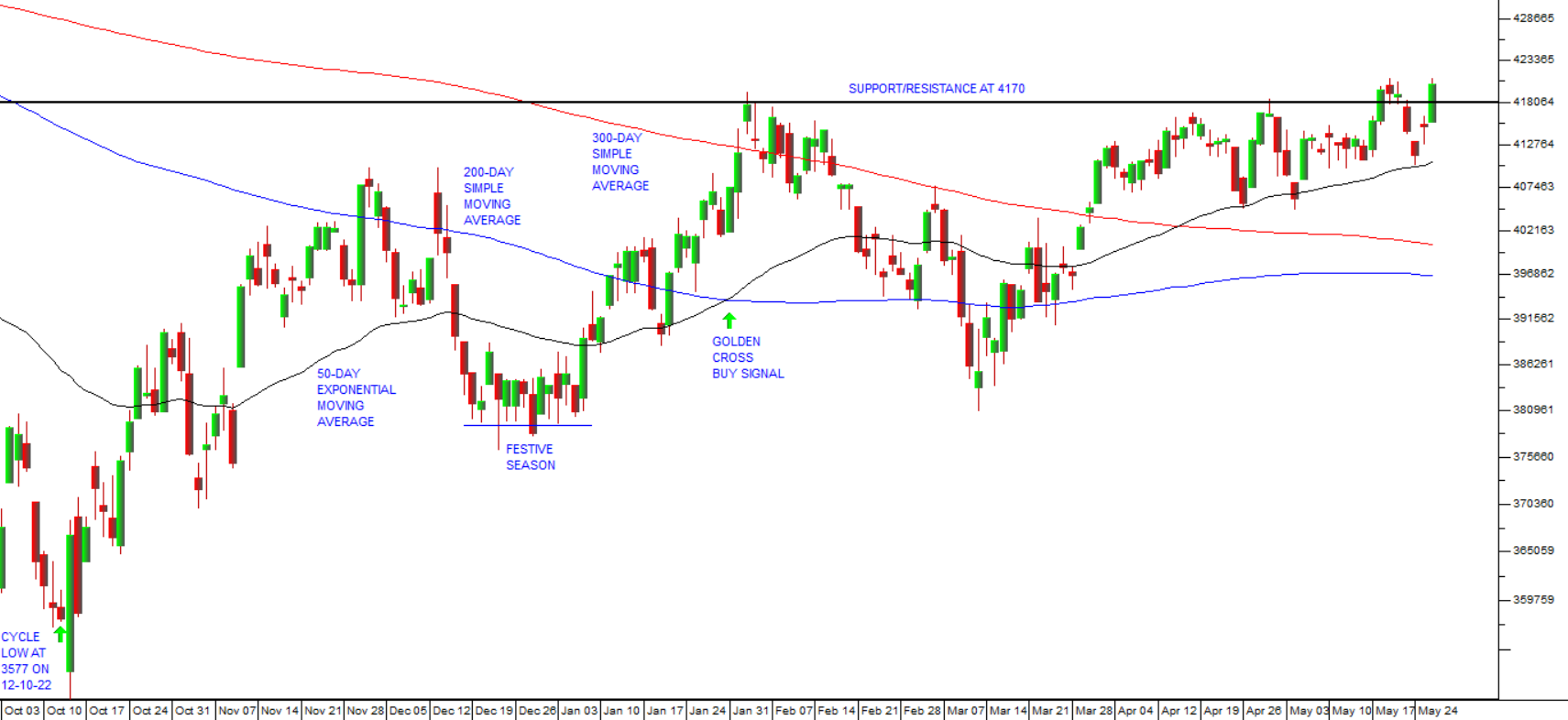

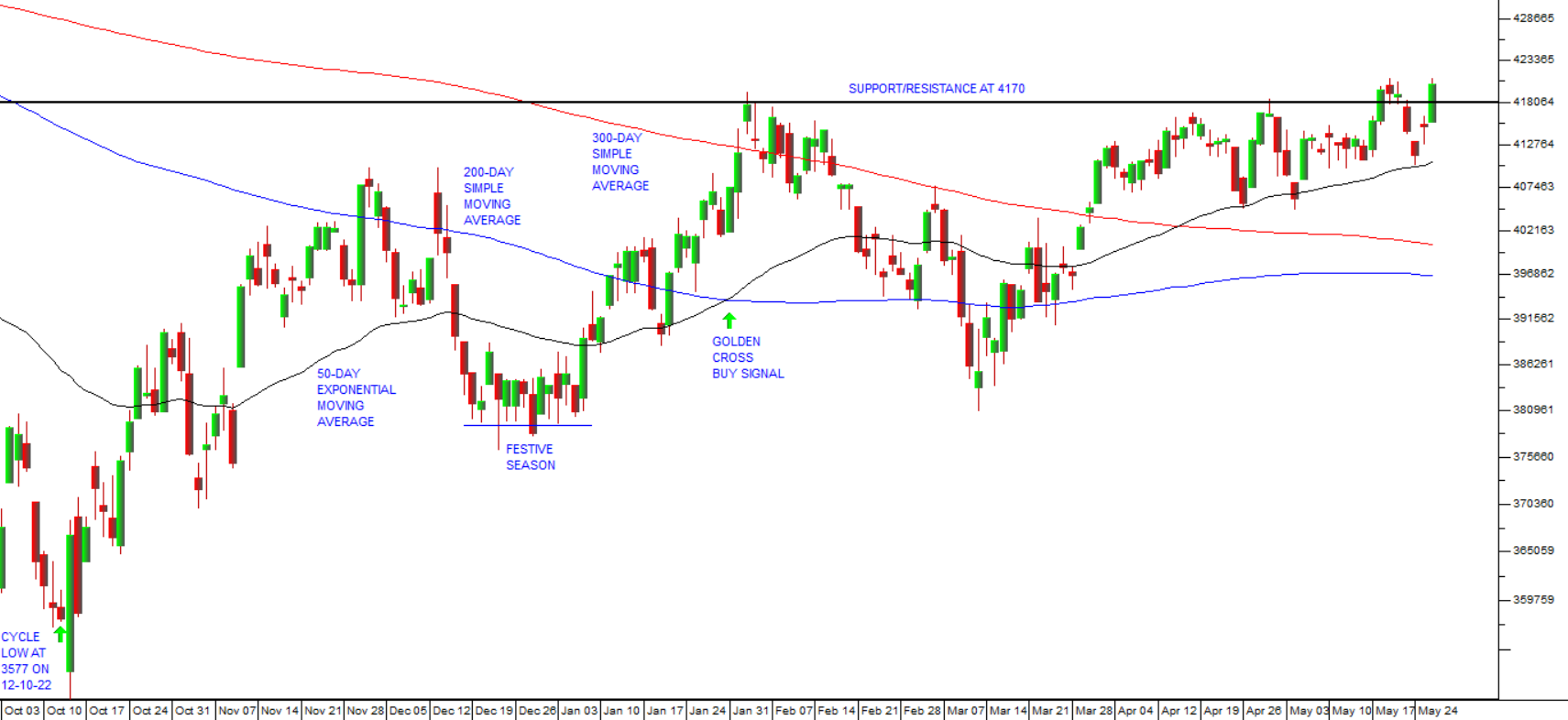

This can be seen in the progress of the S&P500 index, which has been testing resistance at just above 4170 and on Friday last week closed at a new cycle high of 4205 on the strength of new hope that a deal is imminent. Consider the chart:

As you can see, the S&P is repeatedly testing the 4170 resistance level which indicates extraordinary bullishness.

The negotiations around the debt ceiling will inevitably be a temporary disruption to the market that will almost certainly be resolved within the next few days.

The far more important consideration is the amazing residual bullishness which is evident in this market. This bullishness has characterized the current bear trend from the beginning - and continues, despite that fact that most analysts are now predicting that the US economy will fall into recession probably before the end of this year and certainly during 2024. The persistent yield curve inversion is the strongest evidence of an impending recession. And there is growing evidence that the cumulative impact of the Federal Reserve Bank’s 10 interest rate hikes totalling 5% is having an impact – seen in the tame 1,1% growth in GDP in the first quarter.

The bulls appear to be taking the position that, if there is a recession, it will be relatively short-lived and that the Fed will be reducing interest rates again soon. This idea is bolstered by the fact that 2024 is an election year and the incumbent Democrats will certainly not want to be fighting it in the teeth of a recession.

Our view is that core inflation in America (which excludes food and energy) will continue to prove very sticky and the Fed will find it almost impossible to reduce rates until it gets down to the target level of 2%. So, we are expecting the recession to be both longer and deeper than is currently being discounted into the S&P500 index.

This, in turn, implies that the current bullishness on Wall Street is misplaced. Note that the JSE Overall index made an all-time record high on 27th January 2023 and has been trending down since then.

Post Script

As anticipated, on Sunday, the Democrats and Republicans reached an agreement on raising the debt ceiling. Both sides gave some ground, and both got some wins. The important point is that the debt ceiling is lifted for 2 years and so should not become an issue again until after the 2024 elections. Altogether, Wall Street investors, both bulls and bears, appear to have placed far too much emphasis on the importance of this event – which has happened more than 100 times in the past and has always been resolved.

← Back to Articles