The Rand 2022

It is that time of year when various experts feel it incumbent on themselves to make predictions – especially for the progress of the rand during 2022. Of course, the strength of the rand is a vital component of any private investor’s analysis because so many of our shares have significant interests overseas or are engaged in exporting.

Nedbank’s pessimistic forecast for 2022 is that the rand will weaken to below R18 to the US dollar and will average R16.01. BNP Paribas, which is the local arm of a French banking Group, predicts that the rand will weaken by a further 7,5% during the year. They are predicting a major slowdown in the South African economy due to further load-shedding by Eskom and rising local interest rates.

Our view is markedly different. We have long held that the rand is significantly under-valued against hard currencies. We believe that its performance is predicated by two primary factors:

- Our propensity as a country to “shoot ourselves in the foot” economically, by unnecessarily introducing uncertainties into the business environment and by demonstrating a lack of social discipline (as happened with the civil unrest in July 2021).

- The state of international investment sentiment. This sentiment oscillates between “risk-on” and “risk-off” depending on whether overseas investors are scared by developments in the world economy, or confident of continued growth. When they are confident, they seek the real rates of return available in emerging economies. When they are scared, they move out of emerging economies and back into “safe havens” like US Treasury Bills.

We have a few reasons for thinking that the rand will appreciate this year. Consider the charts:

.png)

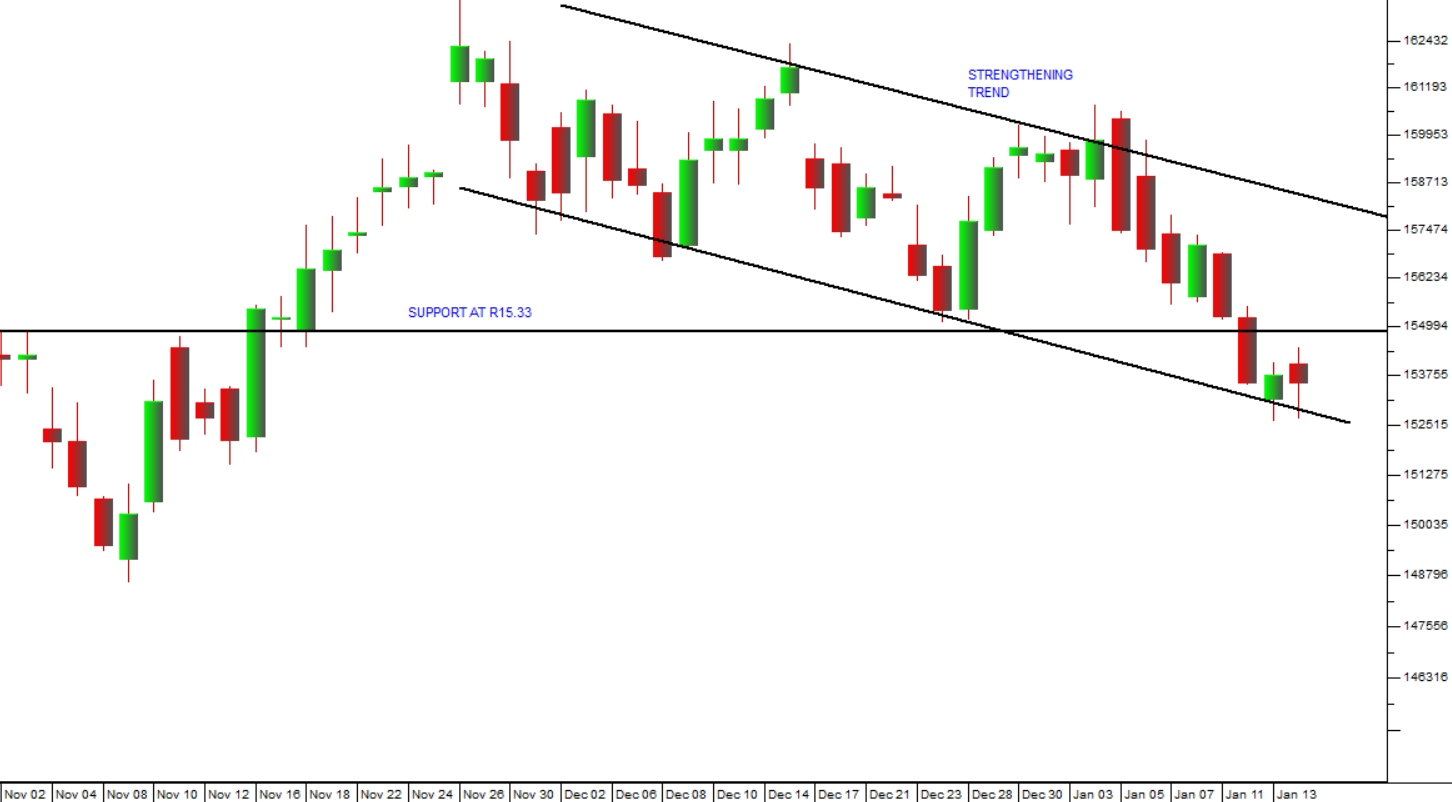

The upper chart shows the progress of the rand/US dollar exchange rate from July 2017 to date. The lower chart shows the detail of the current position, (as represented by the red box in the upper chart) from November 2021 to date.

As you can see the rand has been in a weakening trend since June 2021, partly because of internal factors like the July unrest and the ANC’s poor showing in the elections and partly because of periodic shifts to “risk-on” among international investors.

Since the beginning of December 2021, however, the rand has been appreciating as confidence in the US economy increased and in the absence of any economic disasters locally. The strong performance of commodity prices with the concurrent improvement in the national debt have done much to restore confidence.

On a purchasing power basis, the rand is reckoned to be about 7% undervalued, but we believe that it has the potential to strengthen further than this. While load-shedding and the pandemic are certainly negatives, the world is awash with cash which is looking for the high real rates of return offered on our government bonds.

Right now, extraordinarily, inflation in the US is about 2% higher than here in South Africa - while the yield on their 10-year treasuries is just 1,75% against the yield on our long bonds at over 9%. We see more investment cash coming into this country and the rand strengthening continuously – provided, of course, that our esteemed leaders can refrain from economic suicide.

← Back to Articles