The Confidential Report - October 2025

1 October 2025 By PDSNETBackground and Context

Before we get into the detail of this month’s Confidential Report, I thought it would be useful to spend a few minutes considering the big picture of exactly where world markets are generally today, including the JSE.

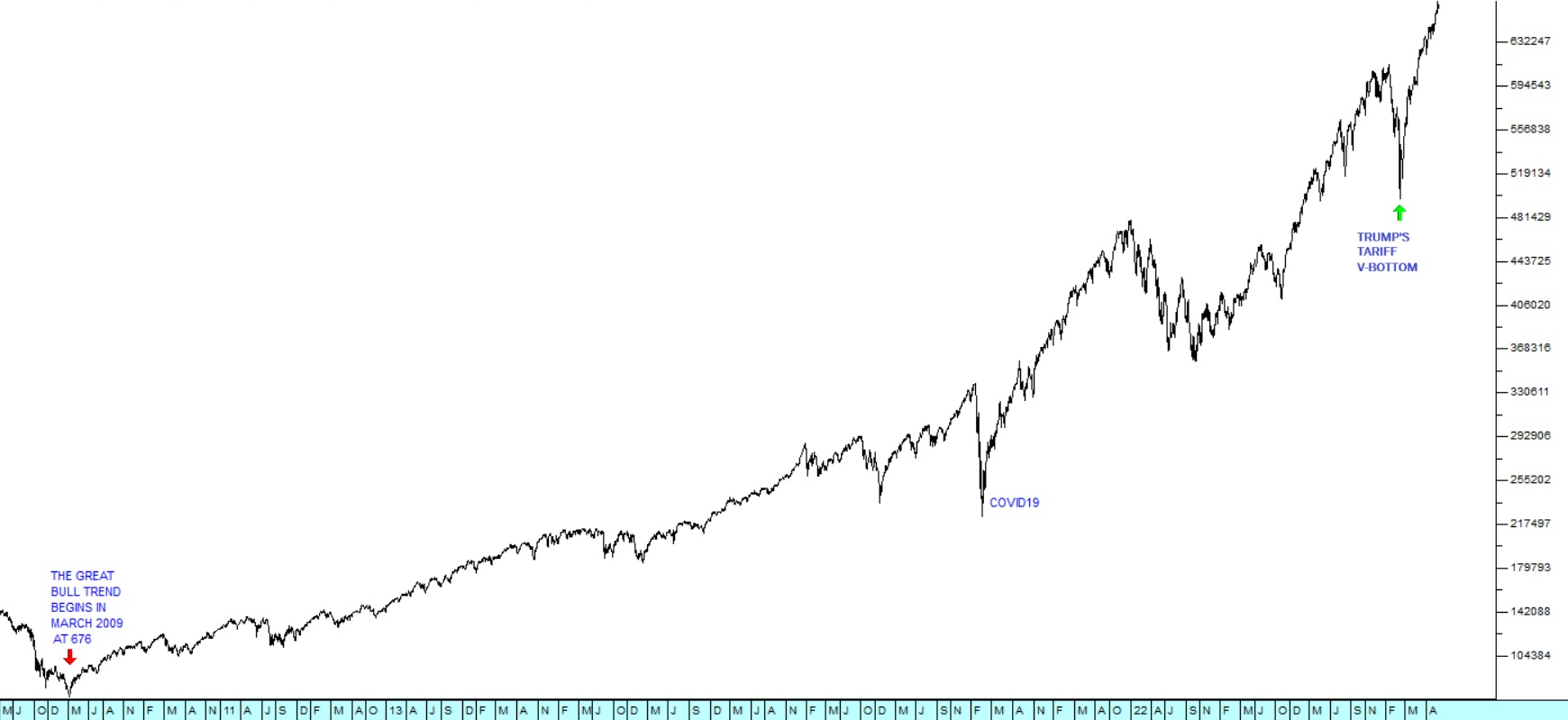

Like all major stock markets around the world, the JSE roughly follows Wall Street and Wall Street is most accurately represented by the S&P500 index, which is an average of the 500 largest companies in America. In our view, the S&P has been in primary bull trend for more than 16 years, Consider the chart:

S&P500 Index Semi-log chart : March 2008 - 26th of September 2025. Chart by ShareFriend Pro.

As I have previously explained, I regard the COVID-19 downward spike in March/April of 2020 as an “aberration” from a technical perspective, because it was brought about by a black swan event that was not market-related. If we ignore that, then the pattern of the bull trend becomes obvious. It has been rising steadily between two parallel channel lines which are both supported by multiple touch points.

I have been consistently and continuously bullish about this market since its inception. In my article of 21st of July 2025 ,The 16-Year Bull Trend, I referred to another article that I had written and which was published in the Stock Exchange Handbook of June 2009, shortly after this bull trend began. In that article I proclaimed that markets at that time represented “The Greatest Buying Opportunity this Century”. I do not believe that I was wrong.

More recently, in a tweet on “X” in January of 2024, when the S&P was still below 5000, I predicted that my calculations indicated that it would reach 6458 within two years. In fact, it passed that level on the 13th of August 2025, just 19 months later. It is now my opinion that the S&P will rise to at least 10 000, and probably much more.

It is important to understand that this long-term upward trend has become exponential. In other words, the S&P is rising at a faster and faster pace as the impacts of new technologies are becoming clearer. To illustrate this, I marked the points on the chart above where the S&P passed 1000-point intervals, and you will notice that those intervals are becoming shorter.

This market is being driven by advances in technology which promise to substantially improve the productivity hence profits of all S&P500 companies. Right now, the primary driving force is artificial intelligence (AI), but there are other improvements which are making their presence felt - like the advances in battery technology and solar power. These technologies are steadily bringing the cost of energy down. Humanoid robotics is also beginning to gain momentum, but its impact on profits is still minimal.

The chart above is semi-logarithmic to enable us to properly identify the channel. Its exponential nature can probably be better seen in a linear chart of the same time period:

The only similar market to this historically occurred in the 1920’s where the impact of new technologies like the motor car and the telephone saw massive increases in productivity and corporate profits, leading to a boom in share prices. Today, the impact of technologies like AI and humanoid robotics are having a similar effect. It is almost impossible to assess how far these technologies will take the S&P – but in my view, the bull market, despite having been there for 16 years, is only just beginning to discount future profits and it still has a long way to go. I believe that the S&P and hence all stock markets around the world, including the JSE, will probably continue to rise for the foreseeable future. Private investors should be fully invested to take advantage.

Your protection against a major downward move is, as always, to maintain a strict stop-loss strategy on your individual holdings. You can widen your stop-loss percentages as the shares which you have bought “go into the money” (the point where your stop-loss level rises above your purchase price), but you cannot ignore your stops, no matter how optimistic you may become.

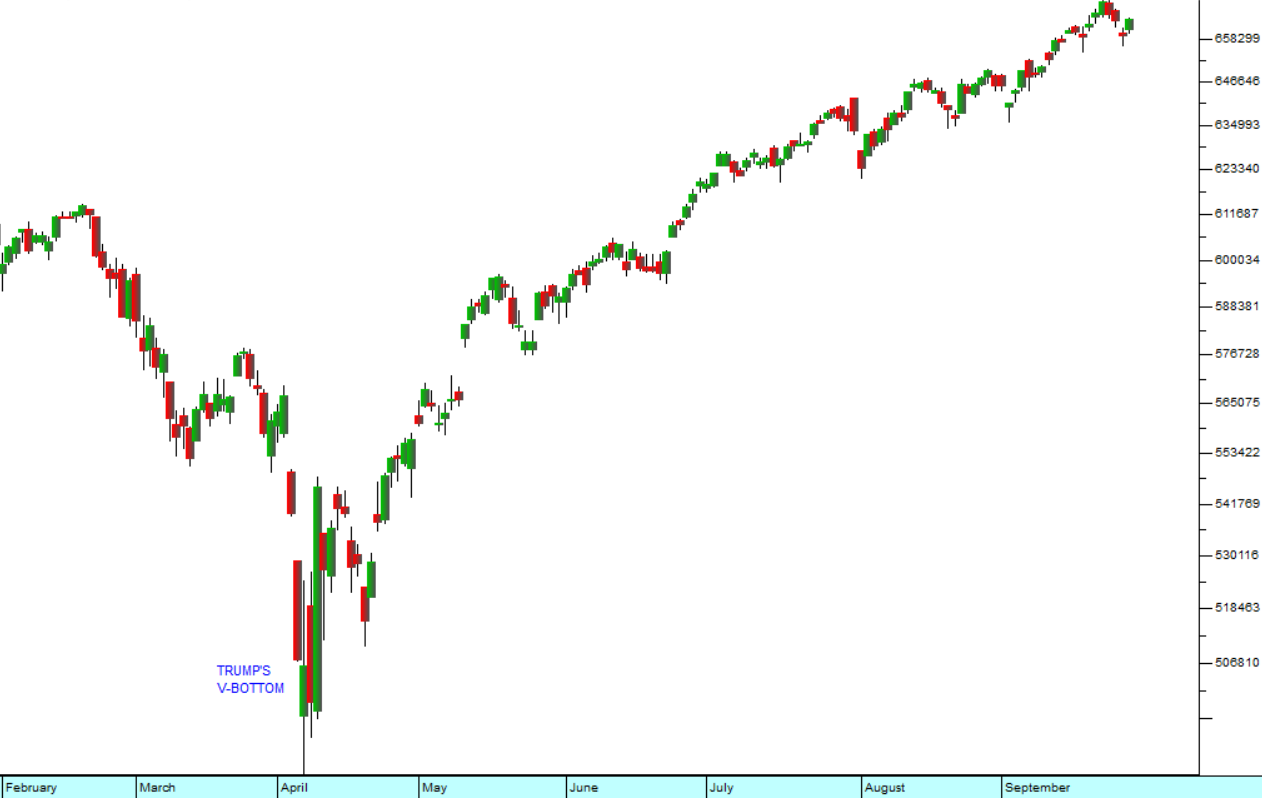

The S&P has recovered rapidly from Trump’s tariff V-bottom and HAS gone on to make a series of new all-time record highs Consider the chart:

Trump delayed the progress of the S&P by approximately four months – and so it has been busy catching up.

The succession of record highs begs the question, “Is the S&P now overvalued?” In historical terms it certainly is - because the average P:E ratio of the 500 companies which it includes is now 25,9 – which is about 41% above its 20-year average. Does that mean that it is at or close to a top? Not necessarily, because, if the profits of companies is expected to rise substantially, then investors may just be discounting that growth. And certainly, something is driving the US economy.

Gross domestic product (GDP) in America grew at the rate of 3,8% per annum in the second quarter of 2025. This is very substantial growth, given the size of the US economy. It was driven by consumer spending and business investment in intellectual property products (like AI) which was up 15% in the last month. With the 25-basis point cut in interest rates, we expect the jobs market to recover quickly. The economy is proving to be very resilient with an AI spending boom clearly under way.

Economists are blaming Trump’s tariffs and immigration policies for the slow-down in the jobs market, but weekly claims for unemployment benefits dropped 14,000 to 218,000. In our view, the US economy is booming and that is being reflected in record-breaking equity prices. We believe that the upward trend will continue despite Trump and not because of him.

The Federal Circuit Court of Appeals in America has ruled by 7 to 4 that most of Trump’s tariffs are illegal and gave the Trump administration until the 14th of October 2025 to appeal their judgement – which will inevitably go to the Supreme Court. Trump’s appointees dominate the Supreme Court, so we should probably expect the Appeal Court’s decision to be overturned. However, Trump’s largely watered down tariffs have already been fully discounted into markets and the eventual outcome is far from certain. I believe that it unlikely to have much impact on Wall Street.

The consumer price index (CPI) was worse than expected in August 2025 at 0,4% and it was the worst print this year. There is some concern that the figures are an early indication of the tariffs, but this was not enough to stop the monetary policy committee (MPC) from reducing interest rates by a further 25 basis points. The cost of housing was up 0,4% and food prices rose by 0,5% in the month. The price of coffee has risen sharply, while the price of beef has been impacted by import duties and the effect of droughts in parts of America.

The CPI rose to 2,9% for the year to end-August and may rise further as the impact of Trump’s tariffs becomes more widespread and the level of personal consumption expenditures (PCE), which is the Federal Reserve Bank’s preferred measure of inflation, was at 3,1% still well above the goal of 2%. Overall, I believe that interest rates will continue to fall, even if more slowly. But the progress of the stock market is not really dependent on interest rates at this time. It is responding to rising optimism about the multifarious benefits of AI.

Ukraine

Three-and-a-half years of war are taking their toll on the Russian economy. The CEO of Sberbank, Russia’s largest bank, says that the economy is stagnating and urges the Russian government to reduce interest rates dramatically to avoid recession. The Russian economy is on a war footing, which has stimulated growth in 2023 and 2024, but that effect may be coming to an end. With interest rates at 18% most businesses and consumers are struggling. Sberbank’s CEO says that the economy is stagnating and suggested that interest rates should be reduced by a further 6% before the end of 2025 to avoid recession. Data from the banking community shows a sharp slowdown in economic activity in July and August 2025 with growth close to zero. In our view, it is the failure of the economy that will ultimately force Putin to stop the war in Ukraine.

On the night of the 7th of September, in its largest attack to date, Russia sent 805 drones and 13 missiles into Ukraine. Of these the Ukrainians managed to destroy 751 drones and 4 missiles. Despite that, 4 people were killed including a child and a large government building in Kyiv was destroyed. The attack shows that Trump’s meeting with Putin in Alaska was pointless and achieved nothing. Putin has shown no inclination to agree to a ceasefire or to commence peace talks. Trump finally appears to have realised that he is not getting anywhere with diplomatic efforts to bring Putin to the negotiating table and now says that he is backing Ukraine to win the war. This reversal of his position is obviously beneficial, provided it results in stronger sanctions against Russia and more aid to Ukraine – but that is far from certain.

The European leaders, who are part of the “coalition of the willing”, have themselves been talking about more onerous sanctions and, more importantly, the possibility of putting European troops on the ground in Ukraine. The commitment of European troops to the war will amount to a major escalation, and might well force Putin to the negotiating table. In our view, the involvement of European troops with boots on the ground is the next logical step in this conflict, even if their role is simply to relieve Ukrainian troops to fight on the frontlines.

Poland has characterised the drones which entered its airspace as a “large-scale provocation” which does not mean that Europe is on the brink of war. The drones were shot down in the first shots fired by a European nation in the Ukraine war. Poland activated Article 4 of NATO’s treaty in terms of which members of the alliance met to discuss the implications of the incident. Notably, many European countries and America all said that they sided with Poland over the incident. At this stage Poland has not described the drones as “Russian” and Moscow has not commented. In our view, this amounts to an escalation by Russia and, if repeated, could justify some European nations committing troops to Ukraine. President Zelensky called for a “strong response”.

NATO countries are set to impose stricter sanctions on Russia to prevent the sale of oil, especially to NATO countries in an effort to make it difficult for Russia to fund the war. Trump has indicated that he will support stronger sanctions, including sanctions against those countries which buy oil from Russia, like China, India, Hungary, and Slovakia. So far Russia has managed to avoid the worst effects of sanctions by exporting its fossil fuels through other countries, albeit at a significant cost.

Ukraine has been stepping up its drone attacks on Russian oil facilities. On the 14th of September 2025 Ukraine attacked the Kirishi oil refinery with numerous drones. Kirishi is one of Russia’s largest refineries processing about 6,5% of Russia’s crude oil. The continuous attacks have cut Russian oil production by as much as 20% and resulted in fuel shortages inside the country. In parts of Russia, there are now queues at those fuel stations which still have fuel, and some have run out completely. This is bringing the impact of the war home to ordinary Russians.

Political

A recent IPSOS poll shows that about 80% of the South Africans surveyed are now pessimistic about the performance and prospects of the government of national unity (GNU) – this compares with only 40% shortly after it was formed. The principal problem seems to be the perception that nothing has changed since it took office – especially as far as service delivery is concerned. At the moment, the ANC has 159 seats in Parliament compared to the DA’s 87 and it is apparent that the ANC’s support especially in the key metros of Tshwane and Johannesburg is declining. In our view, the GNU has gone through a steep learning curve and should slowly begin to perform better, but patience is required. Much now depends on the outcome of the municipal elections next year. The GNU is to hold a symposium on economic growth in South Africa where each department will present its plan to accelerate growth. The outcome of the symposium will be closely watched by voters and will probably impact on the elections. The symposium is being championed by Patricia De Lille, Minister of Tourism.

It seems that the ANC, in the form of President Cyril Ramaphosa, has finally realised the reason for their downfall and the DA’s relative success. In a meeting with municipal leaders, Ramaphosa pointed to the ANC’s declining support and blamed it on poor service delivery. He then pointed to DA-led cities and said that their success in service delivery was attracting businesses and people while ANC councils were losing support. He went further and said that the ANC must provide service delivery - or die. To us, this is a long-overdue epiphany. The DA has the enormous political disadvantage of being perceived as a white party, but it has been able to counter that effectively by simply governing those parts of the country that it controls exceptionally well. Next year’s municipal elections are looming and promise to yield further gains for the DA, while the ANC’s support looks to be waning.

Economy

As expected, the monetary policy committee (MPC) kept interest rates unchanged at its meeting on the 18th of September 2025. Two members of the committee were in favour of a 25-basis point cut. Rising commodity prices, especially platinum and gold, have benefited South Africa as has the decline in the US dollar. The Reserve Bank increased its forecast for growth in 2025 from 0,9% to 1,2% - which we think is still quite conservative. The Trump tariffs are not expected to have a long-term effect on the economy. The Eskom price increase is a major negative for inflation and has made the MPC more hawkish.

The consumer price index (CPI) came in at 3,3% in August, down from July’s figure of 3,5%. Food inflation particularly was 5,2% sharply down from July’s 5,7% because of South Africa’s good harvest and fuel prices were down. The good CPI figure means that the monetary policy committee (MPC) has plenty of room to keep interest rates unchanged but raises the possibility of further rate cuts before then end of the year. Core inflation, excluding food and fuel, was 3,1%, near to Lesetja Kganyago’s new target level of 3%.

The Bureau of Economic Research (BER) survey of inflation expectations shows that inflationary expectations have dropped to a record low of 4,2% over the next five years. This signals a significant shift in consumer and business perceptions and will have long-term consequences for the economy. Consumers are repaying debt and taking advantage of the high interest rates to save. Interest rates are expected to continue falling steadily in the coming months which will reduce the pressure on businesses. The monetary policy committee (MPC) is also intent on keeping South African government bonds attractive to overseas investors with high real interest rates.

Gross domestic product (GDP) increased by 0,8% in the second quarter of 2025 – up from 0,1% in the first quarter. This growth is the equivalent of 3,5% per annum if seasonally adjusted – just above the GNU’s goal of 3%. Gold and chrome were both stronger and agriculture was up 2,5%. Manufacturing increased by 1,8% with 7 out of 10 sectors showing improvement. Household consumption was up 0,8% showing the impact of the rising level of real wages due mainly to the low inflation rate. The figures are much better than expected and we continue to believe that economists are generally under-estimating growth in South Africa. The effect of Trump’s tariffs will be felt more in the third and fourth quarters.

Retail sales were up 5,6% in real terms in the year ended 31st July 2025. Household consumption was the big winner showing the impact of lower inflation and rising real incomes. The textiles, clothing and footwear category was up 10%, general dealers rose 3,3% while hardware, paint and glass were up 13,2%. Contributing factors include the falling interest rates and the switch to the two-pot retirement system which released funds into the economy. Obviously, the advent of Trump’s tariffs is a negative which still has not worked its way through the economy. Despite this, our view is that 3rd quarter gross domestic product (GDP) will surprise to the upside.

The current account of the balance of payments (BOP) had a large R82,8bn deficit in the second quarter of 2025, due to a decline in exports and an increase in imports while dividend and interest payments to foreign investors increased. The trade account showed that exports decreased to R177bn compared with the first quarter’s R211bn, while imports increased by R8,2bn. During the quarter the rand fell against a trade-weighted basket of currencies, even though it strengthened against the US dollar. The weaker currency tends to discourage imports and encourage exports. The figures show that the economy remains reliant on its raw materials exports and remains export-led. Improved logistics, especially at the ports is starting to help exports. The deficit on the current account tends to weaken the rand over time.

Goldman Sachs has published a report on the South African economy in which they say that they expect growth to accelerate from 1% in 2025 to as much as 2,5% in the medium term. They base this optimism on:

1. declining interest rates,

2. the expected improvement in logistics both at Eskom and Transnet,

3. the low level of inflation with the resetting of the inflation target to 3% and

4. the potential for sovereign credit ratings upgrades from the major rating agencies.

We have long been of the view that the Reserve Bank’s projections for growth in the economy are conservative and that the actual growth will exceed local expectations.

The ABSA purchasing managers’ index (PMI) fell back below 50 in August 2025 as a result of weak demand and the imposition of US tariffs. The index came in at 49,5 indicating a slight contraction and reversing July’s positive figure. The third quarter’s reading is still on track to be above 50 and is so far considerably better than the second quarter’s 45,4. New sales orders fell sharply in response to the prospect of tariffs.

The Competition Commission published a report analysing increases in the cost of living since 2020. The figures show that the cost of electricity has risen by 68% over that period and water has risen by 50% - compared to inflation of just 28%. Clearly, the sharp rise in the price of electricity is driving many consumers and businesses to implement alternatives and to move away from Eskom. Eskom has also recently won a court case against the National Energy Regulator (NERSA) which will allow it to recover about R54bn from its customers over the next few years. This will drive even more people to move to solar power and other renewables, making Eskom progressively less and less viable.

The new rules for small businesses gazetted by the Minister of Labour and Employment are designed to make it easier to dismiss employees with the process involving far less red tape requirements like letters of warning and other dismissal procedures required by the Labour Relations Act of 1995. The new rules are designed to adjust the draconian requirements of the existing labour legislation which have made businesses reluctant to employ people because, once employed, it becomes very difficult and expensive to fire them. Business has blamed these draconian labour laws for the high level of unemployment in South Africa.

South African exports to America decreased by 18% in the first quarter of 2025 and by 3% to the rest of the world. Vehicles and motor vehicle parts fell by a whopping 53% following their fall of one third in the first quarter. Iron and steel exports fell heavily, but that was in line with declines in these exports to other parts of the world. Precious metals and stones were down 6%. Of course, the impact of Trump’s 30% tariff on South African exports to America has not yet kicked in and is expected to further impact exports – but South African exporters have been busy looking for alternative markets for their products. Gold and platinum prices have increased recently at the same time as the cost of oil imports has been declining with the result that the terms of trade has remained stable.

Average pay rises have been above 5% while inflation is hovering around 3%, meaning that households are generally better off. This can be seen in the 22,5% increase in new vehicle sales in August 2025. The strong GDP figures for the second quarter show that the economy is improving rapidly stimulated by low inflation and falling interest rates. Payinc (previously Bankserv) shows the number of transactions that they processed in August was up 9,4% over the same month last year.

Moody’s has pointed out that South Africa has much higher real rates of interest than other emerging economies such as Poland, India, Malaysia and Romania. The higher rates of interest mean that consumers and businesses struggle with the high cost of borrowing. The government too pays very high rates on its massive debt. What Moody’s does not point out is that the Reserve Bank, under Governor, Lesetja Kganyago, is forcing the people of South Africa to become a nation of savers rather than a nation of spenders. The high real interest rates are encouraging South Africans to repay debt and save. In the long term, that shift in behaviour will have huge benefits because it will substantially reduce our reliance on foreign direct investment (FDI).

Beneficiation is one of the ways that South Africa can move away from just being an exporter of raw materials and an importer of finished goods. We have between 70% and 80% of the world’s resources of chrome and vast reserves of iron ore yet we are exporting both these raw materials to China and importing ferrochrome, stainless steel and finished products from them. The reason is that China’s cost of electricity is about half of South Africa’s. Over the past 20 years (since 2005) Eskom has pushed electricity prices in this country up nearly ten-fold. From having about the cheapest electricity in the world before the ANC came to power, we now have almost the most expensive electricity. Smelting ferrochrome requires about 2800kWh per ton and the result is that almost all our ferrochrome smelters have now shut down because they are unprofitable – putting thousands of people out of work and affecting various downstream industries. At the same time there is a growing black market chrome mining industry in South Africa which Glencore estimates accounts for about 10% or 2,7m tons per annum worth around R7,5bn. The ANC’s corruption and mismanagement of Eskom together with its inability to adequately police and control illegal exports and imports is costing this country enormously.

Glencore Alloy’s CEO, Japie Fullard, has highlighted the fact that South Africa is in the process of losing a key beneficiation industry – the production of stainless steel. This is mainly because of Eskom’s extraordinary price increases which have made the industry unprofitable. Glencore has a joint venture with Merafe to produce stainless steel and that company is about to retrench 2500 workers and close more of its smelters. Fullard points out that each job lost in the stainless steel industry means that a further 7 indirect jobs are lost. Fullard says that China is producing stainless steel for half the price that we can produce it. The price of electricity has increased 8-fold since 2008. The irony is that South Africa has the world’s largest reserves of the chrome necessary to make stainless steel. So now we export that to China and then import their stainless steel. It is clear that the ANC’s appalling mismanagement of Eskom is costing the country dearly.

New car sales in August came in at 51880 were up 18,7% from the same month a year ago. Total sales for the first 8 months of the year was up 14,5% compared to 2024. Lower interest rates have been a positive factor and consumer interest is strong. Most of the sales are for cheaper vehicles and reflect improving consumer take-home pay. Vehicle replacements which have been postponed are now taking place as budgets improve and consumers have more disposable income. Obviously, the export market will be hurt by Trump’s tariffs as manufacturers look for alternative markets.

The Rand

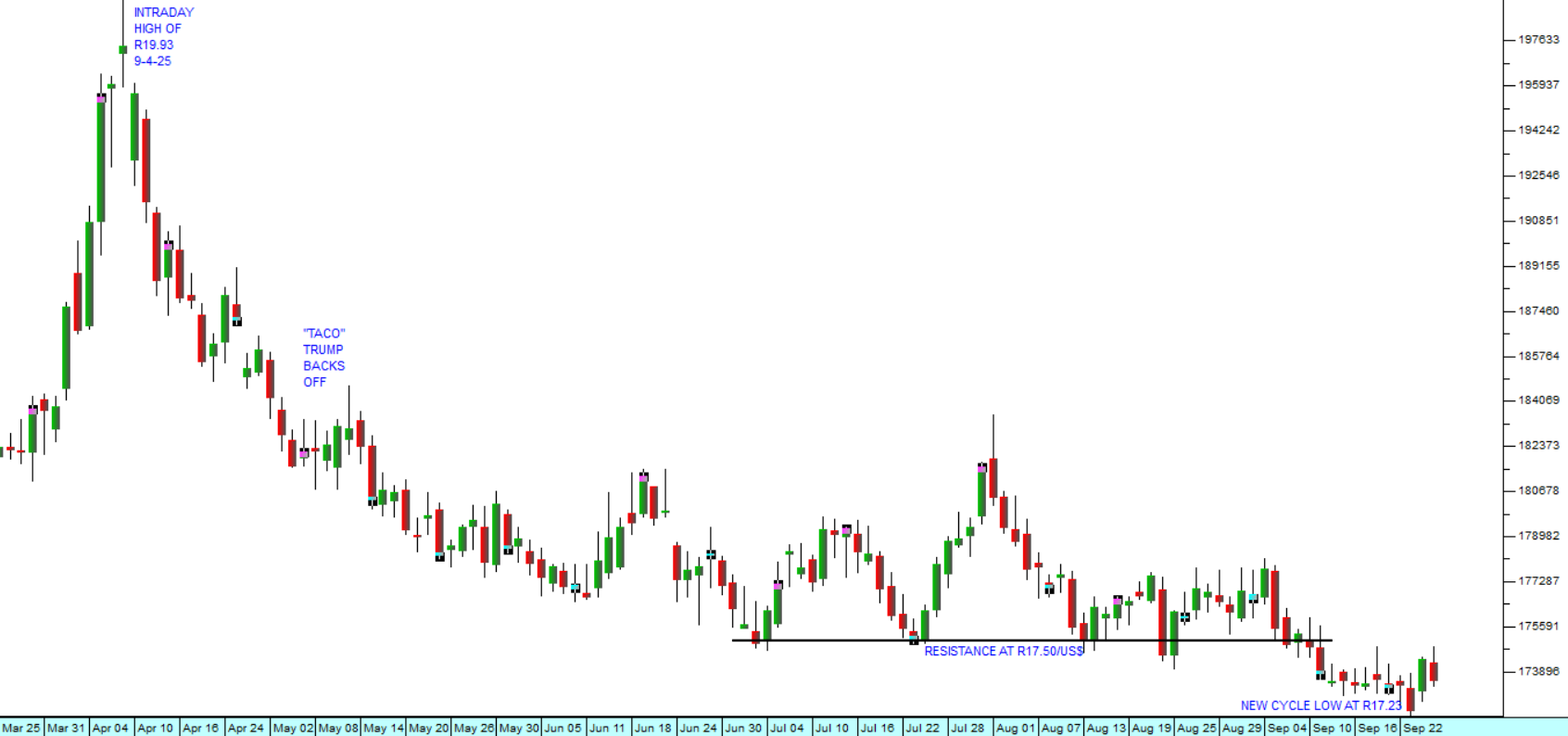

We have commented before about the relationship between the rand and risk-on sentiment in world markets. Right now, sentiment is strongly bullish on world markets and sentiment is predominantly risk-on. This has resulted in a surge of investment into high-return emerging market assets and the rand has benefited accordingly.

The rand has finally broken up through resistance at R17.50 to the US dollar. It had bounced against that resistance level four times since the beginning of July 2025 as sentiment in international markets moved inexorably back towards risk-on. At the same time, Wall Street has been recording new record highs, and the US dollar has been generally weakening against a trade-weighted basket of currencies. Consider the chart:

In our view, the rand will continue to strengthen and should soon break above the previous cycle high at R17.11 to the US dollar made on the 27th of September 2024 – before the US elections and Trump’s accession. A strengthening rand is mostly good for the South African mainly because it reduces inflationary pressures, especially on the price of fuel. However, it does tend to make our exports more expensive on world markets. Recently, that factor has been obviated to some extent by the rising price of precious metals, especially gold and platinum.

Commodities

The World Platinum Investment Council (WPIC) continues to see the rise in platinum prices as continuing. In a recent report they indicate that there will be an 850 000 ounce deficit this year – the third consecutive year with a deficit. The difference is that this year producers will not be able to make up the shortfall by drawing down on stocks of raw material as they did in 2024. Last year at least 10 000 workers were retrenched in the platinum sector because of low platinum prices. Now suddenly there is a massive shortage, and prices are rising with global superpowers trying to secure stocks of the metal. Military technology, hybrid/electric vehicles and the rise in renewable energy installations are all adding to demand. South Africa’s platinum share prices have increased substantially. For example, Northam has risen by 96% in the 133 days that it has been on the Winning Shares List (WSL).

Gold has moved up to a new record high at $3774 per ounce taking South African gold producer shares like Pan African, Harmony, Goldfields, Anglogold and DRD up with it. It is interesting to consider the state of the world’s supply of gold. Between 1990 and 2024 more than 350 gold deposits worldwide were discovered containing an estimated 3bn ounces of gold. In the last five years, there have been six more deposits found with a further 27m ounces of reserves. But exploration has not kept up with demand, especially central bank demand, resulting in a sharp rise in the price. Consider the chart:

The chart shows that the price of gold in US dollars encountered significant resistance at $3424 bouncing that level 4 times (the red arrows) before finally breaking up through that resistance on 1st September 2025.

The war in Ukraine and Israel’s ongoing conflict in the Middle East have significantly increased uncertainty levels among investors. South Africa’s problem is that its remaining gold reserves are very deep and hence mostly not economically viable. The country, which produced more than 1000 tons of gold in 1970, is now only the world’s tenth largest producer.

You will notice, however, that we have had most of the leading gold shares on the Winning Shares List (WSL) for a long time:

|

|

|

|

|

|

|

Pan African |

31-01-2024 |

430c |

2002c |

365.58% |

|

Harmony |

16-11-2023 |

9920c |

30960c |

212,1% |

|

Anggold |

05-03-2024 |

38932c |

117666c |

202,23% |

|

Goldfields |

04-2-2025 |

32915c |

70649c |

114,64% |

|

DRD Gold |

06-3-2025 |

2261c |

4828c |

113,53% |

Hopefully you have taken advantage of this bonanza!

Companies

NEW LISTINGS

- ASP Isotopes (ISO) produces and sells such rare and esoteric substances as ytterbium 176 and silicon 28. Ytterbium176 is a radiopharmaceutical used in the treatment of prostate cancer. It has been said that every man will eventually get prostate cancer, if he lives long enough. Brachytherapy and radiation using radioactive isotopes have made prostate cancer one of the lowest risk forms of cancer in recent years. Silicon 28 is used in quantum computing and next generation semi-conductors. This highly enriched form of silicon is critical for producing high-performance microchips and nanowires, as well as for developing quantum computing technologies.

- Greencoat Renewables (GCT) is taking advantage of Europe’s rapid progress towards carbon neutrality by 2050. It has 40 renewable energy installations producing more than 1,5 gigawatts of power in 5 European countries. 97% of their production comes from onshore and offshore wind energy with 55% in Ireland, 22% in Germany, 10% in Sweden, 8% in France and 3% in Spain.

Both of these companies are involved in exploiting cutting edge technologies. Neither one is cheap and both have considerable risk. But they also offer the potential for capital gain. They do not yet have sufficient trading days recorded to make any kind of technical assessment possible and so far we have not put either onto the Winning Shares List (WSL).

PAN AFRICAN (PAN) – We first added PAN to the Winning Shares List (WSL) on 31st January 2024 at 430c and then recommended it again in an article on the 13th of May 2024 when the shares closed at 580c. Finally, we once again drew your attention to Pan African in last month’s Confidential Report on 3rd September when the share was 1633c. Since then it has gone up further to reach a high of 2406c before falling back to 2002c where it closed last Friday. Consider the chart:

NASPERS

This company has long been a favourite of ours because its CEO, Koos Bekker, has been constantly preoccupied with trying to release value to its N shareholders. The problem is that the “N” share structure is generally frowned upon by investors because the voting power of the N shares is far lower than that of the ordinary shares. It has 907128 unlisted "A" ordinary shares. Each "A" ordinary share has 1000 times the voting power of the 438,3m "N" shares which are listed - so they effectively control the company with 67,4% of the vote – even though they have contributed only a fraction of the capital.

Bekker is always coming up with ideas to give value to the “N” shareholders, and his latest idea is to conduct a 5-for-1 share split the details of which were announced on the 15th of September 2025. So, a person holding 1000 Naspers shares trading for R6065 will end up with 5000 shares each theoretically trading for R1213. The value of his holding will be unchanged, but the shares will become cheaper and within the range of a larger group of shareholders. The result should be that the price will go up.

We originally added Naspers to the Winning Shares List (WSL) on the 15th of February 2025, which was trading for R4600, so it has gone up substantially since then. It should appreciate further now with the split. Consider the chart:

Naspers (NPN) : January 2025 - 26th of September 2025. Chart by ShareFriend Pro.

OUTSURANCE

OUTsurance (OUT) is what remains of Rand Merchant Bank after unbundling of Discovery, and Mommet and the sale of its 30% stake in Hastings. By March, all that was left was the insurance company. We always believed that OUTsurance would be a solid blue chip investment and we added it to the Winning Shares List on the 15th of February 2025 at a price of 4457c. It has been in a steady upward trend since then. Consider the chart:

As you can see the upward trend began in June this year and is still continuing. You should note that for the past four days the share has been falling – which has brought it back to the trendline. We see this as a potential buying opportunity.

ATTACQ

Attacq is a property developer which listed on the JSE in 2013 and converted to a real estate investment trust (REIT) in May 2018. It owns the Mall of Africa and is busy developing the Waterfall City complex. It is now building the Ellipse Waterfall residential high-rise, which will have 590 apartments priced between R1,5m and R12m. Overall, Waterfall City is expected to consist of over 1 million square meters of multi-use space over the next 5 to 10 years. What we especially like about this REIT is it very low loan-to-value (LTV) of 25,3%. This substantially reduces the risk of investing and gives it the financial headroom to take advantage of opportunities that may arise in the market. Property generally is performing well at the moment because of falling interest rates and Attacq is one of the best REITs on the JSE. Consider the chart:

After a period of sideways movement which ended at the beginning of 2024 the share has been trending upwards. We added it to the Winning Shares List (WSL) on 25th January 2024 at a price of 964c. It has since risen to 1381c. We believe that it will continue to perform well.

CHOPPIES

Choppies is an interesting share from a private investor’s perspective. It specialises in running supermarkets in Africa – except for South Africa. In this country the retail grocery sector is over-crowded and highly competitive. South African retailers like Pick ‘n Pay and Shoprite have burnt their fingers trying to establish themselves in countries to the North and have withdrawn – so Choppies really has the field to itself with minimal competition. Clearly it has established a set of business methods which work in Africa and has learned to manage political and currency uncertainty as well as transport and corruption problems. In our opinion, it is quite possible that one of the retailing giants in South Africa could try to acquire Choppies in due course. Consider the chart:

You can see that after an extended period of sideways movement which ended in February 2025, this share entered a new upward trend which is on-going. In our view it has begun to attract the attention of institutional fund managers. We added Choppies to the Winning Shares List (WSL) on the 6th of March 2025 at a price of 85c. It has since risen to 194c – more than doubling in less than six months. We expect it to continue to perform well.

DISCLAIMER

All information and data contained within the PDSnet Articles is for informational purposes only. PDSnet makes no representations as to the accuracy, completeness, suitability, or validity, of any information, and shall not be liable for any errors, omissions, or any losses, injuries, or damages arising from its display or use. Information in the PDSnet Articles are based on the author’s opinion and experience and should not be considered professional financial investment advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Thoughts and opinions will also change from time to time as more information is accumulated. PDSnet reserves the right to delete any comment or opinion for any reason.

Share this article: