The Confidential Report - October 2023

4 October 2023 By PDSNETAmerica

The US Federal Reserve Bank held interest rates unchanged for the second time at their meeting on 20th September 2023, but remained hawkish in their commentary. Rates remained unchanged at between 5,25% and 5,50%. The monetary policy committee (MPC) expects that rates will fall slightly in 2024 to about 5,1% and then further in 2025 to around 3,9%. The market has had to adjust to the idea that rates would remain at high levels for most of 2024 and only fall significantly from 2025. The relative hawkishness of the MPC’s comments after the meeting impacted negatively on the S&P500. The S&P has corrected back to its underlying support trendline and spiked down to 4274. Consider the chart:

You can see here the current correction which has taken the S&P down by 7,84%, the underlying trendline is barely holding and may be broken soon. Despite this, our view is that the S&P, which has been “backing and filling” for the past week will probably break upwards and, in time, exceed the previous cycle high at 4589. Eventually, we will see the index making a new all-time record high to resume the long-term bull trend that began in March 2009. Other world markets, including the JSE will probably follow Wall Street up.

US Gross domestic product (GDP) growth in the second quarter came in at 2,1% which is still robust considering the high levels of interest rates and shows that the economy is nowhere near a recession (defined as two successive quarters of negative GDP growth). The figure is virtually the same as the revised 2,2% growth rate record in the first quarter showing that the high level of rates has not yet impacted growth.

The confusion among Republicans in the House over spending almost led to a temporary shutdown of the government. Hundreds of thousands of civil servants would not have been paid and many different government programs would have stopped operating. This would have meant that millions of Americans who rely on social grants of various sorts would have had to go without. Goldman Sachs estimates that the cost of a shutdown will be about 0,05% of GDP per week that it continues. In our experience, government shutdowns of this sort in America, when they occur, do not last for long. The worst-case scenario would be four or five weeks. The reason for this is that the party which is perceived to be the cause of the shutdown is usually heavily punished by voters – many of whom are civil servants who have to temporarily do without a monthly salary. The Speaker, Kevin McCarthy, presented a bi-partisan resolution to keep the government operational for 45 days. This resolution won more Democrat votes in the house than Republican because it excluded all the radical demands of the MAGA Republicans. However this has resulted in McCarthy losing his speakership.

The irony is that the same MAGA Republicans who were intent on shutting the US government down at the same time pursued a hopeless impeachment process against President Biden, which they had absolutely no evidence for. All this confusion will certainly be very bad for the Republican party in the 2024 elections.

Donald Trump is now facing 4 criminal indictments in four different States as well two civil actions for damages. Absurdly, he remains the front-runner for the Republican nomination. It is also possible that he may be barred from taking office in terms of section 14 of the Constitution because of his involvement in the January 6th 2020, insurrection. All this political chaos is being discounted into the stock market.

Finally, another negative for the US economy is the strike now in progress as General Motors, Ford and Chrysler. The strike is in its second week and is impacting production. The president of the United Auto Workers union says that the two parties are far apart at this stage. One of the issues appears to be the development of electric vehicles, the production of which is seen as requiring less jobs.

Notably the strike has not impacted Tesla, the motor manufacturer that dominates the EV market in America and around the world. Tesla is not unionized because of stiff and sometimes illegal resistance to unionization by Elon Musk. The wisdom of his opposition is now becoming very apparent. It is also noteworthy that Tesla shares have more than doubled in value since the beginning of this year.

The US economy created 187 000 new jobs in August 2023 (the non-farm payroll) and the unemployment rate ticked up to 3,8%. Job creation has definitely dropped off in the last year as interest rates have been rising, but the unemployment rate has remained static at between 3,4% and 3,8% with a slight uptick evident in the August number. The job market has remained generally strong throughout the rate hiking cycle showing that the economy is still in good shape and growing.

In our view, the rate hiking cycle has topped out and interest rates can be expected to begin declining late in 2024. There is an outside possibility that the monetary policy committee (MPC) could raise rates one more time by 25 basis points when it meets in November, but at this stage that looks unlikely.

As indicated earlier, our view is that the great bull trend of the past 13 years will continue, but there are three potential wild cards which we believe could impact, positively or negatively, on that scenario:

- The first of these is the war in Ukraine which is analysed more fully below.

- The second possible problem may come from the Chinese economy where growth has slowed sharply, and which has a major potential problem in its housing sector (which accounts for about a quarter of that economy). However, August 2023 data suggests that it may be stabilizing.

- A third potential threat to continued growth is the rising oil price which has been rising steadily since June this year and is now approaching $100 per barrel on North Sea brent. Consider the chart:

There can be little doubt now that the price of North Sea Brent oil has based out at about $72 per barrel and is now in a strong new upward trend. Last week, Brent came close to breaking above the psychological level of $100 per barrel, stimulated by a shift in perceptions of growth in the US economy. Growth, especially in America, (which consumes 25% of the world’s oil) means a rising demand for oil. A higher oil price means rising inflation worldwide and slower economic growth as more and more disposable income is diverted to pay for transportation.

Ukraine

The war in Central Europe impacts on equity markets directly through the price of oil and grains. But it has a much deeper and longer-term significance because it is essentially a war between democracy and autocracy – literally good versus evil. It is a perennial battle that has been going on since the beginning of history and is the subject of all our religions, legends, and stories. It is a battle that is being fought right here in South Africa and it is very much the focus of American politics in the run up to the November 2024 elections. It has been well said that:

“The only thing necessary for the triumph of evil is that good men to do nothing.”

Russia is the residue of the dissolution of the Soviet Union following the collapse of the Berlin Wall. Vladimir Putin, the quintessential autocrat, seeks to re-establish the Union of Soviet Socialist Republics (USSR) by annexing all those satellite countries which took the opportunity offered by the fall of the Berlin Wall in November 1989 to escape authoritarian rule. These are countries such as Latvia, Lithuania, Poland, Moldova and, of course, Ukraine.

He is opposed by President Zelensky and the people of Ukraine who are fighting this war on behalf of the entire free world. The North Atlantic Treaty Organisation (NATO), Europe and America, are giving them the weapons and other support that they need to defend themselves against this naked and unprovoked Russian aggression.

So far America is estimated to have given Ukraine about $100bn worth of assistance (Including the current aid package which Biden is trying to get through congress). This should be compared to America’s annual gross domestic product (GDP) which is expected to be about $23,3 trillion this year. It is less than half of one percent – which seems like a fantastic bargain for the estimated destruction so far of roughly half of the Russian army and military materiel. And NATO has not suffered a single casualty! Instead, it has drawn in two powerful new members – Finland and Sweden.

It is also important to understand that the Russian economy has a total GDP of about $2,1 trillion – which is about the same size as the state of Texas and about 60% of the state of California. Russia cannot possibly hope to outlast the combined economic power of both America and Europe. That idea was absurd from the beginning. The only chance Putin ever had was to win very quickly and decisively handing NATO an unpleasant fait accompli and then hoping that they would accept it as they had the annexation of Crimea.

There has been some recent evidence that NATO countries may be tiring of their support for the war in Ukraine. The Polish government briefly said that they would be halting supplies of military aid to Ukraine. This came on the eve of a critical election in that country and possibly resulted from the unhappiness of Polish farmers with the new arrangements for grain exports from Ukraine, following the blockade of grain exports through the Black Sea by Russia. The situation has been resolved and Polish support is flowing again.

In addition to this, there has been some opposition from members of the Republican Party in the US, making it appear that the once solid support for Ukraine might be wavering. No doubt Vladimir Putin is getting great encouragement from these nascent signs of dissent within NATO.

At the same time, the Ukrainians, fighting a war which is completely unique and utterly different from any previous war, have been making incremental gains, especially in the South and East of the country. So far, they claim to have “liberated” 54% of the land which Russia had annexed and there is clear evidence that they are on the brink of breaking through the extraordinary defensive lines that the Russians had put in place. Progress is expected to accelerate once Tokmak is taken and the vital land route for resupply of Crimea is cut off. Of course, winter is coming and that will make it much harder for both sides to advance. No doubt Putin is hoping for a lengthy stalemate that will enable the Russian army to re-group and the problems within NATO to become more pronounced.

In our view, the position which Russia now finds itself in is now completely untenable and the country has been brought to the brink of collapse by its ill-advised pursuit of this war. The collapse of the ruble exchange rate has recently been emphasized by the Russian central bank’s decision to hike rates even further to 13% in their desperate effort to prevent the ruble falling below 1c US on the open market. We believe that the situation is very close to collapse and that Putin’s position is tenuous and that the problems within NATO have been quickly resolved and the flow of weapons and support to Ukraine will continue and increase. Certainly, Russia does not have the economic strength and size to sustain the war against the enormous power (both military and economic) of the combined economies of the NATO alliance. We will be surprised if Putin survives much beyond the end of this year. His desperation is evident in the recent overtures that he has been making to North Korea (of all countries!) apparently as a source of weapons. Has the once great and much-vaunted Russian military machine finally run out of resources?

Our observations of the war show that Ukraine is benefiting enormously from the precision artillery supplied by Western countries combined with their own amazing development of drone technology. This contrasts sharply with the Russian efforts to prosecute the war with indiscriminate generalized barrages which are far less effective. Clearly, we are close to the point where the frontline will become static as winter closes in. If, by that time, the Ukrainians are able to significantly cut off supplies to Crimea the Russians will have effectively lost the war. The recent devastating attack on the Crimean port of Sevastopol has made the Russian Black Sea fleet more-or-less irrelevant and it clearly demonstrates the amazing prowess of Ukrainian drone development. In our view, Russia’s control of Crimea is hanging by a thread – and if Crimea is lost then Putin is probably also lost. How can he possibly justify the enormous cost of this war, both economically and in terms of lives lost to the Russian people?

Political

As the year draws to a close, the impending 2024 elections in South Africa are becoming increasingly important, not only to the ruling ANC, but also to all South Africans. It is clear that the ANC has lost significant support since the last election, much of which is because of their inability to solve the electricity problem. That problem is not going to disappear before the election – in fact, recent estimates suggest that loadshedding will get worse in the remaining months of this year and well into next year. The National Energy Crisis Committee (NECOM) itself does not see much improvement before the end of next year. That is bad news for the ANC because loadshedding is a burden which is borne mostly by its traditional support base.

It now seems clear that the ANC will not have a majority in Parliament after the elections and that its support may fall to as little as 40%, forcing it to compromise with one or more of the opposition parties. The ANC is using its power in government to implement the expensive populist measures (such as the recent 7% civil service wage hike) which it needs to maintain its support base. Unfortunately, this extra spending comes at a time when the fiscus is taking strain partly from declining tax revenues due to the fall in commodity prices. We can expect the mini budget due on 1st November 2023 to show a considerably enlarged deficit and there is now talk that VAT will have to be increased by as much as 2%.

It must be terrifying for the ANC that Post Bank, originally a part of the bankrupt and completely incompetent Post Office, is responsible for the monthly payment of 6 million social grants. According to a group of the bank’s board members who recently resigned, Post Bank has several times come within a few days of failing to pay these grants on time. To us it appears obvious that it is merely a matter of time before the ANC accepts the fact of their inability to manage such a complex process and hands this critical function of paying social grants to one or more of South Africa’s excellent commercial banks. The prospect that Post Bank might fail to pay these grants in the months leading up to the 2024 elections must be harrowing for the ruling party.

Economy

The Reserve Bank’s decision to keep the repo rate steady at 8,25% is in line with other countries, particularly America and the UK. The repo rate is usually about 3,5% lower than the prime overdraft rate offered by commercial banks. The Reserve Bank increased its forecast for gross domestic product (GDP) growth in the South African economy this year from 0,4% to 0,7% following the improved economic performance of the past few months and that inflation was predicted to come in at 5,9% for the year. Core inflation excluding food and fuel is expected to be 4,9%. The interest rate decision was close, with 2 members of the monetary policy committee (MPC) voting to raise rates by 25 basis points. The level of interest rates in South Africa remains well above the inflation rate, offering investors an attractive real return on their funds and attracting overseas investors.

The Reserve Bank’s leading business cycle indicator for July 2023 was, once again, slightly up after June’s positive showing. In the four months before June the index fell, but it now seems to be recovering. This is an amazing testament to the resilience of the South African business sector – given the high level of interest rates and continuous loadshedding which it faces. The growth is confirmed by the Reserve Bank’s higher estimate of GDP growth of 2023 at 0,7% - up from 0,3%. There was also slightly less loadshedding in the 2nd quarter. It now appears that the South African economy will avoid falling into a recession.

Gross domestic product (GDP) grew by 0,6% in the second quarter of 2023 – ahead of analysts’ expectations of just 0,1%. Obviously, the reduction in loadshedding during the quarter was a major factor. Growth in the 1st quarter was 0,4%. Mining and manufacturing were the star performers in the second quarter, gaining 0,1% and 0,3% respectively. Financial services gained 0,2% and agriculture gained 4,2%. Growth this year is still likely to be less than 1%, which means that the unemployment rate will continue to worsen.

The BankServ economic transactions index (BETI) fell in August 2023 to 134, down from July’s 135,6 – indicating that the South African economy is shrinking. Various factors caused the fall, including the taxi strike, Transnet’s inability to keep the rail line to major ports functioning and the continuous and rising levels of loadshedding. Loadshedding has also been impacting substantially on retailers and food producers. Libstar recently reported that profits were down 40% in the six months to 30th June 2023 and RCL Foods reported headline earnings per share (HEPS) down 46% in the year to 30th June 2023. Shoprite said it spent R1,3bn on diesel in its recent annual results to 2nd July 2023 and Pick ‘n Pay reported a loss for the six months to 31st August 2023 partly because of loadshedding. The South African grid gets about 6,2 gigawatts of power from renewables while about 40 gigawatts comes from coal-fired power stations. Ironically, coal-fired power stations are far less reliable than renewables at this stage.

BankServ’s take-home pay came in at R15578 in August 2023 – up 5,8% from July and the second monthly improvement in a row. Companies are steadily reducing their dependence on Eskom and working around loadshedding. There has been a noticeable improvement in manufacturing and the construction industry is benefiting from lower tender competition and a rise in available work. The consumer price index (CPI was just 4,8% in August so the average household is better off financially than it was. On the negative side, interest rates remain high and there is a substantial increase in the petrol price on its way in October.

Manufacturing improved in the 3rd quarter of 2023 probably because many businesses have implemented alternative energy solutions. The ABSA/BER manufacturing survey shows that sentiment in the manufacturing sector improved noticeably with confidence up 6 index points from the second quarter. There was a slight reduction in loadshedding in August month, but mostly manufacturers have moved to other power sources. Manufacturing now contributes about 13% of gross domestic product (GDP) which is a substantial drop from its 23% contribution in 1980. Expectations for the next year have improved substantially, showing that manufacturers are confident of their ability to meet industry problems going forward.

Inflation at the factory gate, the producer price index (PPI) rose by 4,3% in August 2023 – more than economists’ projections of 3,7% and the first monthly increase in a year. The increase reflects the increased costs of electricity and the impact of loadshedding and rising food and fuel prices. Metals, machinery, equipment, and computing equipment rose by just over 10% as a result of the rising demand for renewable energy equipment. The PPI for electricity was 18,7% while the PPI for agriculture, farming and fishing was down to 6,3%. The rise in the price of oil and the weakness of the rand were contributors.

South African Revenue Services (SARS) has warned that tax collections are coming in far slower than what was projected in the February 2023 budget. For the first 5 months of the tax year, collections are down R22bn due to lower corporate taxes and higher VAT repayments. This is obviously a reflection of a drop in the profits of mining companies who have seen their commodity prices declining. It is also an indication of the effects of higher interest rates and loadshedding on corporate profits generally. Lower tax collections usually means a higher budget deficit and the Treasury recently increased its borrowing of short-term funds in the bond market from R12bn to R14bn per week. It is estimated that the government will need to borrow as much as R600bn this year to cover its expenses plus the R254bn of Eskom’s debt that it has agreed to take on. At the same time, the demand for additional funding is pushing yields on government bonds up.

In response to lower tax collections, the government has embarked on a cost-cutting exercise. Among the measures is an effort to cut the civil service by 200 000 and freeze pay levels, which is upsetting the civil service unions. It is also proposed to increase VAT by 2%, a move which will impact the broader economy. Clearly, the government is trying to drag its expenditure back inside its income and its borrowing capacity. This is the correct thing to do, but it will probably have a further negative impact on the ANC’s popularity in the run-up to the elections next year.

The mid-term budget policy statement (MTBPS) is due to be delivered on 1st November 2023. It is likely to be characterized by sharply reduced tax revenue and spending over-runs leading to higher debt levels. This, in turn, means that government spending will have to be curtailed to avoid a situation where the government’s interest payments become too large as a percentage of its available revenue. Tax revenue will be about 20% lower than last year partly because of the drop in commodity prices and partly due to the impact of loadshedding on the broader economy. In addition, the 7% hike in the civil servants’ wages was not included in the budget and will knock a large hole in revenues. The social relief of distress grant (SRD) is now costing about R65bn a year and that number is expected to rise to R90bn if the grant is increased to R480 per person – as is expected. The government is having to spend more and more on interest which leaves less and less for other discretionary expenditure. The interest bill is now approaching R100bn per quarter. Since the 2008/9 tax year, the government deficit has increased from 23,5% of gross domestic product (GDP) to an estimated 71% by the 2023/4 tax year. It is expected to rise further to 73,5% by 2025/6. It seems that South Africa will have to learn to “cut its coat according to its cloth” – which will mean some significant spending cuts prior to next year’s critical election. It also looks like the government may have to raise VAT by 2% to fund the SRD in the future.

Mining output fell 3,6% in the year to end-July 2023 due to rising loadshedding and falling commodity prices. The decline will impact South Africa’s gross domestic product (GDP) as well as tax collections which are already taking strain. Mining contributes about 7,5% of GDP. Platinum group metals output fell by 10,4%, coal output was down 7% and manganese was down 11,5%. On the positive side, gold production rose by almost 13%.

The news that, as of its financial year-end on 31st March 2023, Transnet had a debt pile of R130bn and was paying interest of R1bn a month came as no surprise. Having reached the limit of what they can borrow, the company is now considering selling assets worth about R50bn to help finance an R85bn cost for infrastructure at its subsidiary Transnet Freight Rail. Understandably, the Treasury is not interested in further bailing out the company which has been the subject of mismanagement and corruption. The problem is that the lack of adequate infrastructure is costing the economy heavily because mining output cannot be transported to port by rail and road transport is about four times as expensive. This is yet another case where the ANC took over a fully functioning system in 1994 and have allowed it to deteriorate to the point where it is unworkable.

The recently produced report by the Center for African Markets and Management complains about the fact that as much as 30% of cement used in South Africa is imported and that imported cement can cost as much as 40% less than locally produced cement. The imported cement comes from China, Vietnam, and Pakistan where producers are making the cement and transporting it to this country for far less than we can make it. The question is, “How can they do this with such a high-bulk, low-value product like cement?” Obviously, local producers are simply far less efficient at producing cement – and perhaps, instead of lobbying for tariff protection, they should be looking at how those countries are able to produce their product so much more effectively. Of course, South African consumer’s benefit enormously from cheap imported cement because it means that they don’t have to pay a premium for their cement simply to subsidise what is clearly a highly inefficient industry.

Once again, we are being fed some optimism about the outlook for Eskom and loadshedding. This time it comes from business leaders who serve on the National Energy Crisis Committee (NECOM), and they are saying that, while loadshedding will get worse for the rest of this year, by the end of next year it will be much lower and under control. This is a story that South Africans have heard too many times to believe it. Most of us find the Daily Investor’s article about how Eskom has deteriorated since Andre de Ruyter left more credible. Our new Minister of Electricity, Ramokgopa’s does not appear to have improved any of Eskom’s metrics since he was appointed six months ago. The energy availability factor (EAF) has become worse and the outlook for loadshedding is far worse for the rest of this year and throughout 2024. We can now expect Eskom to produce 2100mw less than is required throughout that period – which means loadshedding will continue and even get worse. Those South Africans who are moving to renewables are doing the right thing. The energy action plan does not seem like it will come to our rescue anytime soon and whatever money you spend on implementing a renewable solution will be money well spent.

The El Nino weather phenomenon is now officially in progress and will likely result in a period of drought years in Southern Africa beginning in 2023 and 2024. This will have a major impact on the South African economy because it will likely result in a smaller maize crop and necessitate the import of grains. It could also result in more widespread water shortages, especially in Gauteng which would impact directly on consumers and businesses. While there is no certainty, El Nino is expected to be more severe than it has been in the past due to record ocean temperatures as a result of global warming. Food prices are likely to rise and that will impact directly on several JSE-listed companies.

It was good to hear the International Monetary Fund's first deputy MD, Gita Gopinath, describe South Africa as having “...deep financial markets and long-maturity debt...” as well as “...strong monetary policy”. These are the attributes, especially our monetary policy, that have kept the economy of this country from slipping into “banana republic” status over the past 30 years. Our relatively low level of inflation has stood out among emerging economies, and this combined with our very liquid currency market has made the rand a favourite of international investors.

The Rand

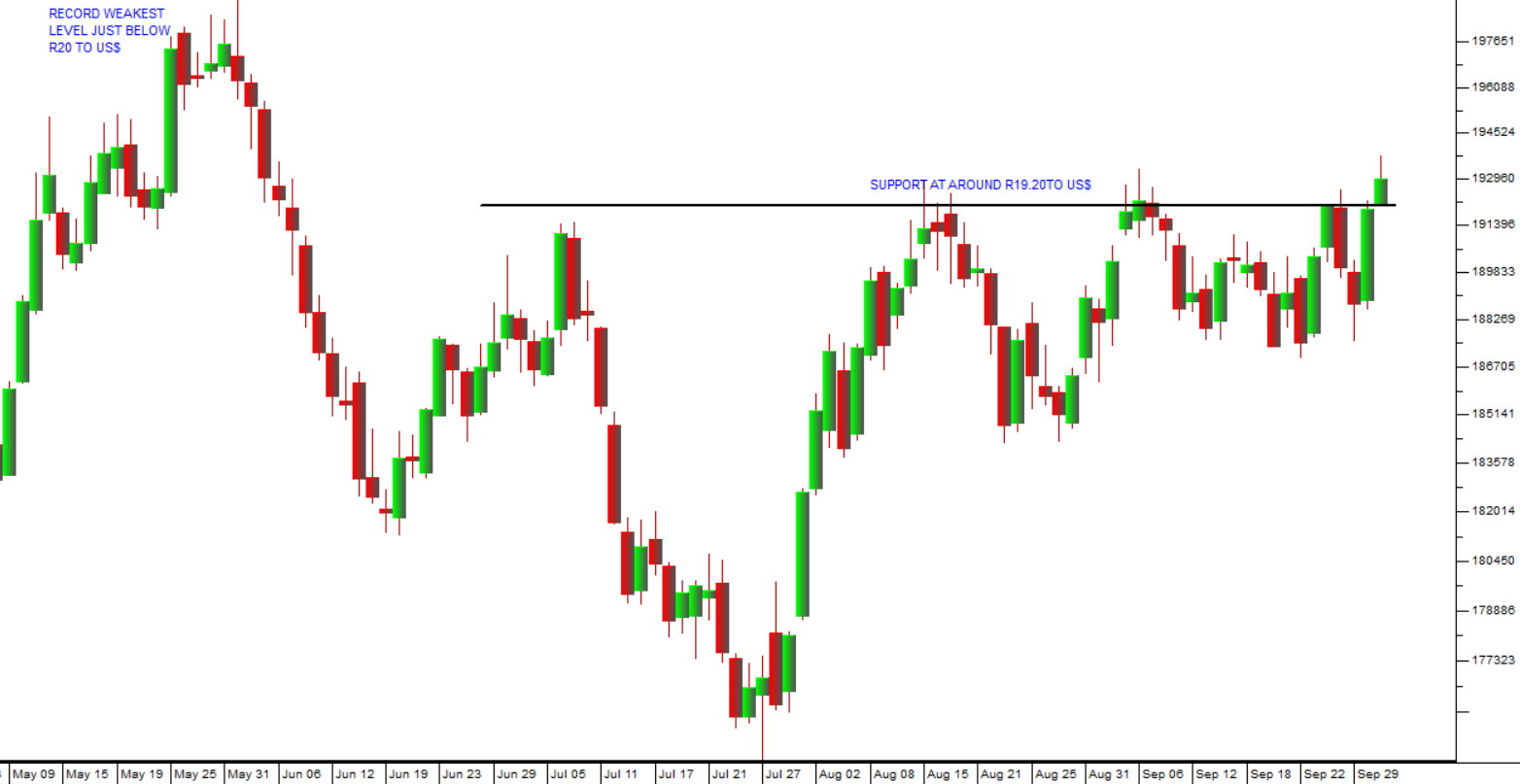

The rand, having reached its lowest level ever at the end of May 2023 has managed to strengthen slightly and now appears to have support at around R19.20 to the US dollar. Consider the chart:

The rand is subject to both upward and downward pressure because of its status as a leading emerging market currency. Whenever international investors become more optimistic (i.e., “risk-on”) they seek to buy high-yielding emerging markets assets and the rand strengthens as a result. The opposite (“risk-off”) is also true. The influence of these international shifts in sentiment combines with local factors such as the high debt-levels of the government, the weakness of commodity prices and the impact of loadshedding. The result tends to make the rand/US$ chart quite volatile.

The overall direction of the rand against the US$ over the long term is always going to be down. Emerging economies usually have higher inflation rates and higher political risk than first world economies which result in the steady erosion of their currency values. The general downward trend is, however, often interrupted by periods of strength, some of which can be quite protracted.

The strength of the rand has a direct impact on the South African economy and especially on inflation because it is a primary determinant of the petrol price. At the same time, most listed companies on the JSE have some exposure to the rand because they have business interests in overseas countries. A weakening rand means that rand hedge shares like mining companies receive more rands for their exported products making them more profitable. This effect is especially noticeable with mining shares.

HSBC recently produced a forecast that the rand will fall to R25.50 to the US dollar next year. Their prediction is based on the worsening government finances heading into the new year with the budget deficit now expected to be above 5% of gross domestic product (GDP) – worse than the 4% estimated in the February 2023 budget. The current account is also seen as worsening as commodity prices soften leading to lower mining profits and tax revenue. Of course, a major factor will be the ANC’s performance in next year’s elections. The ANC is widely expected to lose its majority in Parliament - a fact which is already causing them to implement unaffordable populist strategies like the 7% civil service wage hike. But the rand is also substantially impacted by the delicate international balance between “risk-off” and “risk-on”. If international investors become more optimistic about investment, they could easily drive the rand up at least in the short term as they seek higher yielding emerging market investments. In our view, the rand will continue weakening against hard currencies, but that weakness will be interspersed with bouts of strength as overseas investors alternately blow hot and cold on high yielding emerging market investments.

General

Of course, it is no surprise to find out that South Africa is a “hotspot” for criminality in Southern Africa as reported by the Global Organised Crime Index for 2023. We all know that crime is endemic here and that it is rife in the public sector which cooperates with crime syndicates to implement state capture schemes of massive size. Andre de Ruyter’s book “Truth to Power” which has now been substantially vindicated showed the deep corruption within Eskom, but such corruption is a feature of almost every large state organization and extends from top level executives to low-level employees. Perhaps the only parts of government which have not been significantly corrupted are the Reserve Bank and the Judiciary – but these have been severely hampered by a lack of resources, making their tasks increasingly difficult.

In November 2023 South Africa will have to argue for its continued inclusion under the American African Growth and Opportunity Act (AGOA). We will be represented by Ebrahim Patel, our Minister of Trade and Industry, and we will have to present arguments for why we should continue to benefit. It seems that our strongest argument is that other smaller African countries benefit from South Africa’s relative prosperity and thus our exclusion would have a direct and damaging impact on them. There has been continuous resistance to South Africa’s inclusion on the grounds that it cannot really be seen as the type of very poor country that the Act is designed to assist. More recently our foolish stance on Russia’s war in Ukraine has antagonized America unnecessarily. If we lose our status in terms of AGOA the economic impact on this country and especially the motor industry here will be substantial.

Companies

ATTACQ (ATT)

Attacq is a property developer with 52 buildings and a gross lettable area of 741490 square meters. The company also has five “managed precincts” throughout South Africa. The most important of these is Waterfall City which is an enormous mixed-use property with office residential and retail. The Government Employees’ Pension Fund (GEPF) has invested R2,7bn in Waterfall City. In its financials for the year to 30th June 2023 the company reported distributable income up 14,5% and they paid 80% of that out as a dividend. The company has a reasonable loan-to-value (LTV) ratio of 37,3%. What makes this share interesting is that it is trading at less than half of the company’s net asset value (NAV). We consider it to be one of the best real estate investment trusts (REIT) on the JSE. Consider the chart:

You can see here that following the downward trend of COVID-19, Attacq stabilized in an island formation in October of 2020 and then began a steady recovery which is on-going. In our view the share will continue to perform well in the future.

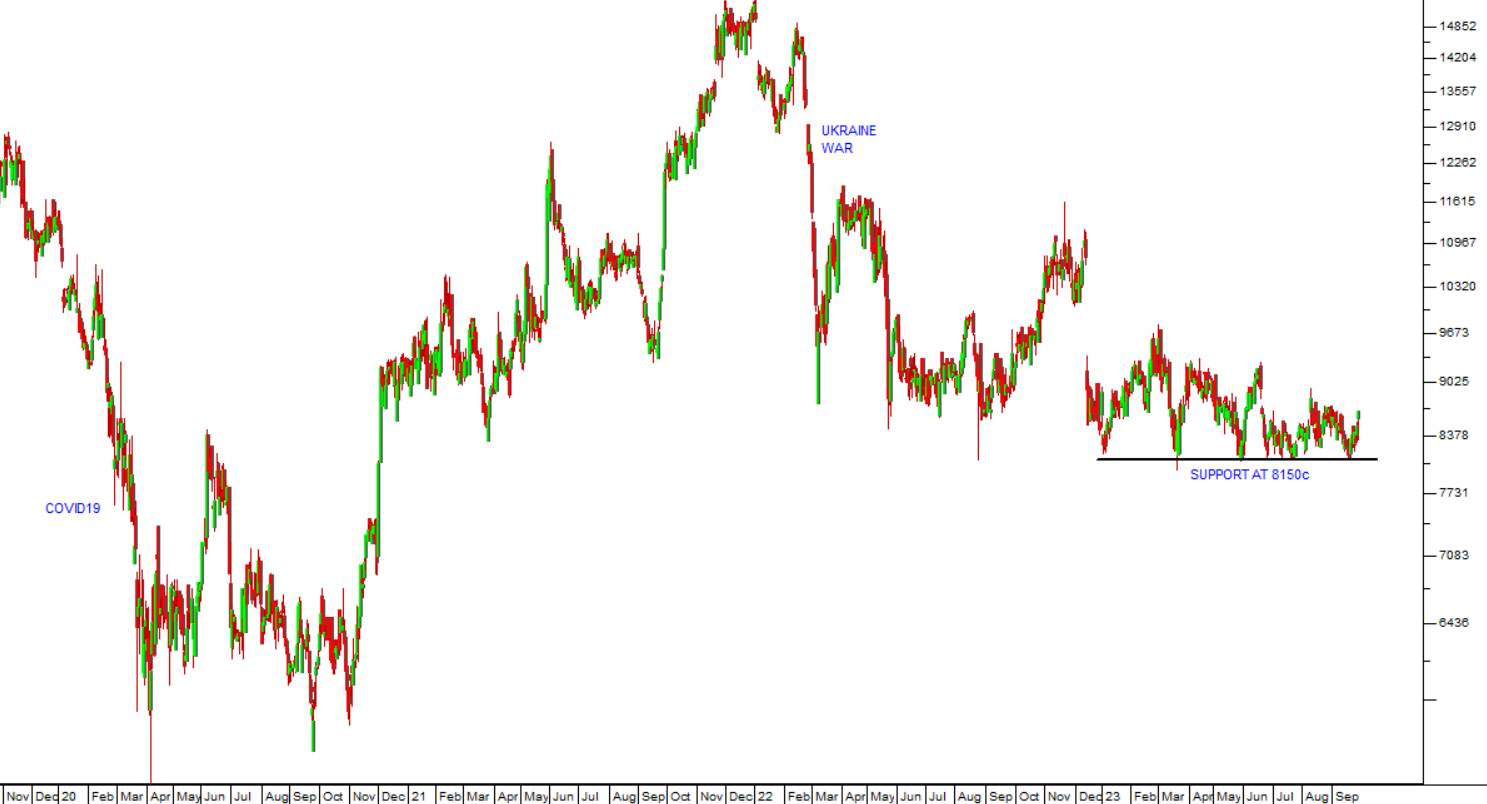

BARLOWORLD (BAW)

Barloworld is a supplier of heavy earth-moving equipment and related spare parts in South Africa and Eurasia, including Russia. It is also involved in manufacturing starch for a variety of consumer industries in South Africa through its subsidiary, Ingrain. The company has been affected by two major negatives over the past few years. COVID-19 had a major impact on the share as it did on most listed companies, but after a period of “backing and filling” the share recovered strongly from November 2020. That was followed by the start of the war in Ukraine in February 2022. Because of the company’s interest in Russia, investors have down-graded the share. It now appears to have found some solid support at around 8150c and we believe that it is poised to continue moving up. Consider the chart:

On Thursday last week (28-9-2023) the company published an update on the 11 months to 31st August 2023. They reported that revenue from continuing operations had increased by 15% and that earnings before interest, taxation, depreciation and amortisation (EBITDA) had improved by 13%. Operating profit was up 18%. This was despite a 46% drop in revenue from Russia. The company’s diversification into starch through Ingrain grew by 12,1%. Overall, we regard this as a well-managed company that will benefit immediately from any resolution in the Ukraine war and which looks cheap to us on a P:E of 5,92.

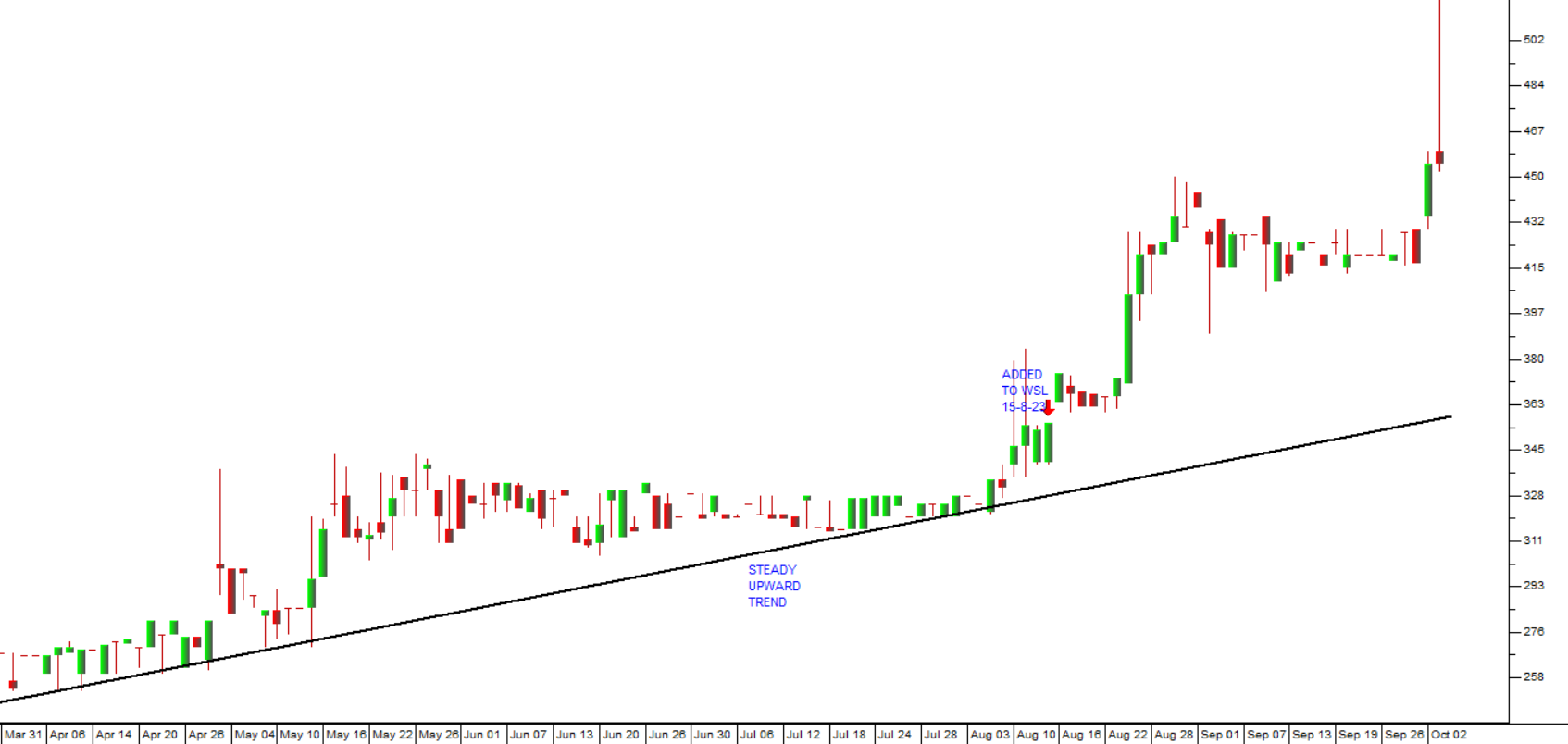

4-SIGHT (4SI)

This is a company involved in “Digital Transformation for Businesses, with the convergence of the Operational Technologies (OT) and Information Technology (IT) worlds with the Business Environment (BE) to ultimately reach the Artificial Intelligence (AI)”. It is at the cutting edge of information technology and appears to be beginning to be really successful. In its recently published results for the six months to 30th June 2023 the company reported that revenue was up 37% and that HEPS almost tripled to 3,8c per share. The company does not yet pay dividends, preferring to plough profits back into further growth. Consider the chart:

Here you can see that this penny stock has been trading in a sideways pattern for the past year and then broke up out of that pattern at the beginning of August 2023. We added it to the Winning Shares List (WSL) on 5th August 2023 at a price of 31c. In the two months that it has been on the list it has risen to 45c – a gain of 45%. The share trades about R87 000 each day on average which makes it practical for a small investment. Obviously, it has not yet attracted institutional interest, but it is growing rapidly.

CALGRO M3 (CGR)

Calgro is a property company which specialises in the development of Integrated Residential Developments and the development and management of Memorial Parks. In its most recent results for the year to 28th February 2023 the company reported that headline earnings per share (HEPS) increased by 45% to 153,18c per share. This puts the share on a very low P:E of just 2,72 making it very, very cheap. It has a net asset value (NAV) of 951c per share which means that it is trading at more than a 50% discount to NAV. In July 2022 the annual general meeting approved a share buy-back of up to 20% of the company’s issued share capital. Since then, it has bought back 13 million of its own shares for an average price of 233,8c per share. The share closed on Friday last week at 417c which means that the company has made a substantial profit off the buy back. Consider the chart:

The share has been in a steady upward trend since April this year and we added it to the Winning Shares List on 15th August 2023 at 356c per share. It closed on Friday at 417c – which is a gain of 17,13% in 7 weeks. We believe that it has further upside potential.

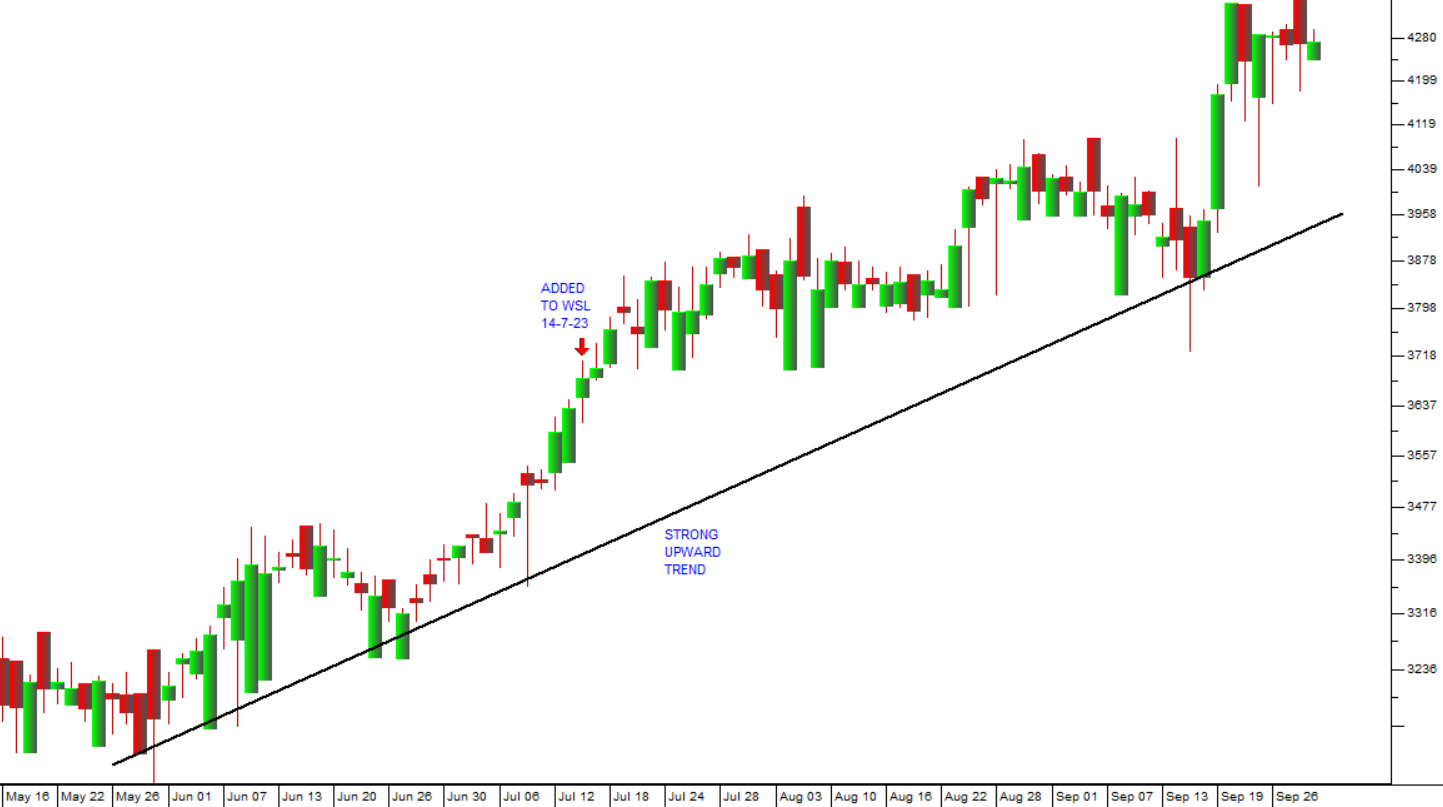

OUTSURANCE (OUT)

OUTsurance is a very well-known insurance brand in South Africa. It is a multinational insurance group that specialises in property and casualty insurance. In the year to 30th June 2023 the company reported that revenue was up 43,4%. The business has recently been split out from RMI and now stands on its own as a listed entity. Consider the chart:

OUTsurance has been in a strong upward trend since May 2023 and we added it to the Winning Shares List (WSL) on 14th July 2023 at a price of 3684c per share. It closed on Friday last week at 4276c – a gain of 16%. We believe that this is a solid blue-chip, institutional share that will continue to perform well in the future.

CAPITEC (CPI)

Capitec has once again surprised the market by producing excellent results for the 6 months to 31st August 2023. The company now has 21 million active clients and added just under 1 million clients in the six months. Headline earnings per share (HEPS) rose by 9% to 4,7bn in the extremely difficult South African economic environment. This is an outstanding performance which shows that this share should be part of every private investor’s portfolio. Technically, the share price fell from April 2022 until June 2023, but then it began to rally. Consider the chart:

As you can see from the chart, we have added a 200-day simple moving average and a 65-day exponentially smoothed moving average. Since its low point in June this year the share has been moving up and has broken up through both moving averages. It is on a P:E of 20,29 – but that high rating is deserved given its excellent results. We believe that Capitec will continue to take market share away from the other big banks and that the share will perform well.

DISCLAIMER

All information and data contained within the PDSnet Articles is for informational purposes only. PDSnet makes no representations as to the accuracy, completeness, suitability, or validity, of any information, and shall not be liable for any errors, omissions, or any losses, injuries, or damages arising from its display or use. Information in the PDSnet Articles are based on the author’s opinion and experience and should not be considered professional financial investment advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Thoughts and opinions will also change from time to time as more information is accumulated. PDSnet reserves the right to delete any comment or opinion for any reason.

Share this article: