The Confidential Report - July 2023

America

There can be very little doubt after Friday’s close on the S&P500 that we are back in a bull market now. After last Friday’s 1,23% rise, the index looks to be well on its way to breaking above the all-time record high of 4796 made on 3rd January 2022. Consider the chart:

You can also begin to see that the index is rising within defined channel lines. These channel lines are not completely clear yet, but they will probably give boundaries of upward and downward cyclical moves within the bull trend.

Even the slope of 300-day moving average (probably one of the most conservative indicators) has now turned upwards.

So, what is causing all this excitement?

The inflation figures for May 2023 came in better than expected. Core personal consumption expenditure (PCE) was 4,6% - better than then 4,7% which economists were predicting. Core PCE is the primary measure of inflation which the Federal Reserve Bank (the Fed) uses to determine the future of interest rates. Of course, the number is still far away from the Fed’s goal of 2% but the market took heart from the number.

At its last monetary policy committee (MPC) meeting the Fed decided not to increase interest rates and to take a pause in the hiking cycle. They also said, however, that they expected to increase rates by a further two 25 basis point hikes in the future. The market is now pricing in an 87% probability that rates will rise by 25 basis points at its July 2023 meeting.

Investors do not seem to be concerned about the possibility of an impending recession caused by the cycle of rate hikes.

The economy does appear to be slowing down in some areas with consumer spending coming in at 0,1% in May below analysts’ expectations of 0,2% and well below April’s revised 0,6%. Against this, non-farm payrolls showed that the US economy added 339 000 new jobs in May 2023, the highest job creation in 4 months – hardly an indication of a slowing economy.

To us it appears that the interest rate hikes have not yet impacted much on the perceived future profits of companies in the S&P500. If you are making excellent after-tax profits, then the 5,5% in finance costs that you will be paying on your overdraft after the Fed’s two additional rate hikes is not really important. It is only when product sales begin to slow down that those costs gain significance – and sales are a mostly function of consumer spending.

For example, Tesla made $12,6bn in 2022 with 16% operating margins (more than double what it made in 2021) allowing it to cut its prices to boost its sales. It is highly unlikely that the current level of interest rates is of much concern to Tesla and they will only begin to become concerned when consumers stop buying their cars. But Tesla’s sales rose 51% in 2022 showing that its products are still in high demand despite the fact that rising interest rates make them more difficult to finance.

Companies in America are still ramping up employment at an impressive rate. That can only mean that on average they are growing both sales and profits. The Fed’s attitude that they have not yet done enough is therefore justified. At this time it is well remember the old Wall Street adage:

“The Fed will keep raising rates until something breaks.”

So far, nothing of great importance has broken, but the effect of rising interest rates is cumulative. The longer the economy has to operate under these higher rates the more likely it is that something significant will break – perhaps in the housing market, perhaps among commercial banks, perhaps in the motor industry.

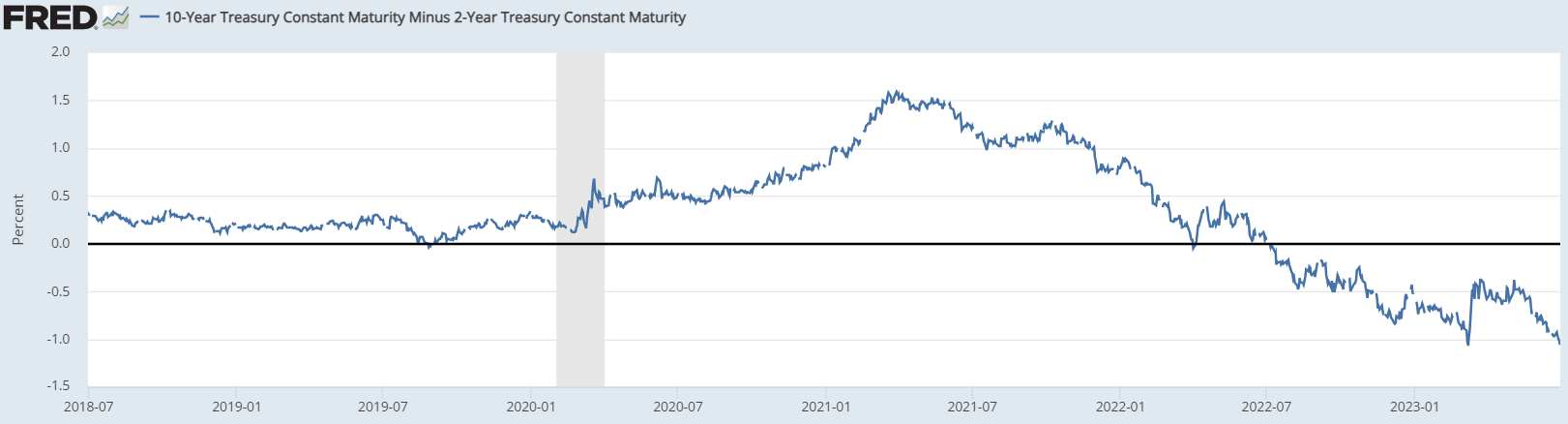

The yield curves of the various US government bonds are still showing a strong and persistent inversion – and that is one of the most reliable leading indicators of economic activity in the US. Inevitably, when the yield curve remains inverted for an extended period of time the economy slips into recession.

The chart which follows show the gap between the yield on the 10-year US treasury bill and the 2-year US treasury bill. It shows that the yield on the 2-year rose above that of the 10-year (i.e. became inverted) in July 2022 and has remained there ever since.

Our view remains that the US economy will almost certainly enter a recession either in the second half of this year or the first half of next year. The only thing that could prevent that is if the Fed “pivots” and begins to reduce interest rates – which does not look probable given their most recent remarks.

So, while we are technically in a bull trend, it may be that investors are still too optimistic about the future profits of the companies they are investing in. Tesla may be doing well, but the other US motor companies are mostly mired in increasingly expensive debt and are seeing declining sales. For example, in 2022 General Motors (GM) made a profit of $9,9bn off revenue of $156,7bn – which gives it a 6,3% margin. With 92,5% more sales than Tesla, it made 20% less profit. Rising interest rates will definitely be a matter of great concern for GM. Their profits are being squeezed between declining sales and rising interest rates.

Ukraine

The situation in Ukraine has taken an interesting turn with the so-called “mutiny” by Yevgeny Prigozhin and the Wagner group. Initially, their rebellion appeared to be gaining rapid ground and then suddenly a “deal”, apparently brokered by Belarus president Lukashenko, was announced whereby Prigozhin would move to Belarus and his force of some 25 000 men would be integrated with the Russian army. We have a number of problems with the credibility of this “deal”:

- The day before it was announced both Prigozhin and Putin were very vocal and aggressive towards each other – then suddenly their differences were miraculously resolved.

- Prigozhin is known to be very protective of and loyal to his troops. Now, suddenly and inexplicably, he is happy to abandon them to the Russian army an organisation whose leaders he totally and publicly holds in absolute contempt.

- In terms of the deal, Prigozhin and his men received a full amnesty for their mutiny, and he is to go to Belarus. Nothing has been said about what he is to do there, but our perception of him is that he is not the type of person to quietly retire and sit on his hands.

- Furthermore, to us it just seems highly unlikely that Putin would want to sideline his best, battle-hardened, demonstrably effective and proven commander in the Ukraine war.

In our view, a good explanation would be that Putin has offered Prigozhin the presidency in Belarus to replace Lukashenko, a Putin appointee. Lukashenko has not been cooperating with Putin in his management of Belarus, or the prosecution of the Ukraine war. Lukashenko's health is also now in doubt.

For Prigozhin, whose Wagner group is basically stateless and welcome only in Russia, becoming a dictator of his own country would certainly be a major motivator. Putin installed Lukashenko as leader in Belarus and so should easily be able to replace him.

Perhaps part of the deal was that Prigozhin would mobilise the Belarus army and air force against Ukraine, opening a new Northern front which Kyiv would be hard pressed to counter.

Of course, this is speculation, but it is just possible that Putin, who is known to be a canny political strategist, has found a way to convert a potentially dangerous enemy into a powerful ally.

Of course, the troubles that Russia is having within the leadership of its military will probably benefit Ukraine and damage the morale of the Russian troops it is fighting – at least in the short term - but it is also quite possible that Putin has just executed a clever “sleight of hand” which has gone completely unnoticed by the media and NATO.

We find it very difficult to believe that Putin was willing to lose his most effective military commander in the war so far. It just does not make sense.

Notably, most commentators around the world are now saying that the end of Putin’s reign is near and that the war in Ukraine could be over sooner than expected. We really hope that they are right – but perhaps this is exactly what Putin wants us all to believe.

One important point to note is that Prigozhin is popular with the Russian people because he dares to criticise the Russian army and disputes Putin’s publicly stated reasons for going to war with Ukraine in the first place. He is also seen as a hands-on leader who has proved that he is an effective commander on the battlefield. His popularity contrasts with the fear with which most Russians regard Putin and that makes him a potential long-term threat to Putin’s leadership of Russia.

If he gets well-established in Belarus, he could very well become a major problem – but for the moment making him the leader of Belarus buys Putin some time and turns him from a problem into a potential solution in the Ukraine war.

Economy

The inflation rate (consumer price index or CPI) dropped sharply in May to 6,3% down from April’s 6,8%, but remained outside the target range of 3% to 6%. Core inflation, excluding food and energy prices, was 5,2% justly slightly below April’s 5,3%. The impact of loadshedding has been to increase inflation in the short term as businesses passed on the costs of implementing alternative power solutions. The effect of rising interest rates has been to curb inflation, but the approved 18,65% increase in electricity tariffs will have a negative impact. The strength of the rand has been another factor especially considering South Africa’s stance on the Ukraine war and Russia.

South Africa’s gross domestic product (GDP) expanded in the 1st quarter of 2023 by 0,4% - which was in line with consensus expectations. The growth resulted from growth in the food and construction sectors. Mining production was up 0,9% and tourism recovered, especially in the Western Cape. Agriculture was weak because of persistent loadshedding. The energy availability factor (EAF) was at a low point of 53,2% which impacted productivity in all sectors. Altogether, South Africa’s growth in 2022 was 1,9% - down from the post-COVID-19 recovery in 2021 of 4,7% growth. Growth is expected to continue to be depressed as loadshedding continues. Nedbank has announced that it expects GDP growth to be just 0,1% this year.

African Bank’s R2,2bn impairments expense in its financials for the six months to 1st March 2023 is an indication of the strain which lower income consumers are taking at the moment. The company’s credit loss ratio has increased from 4,8% to 11% as a result of customers being unable to make repayments. The rise in the cost of fuel and food have reduced households’ available income. Many customers have also lost their jobs as a result of loadshedding and the tough economic environment. African Bank mainly serves lower income groups, showing that the pain is mostly being felt by the poorest South Africans.

In an investor presentation, the CEO of Motus, a motor dealership company that was unbundled from Imperial and separately listed on the JSE, said that the average cost of running a motor vehicle had increased by 48% between 2019 and May 2023. The assessment was based on an average motor vehicle costing R280 000 and doing 2500km a month. The average vehicle owner’s costs had increased by R3775 a month. This had led to people “buying downwards” to cheaper vehicles. Obviously, this substantial increase in the cost of motoring has a direct impact on consumers’ disposable income and hence on gross domestic product (GDP).

Manufacturing production surprised to the upside in April this year. The Department of Statistics reported that production increased by 3,4% compared to the previous year. The fact that this comes at a time of increased loadshedding shows that most manufacturing companies have implemented plans to get away from Eskom. April was the first month in the past six months where manufacturing production increased on an annualised basis. It should improve the prospects for gross domestic product (GDP) growth.

Retail sales fell year-on-year 1,6% in April 2023 – the fifth consecutive monthly decline. On a monthly basis, sales were up 0,4% compared to March 2023. Volumes were down 1,1% over the year indicating that consumers are cutting back in response to loadshedding and higher interest rates. The fall in BankServ’s take-home pay shows that consumers have less disposable income and there is also evidence that they are using more unsecured credit to buy essentials.

The various unprofitable state-owned enterprises (SOE) are a massive drag on the South African economy and, in our opinion contribute little or in many cases nothing to the welfare of South Africans. Since 2013 the Treasury has provided about R330bn in subsidies to various SOE's. Of this just over R180bn has gone to Eskom (the government has agreed to take over R254bn of its debt on top of that) and just less than R50bn has gone to SAA. Right now the Post Office is asking parliament for a R3,8bn bailout on top of the R2,4bn bailout it got in February this year. It regularly makes a loss of around R2bn per annum and is now in business rescue. It has almost 12000 staff of whom it plans to retrench 7000 in terms of its business rescue plan. Once this is done the Post Office plans to continue doing what it does – provided, of course, it gets the R3,8bn it is asking for. It seems evident to us that the organisation was massively over-staffed with 12000 employees and much of the R3,8bn bailout will be absorbed just on paying them out retrenchment packages. But the real question is, “Does South Africa really need a Post Office- especially at this enormous cost?”. The R50bn paid to SAA was clearly a complete waste of money because this country certainly does not need a government run airline. We suggest that it also does not need the Post Office whose meagre remaining roles could easily be handled by existing private enterprise.

President Ramaphosa’s “partnership” with top business leaders to overcome the current power crisis could well work to improve conditions dramatically in this country - provided it does not get bogged down by ideological problems or get dragged down by the many who have vested interests in retaining the status quo. On the surface, it looks like the President is at last demonstrating the kind of leadership that could actually make a difference. He is mobilising this country’s undoubted wealth of business skill and leadership to pull us back from the precipice. He will certainly face some very powerful opposition that will try to paint him as a sell-out to “white minority capital”, and everything will depend on his ability to face this opposition down and persist.

The Rand

There is a definite relationship between the rand and the S&P500 index from Wall Street. Whenever Wall Street is expected to fall, the rand tends to fall first – probably because international investors sense a shift towards “risk-off” and seek to pull their capital out of emerging markets. The opposite is also true. If the rand begins to strengthen then you can be fairly sure that the S&P is about to start climbing. During April and most of May this year the rand weakened significantly reaching a cycle low of R19.76 to the US dollar on 31st May 2023. Then it began to strengthen in anticipation of a shift to risk-off – which lasted until the end of May. The current sell-off in the rand coincides with the downward trend in the S&P over the past week. Consider the chart:

Eskom

The 7%, 3-year wage deal which Eskom has signed with employees is above inflation and will significantly add to the company’s cost base. The company already has a debt of around R420bn, of which the government has agreed to pay R254bn. In our view, this wage deal means that Eskom has given in to the unions who engaged in an illegal strike to get their way. In the bigger picture it is simply another “nail in the coffin” of this beleaguered and dying state-owned enterprise (SOE). The Eskom unions seem intent on “killing the goose that lays the golden eggs”. Their short-sightedness is contributing directly to the inevitable death of Eskom as a profitable business - not that anyone appears to see Eskom as a business these days. They seem oblivious to the fact that, if Eskom dies, they will lose their jobs.

A survey conducted by Eskom in collaboration with various renewable energy associations shows that South Africa has as much as 66 gigawatts of renewable energy in the process of being built. Many of the installations will only begin producing power after 2026. If these projects all come to fruition, South Africa’s electricity problem will be over and Eskom will at best be reduced to a transmission company. Let us hope that this is the case.

The ABSA survey of sentiment in the manufacturing sector showed that manufacturing remained depressed in the second quarter of 2023. What was particularly noticeable was the sharp contraction in the number of hours worked per worker which fell to 20 from 32. This shows that loadshedding has caused factories to close for extended periods and cut back on hours worked. The bottom line is that workers are working far less hours and that is simultaneously impacting their incomes and the profitability of the factories. The manufacturing sector is clearly operating well below its potential capacity.

The mining sector saw production up 2,3% in April 2023 despite high levels of loadshedding. Mining uses a lot of electricity, but the sector has been steadily implementing alternative power solutions and moving away from Eskom for some time. Gold production was up 27,4% year-on-year and coal was up 12,5%. Platinum group metals (PGM) were down 4,6% and iron ore was down 3,6%. The sector is a major contributor to gross domestic product (GDP) and it tends to be volatile because the prices of metals and minerals which it produces are mostly outside of its control.

Business Day on 22nd June 2023 reported the appointment of Robert McBride to go after the criminal syndicates at Eskom holds out some hope of reducing the losses there due to theft. Mc Bride has a reputation for being effective in crime fighting and will report directly to the President. Obviously, his success will depend on the support which he receives from government. Hopefully, he will be able to address some of the problems highlighted by Andre de Ruyter in his salutary book, “Truth to Power”.

The Minister of Electricity, Kgosientsho Ramokgopa, says that it will cost about R210bn to improve the distribution arm of Eskom to the point where it can provide an adequate transmission grid. This is an enormous number, coming as it does on top of Eskom’s current debt of around R420bn. In our view, the idea of splitting a distribution company out of Eskom was always flawed because current renewable energy is mostly already distributed. Individual houses and businesses are increasingly generating their own power on site and so there is less need for distribution. The concept of having a few large power producers transmitting the power they generate to millions of consumers and businesses is becoming out-dated.

General

There were ten municipal by-elections held on 28th June 2023 in South Africa. The DA did remarkably well holding onto 4 of the seats and winning about 33% of the votes cast. The ANC, by contrast won 26,3% and the IFP 15,7%. The by-election was particularly significant because the ANC lost a key strong-hold seat in Johannesburg and also because the EFF made such a poor showing. These by-elections do not necessarily indicate what will happen at the general election of 2024 – but they certainly are an indication of the direction of voter sentiment. By now, it is quite widely accepted that the ANC will probably lose their majority in parliament in next year’s election. What is not so widely accepted is that they will then probably be forced into an alliance with the DA – a development which we would consider to be a material benefit for this country. The DA’s influence over ANC decisions, especially in the areas of mining and energy, could greatly benefit the economy.

The passing of the National Health Insurance bill through parliament is a function of the ANC’s thin majority in parliament and its impractical penchant for populist ideas. If, as we expect, the ANC loses its majority in parliament after next years’ elections, such a bill would never pass. It is opposed by a long list of community and business organisations as well as the opposition party, the DA. It reduces medical schemes to providing only “gap” cover which may well take away their viability. But the biggest concern is that the NHI will turn into another government run corrupt, inefficient and incompetent behemoth like Eskom or Transnet. If there is one thing that we have learned in 30 years under the ANC it must surely be that they lack the ability to run large organisations efficiently.

South Africa’s “neutral” stance on the war in Ukraine is likely to cause some considerable problems for the economy in the future and does not appear to have any significant benefits. Clearly, the countries of Europe and America represent vastly more important markets for this country than Russia ever has (Russia’s economy has about the same gross domestic product as the state of Texas). We apparently have ambitions to be the “peacemaker” in the Ukraine conflict and that is the somewhat absurd justification for our stance. The fact that we have not condemned Russia for its unprovoked and imperialistic attack on Ukraine shows that we do not hold the ideal of democracy in very high regard. Even if the neutrality was justified, we can hardly afford this type of foreign policy which alienates our main trading partners.

South Africa is one of 36 African countries which benefit from America’s African Growth and Opportunity Act (AGOA). Its participation in the trade benefits of this Act have been jeopardised by the government’s friendly attitude towards Russia since the beginning of the Ukraine war. Officially, the government is neutral on this conflict, but its actions have indicated that it is favouring and assisting Russia. South Africa is now approaching the ten-year re-evaluation of its status under AGOA which expires next year. Our esteemed Department of Trade Industry and Competition minister, Ebrahim Patel, is to travel to the US to argue for South Africa’s continuing participation. The Act requires that beneficiaries do not engage in any activity which harms America or its national security interests. Already there is a bipartisan effort to have South Africa removed from AGOA. The consequences of losing our AGOA status will be severe.

The draft regulations produced by the Minister of Water and Sanitation, Senzo Mchunu, require that farmers and commercial forestry show a black ownership of between 25% and 75% in order to obtain or retain a water licence. This is a racist and foolish idea which could severely endanger food production in this country and reduce the value of farms across the country. It appears that no consideration has been given to the need for South Africa to be self-sufficient in food – or the impact that this will have on employment levels in the farming community. If the regulations are enacted, then many productive farms will be forced out of business.

Commodities

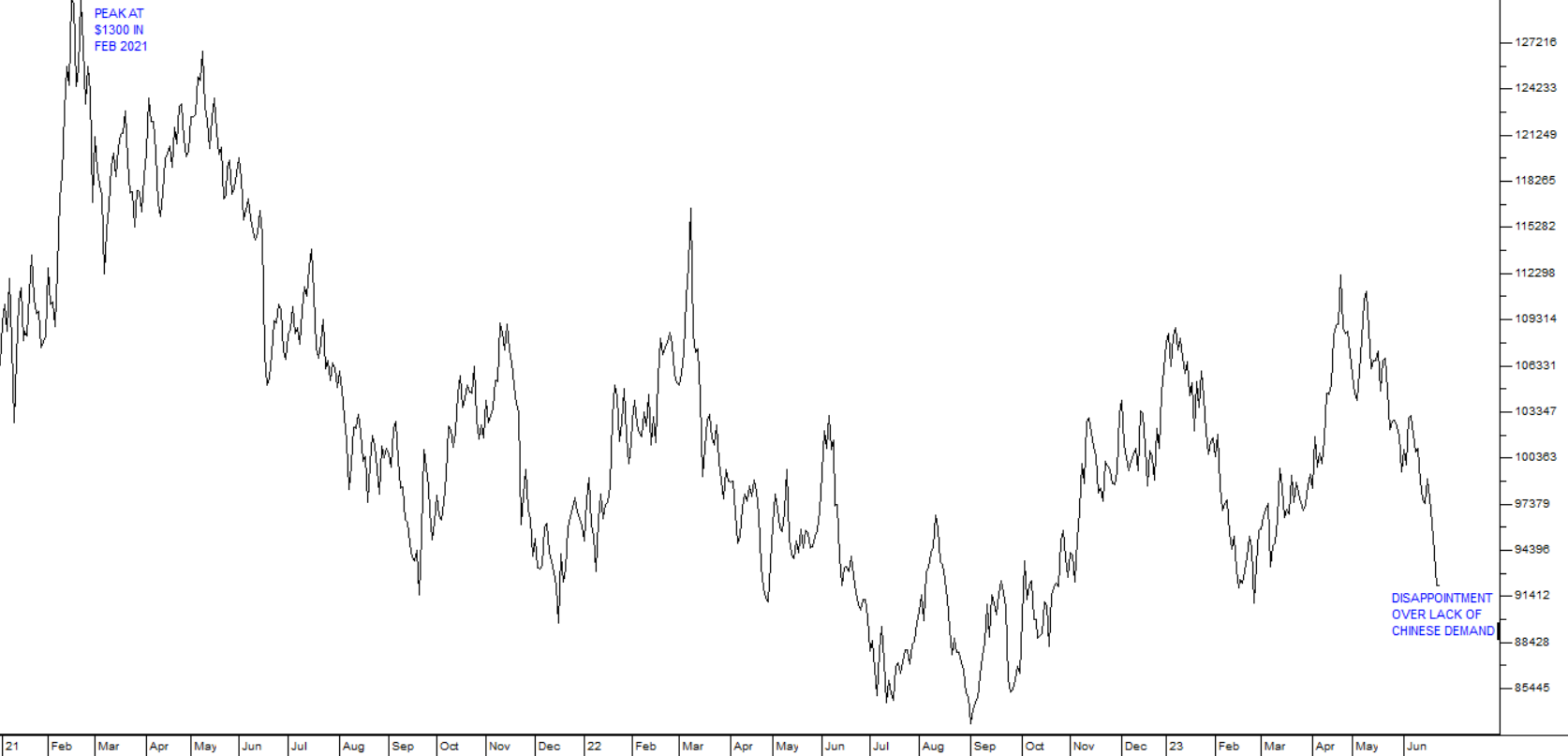

Following its problems with COVID-19, the Chinese economy was supposed to bounce back resulting in a rise in commodity prices, but the Chinese economy has been under pressure and commodity prices have been trending down. The platinum price has fallen from its peak of around $1300 per ounce to current levels around $905. This has impacted commodity shares like Anglo American, Implats, Sibanye, Angloplats and Northam. Consider the following chart of the platinum price:

The palladium price has also been falling which means that the entire PGM mining sector is taking some strain. We expect this trend to continue as the world economy enters recession later this year and early next year.

Companies

CAPITALISING ON SHARE COLLAPSES

A professional investor is a private investor who makes his or her living by investing in the share market. One of the main differences between a professional investor and a beginner is that a beginner gets excited when a share is going up, while a professional gets excited when a share is going down.

When a high-quality secondary share or a blue-chip share falls dramatically, it often represents a great opportunity for private investors, especially those who have become professionals. This type of share very seldom ends up in liquidation. In most cases it has sufficient accumulated assets and quality of management to fix whatever the problem was and then return to profitability over time.

There are, of course, exceptions to this – like Steinhoff. Steinhoff was never going to overcome the problem when its management admitted, in writing, to having committed a fraud on its shareholders. This led to an insurmountable debt as a result of the consequent civil actions. But Steinhoff was the exception. In most cases, provided the company is of good quality, sooner or later, whatever problems existed are resolved, the share price reaches a bottom, and begins to recover.

The first question you need to ask yourself when you see or read about a high-quality share that is falling dramatically and unexpectedly is, “Is it going bust?”. Obviously if you think it might, then you should stay away. But if you think it will survive then you have a definite opportunity to make an excellent capital gain.

To determine whether it can overcome its problems and recover, you will need to look at its financials to determine whether the company has a strong enough balance sheet to weather the storm. You will also need to look at its management to establish whether they have the ability to steer it into a recovery.

Perhaps a classic example of blue-chip shares recovering from difficulties in recent times is the collapse of all the major banking shares during COVID-19. They all fell heavily, and yet at the time common sense indicated that it was extremely unlikely that any of them would actually fail and go out of business. Logically, therefore, it was reasonable to assume that at some point their share prices would stop falling, turn and begin to rise again. The trick was to have a mechanism that would alert you to that turning point with a degree of reliability.

Over the decades that we have been watching the stock market, we have found that the 65-day exponentially smoothed moving average (65-day E) provides just such a mechanism. If you are unsure about how an exponential moving average is calculated go back and read our lecture module 24 on “Types of Moving Averages”.

When you are faced with a collapsing blue-chip share, wait for it to break up through the 65-day E. This will give you a good balance between getting in too soon while it is still falling and getting in too late “after the ship has sailed”.

By the time a share breaks back up through its 65-day E, the problem that caused the share to fall in the first place will have been well aired in the media and those big institutions that wanted to get out will have done so. The management of the company, which may have been changed as a result of the problem, will by that time have made the necessary adjustments and changes to its structure to set it back on a profitable path. Their efforts to do this will also have been widely reported in the financial press.

Of course, even after an upside break through the 65-day E, the share can still fall further once you have bought – so, as a private investor, you must be sure to have a solid stop-loss strategy in place to get you out with minimal losses in that event. Remember, the share market is not about certainties – it is about probabilities.

In the example we gave above, the JSE Banks index (JS3011), from its pre-COVID19 peak of 8287 on 26th February 2020, fell 47% to a low point of 4394 on 14th May 2020. At the time no one thought it likely that any of the big banks would fail – they were simply too-well capitalised and had the Reserve Bank’s backing. Despite this, the atmosphere of fear and risk in the market was so great at that time that only the most sophisticated professional investors were willing to buy in. For the average private investor, the only important question at that moment was, “When will the banking shares turn and begin going up again?”

The break up through the 65-day E came on 3rd June 2020 at an index level of 5805 – 14 trading days after the lowest point. After that, as the effect of COVID-19 became better understood in the market and the fear subsided, the banking index climbed steadily back to 11040 (29/3/22) during the next 22 months – a gain of 90%.

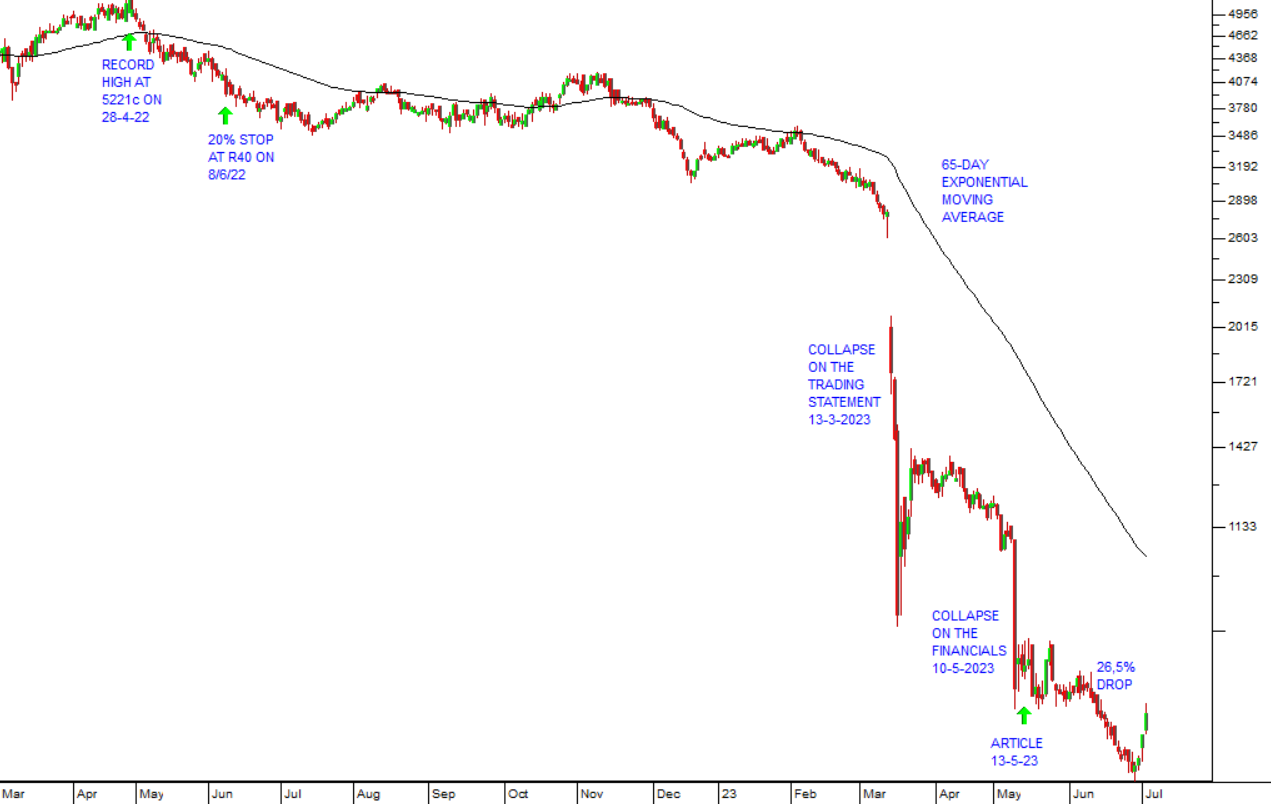

TRANSACTION CAPITAL

Right now, a high quality share, Transaction Capital (TCP), is going through exactly the type of unexpected collapse that we have been discussing.

On the 15th of May 2023 we published an article about the sharp fall in Transaction Capital’s share price and gave the following advice:

“One of the best technical mechanisms for staying out a share which is collapsing is to apply a 65-day exponentially smoothed moving average (65-day E) and wait for a clear break up before getting interested”.

On the 15th of May 2023 the share closed at 761c. Over the past six weeks the share has fallen by a further 26.5% to a low of 559c on the 28th of June 2023. Our advice remains the same – wait for a clear break up through the 65-day E. Consider the chart:

The important question to ask is, “Is TCP going bust?” – because if it is, then you are obviously not interested. But, if you think that it will survive (as we do), then it follows that at some point the share price must turn and begin going up again, creating a buying opportunity.

The problem then is to determine exactly when that happens. As you can see from the chart, the share price is still falling and with it the 65-day E. The fall is rapid, and we should not have to wait too long before it finds its nadir. The steady sell-off indicates that one or more big institutional investors have decided to liquidate their holdings and are selling in a controlled manner so as not to frighten the market.

What is interesting is that a non-executive director of TCP, Christopher Seabrooke, has been buying Transaction Capital shares. What does he know? He evidently agrees with us that the share is now getting cheap. However, his purchases have not been enough to turn the share around yet.

Eventually, the big institutions will have overcome their fear and sold all that they want to sell. Then the share will begin to rise again. We expect that in time it will break above its 65-day E giving an early buying signal. That is the moment we are waiting for. If we are still happy with the company’s fundamentals, then we can buy – and we will have the great satisfaction of knowing that we are getting the shares at a fraction of the price that the big institutions were paying just a few months ago.

So, we urge you to apply a 65-day E to TCP and wait for that upside break.

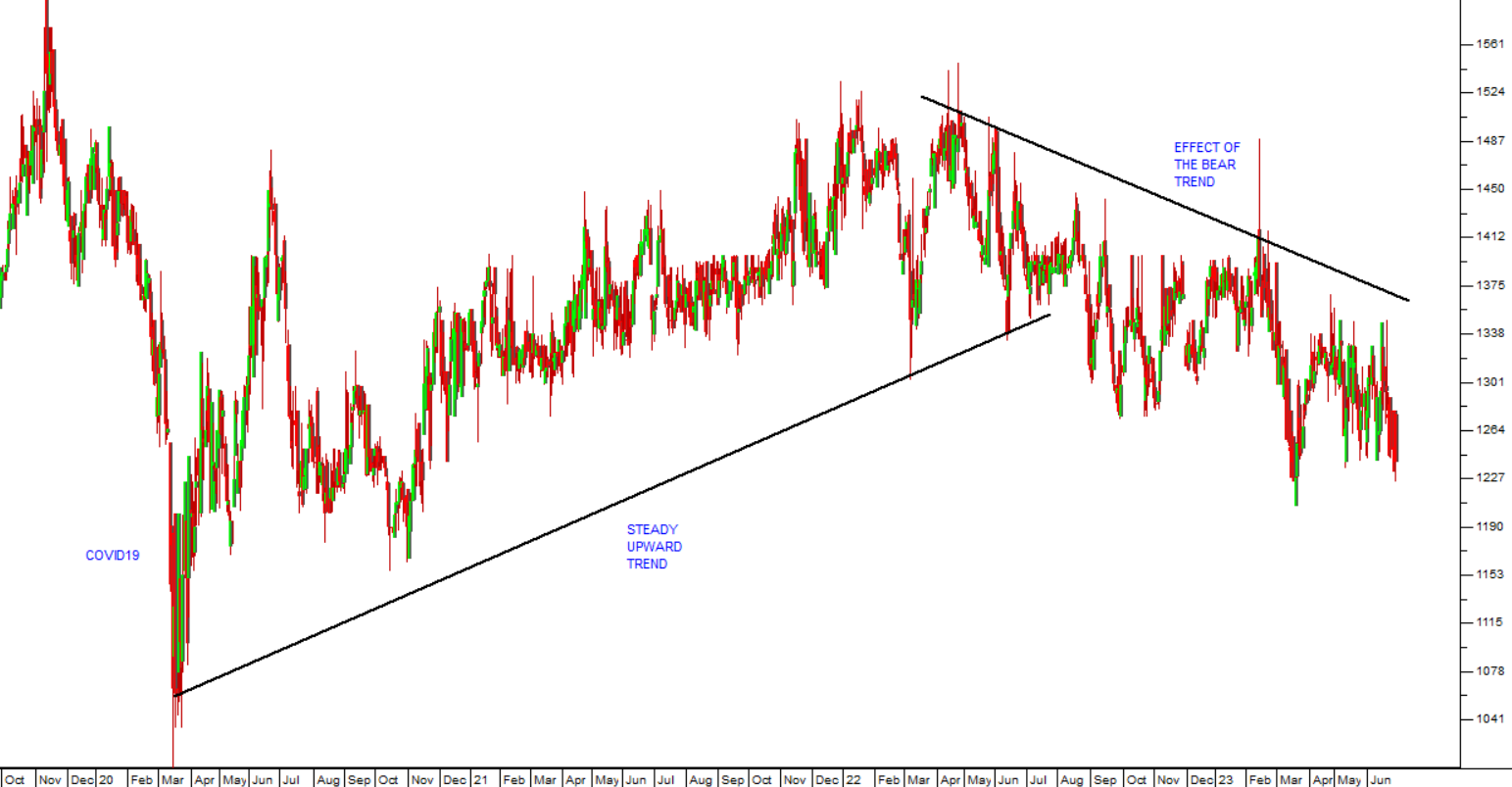

STOR-AGE

Stor-age (SSS) is the JSE's only real estate investment trust (REIT) which specialises in buying and running domestic self-storage facilities in all major South African cities and in the UK. Its business is split about 60% in South Africa and 40% in the UK. It expects its UK business to exceed the South African business in due course. The company owns 93 properties worth R10.4bn in SA and the UK. The business of Stor-Age tends to do well in recessions as well as in boom periods of the economy. The average client keeps his storage unit for 2 years. The client base is widely diversified and very stable from a statistical point of view. The company's expansion into the UK demonstrates its ability to find appropriate properties and add them to its portfolio. It also gives the share a rand-hedge element. In its results for the year to 31st March 2023 the company reported rental income up 17,3% with same-store rental income up 9,3%. The company's loan-to-value (LTV) is 30,8%. The company said, "Total occupancy, including organic growth, acquisitions and new developments, grew by 19 200m2 with same-store occupancy up by 10 000m2. After a strong performance in the first half of FY23, the UK traded in line with expectations for the remainder of the year. Same-store rental income increased by 8.9% year-on-year with occupancy growth of 2 000m2". We believe that this is one of the best property investments available on the JSE. It offers a steady growth and minimal risk. Technically, the share was rising steadily until April 2022 then it began a downward trend which is still in progress. In our view this represents a potential buying opportunity. In effect you are buying about R15 worth of property assets for R12.50 which looks like a bargain: Consider the chart:

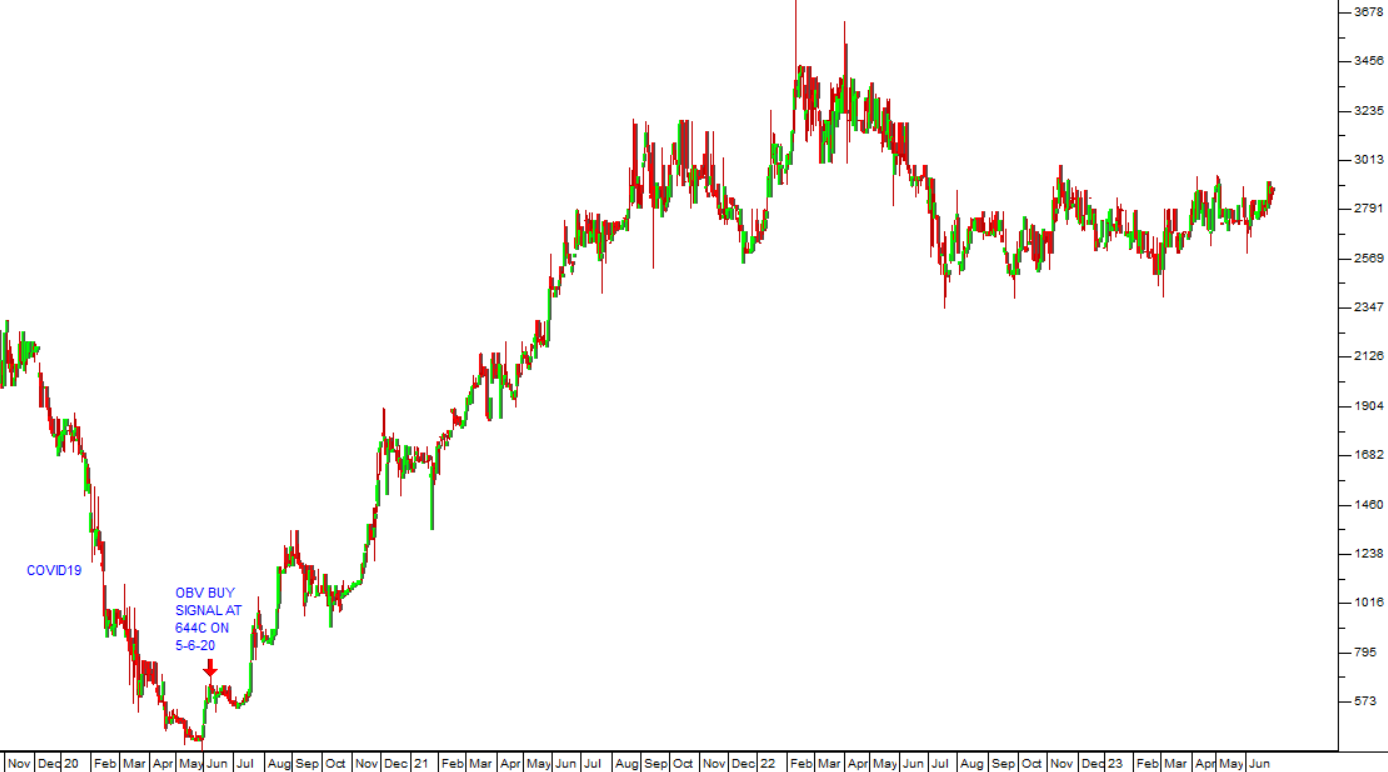

INVICTA

The Invicta Group (IVI) consists of five operational segments, namely: 1. Replacement parts Industrial 2. Replacement parts Auto-agri; 3. Capital Equipment; 4. Replacement parts equipment, and 5. Kian Ann Group. Christo Wiese (of Steinhoff fame) is the chairperson and owns a 37,57% shareholding. In its results for the year to 31st March 2023 the company reported revenue up 8,1% and headline earnings per share (HEPS) up 47,9%. The company's net asset value (NAV) increased by 23,1% to 4634c per share. The company said, "While revenue grew by 8% year-on-year, and the gross profit margin increased by 1.8%, from 30.7% to 32.5%, selling, administration and distribution costs were 21% higher. RSS industrial increased revenue by 8,4% while the Auto-agri sector increased turnover by 19,2%". Technically, the share gave a solid on balance volume (OBV) buy signal on 5th June 2020 at 644c per share. Since then, the price has risen to 2881c but it is still well below its NAV. We believe that it will continue to perform. Consider the chart:

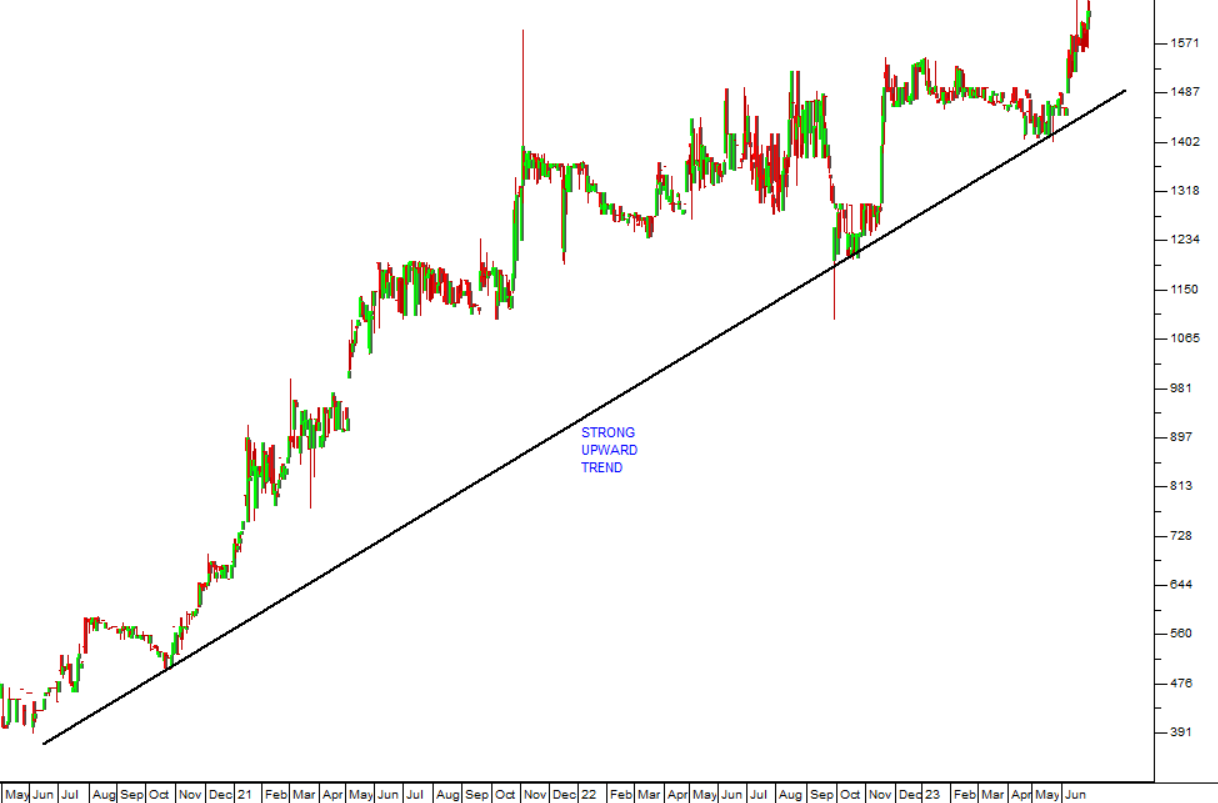

ARGENT

Argent (ART) is a manufacturer and beneficiator of steel and aluminium products supplying a wide range of businesses in South Africa. It also has operations in the US and the UK. Many of Argent's products are well-known in South Africa such as Xpanda and Jetmaster. It also supplies bulk steel products and beneficiates to suit specific needs. For example, it sells tube, sheet coil and plate steel. It modifies these products with bending, slitting, and cutting to length. It is the largest distributor for Hulamin and offers a full range of aluminium products. It manufactures ladders, castors, and storage bins. It also produces paint and a range of steel cupboards, desks, filing cabinets and other office furniture. It manufactures and markets a variety of steel fencing and gates. Most of these businesses are directly impacted by the state of the South African economy so the current conditions have forced the company to restructure substantially. In its results for the year to 31st March 2023 the company reported revenue up 12,8% and headline earnings per share (HEPS) up 21,3%. The company's net asset value (NAV) increased 19,9% to 2683,6c per share. This share is trading on a very low multiple of 3,89 - which we think makes it very good value. The company's share buy-back program has seen its issued share capital drop by more than one third since 2016. The share has been rising since its low of 1416c on 8th May 2023 and now at 1600c it is still well below its NAV. We regard this as a good investment at current levels. Consider the chart:

HYPROP

Hyprop (HYP) is a leading property real estate investment trust (REIT) that specialises in high-quality shopping malls in South Africa and some interests in Eastern Europe and Africa to the North. It owns some of South Africa's best-known shopping malls like Rosebank, Canal Walk, Hyde Park, and Clearwater. It has been impacted to some extent by the fall-off in consumer spending through lower trading densities. This share is currently trading at close to half of its net asset value (NAV) of R60.88 - which in our view makes it a good buy. In its results for the six months to 1st December 2022 the company reported a 36% increase in distributable income and retail vacancy rate of 1,5% in South Africa. The company's loan-to-value (LTV) was at 37,2%. In a pre-close operational update on 27th June 2023 the company said, "The Group's operational performance continued to improve steadily over the period. The South Africa ("SA") portfolio's tenant turnover increased by 9.8%, compared to the previous corresponding period, exceeding 2019 levels". Technically, the share is once again in a downward trend, but we consider this to be a good buy at current levels. Consider the chart:

← Back to Articles