The Confidential Report - August 2024

America

Joe Biden’s statesman-like decision to step down and make way for Kamala Harris as the Democratic nominee is having a major impact on American politics and radically changes the prospects for the November elections. Harris is now leading in most of the polls and has raised over $310m for her campaign, in the first three weeks of her candidacy. Trump has already stated that he will not accept the result of the elections if he loses. The Republicans have taken some encouragement from the recent Supreme Court decision which effectively converts the presidency into a dictatorship. This election is now about whether Americans want to live in an autocracy or a democracy. The outcome in November remains difficult to call, but whatever happens it will have a major impact on the US economy and the world. A second Trump presidency will mean a more protectionist and isolationist approach to the US economy with higher tariffs, especially from Chinese imports. South Africa may suffer for its membership of the BRICS countries. A Harris presidency would mean business as usual for South Africa and a renewal of our AGOA membership with no important changes from the current situation. In our experience, presidential elections in America do not have a major impact on their stock markets.

The decision by the Federal Reserve Bank (the Fed) to keep interest rates unchanged and to support the idea that rates will begin falling in September resulted in an exuberant 1,6% jump in the S&P500 and a 2,6% increase in the NASDAQ. Nvidia rose by an amazing 12% in a single trading day. Jerome Powell, Governor of the Fed said that many of the traditional indicators of recession, like the inverted yield curve and the Sahm Rule, which suggested that the economy was headed into a recession, did not appear to be giving accurate predictions. He said, “...history doesn't repeat itself; it rhymes." His comments resulted in a surge of enthusiastic bullishness which took the S&P up 1,6% on the last day of July.

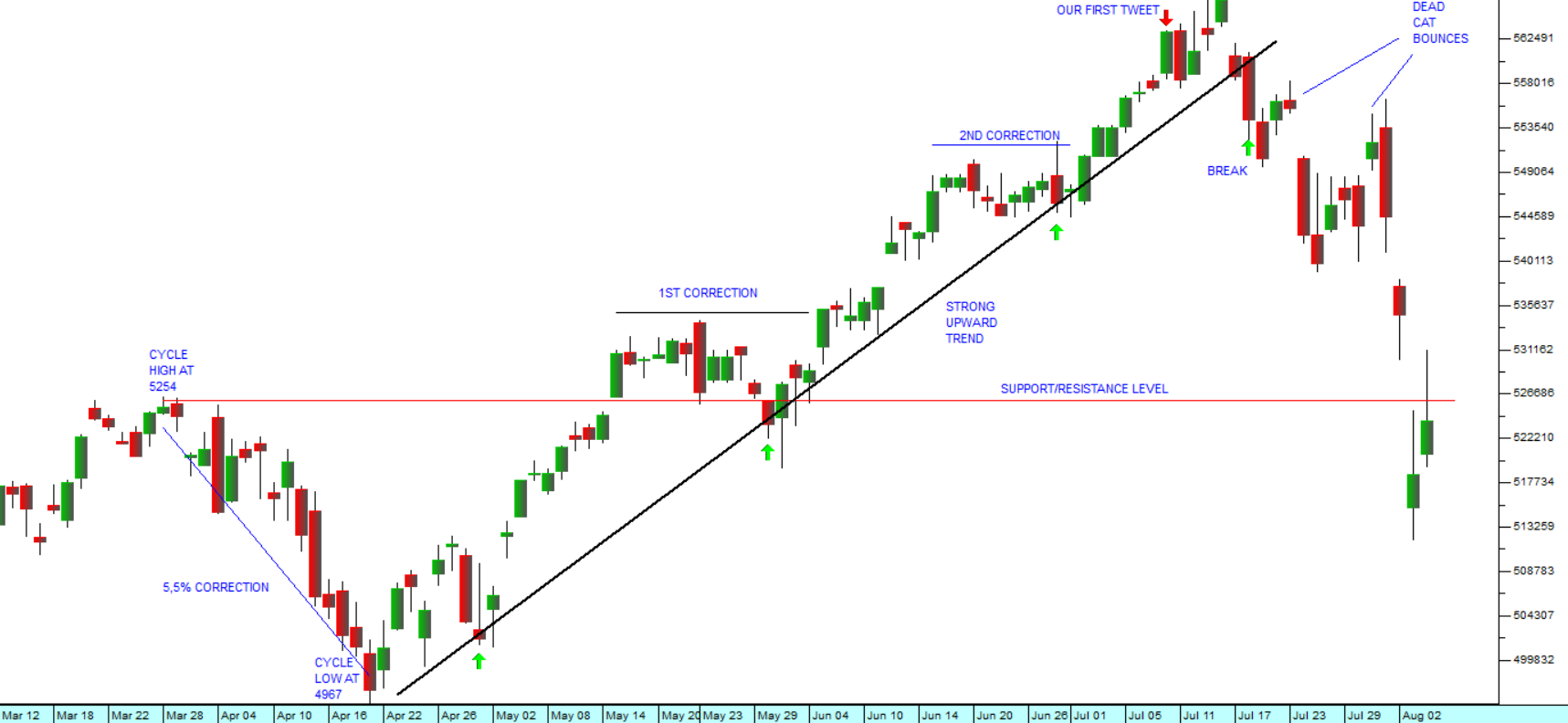

We first tweeted (“X”) on the 10th of July, nearly a month ago, that “...some sort of correction is looking more and more likely.” Then on the 29th of July we gave more detail saying that the correction would probably take the S&P down to “at least 5355” and pointing out the two “dead cat bounces”.

Consider the chart:

Following Powell’s bullish remarks, on the 1st of August, we again said that we did not believe that the correction was over, and then on Friday last week we pointed out the “shooting star” formation which anticipates further downside movement. As expected the S&P fell a further 1,84% on Friday breaking below 5355 to close at 5346.

It appears that suddenly, investors have become worried that the US economy may be headed towards a recession. The latest economic data is definitely beginning to look a little negative. On Wednesday last week, the ISM manufacturing index came in at 46,8%, somewhat worse than expected and the yield on the 10-year treasury bill dropped below 4%. This worry completely reversed the excitement which Jerome Powell’s remarks created. On the 1st of August 2024, the S&P500 fell a whopping 1,8% in a single day. This negative data gave Powell the space to make some fairly bullish remarks following the monetary policy committee (MPC) meeting on Thursday and that resulted in the index recovering most of the lost ground.

However, more negative economic news was in the pipeline with the US economy only creating 114 000 new jobs in July 2024, well below estimates of around 180 000 and almost half of the average of 215 000 over the past year. At the same time, the unemployment rate increased to 4,3%. This news caused the S&P500 index to off-load 2,5% in a single session on Thursday followed by Friday’s 1,84% fall. Fears of recession are clearly growing among investors. The Sahm Rule states that the economy is in recession when the three-month average of the jobless level is half a percentage point higher than the 12-month low.

Powell says that this time the Sahm Rule will not prove to be correct – and we agree with him. Despite that, the correction has now taken the S&P down 5,65% from its record high of 5667,2 (made on 16th July 2024) and may take it down further. Indications are, however, that we are now at or very close to the low point of this correction. We continue to see this as simply a correction within the long-term bull trend which began in March 2009 – and so we expect that sooner or later the S&P will recover and go on to make further record highs.

The S&P500 index is trading at a P:E of 27 – which is high in historical terms, but by no means as high as it can go in a bull trend. For example, immediately following the sub-prime crisis in May 2009, the S&P traded on a P:E of 122. We do not think that the impact of artificial intelligence (AI), humanoid robots and solar energy have yet been fully discounted into markets. Of course, October 2024 will see some nervousness in equity markets, but again we do not believe that it will signal the end of the bull market. Rather we expect the S&P to continue to climb, although not it a straight line. There will undoubtedly be more corrections.

Ukraine

The Russian propaganda machine is working hard to try and create the illusion that the Russian economy is growing and that the sanctions imposed by NATO countries are having no effect. According to an article recently produced by 8 leading EU Finance Ministers this is a lie. These ministers claim that Putin is “re-Sovietizing” the Russian economy which will inevitably result in its decline. The economy has shifted over to a war footing where it is being sustained by massive fiscal spending on war material. There is also a severe shortage of labour in the economy which is now starting to put upward pressure on wages. Together with the weakness of the ruble, this has caused inflation to rise despite record high interest rates. Russia’s national wealth fund is estimated to have halved in size as a result of war spending. Exports of petrol and sugar have now been temporarily halted to ensure domestic supplies. Measures have also been put in place which prevent the movement of capital out of the country. Despite this the country is leaking capital at an alarming rate. These measures combine to make the life of average Russians much more difficult. Sooner or later Putin will be forced to begin printing money to finance the war effort. This will result in higher inflation. Already inflation has risen from 3,3% in June 2023 to 8,7% in June 2024. Russian export revenue has declined by about one third since 2022. In June 2024, the EU adopted its 14th sanctions package against Russia, specifically targeting liquified natural gas (LNG) and the Russian “shadow fleet” which is used to export their fossil fuel products. At the same time the EU has given Ukraine a $50bn loan which will repaid by income from Russia’s frozen bank assets.

It is now 30 months since the Russian invasion of Ukraine in February 2024 and Putin’s attempt to take control of the entire country. Putin has clearly not achieved his objectives despite the enormous cost in Russian casualties and military hardware. The flow of weapons into Ukraine from NATO countries and especially America has resumed and is beginning to have a definite impact on the front line. Combined with the permission given to Ukraine to use those weapons to attack targets inside Russia, the effects are beginning to seriously degrade the Russian war effort. Many analysts are now saying that Russia is on the brink of collapse, both economically and militarily. The Russians have made small territorial gains in some areas, but at such an enormous cost in both men and materiel that it seems unsustainable. The ever-strengthening sanctions from the West are having a huge impact and the cost of sustaining the war effort is taking a huge toll. Putin is also beginning to face some serious opposition at home with more and more Russians feeling the direct effects of the war. Russia has been forced to approach other countries to obtain weapons to continue. Both sides appear to be moving more seriously towards peace talks, but a major sticking point in any talks will be Ukraine’s stated requirement that Russia withdraw from all occupied territories, including Crimea. An end to the war would obviously have a substantially positive impact on equity markets world-wide.

Political

Political risk remains high in South Africa, but it has certainly moderated since the elections. The Government of National Unity (GNU) is in place and senior positions have been allocated. The markets generally have responded positively to the shift in the political structure in South Africa. Equities, bonds, and the rand are looking stronger than they did before this new dispensation. However, there remains the potential for discord within the GNU. The ANC and the DA have been political enemies for 30 years and there are significant differences between their policies. This could lead to a deadlock or even the collapse of the GNU if it is not handled carefully by both parties. Investors should not overlook the fact that in this event, the ANC could break with the DA and look to form an alliance with the EFF and MK in order to obtain a majority in parliament. That is a potential investment risk to the rand and to equity markets going forward. The hope is that the reforms being introduced, particularly by Operation Vulindlela and especially in the areas of electricity production and port and rail coordination, will result in a near-term permanent improvement in the economy.

The first cabinet meeting after the formation of the Government of National Unity (GNU) appears to have been successful with extraordinarily little bickering according to insiders. President Ramaphosa is said to be “buoyant” after the meeting which included all the newly appointed ministers and deputy ministers. There was general agreement on the major problems and how to solve them, especially where the economy was concerned. Even the National Health Insurance (NHI) was seen as practical with a few changes. The main emphasis was returning the country to economic growth after years of very low and negative growth.

The discovery by the newly-appointed DA Minister of Public Works, Dean Macpherson, of a massive and systemic fraud in the department shows that cyber criminals have stolen at least R300m from the department over a period of 10 years. This ratifies the public perception that the ANC’s government is riddled with corruption and that the DA’s recent involvement is likely to lead to a significant clean-up. Over time, this can only be good for the country and the economy. Macpherson is intent on “turning South Africa into a construction site” with numerous public/private partnerships constructing new and much-needed infrastructure – but clearly that cannot be done in a department where there are “...almost no proper financial controls.”

The newly appointed DA Minister of Home Affairs, Leon Schreiber, has vowed to eradicate the backlog of over 300 000 applications and turn Home Affairs into a powerful engine for economic growth. The backlog has already been reduced by about 30% with Deloitte and FNB providing extra resources to speed up the process. As part of the President’s operation Vulindlela, the streamlining of visa applications is expected to improve tourism, especially in the Western Cape. Schreiber’s efforts can be seen as one of the first really positive impacts of the newly formed Government of National Unity (GNU).

The government’s efforts under the National Health Insurance (NHI) to control where doctors can work with a “certificate of needs” has been declared to be unconstitutional by the High Court. This is a major blow to the NHI and an area that has been strongly opposed by business and health professionals. The government was trying to get the court to approve the requirement that health professionals obtain a certificate of need to practice in a specific area – and to make it a criminal offence to practice without such a certificate. The court has said this interferes with the doctors’ right to work in whatever part of the country that they wanted to.

South Africa remains at risk of losing its participation in the African Growth and Opportunity Act (AGOA) and is slated to have a full review of its relations with the US. The newly appointed Minister of Trade, Industry and Competition, Parks Tau, will travel to America to argue South Africa’s case for remaining part of AGOA. The problem is our close relations with China and Russia and our support for Hamas which are seen as anti-American. Obviously, if we lose our AGOA membership, it will be a significant cost to the country, especially the motor industry. Our exports to America under AGOA are allowed duty-free. About one fifth of our exports to America are affected – which is about 2% of our total annual exports. South Africa is regarded as an upper-middle income country and AGOA is designed to benefit lower income countries, but South Africa argues that its inclusion benefits dozens of lower income countries, especially in Southern Africa. We see that outcome as unlikely given South Africa’s importance to the rest of Africa. America does not want to push us further into the Russia/China sphere of influence.

Economy

The decision by the Reserve Bank’s monetary policy committee (MPC) to keep rates unchanged at its July meeting was conservative with many economists suggesting that a rate cut was overdue given the low level of economic activity and the reduction in inflationary pressures. There is a need to keep the interest rates on our government bonds attractive relative to what is available in first world countries. The inflation rate is expected to fall below 4,5% (the midpoint of the target range) next year. The danger is that postponing a rate cut could put the economy in danger of falling into a recession. Generally, the MPC is looking 9 months or a year into the future when making their decisions. So, they are considering where inflation will be in the middle of next year. In our view, the MPC is right to be conservative because the ANC’s one great economic success, even through the Zuma years, has always been the strict control of its money supply and inflation. This has given us a distinct edge over other emerging markets where inflation is a real problem.

The producer price index (PPI) was steady at 4,6% in June 2024, unchanged from May. However on a monthly basis June fell by 0,3%. So far this year the PPI is averaging 4%, compared to the average in 2023 of 6,7%, mainly because of the drop in the price of fuel. The lower PPI means that the inflation rate is going to continue falling, leading to a new trend of reduced interest rates beginning probably in September this year. Lower inflation is good for the economy because it keeps us in line with our main trading partners and makes the country more attractive for foreign direct investment (FDI).

Inflation in South Africa has remained under tight control thanks to the performance of the Reserve Bank under the governorship of Lesetja Kganyago. Efforts are under way to reduce the consumer price index to 4,5% by next year. The June 2024 inflation rate was 5,1%, slightly below May’s figure of 5,2%. The repo rate was held unchanged at 8,25% at the July 2024 monetary policy committee (MPC) meeting. The MPC expects the inflation rate to be 4,9% for the whole year. Rates should begin falling from September 2024. The low level of inflation in South Africa has been a major factor in maintaining foreign domestic investment into this country and it compares well with inflation rates in first world countries. For example, the Nigerian economy which was recently touted as being larger than that of South Africa is labouring under inflation of 34,2% per annum, which is the highest in 28 years. The country’s currency has been devalued twice this year while subsidies on petrol and electricity have been slashed. Consistently low inflation has enabled South Africa to survive the Zuma years and emerge with a strong hope of future growth.

Bank of America says that growth in gross domestic product (GDP) is expected to increase to at least 2% over the next 3 years as a result of the improvement in Eskom’s electricity supply and the elimination of loadshedding. This improvement will lead to greater tax collections and a reduction in the national debt over time. The government is projecting a budget deficit of 4,3% of GDP in the 2024 financial year falling to 3,9% in 2025. It is obviously important to reduce the deficit so that finance costs make up a smaller percentage of revenue. The new cabinet which has just been sworn in will cost more than R1bn per annum with ministers getting R2,68m per annum and deputy ministers getting R2,2m.

Stats SA reported that the government spent R2,04 trillion in the 2022/2023 financial year. Interest on the government’s debt increased to 15% of this or R308bn. Social grants swallowed up R242bn. Provincial governments which cover health and education got R694bn. The main problem with these numbers is the high level of interest on the government’s debt. That must be brought down to a more reasonable level to avoid the country falling into a debt trap.

The Bureau for Economic Research is expecting the South African economy to grow by 1% this year, rising to 2,2% next year. If it happens, this will be the first time that growth has been above 2% since 2013. Their improved forecast is a result of the elimination of loadshedding combined with the expectation that interest rates will begin to fall later this year. The International Monetary Fund (IMF) sees South Africa's economy growing 0,9% this year and 1.2% next year. The size of the government debt is seen as a major problem by the IMF. They say that the debt must be reduced steadily over a period of years. The IMF did not comment on the outcome of the recent elections. In our view the IMF’s growth projections are very conservative. We are expecting growth to come in significantly higher, especially next year.

ABSA’s purchasing managers index (PMI) rose to 52,4 in July 2024 – sharply up from June’s figure of 45,7 and well above the neutral level of fifty. The greater optimism is a reflection of the new Government of National Unity (GNU) and the suspension of loadshedding. There is also the anticipation that interest rates will begin to fall from September 2024. There has been no loadshedding for four months now. Lower prices for petrol and diesel in recent months have also contributed. Producer price inflation (PPI) has also been sharply lower in recent months falling from over 6,5% in 2023 to around 4%. This improves the profitability of producers.

Bankserv’s take-home pay index shows that the average South African’s salary was 6% high in the year to 30th June 2024 – against an inflation rate of 5,3%. This means that real incomes increased by just 0,7% over the year. Right now, consumers are battling with high interest rates which are only expected to begin falling in September as inflation prospects begin to come down. The Reserve Bank is expecting inflation in 2024 to be 4,9%. The elimination of loadshedding is gradually resulting in increased business profits, a better labour market and more salary increases. Reforms in Transnet’s logistics can also be expected to yield improvements in the economy which will directly affect salaries and wages.

Retail sales increased by 0,6% in the month of May 2024. Most of this was a result of a 2,9% increase in sales by general retailers (i.e., supermarkets). There has been no loadshedding for four months – which has increased company profits and allowed them to increase the pay of their employees. Consumers were also slightly more optimistic than in previous months. Retail sales is critical to the economy’s growth and consumers have been under significant pressure due to the high level of interest rates.

New car sales in July 2024 were about 1,5% higher than in July last year, as consumer confidence improved following the elections and the end to loadshedding. The high level of interest rates remains a disincentive to buyers, but rates are expected to begin falling as soon as September 2024. There has been an increase in applications for vehicle finance, which suggests that demand is increasing. As interest rates come down over the next year, we can expect consumer demand to pick up throughout the economy, especially if demand for our exports improves.

Mining production fell 1,1% in May 2024, mainly because of a 4,1% decline in the production of platinum group metals (PGM). Mining production in May 2024 was about the same as May 2023 with coal and chrome up while precious metals were down. Amplats, Sibanye and Implats have been retrenching workers and closing shafts even though the platinum market has moved into deficit. Precious metals still account for a substantial share of South Africa’s economy and exports. In our view, these markets will bounce back in due course as the world economy benefits from declining interest rates.

Difficulties at South African ports continue with both exports and imports falling by 8% in the first quarter of 2024. South Africa was one of only two countries world-wide to experience a drop in trade in the quarter (the other was Japan). The problems at the ports appear to be getting worse with the country losing at least R26,7bn worth of iron exports alone since 2010. At Durban port only seven of the sixteen available ship-to-shore cranes are operational, slowing down the off-loading of ships and creating a backlog of ships waiting to enter the port. This type of bottle neck is costing the economy dearly.

Francois Engelbrecht, professor of climatology at Wits says that the climate in Southern Africa had become dramatically warmer and was expected to become drier as a direct result of climate change. His expectation is that there will be an increase in droughts and heat waves leading to widespread crop failures. Millions of people in South Africa are subsistence farmers who rely on growing a few acres of maize every year to feed their families. In drought years they become dependent on charities and government subsidies. South Africa is normally able to export maize in a good year but has to import maize in drought years. This puts pressure on our foreign exchange reserves.

South Africa hosts a substantial illegal scrap metal industry where cables and other metals are stolen from government departments and state-owned enterprises (SOE) like Transnet and exported. This has caused massive and continuous problems for the economy over many years. The proposal now is that all scrap merchants be registered with the government and that they report all their purchases and sales of scrap metal. The scrap metal industry has raised concerns that the software used for this may be hacked or may be unreliable since the government generally does not have a good track record with developing software. They also complain that they have not been involved in the development of the software. These are legitimate concerns but the cost to South Africa of the constant theft of cable and other metal is enormous and must be addressed.

The illegal sale of cigarettes in South Africa results in a loss to the state of approximately R2bn a month in lost tax revenue. Illegal cigarettes are selling for roughly half the cost of legal cigarettes and are widely available in stores. The problem was exacerbated by the ban on cigarette sales during COVID-19 which allowed the illegal cigarette business to gain complete dominance of retail sales. Illegal cigarettes also have significant health problems because the chemicals which they contain are not monitored and regulated. They contain more cadmium, lead, tar, and carbon monoxide than legal cigarettes.

Most service delivery in South Africa is provided by 257 municipalities, about half of which are under investigation by the Hawks for corruption. This has resulted in extremely poor service delivery from the municipalities concerned. The proposal now is that the worst municipalities be dissolved, and fresh elections be held to appoint new officials. The South African Local Government Association (SALGA) which represents the municipalities is opposing the idea. The lack of service delivery is a persistent problem in this country and was a major factor in the recent elections which saw the ruling ANC’s support drop by 17%.

It is apparent that the new government of national unity (GNU) is toying with the idea of forcing pension funds to invest in prescribed assets. This policy was last used by the National Party before the ANC came into power and it was abandoned because it interferes with pension fund managers’ choice of which assets to invest in – and that causes returns on pension investments to fall. The GNU in the form of Parks Tau is proposing the Regulation 28 in the Pension Funds Act be adjusted to possibly set minimum levels for investments in certain asset classes to increase investment in infrastructure. This idea was also part of the ANC’s 2024 election manifesto. Pension funds already do invest in government assets based on what return they can expect to get and the risk they are taking. Forcing them to invest in a particular asset class would reduce the returns they can get and increase the risks.

Eskom

Friday, 5th July 2024 marked the 100th day without loadshedding in South Africa and heralds a new era of economic growth if the current direction can be maintained. Many were disappointed with President Ramaphosa’s re-appointment of Gwede Mantashe as Minister of Mineral Resources and Energy because of his well-known views on coal and his opposition to renewables. He has been sidelined in electricity management by the new Minister of Electricity, Kgosientsho Ramokgopa, who is now in charge of Eskom and has responsibility for drawing up the new Integrated Resource Plan (IRP). Mantashe clearly still has significant power within the ANC, but his historically obstructive approach to renewables may now be at an end. At the beginning of July 2024, Eskom announced that it had brought the number 5 unit at Kusile power station online, supplying about 800mw of additional power.

In a recent presentation Standard Bank has said that it sees definite progress at both Eskom and Transnet which will lead to gross domestic product (GDP) growth improving towards 3% per annum in the coming years. Standard said that Eskom’s unplanned outages had been reduced substantially and that additional wind power generation had ensured that the increased demand over the winter period had not resulted in loadshedding. At the same time the logistics at our ports have improved with turnaround times for ships going from 18 days in October last year to about 4 days. During the presidency of Nelson Mandela, the economy grew on average by 2,7% per annum, during Thabo Mbeki’s presidency it grew by 4,1% on average and during Jacob Zuma’s presidency it grew by just 1,5% per annum. Since President Ramaphosa took over there has been definite evidence of improvement and growth should increase as a result.

Electricity production in South Africa is moving rapidly towards renewables and competition between suppliers. The National Transmission Company of South Africa (NTCSA) began in business from the 1st of July 2024 and is buying electricity from whomever can supply it at competitive rates. Combined with the rapid spread of solar power this should have the long-term effect of reducing the price of electricity in this country. We believe that it is unlikely that loadshedding will resume, especially now that winter is coming to an end and Eskom’s energy availability factor (EAF) is above 60%. The availability of cheap abundant electricity in this country will have a massive impact on the economy and hence, in time, on the stock market.

The Boston Consulting Group (BCG) says that the South African mining industry is struggling with the rising cost of electricity and that production may be affected. According to BCG South Africa is short of between 4 and 5 gigawatts of power to exploit its mining potential. The mining sector accounts for about 8% of gross domestic product and employs about 500 000 people. Many mining companies have or are installing their own renewable energy resources, but most still rely on Eskom. Renewables are also a variable supply and require a substantial investment in batteries to make them viable. The National Transmission Company of South Africa (NTCSA) has begun operating, but it requires a massive investment into 14000km of transmission lines to become fully viable. SA is making the transition to renewables very rapidly, but there are likely to be problems along the way which will impact mining.

Commodities

GOLD – In our Confidential Report of March 2024 we drew your attention to the fact that the gold price in US dollars was breaking above its long-term resistance level at $2060. We suggested that it was entering a new upward trend. That upward trend is gaining momentum as gold tests its all-time record high at $2462. Political tension in the Middle East has heightened recently after the assassination of Hezbollah leader, Ismail Haniyeh, by Israel. This event has pushed gold even higher.

We expect gold to continue to go up in both US dollars and rands as international investors become concerned about political developments and seek to hedge themselves against a possible downturn in equity markets.

OIL - Since our last Confidential Report on 3rd July, the price of oil has been falling. There has been concern that the American economy might be heading into a recession – which would result in lower demand for oil. At the same time, the world is moving steadily towards renewable energy and away from fossil fuels. Consider the chart of North Sea Brent oil:

You can see the upward trend at the start of 2024 which was followed by a cyclical downtrend. At the time of last month’s Confidential Report, the oil price was at a cycle high of around $87 per barrel. Since then, it has fallen back to $80, and it may fall further. A falling oil price is good for the Democrat’s efforts to win the election in November – and, of course, it is bad for Russia and Putin.

Bitcoin

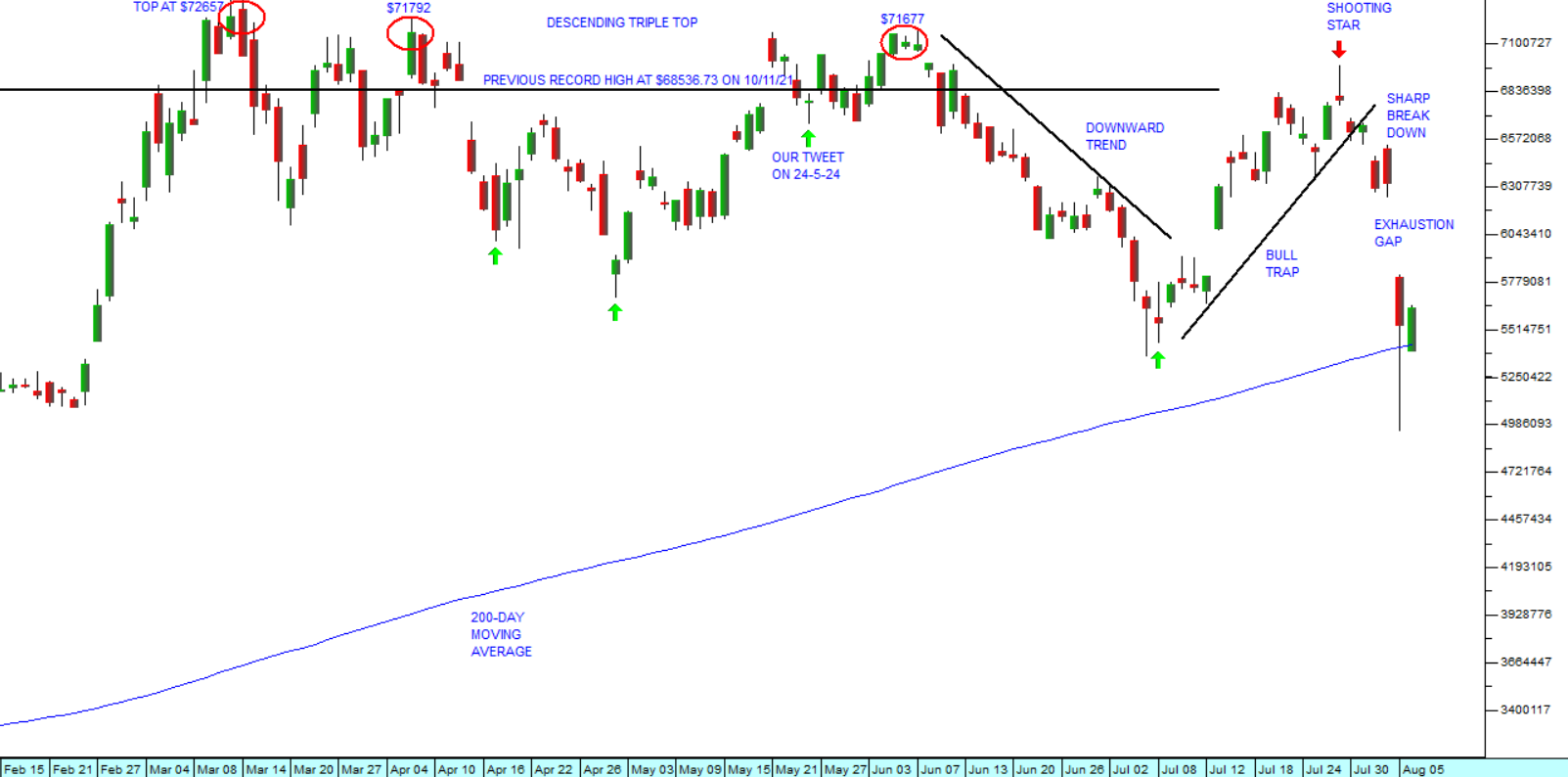

At the end of May 2024, the Bitcoin price was hovering around $70 000 per coin. We pointed out in our tweet of 24th May 2024 that the chart was showing a descending triple top, probably one of the most bearish formations in technical analysis, and that we expected it to fall from those levels. A descending triple top generally means that the smart money is busy dumping in anticipation of a downward trend. They are selling out while sentiment is still positive because they are aware of bad news coming down the pipe. Consider the chart:

The chart shows the series of tops each lower than the previous one. This culminates in the “shooting star” top on 26th July 2024 – which could be seen as yet another descending top. We now expect Bitcoin to fall further.

Cryptocurrencies have no fundamentals and can only really be assessed technically, so a major bearish formation like this should be taken seriously. Our advice remains: If you have them sell them; if you do not have them, don’t buy them.

Companies

One of the main beneficiaries of the newly formed government of national unity (GNU) has been the banking sector. Prior to the elections and the GNU agreement, it was trading on an average dividend yield (DY) of between 6% and 6,5%. The GNU promises to bring improvements to all aspects of the economy over time and the commercial banks will be major beneficiaries of that. Leading the pack is Capitec Bank, which has been going up strongly since November last year. The laggard has been ABSA Bank which has yet to attract investor interest. Consider the chart of the JSE Banks index.

The average DY of the banking sector is now 5,33% - which still looks like good value to us. We expect banking shares to continue to perform in the coming months.

ARCELORMITTAL

ArcelorMittal (ACL) has borne the brunt of the collapse of the construction industry during the sub-prime crisis and the Zuma years. Unlike Highveld Steel it has managed to survive and struggle through a substantial restructuring. Consider the chart of the last four years:

You can see here that the 200-day moving average (MA) has been giving very good signals on when to buy in and sell out of the share. It broke up through the MA in November 2020 at around 60c and rose to a high of over 1000c in January 2022. Then it began a long downward trend and gave a sell signal on the MA in May 2022 at about 725c. Since then, it has fallen back to a low of 85c in December 2023. At that point it went into an “island formation” before breaking up on 10th July 2024 at a price of 134c. We believe that this company will benefit directly from the private/public partnerships that are likely to flow from the new Government of National Unity (GNU).

CURRO

Curro (COH) is a provider of high-quality education in South Africa. As such it is providing a much-needed service to compensate for the virtual collapse of government provided education in this country. It is essentially a service provider with the one caveat that its business requires a substantial investment in capital infrastructure in the form of schools. Other than that, it has the great advantage that, traditionally, parents are expected to pay for their children’s education in advance – which means that Curro generally has a particularly good working capital position and strong cash flows. In its recent trading statement for the six months to 30th June 2024 the company estimated that headline earnings per share (HEPS) will increase by between 10,9% and 21,3% - which shows that it is still growing despite the high level of interest rates. Consider the chart:

As you can see, Curro reached a cycle low in March 2023 at 712c before beginning a new upward trend. We believe that the share has considerable upside potential as the country’s leading provider of private pre-tertiary education, especially with the new Government of National Unity.

CAPREG

Capital and Regional (CRP) is a UK real estate investment trust (REIT) which owns and manages in-town community centres in England. A massive GBP77,9m injection by Growthpoint gave it 51,2% of the business. The share has been trading at a significant discount to its net asset value (NAV) but jumped on the news of the takeover by Growthpoint. In its results for the six months to 30th June 2024 the company reported net rental income up 17,1% and adjusted profit up 17,1%. This is clearly a rand hedge which is now managed by Growthpoint’s experienced team. In our view it will continue to offer stability, growth and protection against any fall in the rand. Consider the chart:

We added the share to the Winning Shares List (WSL) on 29th May 2024 at 1479c and it has already appreciated to 1600c. In the past it has been quite thinly traded, but it now seems to be attracting institutional interest.

BELL

Sometimes the stock market offers private investors the opportunity to make a “windfall” profit in a very short space of time with almost no risk. Such an opportunity was given by the Bell family’s decision to take their listed company private and offer shareholders R53 per share for their minority holding. For some time, we had regarded Bell (BEL) as underpriced on the JSE and had added it to the Winning Shares List (WSL) on 27th October 2023 at 1875c. It produced particularly good results for the year to 31st December 2023 with revenue up 32% and headline earnings per share (HEPS) up 69%. Gradually, the market began to appreciate its value and slowly re-rate it upwards. Consider the chart:

Here you can see that following the buy-out offer the shares have been trading for above R50 – giving those of you who bought it when we added it to the WSL a profit of 169% in just over 9 months.

MURRAY & ROBERTS

The construction industry has been one of the worst victims of the mismanagement of the South African economy, especially since 2010. Some construction companies have gone into liquidation, and all have been forced to downsize, sell off assets and completely re-structure their businesses. However, with the advent of the Government of National Unity (GNU), suddenly the prospects for the remaining construction companies is looking very good. They will be the direct beneficiaries of many anticipated private/public partnerships as we rebuild our infrastructure. At the forefront of this is Murray & Roberts (MUR). Consider the chart:

After a protracted downward trend, M&R finally entered a period of consolidation at around 60c per share. This “island formation” was marked by a “double bottom” at 58c and then an upside breakout in late December 2023. We added the share to the Winning Shares List (WSL) on 21st December 2023 at a price of 106c. It has subsequently risen to 306c this year, giving investors a whopping 188% profit in just over 9 months. We expect it to continue performing well as more construction projects go to tender and are approved.

← Back to Articles