The Confidential Report - April 2023

America

At its peak, the Federal Reserve Bank’s balance sheet reached $9 trillion during the COVID-19 pandemic. They have been reducing that by $95bn a month since late last year in a process called quantitative tightening (Q/T). Clearly, given the collapse of Silicon Valley Bank (SVB) and others, that reduction in the size of the US money supply, combined with rising interest rates, is beginning to impact. The problem is that when a bank collapses, its sucks money out of the economy like a vacuum cleaner. This is because all banks in the normal course of business create money by on-lending about 90% of their deposits to borrowers – so, when they fold, the people who have borrowed money from them have to return it resulting in a sharp reduction in the money supply. The Fed, in an effort to prevent runs on banks, has said that they will support all banks and that no one will lose money which they have on deposit at a commercial bank. Of course, it would be impossible for the Fed to stand good for all deposits at all banks in the event of a run on many banks simultaneously. What we are now seeing is that the impact of Q/T, even at the mild level that it is being done, can have substantial ramifications. The Fed may have to slow down its rate of Q/T or even abandon it entirely if there are more banks in trouble.

The Fed has said publicly that none of the depositors at SVB will lose their money, irrespective of how much they had on deposit with that bank. The problem with this assurance is that it substantially increases the “moral hazard” that bank executives will now feel that the Fed is guaranteeing all their deposits and that therefore they can extend additional credit, even to clients who are not necessarily credit worthy. In a capitalist system, banks must be allowed to fail and depositors at those banks must face the risk that they could lose what they have on deposit there. The government cannot guarantee the survival of banks any more than it can guarantee that companies in general will survive. This is a fundamental truth of the capitalist system. So, by issuing this guarantee to SVB depositors, the Fed has opened the door for further irresponsible growth in the US money supply.

The remarks by Federal Reserve Bank (“Fed”) governor, Jerome Powell on 7th March 2023 to Congress temporarily re-established the Fed’s hawkish stance in investors’ minds and caused the S&P500 index to fall by more than 1,5% - but the effect was only temporary. Powell reiterated that the Fed is intent on getting inflation down to 2% and suggested that interest rates would have to go higher than previously anticipated. Following his remarks, the markets were discounting a 70% probability that the Fed would increase rates by 50 basis points at its next meeting in March. This made it clear that the excessive optimism in this bear trend has, and is still, causing investors to deliberately misunderstand the Fed’s degree of hawkishness. In our view, this one-day decline in the S&P500 was a brief and temporary return to some sanity in a market which seems to be deliberately ignoring what the Fed has been saying. The S&P500 index remains in a bear trend – something which has been obvious for at least the past 8 months.

Then, on 22nd March 2023, the US monetary policy committee (MPC) announced that it was increasing interest rates by a further 0,25% bringing them to between 4,75% and 5%. In the presentation which followed the announcement it became apparent that the MPC anticipated only one more 0,25% rate hike and an indeterminate period before rates would begin to fall. We think that there is a strong probability that inflation in America will not come down from its current levels (around 6%) very easily and that more rate hikes may well be required. In other words, rates may have to go higher and remain higher for longer than investors are expecting.

The sharp rise in US interest rates has caused the value of bonds to decline rapidly. When interest rates rise the price of existing bonds falls in order to bring the effective yield back into line with the higher rates available on new bonds. The decline in the value of bonds has impacted those banks in America which have been heavily invested in them. This fall in the value of one of their key assets, combined with a widespread loss of deposits has brought some banks to a critical point – like Silicon Valley Bank (SVB). Unlike South Africa where the banking sector is dominated by 5 or 6 very large and financially stable banks, America has thousands of banks and many of them are minor regional banks with relatively small asset bases. Some of those banks have been taking strain, especially since the collapse of SVB. The Fed has been stepping in to rescue them. Warren Buffett has famously said, “...only when the tide goes out can you see who is swimming naked”. Well, the tide seems to be going out…

The Fed’s rapid tightening of interest rates is exposing the weakness of many banks. Insolvency is becoming a problem in the banking sector with many banks carrying undisclosed losses on their bond portfolios. This is similar to what happened in 2008 when many US banks lost money in the housing market. People and companies with uninsured deposits, anticipating a run on banks, have been taking their money out and putting it into money market funds and US treasury bills. For example, in the week ending on 22nd March 2023, depositors took a total of $126bn out of US banks and total bank deposits fell 4,4% to $17,3 trillion. In our view, the crisis in US banking is not yet over and we are likely to see more banks in trouble going forward.

Core private consumption expenditure (PCE) which excludes food and energy prices is the main indicator which the Fed uses to determine which way inflation in America is going. In February 2023 the PCE rose by 4,6% over the year – slightly less than the consensus prediction for 4,7%. At the same time the level of growth in consumer spending in February 2023 fell to 0,1% - down from January’s 1,5%. These two items of relatively “good” news caused investors to gain confidence that the Fed’s rate-hiking cycle might be coming to an end and that the point at which the Fed would “pivot” from raising rates to reducing them was near. Indeed, the idea that the pivot could come in the next few months has been gaining traction, despite the fact that the inflation rate is still at 6% against the Fed’s often-stated goal of getting it down to 2%.

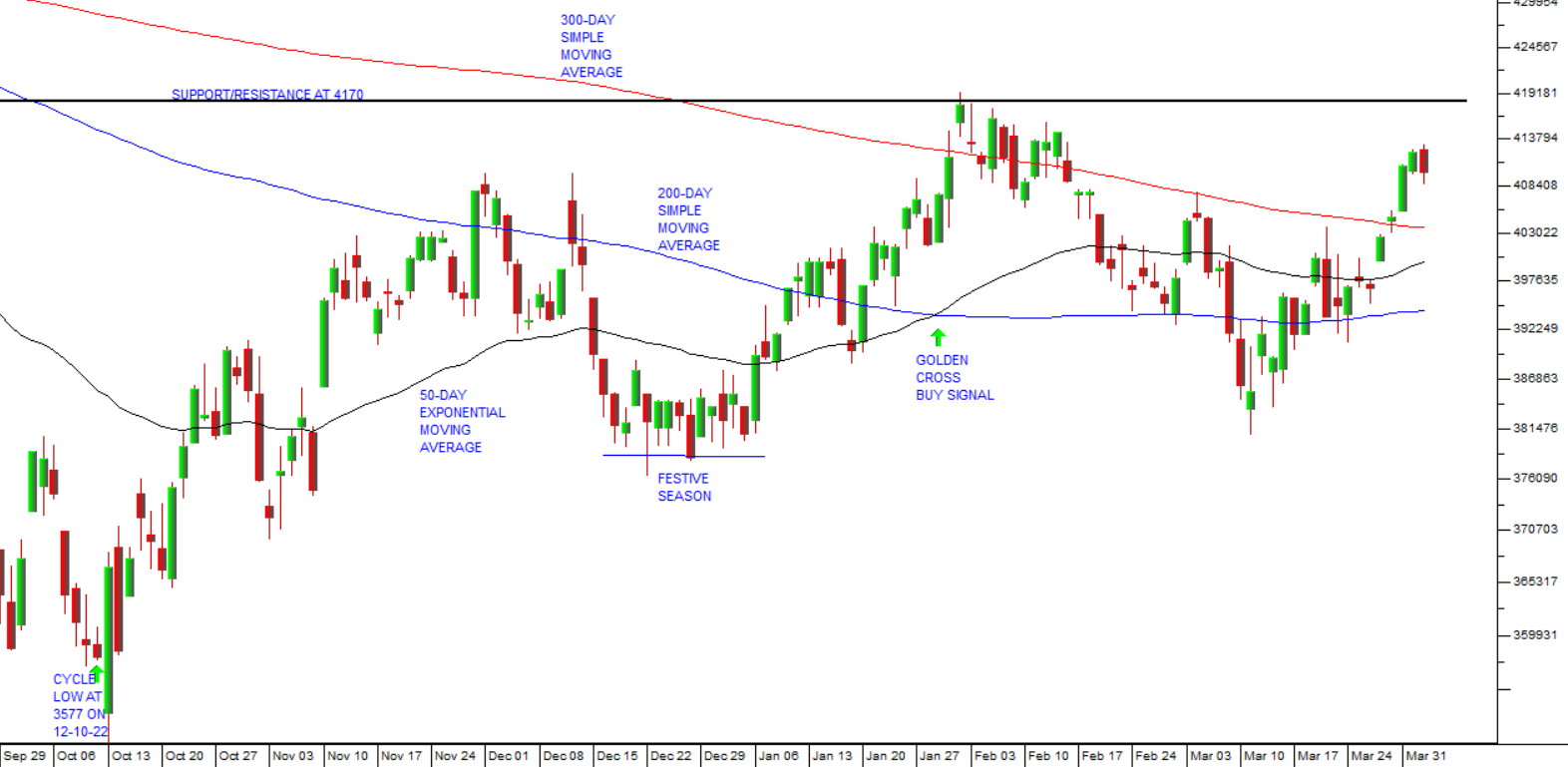

As a private investor, it is very important for you to formulate a view on whether US interest rates are going up or down during the rest of 2023 and into 2024 – because that will be the main factor now in determining whether shares, worldwide, continue in the current bear trend or begin a new bull trend. Our view is that the relatively benign inflation figures coming out of the US are probably temporary. Unemployment is at 3,6% and the US economy has generated over 800 000 new jobs in January and February this year. This shows that the economy that is still growing rapidly and is not yet responding to the Fed’s rate-hikes. We believe that the Fed will be forced to continue tightening interest rates and conducting quantitative tightening (Q/T) for some time and certainly well into 2024. We do not see a pivot in Fed policy during the Northern hemisphere summer this year – and that is the expectation which appears to be driving the S&P500 index higher at the moment. Consider the chart:

The chart shows the progress of the S&P500 index over the past nine months – since it reached a cycle low at 3577 on 12th October 2022. As you can see, the index is moving back up towards the long-established resistance level at about 4170. We continue believe that it is unlikely to penetrate that resistance and will most probably fall back to test the cycle low at 3577.

2024 is an election year in America and that will begin to have an impact on markets. The incumbent Democrat administration will want to fight the election against the background of a strong economy which is creating jobs. This together with the fragility of the US banking system may cause the Fed to soften its approach in the months ahead. But the inflation in the US economy will have to be dealt with sooner or later – if they pause the rate-hiking and Q/T cycle now to reduce the immediate economic pain of bank collapses, they will only be postponing the problem to a later date, by which time it will be worse.

Ukraine

It is apparent that the Russian winter offensive in Ukraine has all but stalled with little or no ground gained. Bakhmut has proved to be a devastating killing field for Russian soldiers, conscripts, and Wagner Group soldiers. Now the Ukrainians are planning a counter-offensive, using the military hardware supplied by the West, including main battle tanks. There is no indication yet where this attack will take place and the options range from Bakhmut to Melitopol or even Crimea. What appears clear is that Russia has exhausted its ability to recruit and train new troops and even its conscripting of convicts is substantially exhausted. It is also running out of ammunition, according to the head of the Wagner group. It looks probable that Ukraine will gain a significant strategic advantage with its planned assault this summer and bring the war much closer to an end. We reiterate our view that Putin will probably not survive another major defeat in field, especially if it becomes apparent that Crimea will be lost.

Now that he has been declared a criminal by the International Criminal Court (ICC) the planned visit by Putin to South Africa in August for the BRICS summit raises an interesting dilemma for our government. Theoretically, he should be arrested as soon as he sets foot here, because South Africa is a signatory of the Rome Statute which established the ICC, but undoubtedly our government will find a way to avoid that (as they have infamously done in the past). South Africa’s Ministry of International Relations has invited Putin so it will be interesting to see whether he accepts the invitation or not. If he does come here, arresting him would give South Africa the opportunity to restore its credibility with the international community – but that seems very unlikely. Notably, Russia is not a member of the ICC.

In an effort to circumvent US and European sanctions and the price cap on oil, Russia has been selling oil to countries like India and China in roubles and in other currencies. This will probably erode the US dollar’s dominance of the oil markets and as the international oil currency. India is now Russia’s largest customer for oil, having displaced Europe and it is the world’s third largest importer of oil. As the sanctions on Russia tighten, India is risking its trading relationship with Europe and America but is taking advantage of the fact that it can buy Russian oil much more cheaply than other types of oil. Since the war began, India has imported several hundred million dollars’ worth of Russian oil which has undoubtedly been used by Russia to finance its war effort in Ukraine. There has been some renewed speculation about whether the US dollar could be replaced as the international currency by another currency. We believe that this idea (which comes up periodically) has very little possibility of happening. About 88% of the world’s trade is conducted in US dollars and about 62% of central bank reserves are held in US dollars.

Political

During President Mandela’s term of office, South Africa was seen as a symbol of moral fortitude in the world and held up as such. That reputation has been steadily squandered by the ANC over the last 25 years, culminating in its current absurd stance on the Russian invasion of Ukraine. South Africa’s tacit support of Russia is certainly going to have some deep consequences in time. The world is looking to see which countries supported democracy in this difficult time and our inability to do so will stand out in sharp contrast to the Mandela era of moral leadership. These sentiments were expressed by the CEO of FirstRand, Alan Pullinger, who described South Africa’s official position on the war as “despicable”. As he says, this policy stance is “...not in the interests of the country” and might easily result in future trade barriers and restrictions. There are indications that the ANC may have received donations from Russian sources last year which may have influenced its stance.

President Ramaphosa’s much-anticipated cabinet re-shuffle was finally announced without any major unexpected changes. Paul Mashatile was appointed Deputy President, replacing Mabuza. A Minister of Electricity was appointed. In our view, this was an opportunity lost to replace the Minister of Minerals and Energy, Gwede Mantashe – but it is clear that Ramaphosa does not yet feel that he has sufficient power within the ANC to do this yet. Rather he has decided to circumvent Mantashe, at least on the energy front with his new Minister of Electricity. The reshuffle was mostly about the internal politics of the ANC and is unlikely to greatly impact the ANC’s popularity or its prospects in the 2024 election or its effectiveness as a government. We consider the reshuffle as a clear case of “...moving the deck chairs around on the Titanic”.

The government has increased its offer to the 1.3m civil servants in this country from 4,7% and then to 7,5% which to us looks like a populist move designed to improve its image with voters ahead of the 2024 elections. The move will come at a substantial cost to the fiscus and is far more than the 1.6% increase allowed for in the February 2023 budget. While the government has been successful in reducing the national debt, much of that achievement is due to the boom in commodities which is now coming to an end. Godongwana warned that the unbudgeted increases would require “very significant trade-offs in government spending because the wage bill is a significant cost driver”. The increase will cost an additional R35.8 billion in the upcoming financial year. Treasury said it will not increase government borrowing to fund unbudgeted wage increases. Evidently, we should expect further populist moves over the next year as the ANC desperately attempts to improve its current 46% showing at the polls at the cost of the country as a whole. The impact of this above-inflation wage settlement with the civil service unions can be seen in SA Transport and Allied Workers Union’s (SATAWU) recent demand for a 9% increase.

The poor support for the EFF’s National Shutdown on 20th March 2023 shows that the EFF still only has at best about 10% of the vote in South Africa. A positive outcome of the day was that it showed a far better police preparedness than the riots in July 2021 and very little damage was done to infrastructure or businesses. In our view, the whole event was ill-advised for the EFF who have now clearly demonstrated that they have little chance of becoming the country’s official opposition any time soon.

A recent poll on a group of over 1500 demographically representative South Africans by the Social Research Foundation finds that the ANC has just over 50% support, the DA has 25% and the EFF has around 6%. This indicates a sharp decline in the EFF’s support and shows both the ANC and the DA doing better than previous polls, including those of the ANC itself. The margin of error in the poll of 4% - which could have a significant impact. There are concerns about the accuracy of the survey and its results.

Eskom

A private report into the corruption at Eskom has been obtained by Business Day (BD). Although disputed by our new Minister of Electricity, the BD says it is about 1 inch thick and substantially supports what de Ruyter said in his ENCA interview – particularly that the corruption is supported and organised by two cabinet members. The report is privately funded and so will continue investigations now that de Ruyter has left Eskom. The importance of this is that it shows that de Ruyter was probably telling the truth and all the ANC bluster (including the assertions of the Electricity Minister) that has followed his interview is probably simply an effort at damage control.

On 2nd March 2023 Business Day also reported on the deliberate sabotage at Tutuka power station. Investigators have been unable to determine who committed the sabotage because of poor security. The objective of the attacks was either,

- to make necessary repair contracts from which the criminal cartel could profit or,

- to discredit de Ruyter and President Ramaphosa in the run up to the ANC’s December 2022 elective conference.

Either way the reporting suggests that what de Ruyter said in his now famous ENCA interview was the truth.

It is a little scary that both the Reserve Bank and the JSE have now put plans in place to cope with a complete collapse of the electricity grid. This shows how rapidly things have deteriorated at Eskom and it points to the fact that all companies and consumers in South Africa should be working towards making themselves independent of the grid. We have said for some time that Eskom is a dying organisation and the preparedness of these two important financial institutions for that eventuality is probably indicative of what is to come.

With the help of a donation of 30 000 hectares of land from Sibanye, Gauteng province is planning to build a solar farm through independent power producers (IPP) which will supply the city with 800MW of power and help it to reduce its reliance on Eskom. In this process it is following in the footsteps of Cape Town which already has sufficient alternative energy to reduce loadshedding by 2 stages. The trend towards getting off the grid is beginning to gain some serious momentum.

As companies and consumers install solar power and other renewable energy solutions, the income of municipalities is declining – along with Eskom’s income. This could lead to a new financial crisis among municipalities many of which are already very badly managed and in financial difficulties. The City of Johannesburg is concerned about the loss of revenue. Revenue from electricity makes up about 44% of their total revenue. Loadshedding at stage 6 has already had a negative impact on revenue. At the same time, the government’s new solar power tax incentive encourages businesses and individuals to move away from Eskom and implement their own solutions. The municipalities collectively are already owed over R150bn in unpaid power bills.

Our new Minister of Electricity, Kgosientsho Ramokgopa, has said that the measures which he takes to sure up the collapsing energy grid are not populist attempts by the ANC to win votes in the 2024 elections – but necessary steps to bring the power situation back to some sort of sanity. He says that he will have to look at the existing coal-fired power stations based on their performance, noting that some of the best were also the oldest and due to be decommissioned within 2 years – like Lethabo which was commissioned in 1985 and works at an energy availability factor (EAF) of 77% while one of the worst performing stations was Kusile. We are of the opinion that Ramokgopa will prove to be effective in the position at least in the short term, but we are not so sure of his long-term effect. We doubt very much that his efforts will have a great impact on the ANC’s performance in next year’s election.

Economy

The 50-basis point hike in interest rates put through by the monetary policy committee (MPC) at its March 2023 meeting came as a surprise to most local economists who were expecting only 25 basis points. The MPC sited local loadshedding and the tightening due to the bank collapses which have taken place in Europe and America. Loadshedding has had and is expected to have a negative impact on inflation causing businesses to increase prices to recover the additional costs. The international financial position has also tightened significantly and threatens the rand. The MPC further reduced their projection for gross domestic product (GDP) growth this year slightly and projected inflation at 6% - sharply up from their previous forecast of 5,4%. In our view this move represents the Reserve Bank once again getting in ahead of other central banks, especially the American Fed. The move caused the rand to strengthen to below R18 to the US dollar. Obviously, higher interest rates will have a negative impact on growth in South Africa.

Gross domestic product (GDP) shrank by 1,3% in the 4th quarter of 2022 on an annualised basis following the third quarter’s growth of 1,8%. The contraction, due mainly to the sharp increase in loadshedding, was far worse than most economists were expecting and raises the possibility that loadshedding has pushed the economy into a technical recession (defined as two consecutive quarters of negative growth). Mining production contracted 7% while agriculture contracted 3,3%. For the whole of 2022 the economy grew by 2% - much less than 2021’s 4,8% which was a recovery from COVID-19. We can expect 2023 to be worse than this year because the loadshedding has reached higher levels and affected more days so far than in the 4th quarter of last year. Economists are now expecting GDP to be at least 0,5% down in the 1st quarter of 2023. Notably, the International Monetary Fund (IMF) is now projecting that the SA economy will grow by a mere 0,1% in 2023, a sharp reversal from its previous estimate of 1,2%. The IMF warns that the country is in danger of falling into economic stagnation. The international rating agency, Fitch, has reduced its estimate of GDP growth to 0,2% from a previous estimate of 1,2% because of loadshedding. These estimates should be compared to the Reserve Bank’s recent estimate for growth this year at 0,2% and the Treasury’s estimate of 0,9%. Altogether, loadshedding is expected to cut about 2% off GDP growth in 2023.

The consumer price index (CPI) rose by 7% in February 2023, slightly up from January’s 6,9% and ahead of forecasts for 6,8%. The probable cause of this rise is that companies are now passing on some of their increased costs associated with loadshedding and the need to install alternative power. The core inflation rate, which excludes food and energy, rose to 5,2% from January’s 4,9%. The rise in inflation prompted the monetary policy committee (MPC) to increase interest rates by more than they would have otherwise. They needed to keep pace with the US 0,25% rate hike in March 2023 and whatever further rate hike is impending. In our view, the rise in local inflation is probably temporary and it should recede as the year continues.

Tax collections in the 2022/23 tax year were R314bn up on the previous year, in part due to higher commodity prices, but also because of an increase of 1 million in the number of individuals registered for tax. There are now 24,8m registered taxpayers who collectively contribute about 35,5% of the total tax revenue in South Africa. The tax-to-GDP ratio has improved over the last two years from 23,8% to 24,9%, but this could be because GDP growth has been stunted by the after-effects of COVID-19 and loadshedding. In our view, the fiscus has been well-managed despite relatively low growth rates and has managed to contain costs and reduce the size of the national debt. Lower commodity prices going forward may constrain future tax collections.

The economy has been adjusting to the collapse of Eskom as a reliable source of power. Businesses and consumers are investing in their own solutions. In the short-term, this will have a negative impact on GDP growth, but we believe that in the longer term it will both reduce company costs and improve production. The collapse of the economy is mirrored in the latest business confidence figures from RMB and the Bureau for Economic Research which show a two-year low in the first quarter of 2023. The index fell to 36 which means that the economy is contracting sharply. Any reading below 50 shows a contraction and vice versa. The survey on which these figures are based is conducted on questionnaires completed by more than 1000 executives from a wide range of different industries throughout South Africa.

South Africa has been officially “grey listed” – which means that an international organisation, The Financial Action Task Force (FATF) has added the country to a list of countries whose controls over such things as suspicious cross-border transactions and proliferation financing are insufficient. It will take us between one and three years to get off the list provided we can demonstrate that we have implemented the necessary controls. The effect of grey listing is to reduce foreign direct investment (FDI) into South Africa and perhaps to increase the cost of borrowing. It may also affect our ratings with international ratings agencies like Moody’s, Standard & Poors and Fitch. Notably, President Ramaphosa is saying that grey listing is not as significant as is being suggested in the media.

Unemployment fell in the 4th quarter of last year but remained high at 32,7%. If people no longer looking for work are included, the figure is 42,6%, also slightly down on the previous quarter. It would be reasonable to expect that the increased loadshedding in the last few months would result in rising unemployment levels, but the economy is showing surprising strength. Youth unemployment is over 60% which means that school-leavers are still struggling to find jobs – which raises the spectre of increased protest action. Altogether the economy added almost 170 000 new jobs in the quarter.

Private credit extension (PCE) grew by 8,4% in January 2023 showing that businesses and consumers are once again taking on more debt to fund their purchases. The steady growth in private credit demand is usually a sign of an economy which is recovering, but in the case of South Africa, the funds may be being used for installing solar power to compensate for Eskom, to pay for the rising cost of fuel or may simply be necessary as a desperate effort to survive financially. Almost half of the new credit extended to companies is in the form of unsecured loans. The additional debt that people are taking on is despite the fact that interest rates have been rising rapidly.

The trade deficit increased to R23bn in January showing the fall off in commodity prices, especially precious metals, but also reflecting lower exports of motor vehicles and transport equipment. In 2022 we had a surplus over the whole year of R211,6bn. Transnet inefficiencies are a big problem for exports - as are loadshedding and the impact of organised crime.

Manufacturing production fell sharply in February because of the increased power restrictions according to the ABSA purchasing managers index (PMI) which fell to 48,8 – down from January’s 53. Inefficiencies at Transnet combined with widespread loadshedding is bringing many factories to a halt. Manufacturing makes up about 14% of gross domestic product (GDP). February month had 7 days in a row of stage 6 loadshedding. The relative weakness of the rand against hard currencies has also had a negative impact. In our view, 2023 will be the year when loadshedding has its greatest impact on the economy. By 2024, most businesses that survive will have made alternative arrangements for power which do not involve Eskom.

The latest figures show that new vehicle sales are running about 4,3% ahead of where they were at this time last year. Over 45 000 new vehicles were sold in February - 2,6% more than in February 2022. It is now predicted that sales for the full year will be as much as 6,3% up on last year. This is surprising given the problems that the economy is facing with increased loadshedding. It shows that the economy is adapting rapidly to the power outages and can still grow. Normally rising vehicle sales are a sign of economic growth because companies and consumers generally only buy new vehicles when they are feeling comfortable financially. During a recession consumers and businesses try to put off buying new vehicles, making their existing vehicles last longer by repairing and maintaining them. Vehicle exports were down 11,5% showing weaker overseas demand.

One aspect of the budget that seems to have fallen well below expectations is the incentives for the motor industry to produce new energy vehicles (NEV). An amount of R729m has been set aside to incentivise producers within the existing automotive and production development program (APDP) but no new policies have been suggested. The industry is very disappointed and saying that international motor vehicle companies may decide as a result to take their production elsewhere. The APDP makes no distinction between NEV's and the older internal combustion engine (ICE) vehicles. The danger is that South Africa will be left out of the world-wide shift to NEV's.

The South African economy’s terms of trade deteriorated last year to an overall deficit of R32bn (0,5% of GDP) compared with the R228bn surplus (3,7% of GDP) in 2021. The deficit reflects an increase in imports and a decline in exports – mainly as a result of declining commodity prices. The 2023 year will almost certainly continue to be in deficit as commodity prices continue to fall. This will ultimately have an impact on tax collections and also on the rand – which has recently been weakening towards record levels against most major currencies.

Mining output shrank by 1,9% in January – far less than expected given the high levels of loadshedding. This would seem to indicate that the mining sector is at the forefront of the move away from Eskom and towards renewable power. The sector has been under pressure because of loadshedding, Transnet’s inefficiencies and the general drop in commodity prices. However, almost all mining companies are in the process of installing their own power sources to reduce their reliance on Eskom. The biggest declines were in platinum group metals, down 15,2% and diamonds, down 15,5%. Iron ore output was up 12% and coal production was up 4%.

Seasonally adjusted retail sales were up by a surprising 1,5% in January 2023 despite the adverse impact of loadshedding and rising interest rates. DIY sales were down 4,8% in a reversal of higher spending on home improvements during the COVID-19 period. Textiles, clothing, and footwear were 2,3% up, but overall the picture was not bad considering the pressure which South African consumers are under.

Rand

The rand has strengthened by almost 4% over the past month mainly because there has been increased optimism about the likely pattern of future central bank interest rate hikes, especially in America. In our view, this optimism is probably going to turn out to be unfounded, but in the short term it has been causing a shift towards “risk-on”. Risk on means that international investors have become more positive about the future and have switched their attention to getting a good return on their money rather than protecting it. This means overseas investors have been buying high-return emerging market assets like South African government bonds which offer a much better return than the negative returns to be had from US and European Treasury bills.

Locally, the rand benefited significantly from the recent 50 basis point hike in interest rates put through by the MPC at its latest meeting and the improved state of government finances shown in the budget. These factors have helped to compensate for the negative effect of loadshedding. Consider the chart:

Here you can see the overall weakening pattern which has characterised the rand since risk-off of COVID-19 in April 2020. That weakness has been exacerbated by the bear trend which began on the S&P500 on 3rd January 2022.

The rand seems to have found some support at around R18.60 to the US dollar and since the last Confidential Report in March has been strengthening from that level. We see this strength as relatively short-lived and we expect the rand to break below that support level in the coming months. Our view is based on the idea that Wall Street will resume its downward trend once the impact of rising interest rates on the US economy becomes more apparent and sentiment shifts back towards risk-off.

Commodities

GOLD

There is rising concern about the future of the world economy with many economists predicting a serious recession beginning towards the end of 2023 or in 2024. This recession will be a direct result of the rising interest rates and quantitative tightening being applied by central banks to constrain and reduce inflation. The inflation that they are worried about is a result of the extended period of ultra-low interest rates and the massive quantitative easing that followed firstly the sub-prime crisis in 2008 and then subsequently COVID-19 in 2020. Gold is a hedge against the weakness of paper currencies and political turmoil. When investors become concerned about the stability of the financial world, they move their assets into gold because it has been a reliable store of value for millennia. Consider the chart of the US dollar price of gold over the last 7 years:

Here you can see the progress of gold since the beginning of the current boom in commodity prices which began in December 2015. COVID-19 had a very short term negative impact on gold which very quickly turned positive when investors realized that the universal central bank reaction to the pandemic was to engage in even more quantitative easing.

From August 2020 the gold price in US dollars moved more-or-less sideways and downwards until September 2022. Then between September and November it completed a “triple bottom” at $1630. A triple bottom is perhaps one of the most bullish technical signals that you can see on any chart and following that the price immediately began to rise. Today gold is trading at around $2000 and looks set to break above the key resistance level at about $2050. If it does that, we expect a strong upward trend to follow.

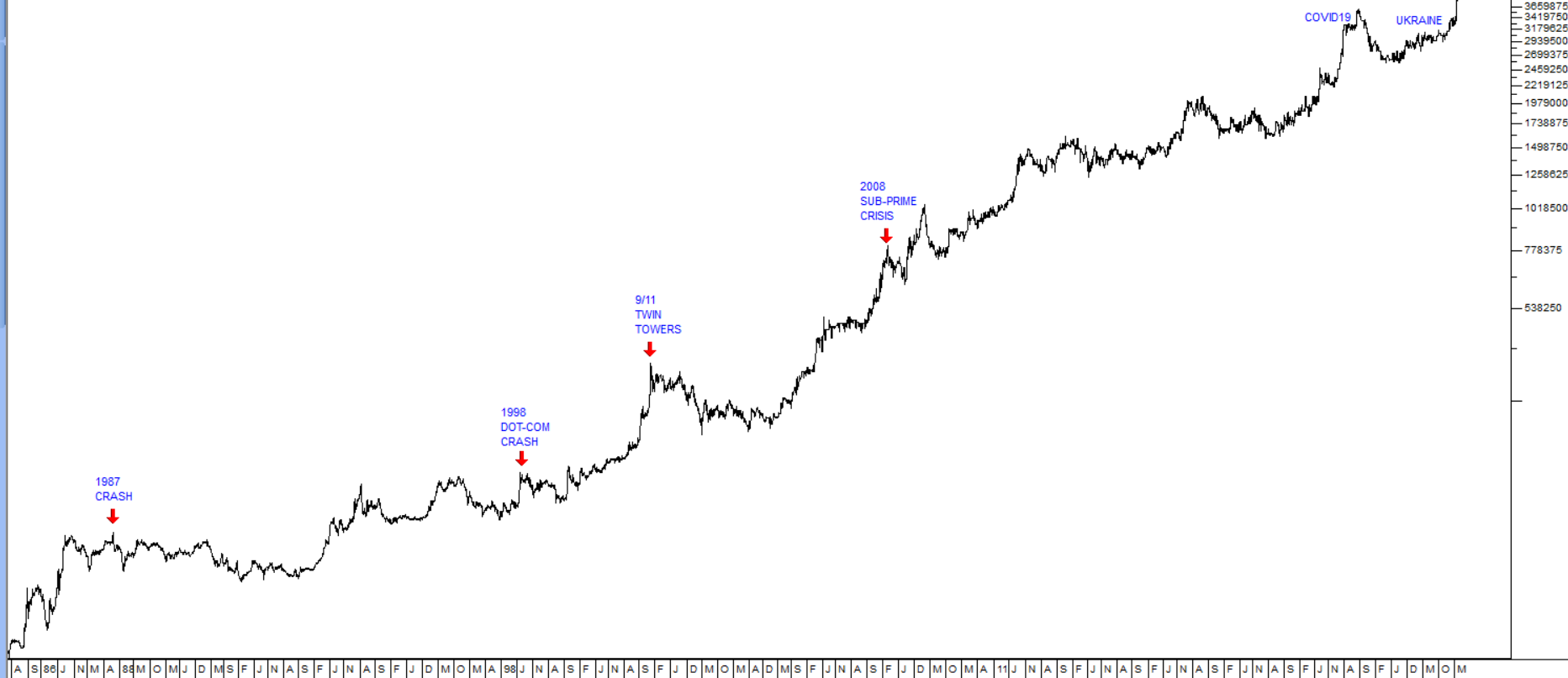

Of course, as a South African private investor, you need to be aware of the rand price of gold. Consider the long-term chart of the 1-ounce krugerrand:

This shows the krugerrand price going back to 28th February 1985. On it we have marked the 1987 crash, the 1998 dot-com crash, the 9/11 twin towers attack, the sub-prime crisis of 2008, COVID-19, and the Ukraine war.

A single 1-ounce krugerrand would have cost you R595 on 28th February 1985. On Friday last week they closed at R38700 each. So, you can see how gold coins would have protected your wealth through all market collapses and other developments (such as state capture) over the past 38 years. And krugerrands have the added advantage that they are accepted in every major city throughout the world.

We have always said that, given the relative political instability in this country, South Africans should keep about 10% of their wealth in gold.

OIL

Oil is still the world’s most important source of energy, and probably will be for some time to come. As such, changes in the oil price impact directly on world inflation and economic growth. When the oil price rises, inflationary pressures mount and economic growth tends to slow. The opposite is also true. Consider the chart of North Sea brent oil since December 2021:

You can see the initial impact of the war in Ukraine which caused oil prices to spike upwards. That was followed by President Biden’s visit to Saudi Arabia in July 2022 and since that meeting the oil price has been trending downwards. The fall in oil has kept the inflation rate in America and the rest of the world down while at the same time stimulating economic growth. It has also had a devastating impact on the Russian economy which is almost totally reliant on oil to finance its war effort.

The main reason that the Fed’s monetary policy has had such a rapid and persistent impact on inflation in America without impacting on economic growth is the steady decline in the oil price. And that decline looks set to continue at least for the time being. Deliberately or otherwise, it probably constitutes Joe Biden’s re-election strategy for 2024. He will be seen as the president who created the most jobs in a single presidential term in US history - while at the same time bringing the inflation created by his predecessors (including Trump) back down to manageable levels.

Companies

NEW LISTING

Premier (PMR) listed separately from its parent company, Brait, on 24th March 2023 and it was the JSE’s first new listing of the year. The company produces food products like Iwisa maize meal, Snowflake flour and Blue Ribbon bread. It competes directly with AVI, Tigerbrands (TBS) and RCL. Brait will retain a 47% stake in the company. The shares were priced at 5820c which gave the company a value of just under R7bn. The share has been trading in the market for around 6000c since listing. The company did not conduct an initial public offer (IPO) to raise capital but has placed the 66m shares available with major institutions. In 2022 the company had revenue of R14,5bn with earnings before interest, taxation, depreciation and amortisation (EBITDA) of R1,5bn. This is a major blue chip institutional share.

BIDVEST (BVT)

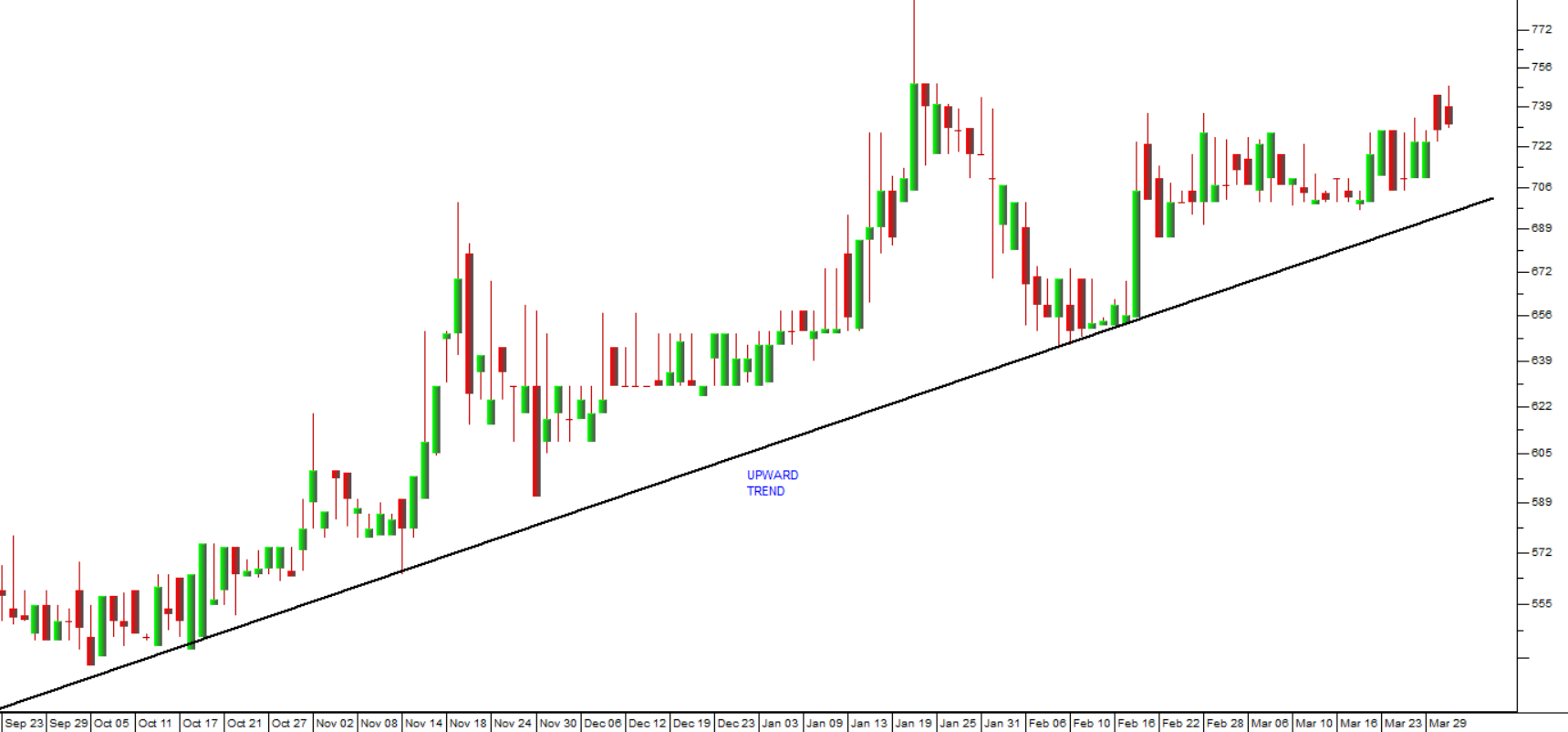

Bidvest (BVT) is a highly diversified South African company with dozens of subsidiaries. Its most notable investments are 66% of Bidvest Namibia which also owns a large property portfolio rented out to various Bidvest companies and 50.1% of Adcock Ingram. Bidvest describes its operations as follows, "Bidvest is a leading B2B services, trading and distribution Group operating in the areas of consumer, pharmaceutical and industrial products, outsourced hard and soft services, financial services, freight management, office and print solutions, travel services and automotive retailing. The diversified portfolio operates in two segments – business services, and trading and distribution – through seven divisions." The directors of each operating company are allowed considerable autonomy within this structure provided they produce good returns. This is the opposite of most listed companies, which aim to retain their focus on a single area of business and constantly sell off or close down "non-core" businesses. Diversification of this sort has the benefit that it reduces risk. When one division is performing badly, the others are performing well. The company is also constantly making new acquisitions. The acquisition of PHS, UK's largest cleaning service was well timed coming immediately before the huge increase in demand for cleaning that followed COVID-19. In its results for the six months to 31st December 2022 the company reported revenue up 14% and headline earnings per share (HEPS) up 15,3%. The company said, "Activity in renewable energy, mining, agricultural, tourism and hospitality-related sectors is expected to remain healthy. Planned investments into alternative energy to mitigate the impact of the electricity crisis in South Africa will continue". The company's investment in alternative energy sources is seen as a potential profit generator. The share price rose sharply on these results. Bidvest trades on a P:E of 16,18 - but we believe it still represents good value at current levels. Consider the chart:

CA SALES (CAA)

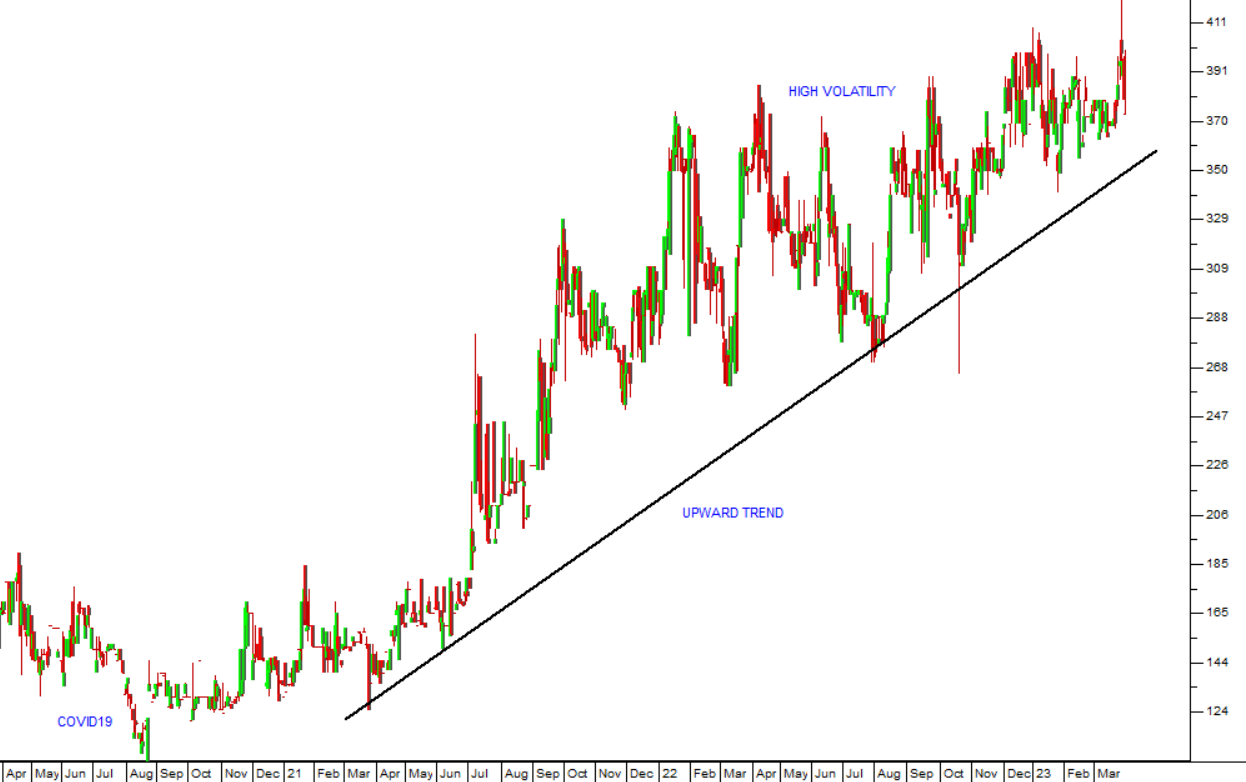

CA Sales listed on the JSE on 27th June 2022. The company supplies food, health, alcohol, and fast moving consumer goods (FMCG) to a wide range of companies. It is involved in warehousing, distribution, marketing, and point-of-sale. In its results for the year to 31st December 2023 the company reported revenue up 18,2% and headline earnings per share (HEPS) up 31,2%. This is one of the only new listings on the JSE over the past year and it is probably too early to assess it technically, but the share is in a steady upward trend. We think it will be a good investment. Consider the chart:

MASTER DRILLING (MDI)

Master Drilling (MDI) is a South African company that specialises in drilling exploration and other holes for the mining industry which has diversified into drilling for hydro-electrical projects and construction. The company has moved away from the South African mining industry and now provides services in North and South America, Europe and elsewhere. It has developed a new horizontal drilling technology, or tunnel boring machine, which could revolutionise the mining industry world-wide. This technology enables the drilling of horizontal tunnels or tunnels which are inclined up or down by 12 degrees. It is much quicker and cheaper than the traditional blast-and-clear methods currently in use. At the moment it requires three operators, but the company is working on a completely automated remote-controlled version. In its results for the year to 31st December 2022 the company reported revenue, in US$, up by 31,7% and headline earnings per share (HEPS), in ZAR, up 21,9%. Technically, the share was in a steady downward trend from February 2017, and we advised waiting for a clear upside break through its downward trendline before investing. That breakthrough came in March 2021 at 806c. Since then, it has moved up to 1420c. It is now trading at about 74% of its net asset value (NAV) and on a price:earnings (P:E) multiple of 6,11 - which looks like extremely good value. We regard the company's horizontal drilling technology as a potentially disruptive technology in the mining industry which may extend the life of some mines and make others economically viable again. So, while this is a risky share, because it is linked to the commodities markets, it has the potential to offer strong growth because of the new technologies which it has that have the potential to revolutionise the mining industry. In our view, that potential is now being realised. Consider the chart:

TRANSACTION CAPITAL (TCP)

During the past month, the risks associated with the business of Transaction Capital (TCP) have suddenly come into sharp focus. TCP lends money to taxi drivers to enable them to buy their taxi. Their ability to repay those loans is clearly a function of how many profitable trips they can make – and that in turn depends on the willingness of consumers to pay the higher costs of transport resulting from the petrol price hikes. TCP has suddenly had to make a R1,8bn provision for bad debts and that has knocked its profits substantially. We have two comments to make about this development (which we did not anticipate). The first is that those private investors who have followed our continuous advice to have and maintain a strict stop-loss strategy should not have lost anything. A stop-loss strategy is there to protect you against precisely those eventualities which you cannot or did not predict. The second point we want to make is that TCP remains a good business and this may well represent a buying opportunity. We advise you to apply a 65-day exponentially smoothed moving average (65-day Exp MA) and wait for a clear upside break. Consider the chart:

The benefit of the 65-day Exp moving average is that it follows the price more closely than a simple moving average. As you can see from the above chart, the moving average has started to fall rapidly. You may be tempted to jump in before the price cuts up through the moving average, but we warn that there may still be bad news coming. It is wiser to wait for the upside break. Each day, as the moving average falls, the price that you will pay will be less. Of course, a break above the moving average does not guarantee that you are safe – but it is probably the best assurance you can have – so make sure you implement a strict stop.

GEMFIELDS (GML)

The Gemfields Group (GML) is a mining group that has two major projects:

- Kagem, the world's largest producer of emeralds (in Zambia) and rubies (at Montepuez in Mozambique), and

- Jupiter Mines, a South African producer of manganese.

The group is led by Brian Gilbertson, previously the CEO of BHP Billiton. Gilbertson identified that the semi-precious stones market was under-developed and offered an opportunity for consolidation and professional management - hence the Gemfield's operation. Like all commodity shares it is risky and its fortunes depend on the prices of emeralds and rubies on the international market - as well as the risks associated with mining in third-world countries. It appears to have found a niche for itself where there is very limited competition, and it should do well as the world economy recovers. In its results for the year to 31st December 2022 the company reported revenue up 32% and headline earnings per share (HEPS) of 4,8c (US) compared with 4,7c in the previous period. Technically, the share rose off an island formation and, although volatile, looks to be in a strong new upward trend. The volume traded has improved to the point where it is a viable investment for private investors.

← Back to Articles