Start an Investment Club

A few years ago, we developed software to manage an in-house investment club for our staff members. We now offer it to any member of the public who wants to set up an investment club, free of charge. Using the daily closing prices from the JSE, this software is designed to keep track of the investments of a group of people who have decided to work together on investing directly into the share market.

The software allows for individuals in the group to put in as much or as little money as they want to and to contribute monthly or put in a lump sum. They can also take out their money whenever they want to. The software keeps track of every member’s position, on a daily basis, as the prices of the club’s portfolio of shares changes in the market. Members are allocated units at the calculated unit price of the day when they contribute funds.

We have been using the software to run our own in-house investment club for several years. When the club started, the units were worth 100c each, but over the years they have gone up and down. The basic rule is that money coming into the club is valued at the unit price of the day and if one person wants to take money out, his/her units are liquidated at the unit price of the day, to pay them out.

Decisions about what to buy and sell are made by a vote of the members and the software has a mechanism for that.

The software allows any member to view their position or the position of the club as a whole on their cell phone, tablet or laptop – so everything is completely transparent.

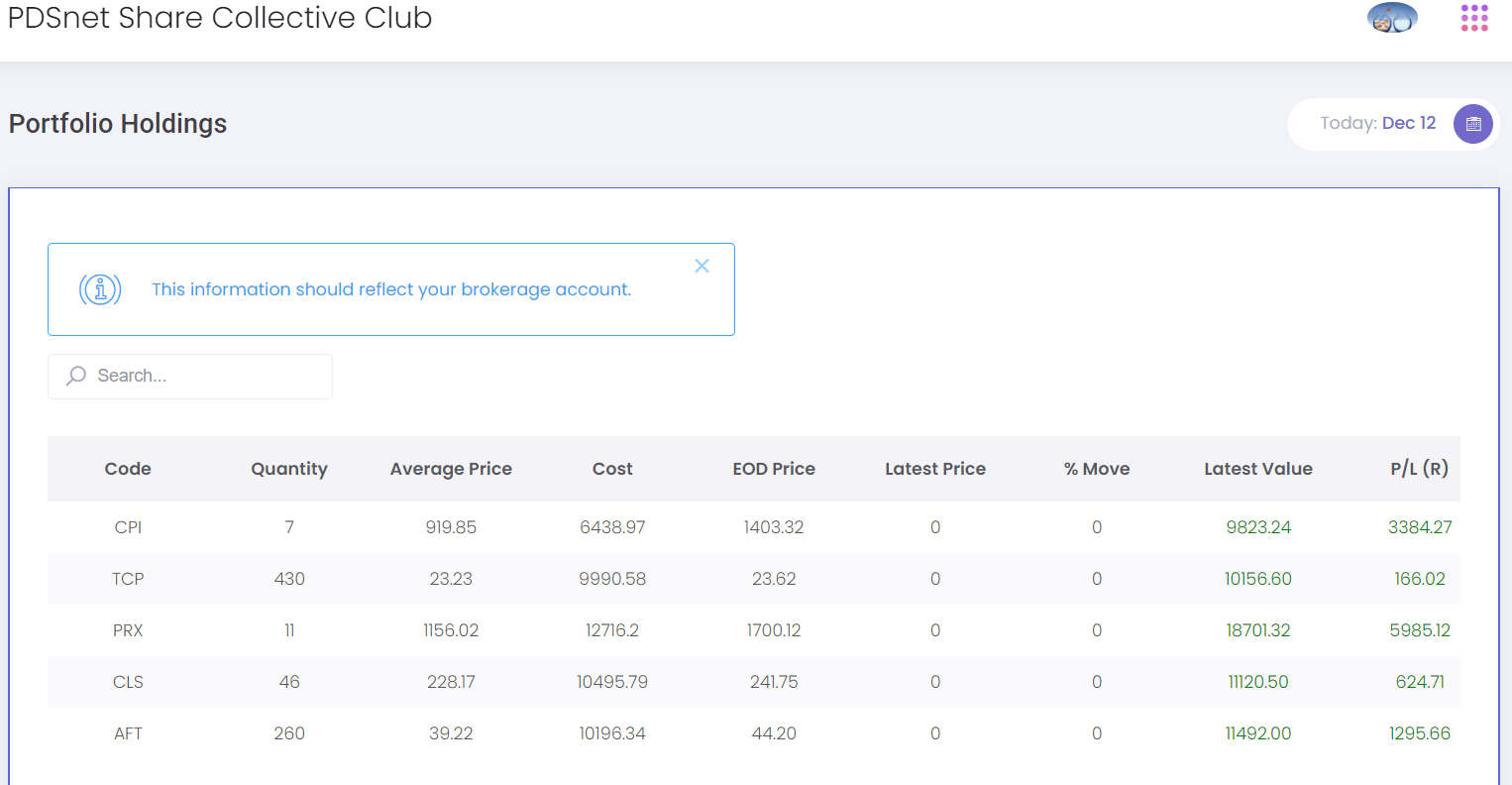

Take a look at the position of the PDSnet investment club as at the close of trade last Friday:

Here you can see that the club holds five shares – Capitec (CPI), Transaction Capital (TCP), Prosus (PRX), Clicks (CLS) and Afrimat (AFT).

The table above shows the number of shares held (2nd column), the average price paid for those shares (3rd column), the total cost (4th column), the most recent end-of-day price (5th column), the latest price (6th column), the percentage move against the end-of day price (7th column), the current value (8th column) and the paper profit or loss so far (9th column).

The 6th and 7th columns are zeros because at the time this screen was captured the market was closed.

However, you can see here that our club is doing pretty well. Prosus is showing a profit of almost R6000 and Capitec has a profit of R3384.

What we have found is that our staff have become very excited by the progress of the club’s portfolio, even when they had no prior knowledge of the share market. It is an excellent inflation-beating saving/investment. There are no costs, beyond the usual bank charges and the cost of a stockbroking account. Everything is immediately transparent and visible to the members.

We have found the investment club to be a highly motivating experience for our staff.

If you think that you would like to start an investment club or know someone who may be interested in this, please click here to register or contact us on +27 11 622 6767 and ask for Corné.

← Back to Articles