Spur

16 October 2023 By PDSNETThe Spur group is an iconic South African brand focused on the fast-food restaurant business. Aside from the Spur Steak Ranches chain it also owns Panarottis, John Dory's, The Hussar Grill, RocoMamas, Casa Bella, Nikos and Modrockers. It has restaurants in Australia, The Middle East, India, Mauritius and other Africa countries like Namibia, Nigeria, Zambia, and Kenya. Altogether it has 639 restaurants which are dominated by Spur which accounts for 62,2% of their revenue.

In the year to 30th June 2023 the company reported revenue up by 27,4% and diluted headline earnings per share (HEPS) up 81%. This shows that they have completely recovered from the restrictions of COVID-19 and are continuing to grow at a rapid pace.

From a balance sheet point of view, the company had no borrowings and R375m in the bank on 30th June 2023. As a result, it earned net interest income of R26m during the year. This puts it in a very strong and conservative position. It is very well placed to deal with any future “black swan" events similar to COVID-19. From an investor’s perspective, the fact that the company is debt-free substantially reduces the fundamental risk in the share.

The group works mostly through franchisees who purchase a franchise in one of its branded restaurants for an up-front fee and then pay the group a percentage of their sales. These franchisees are required to adhere strictly to the branding of the restaurant chain of their franchise. During the year to 30th June 2023 the company opened twenty-two new franchises in South Africa and ten internationally. It also closed twenty in South Africa and four internationally. So, the group is constantly selling new franchises and closing those which prove to be ineffective. It also periodically acquires entire new franchise chains which it believes have potential to expand.

So, this is a service company in the food business. Its success is directly linked to the level of consumer spending in the economy. When consumers have reduced disposable income, they tend to eat out less, but the convenience and ready availability of fast food make it a constant in most consumer’s budgets. The risk inherent in any particular restaurant is taken by the franchisee. The Spur group receives a steady and reliable percentage of all food sold. As the net number of franchises increases so does the company’s income.

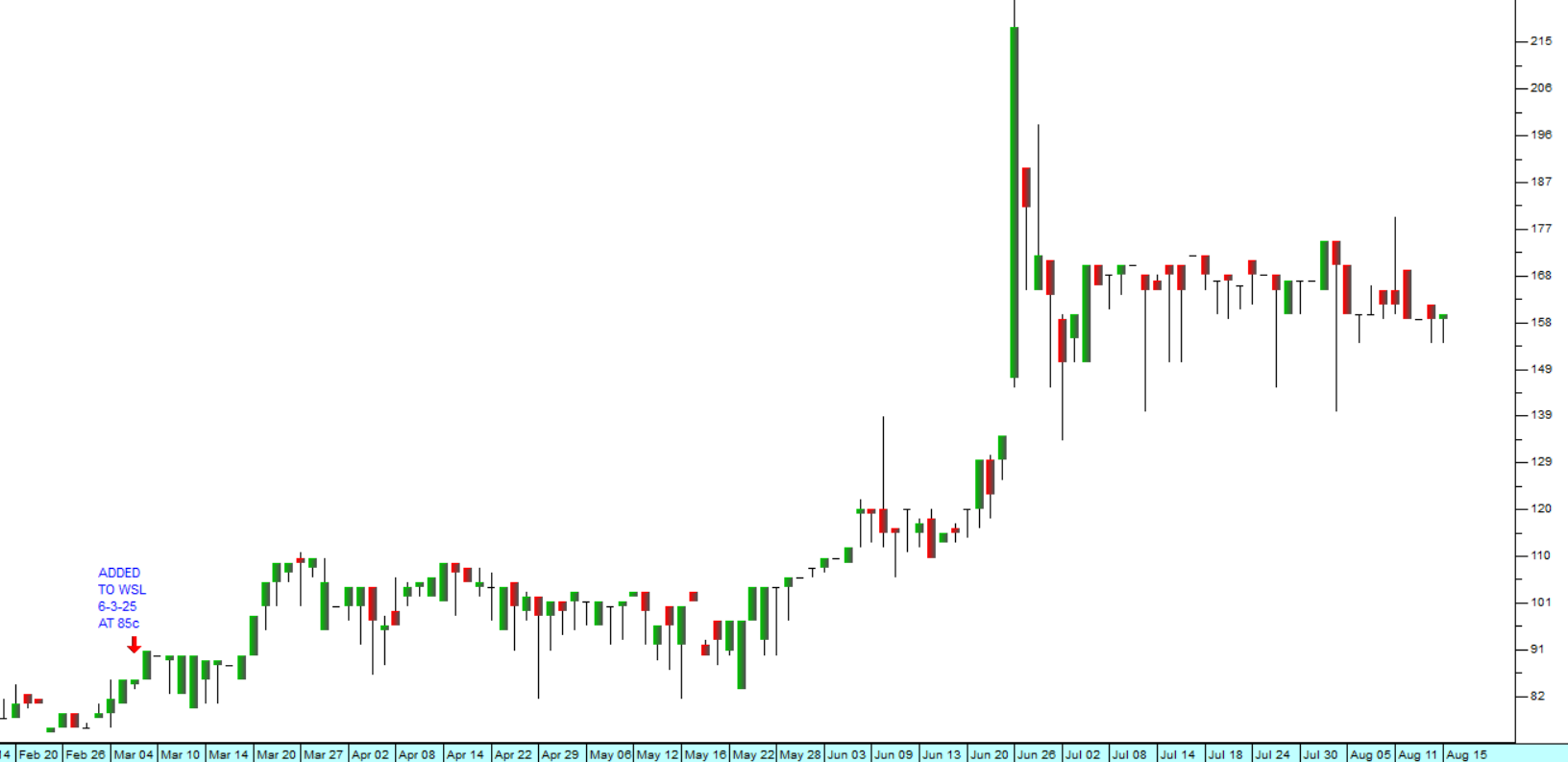

Technically, the share fell to a low of 1240c on 7th September 2020 as a result of COVID-19. Since then, it has been recovering steadily as business conditions normalized. Obviously, restaurants have had to incur the additional expense of implementing alternative electricity solutions to enable them to remain open during periods of loadshedding – but that problem has mainly been dealt with by the individual franchisees.

Consider the chart:

As you can see the share had been moving sideways since March this year and then began to rise steeply once it became apparent that its results for the year to 30th June 2023 were going to be particularly good.

We added it to the Winning Shares List on 8th August 2023 at a price of 2488c per share. Since then, it has risen to 2777c – a gain of 11,6% in just over 2 months. The share is trading on a dividend yield of 5,5% and is debt-free, making it an excellent addition to any private investor’s portfolio.

DISCLAIMER

All information and data contained within the PDSnet Articles is for informational purposes only. PDSnet makes no representations as to the accuracy, completeness, suitability, or validity, of any information, and shall not be liable for any errors, omissions, or any losses, injuries, or damages arising from its display or use. Information in the PDSnet Articles are based on the author’s opinion and experience and should not be considered professional financial investment advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Thoughts and opinions will also change from time to time as more information is accumulated. PDSnet reserves the right to delete any comment or opinion for any reason.

Share this article: