Speculating on Aveng

Aveng was once the largest construction company in South Africa and in August 2008 it traded for just under R70 per share. Since then it has been hammered by a host of problems beginning with the 2008 sub-prime crisis, to the dearth of construction work following the 2010 World Cup, the heavy fines imposed on the construction shares by the Competition Commission for collusion and several big contracts that went bad. The result of all this has been that the share price has plummeted to just 5c.

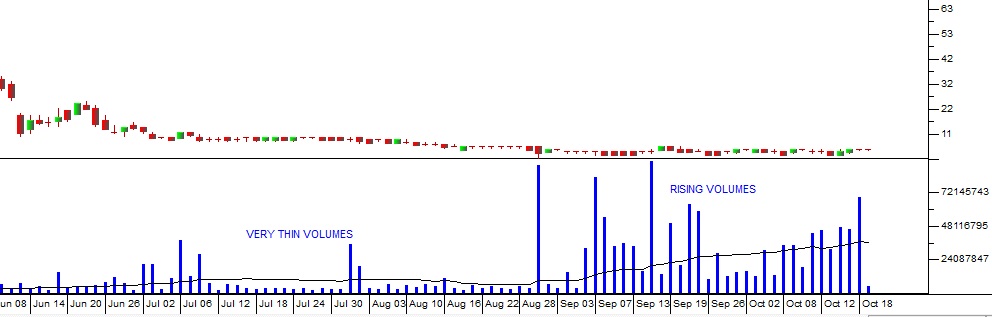

And this is interesting, because the company claims to have a net asset value (NAV) of 620c per share as at 30th June 2018. This is despite debt of R3,3bn - which was R1,3bn of bank debt and a convertible bond of R2bn. This situation has been tackled by a rights issue which raised R493m. Then the company managed to negotiate a buy-back of R657m worth of the bonds at a 30% discount. The rest of the bonds were redeemed in exchange for Aveng shares issued at 10c each. Then, a facility was agreed with Aveng's bankers for R400m. Finally a new cash-management process was implemented for South African operations which made it possible to forecast cash flows and plan accordingly. The board has implemented a six-step plan for the company's return to profitability which includes selling off non-core assets and down-sizing into a more manageable and profitable business. A positive factor here is that the group's Australian venture, McConnell Dowell, has returned to profitability. So it would appear that, at least for the next year or so, Aveng is a going concern which has substantially dealt with its balance sheet crisis. The new CEO and board are optimistic about the future. From a private investor's perspective, what is interesting is the massive increase in volumes traded in the last six weeks. Following its collapse to 12c, the volumes traded dropped sharply and between mid-June and the end of August 2018 there was an average of 4,7m shares traded per day. Then suddenly in September, volumes began to pick up until by the close of trade on Friday (19th October 2018) the share was trading an average of 36m shares per day. Consider the chart:

And the price would appear to be rising slightly as well. From trading as low as 3c, the share has closed for two days in a row at 5c. Rising volumes with rising prices is generally an indication that someone appears to be mopping up the loosely-held shares (of which there are plenty in Aveng's case). Normally, we would advise investors to avoid speculative penny stocks, but in this case there might well be an opportunity. A R10 000 investment will secure 200 000 shares at 5c per share. If the quoted NAV is anywhere near the 620c quoted by management then there should some significant upside potential. It is always good to take a three-year view when investing because that way you can avoid being declared a "share dealer" by SARS and only pay 16,4% in capital gains tax (CGT). So we do not advise a short-term speculation but rather a buy and hold strategy. Our view is that, in three years, Aveng will either have ceased to exist or it will be worth a lot more than 5c a share - and we are leaning towards the latter. Obviously, there is risk, but that risk is minimised by buying only R10 000 worth of the share. If you can afford to risk that sort of cash then the upside potential could be significant.

← Back to Articles