Market Overview

The South African investment environment is never boring. The past week has seen many developments which are having, or may have, an impact on the share market. Most of them are local, but some are overseas.

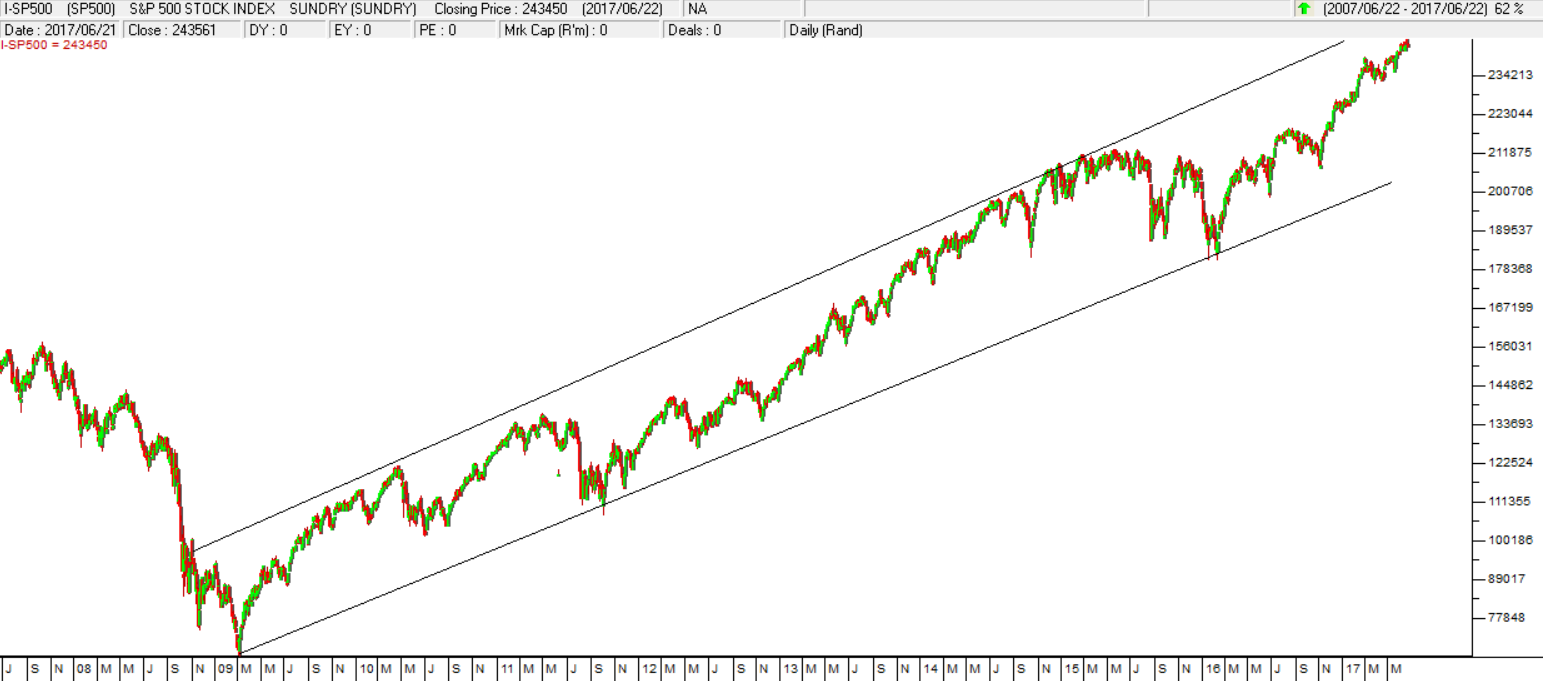

To begin with the S&P500 index has been ramping up to new record highs, once again defying the many investment analysts who said just a few short weeks ago that it was at the top. This is the process of a great bull market. There are always people who stand up from time to time to call the top of the market. They want to be the one who picked the exact top because that will give them enormous credibility if they are right. Sadly, they have all been wrong so far, for the past 8 years. We believe that this bull has still got some distance to run and so none of them will be right for some time and probably, by the time that this market really does top out, investment analysts as a group will be scared to call the top.

S&P500 Index June 2007 to June 2017 - Chart by ShareFriend Pro

The problem is that, because of the various local developments, our JSE Overall index has not broken out of the sideways market that all markets were in since 2014. The S&P broke up out of that sideways pattern in November 2016 and has been rising ever since, but the JSE Overall index has yet to make an upside breakout.

JSE Overall Index June 2017 to June 2017 - Chart by ShareFriend Pro

Despite this, we are confident that sooner or later the JSE Overall will break to the upside. It is merely a matter of time. And the longer it remains mired where it is, the stronger the eventual catch-up will be. The implication of this is that our blue chip shares are probably under-valued in relation to world markets and some sort of upward move is probable, especially if there are improvements in the local economy and political situation. What is clear about the current situation is that it cannot last indefinitely and whatever replaces it has to be better. This means that private investors should be buying up high quality blue chip shares while they are at these relatively low levels.

← Back to Articles