Lessons From Steinhoff

28 May 2018 By PDSNETThe loss by Coronation of R14bn in the Steinhoff debacle shows the weakness of fundamental analysis when compared with technical analysis. Altogether, mostly big institutions lost at least R200bn from the Steinhoff collapse. Coronation, taking a primarily fundamental approach, focused its analysis on predicting the probable future dividends to come out of Steinhoff - and then discounted that, using an internal rate of return (IRR), to arrive at a net present value for the share which they could then compare to the current share price.

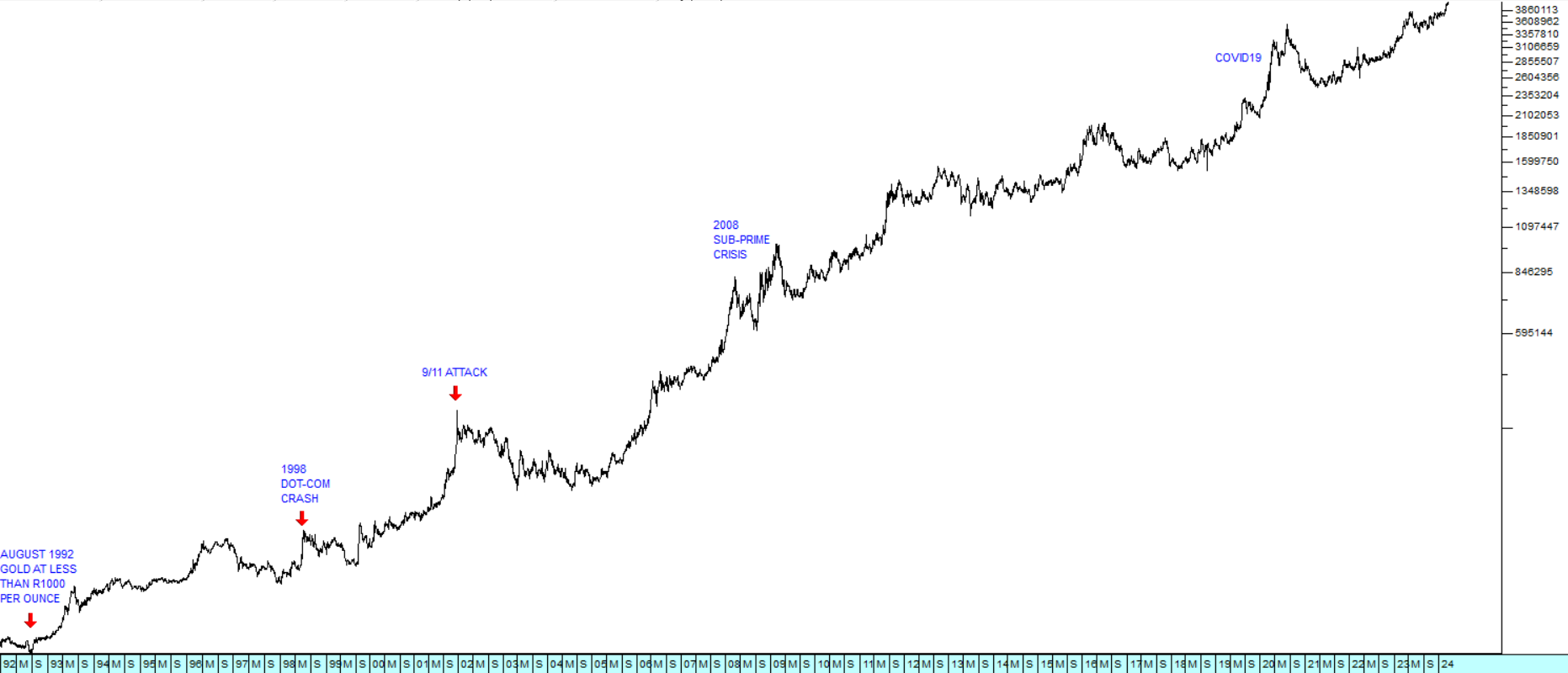

This is the fundamental approach. This caused them to acquire between 5% and 6% of Steinhoff over time but, more importantly, it caused them to hold on to those shares when there were glaring technical indicators which should have got them out of it months before it collapsed. Technically, Steinhoff made a very clear triple top where each successive top was lower than the previous one. There are very few signals in technical analysis which are more negative than that. Consider the chart:

Steinhoff (SNH): January 2016 to May 2018 - Chart by ShareFriend Pro

When a share makes a top and falls back from it in a bull trend, it usually rallies back up to the same level and, if the bull trend is in tact, surpasses it. But if it cannot surpass that top, a double top is formed and disappointment at the share's inability to surpass its previous top causes the share to be sold off down to lower levels. In the case of Steinhoff, this happened twice. creating a relatively rare triple top formation. This was a clear indication that even 15 months before it collapsed, all was not well with Steinhoff. Somebody big was steadily selling out their holdings based on their inside knowledge of Steinhoff's feet of clay. That steady selling caused the 15-month period gradual downward trend before the Viceroy report was published. The whole point of technical analysis is that it reveals insider trading. In any major situation in the market, there always exists a group of people with inside knowledge and they always trade, usually very indirectly, on the strength of that knowledge. Their trades are, however, visible in the share's price and volume pattern if you know what to look for. The big institutions, like Coronation and the many others that were caught with their pants down in the Steinhoff debacle are all steadfastly fundamental in their approach and for decades they have consistently disregarded technical analysis to their cost. But perhaps they should re-consider. Technical analysis can supply some very good indicators of the direction of insider trading long before the necessary information is made public. As private investors, we should applaud the big institutions stubborn and persistent rejection of technical analysis - after all, somebody has to buy when we are selling!

DISCLAIMER

All information and data contained within the PDSnet Articles is for informational purposes only. PDSnet makes no representations as to the accuracy, completeness, suitability, or validity, of any information, and shall not be liable for any errors, omissions, or any losses, injuries, or damages arising from its display or use. Information in the PDSnet Articles are based on the author’s opinion and experience and should not be considered professional financial investment advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Thoughts and opinions will also change from time to time as more information is accumulated. PDSnet reserves the right to delete any comment or opinion for any reason.

Share this article:

_art4mAy24.png)