Gold Fields

24 November 2025 By PDSNETFor the past month, the US dollar price of gold has once again encountered some resistance – this time at around $4000. Despite this, in our view, the gold price is in a strong upward trend which should continue. One of the major factors is the steady decline in the US dollar value against a trade-weighted basket of currencies, but the main reason for the upward trend in gold is that large international investors and central banks are looking to put more and more of their funds into safe investments.

As a private investor, you are aware that investing in gold shares can be risky because gold producers are price takers. The price of gold is set on international markets which are outside their control. They can also be riskier because of all the problems associated with deep-level underground mining. But with high risk comes high return and this may make them worthy of your consideration.

Gold Fields (GFI) is an interesting option. Most of its mines are outside of South Africa, with the exception of South Deep – which, the legendary mining magnate, Brett Kebble, once described as “...the world’s most expensive long drop.” South Deep has been pouring money into the development of the mine and their efforts are finally beginning to pay dividends.

South Deep is said to be the world’s second largest known underground reserve of gold, with an estimated life of 80 years at current production levels and more than 32m ounces of reserves. And it is now developed to the point where it is a safe, low-cost, bulk, mechanised and profitable gold mine.

In addition to South Deep, the company is focusing on bringing the new Salares Norte gold mine in Chile into production. This is a high-grade, open pit, gold-silver project in Chile with 3,9m ounces of reserves. On 12th August 2024, the company announced that it had acquired the remaining 50% of Osisko Mining for $1,39bn. Gold Fields also announced the acquisition of Gold Road resources in Australia for $2,4bn.

The mining house is expecting to generate about $20bn in cash flows from its various projects over the next five years out of which it will pay dividends of $6bn in addition to $500m in special dividends and share buy-backs. It is currently benefiting from the high gold price. It expects to produce 3 million ounces of gold per annum by 2030.

Gold Fields recently acquired the remaining 50% of Osisko to give it 100% of the Windfall project in Canada. Windfall is one of the top ten largest gold deposits in the world and Gold Field plans to spend $1,7bn bringing it into production over the next five years.

Gold Fields shares were moving sideways during 2024, but began a new upward trend in January 2025. Consider the chart:

With the stronger gold price and the upside break out of its sideways pattern, we decided to add Gold Fields to the Winning Shares List (WSL) on 4th February 2025 at a price of 32915c. It has subsequently risen as high as 78955c (16-10-25) and is currently trading for 66431c. This means that it has more than doubled in price over the past 10 months.

We expect it to continue performing well as central banks world-wide move away from US Treasury bills and further into gold bullion. It is obviously a risky commodity share and highly dependent on the gold price, but it is currently in a correction so you would not be buying it at the top of its cycle. If gold climbs out of its current sideways pattern, you can expect GFI to rise sharply. It is a diversified international mining house with some really excellent long-term prospects and great management.

[BD20 – page 11 – Article about Goldfields]

Follow-up

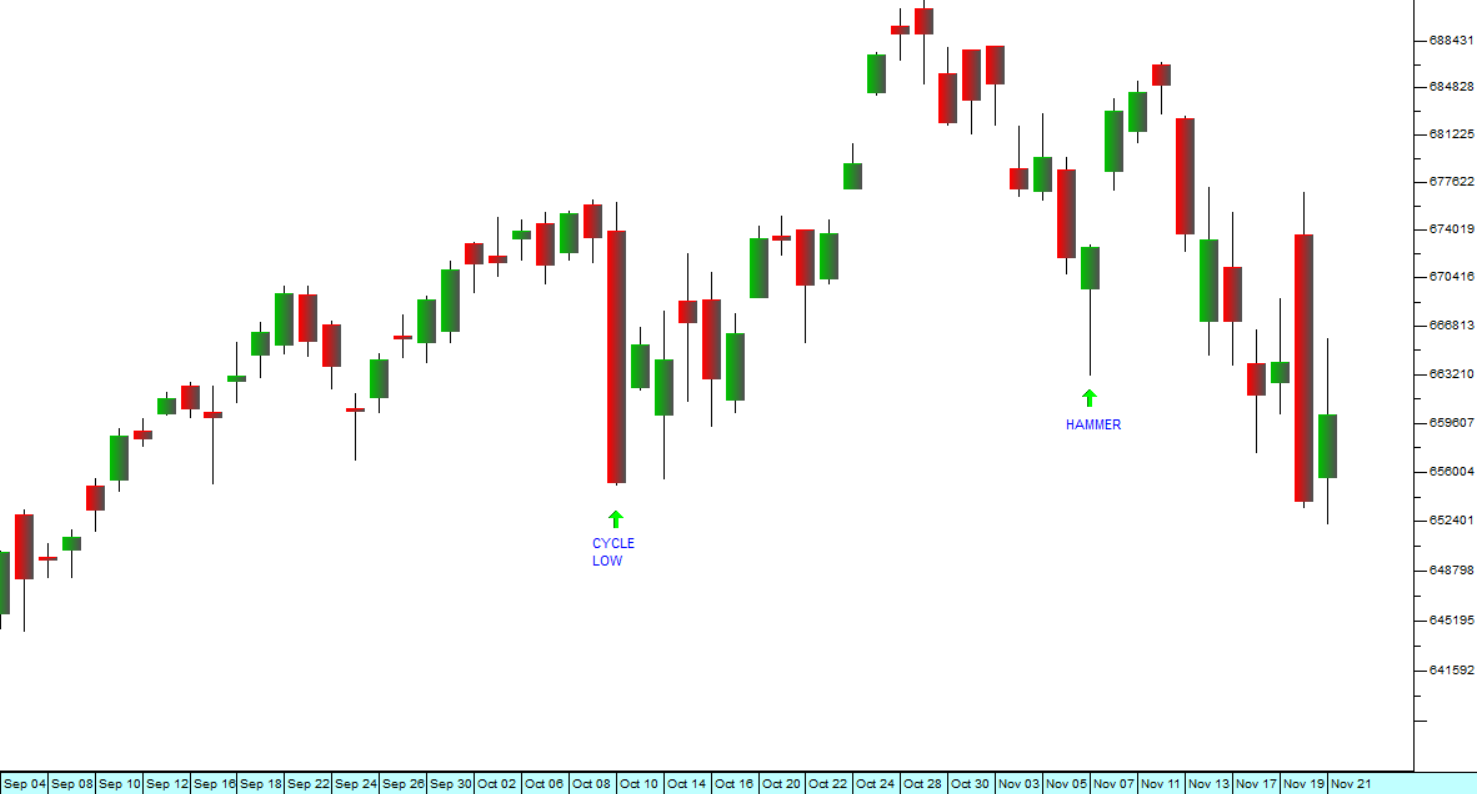

In our article, Bubble which we published about a month ago on 27th October 2025, we suggested that there was potentially an over investment in AI shares. We warned investors to take care and to maintain a strict stop-loss strategy. Since then, the S&P has entered a correction which looks much stronger than the various mini-corrections which have characterised the last six months. From a technical perspective, the S&P now has a descending double top and on the 20th of November 2025 it closed below its previous cycle low made on 10th November 2025 at 6552. This is not a good sign, and it may well cause substantial technical selling this week. Consider the chart:

So be aware – we seem to be in for a significant correction which will not easily be derailed by bulls buying the dips.

DISCLAIMER

All information and data contained within the PDSnet Articles is for informational purposes only. PDSnet makes no representations as to the accuracy, completeness, suitability, or validity, of any information, and shall not be liable for any errors, omissions, or any losses, injuries, or damages arising from its display or use. Information in the PDSnet Articles are based on the author’s opinion and experience and should not be considered professional financial investment advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Thoughts and opinions will also change from time to time as more information is accumulated. PDSnet reserves the right to delete any comment or opinion for any reason.

Share this article: