Curro

22 August 2022 By PDSNETIn your search for high quality shares that are potentially cheap you should definitely be considering Curro (COH). This company, which was spun out of PSG and separately listed on the JSE, is profiting from the general decline in the quality of education at government schools in South Africa. It is focused on education up to grade 12, currently has over 70 000 pupils and has been growing steadily both organically and by acquisition.

Education is in an excellent investment for several reasons:

- Parents will generally bend over backwards to pay their children’s school fees, even in a difficult economic environment which means that Curro’s income stream is stable.

- Much of Curro’s income takes the form of regular payments by debit order and most of those payments are made in advance for education which they have not yet provided.

- Working capital is minimized because the company has almost no stock and a relatively small debtors’ book of parents who have fallen behind on their payments.

On the negative side, an education company has to make large capital investment in buildings and property so the relationship between shareholders’ equity and debt levels must be carefully considered in case the company has over-extended itself.

In its latest results for the six months to 30th June 2022 the company reported headline earnings per share (HEPS) up by 42% off a 15% increase in revenue. This displays a definite improvement in efficiency and cost control which, in turn, is indicative of excellent management.

Revenue increased as a result of increased numbers of students and inflation-adjusted increases in school fees. Parents generally expect school fees to go up by at least the inflation rate every year and they are loathe to change the school that their children attend because that is a major disruption. This means that Curro mostly has an A/B income group clientele that is locked into it for at least five or six years and mostly paying by monthly debit order. These factors make the share very defensive against economic recession.

In the initial euphoria after its listing, Curro’s price:earnings ratio (P:E) reached absurd and unsustainable levels. At the end of 2015, no doubt boosted by considerable institutional “window dressing”, the share closed on a P:E of 248,4. At the time we observed that there was only one way for the share to go from there and that was down. Today, its P:E is a much more reasonable 22,4 and it closed on Friday last week at 1090c – which is below its net asset value (NAV) of 1215c per share.

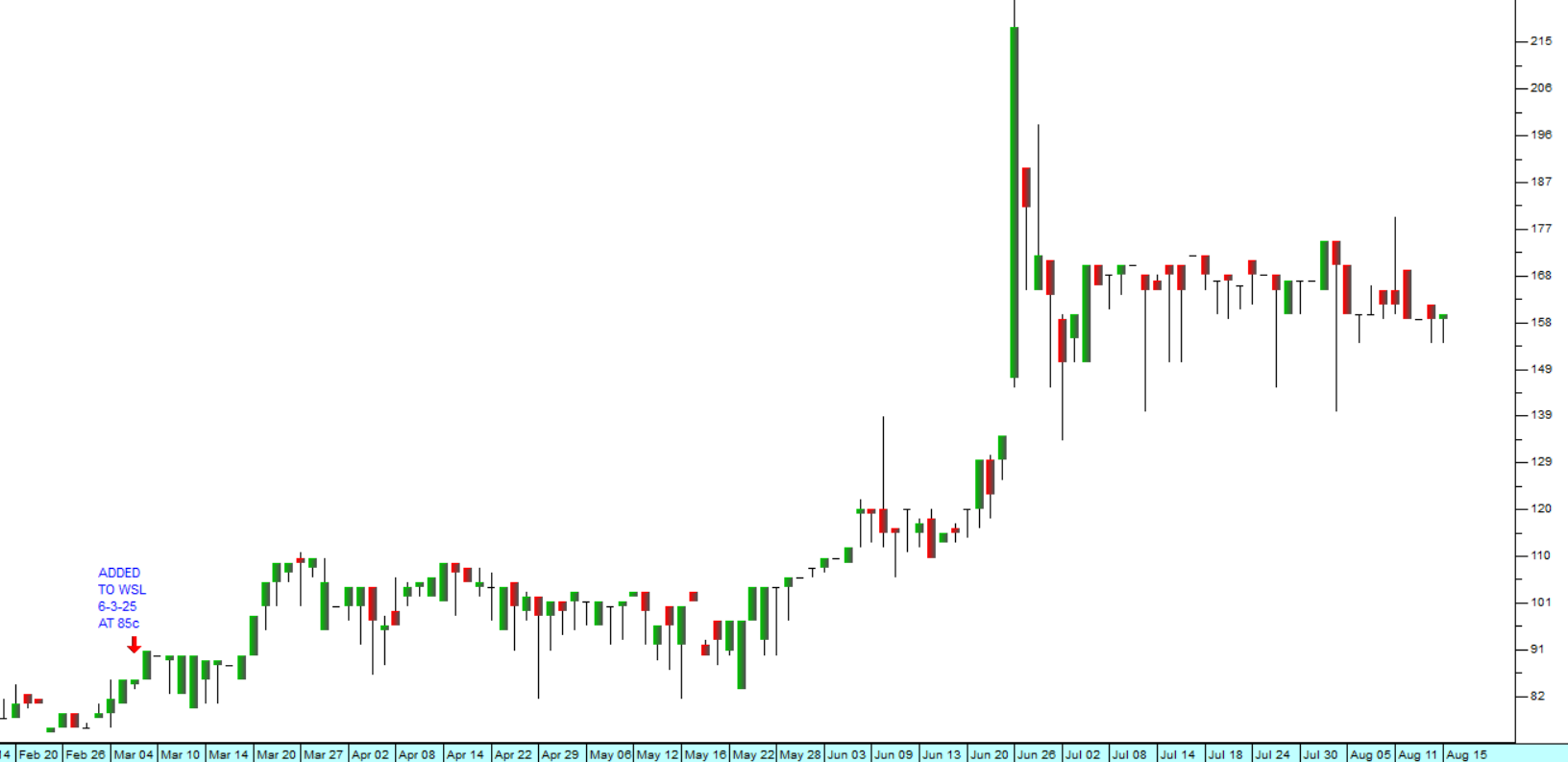

Technically, the share broke up through its downward trendline in July and has entered a new upward trend. Consider the chart:

Finally, it is always a good idea to consider a share’s price earnings: growth ratio (PEG) when trying to assess whether it is cheap or expensive. The figures for Curro’s PEG are as follows:

|

Year |

HEPS |

% Growth |

|

2012 |

7 |

|

|

2013 |

12.8 |

82.86 |

|

2014 |

17.2 |

34.38 |

|

2015 |

28.3 |

64.53 |

|

2016 |

43.9 |

55.12 |

|

2017 |

49 |

11.62 |

|

2018 |

60.1 |

22.65 |

|

2019 |

61.1 |

1.66 |

|

2020 |

36.4 |

-40.43 |

|

2021 |

40.9 |

12.36 |

|

2022 |

55 |

34.47 |

|

|

||

|

Average |

|

27.92 |

|

P:E |

22.43 |

|

|

PEG |

0.80 |

This shows that over the past 10 years, Curro’s average growth in HEPS (assuming that the growth in the first half of 2022 is continued to year-end) has been 27,92% per annum – and that puts it on a PEG of 0,8. A PEG below 1 means that the share is underpriced and vice versa – so this is an indication that Curro at the current share price represents good value in terms of its growth in earnings. If you are unsure about PEG go back and re-read module 10.

DISCLAIMER

All information and data contained within the PDSnet Articles is for informational purposes only. PDSnet makes no representations as to the accuracy, completeness, suitability, or validity, of any information, and shall not be liable for any errors, omissions, or any losses, injuries, or damages arising from its display or use. Information in the PDSnet Articles are based on the author’s opinion and experience and should not be considered professional financial investment advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Thoughts and opinions will also change from time to time as more information is accumulated. PDSnet reserves the right to delete any comment or opinion for any reason.

Share this article: