Overview of the Market

25 July 2022 By PDSNETThe Rand

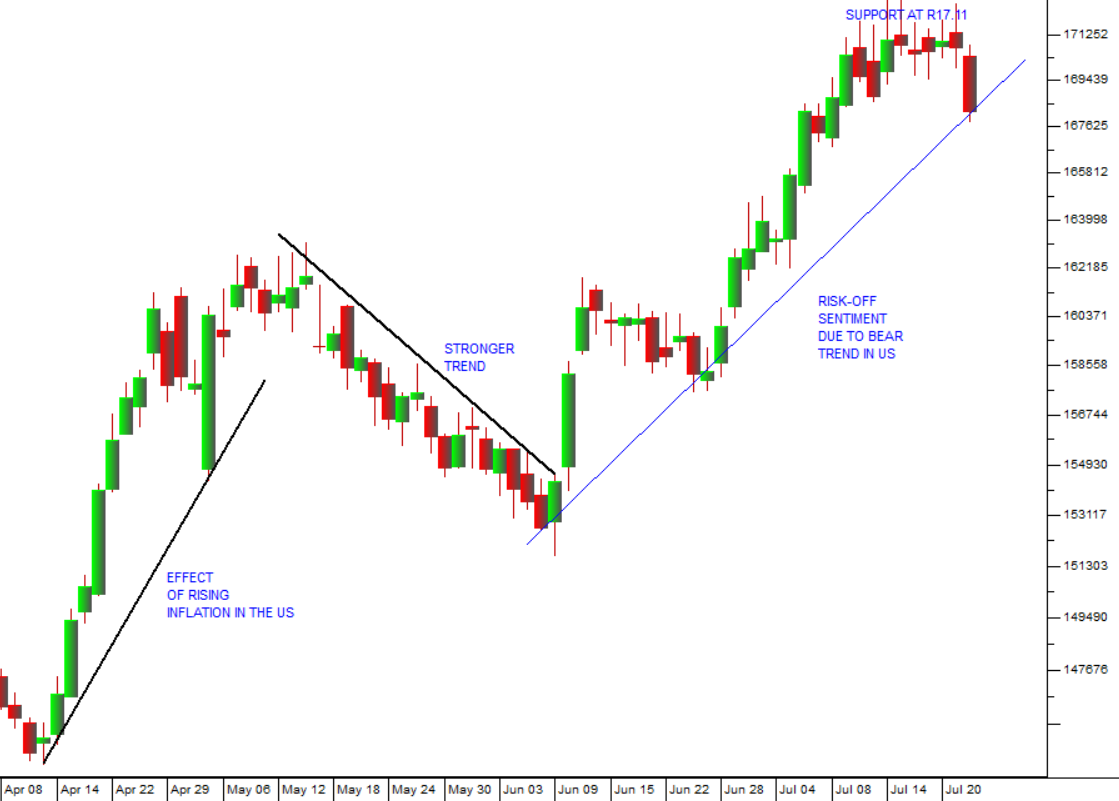

South Africans will have been watching the steady decline in the rand to below R17 to the US dollar with resignation and some despair. It seems as if our currency is always losing ground, making it more and more expensive to travel overseas while increasing local inflation and especially the price of petrol.

The latest fall has been caused by the shift to “risk-off” among international investors as the US Federal Reserve Bank hikes interest rates in its desperate effort to contain US inflation. Investors are rushing out of emerging market investments and back to US treasury bills to protect their wealth as the bear trend on Wall Street continues.

What you may not have noticed, however, is the fact that other first world currencies like the euro have also been taking a pounding. In fact, the euro has fallen from 81,03 euro cents to the US dollar at the beginning of last year almost to parity at 98,7c euro cents. And the rand has actually been appreciating against the euro. For example, on 18th August 2020 the rand was at R20,74 to the euro and today it is just R17,16.

This means that, far from slipping into new negative territory, the rand has been performing at least in line with first world currencies and even slightly better. Much of this is due to the fact that our Reserve Bank has stayed well ahead of many first world countries in this rate hiking cycle. After the latest 75-basis point hike, our repo rate is at 5,5% - which means that the prime overdraft rate here is around 9% - against our inflation rate of 7.4%. This means it is still possible to earn a real rate of interest on money invested in this country. If you contrast that to America where, even after their expected rate hike, the repo rate will be around 2,25% against inflation of over 9%, we still look very attractive.

Technically, the rand does appear to have found some strong support at about R17.11 to the US dollar and looks ready to begin strengthening again. Consider the chart:

The Oil Price

One of the most significant effects of the war in Ukraine has been the sharp rise in the price of oil. Before the war the price had already been rising steadily, but the war pushed it up to levels around $125 per barrel which had a severe knock-on impact on inflation around the world. The situation was really brought home to Americans on the Independence Day weekend when they had to pay more than $5 per gallon for petrol.

It is true to say that the policy of quantitative easing was made possible in large part by the relatively low price of oil during the pandemic. That shield has now abruptly been stripped away and the true inflation impact of printing money to prevent a recession is now becoming clear.

The rising oil price has obviously also been benefiting Russia at a time when the war in Ukraine has made it an international pariah. To address this problem President Biden visited Saudi Arabia and we believe some kind of deal was struck to bring the oil price back to around $100 a barrel. The fall in the oil price has been greeted enthusiastically by the bulls on Wall Street who perceive that with petrol back at around $4 per gallon the pressure on the Federal Reserve Bank to raise rates will be reduced.

Our view is that the respite is likely to be short-lived. The underlying reality is that the cycle of rising interest rates world-wide has only just begun. It still has a long way to go before it has a significant impact on runaway inflation. Consider the chart:

Despite the recent rally on Wall Street, which has taken the S&P500 back above resistance at 3900, it is important to understand that we remain in a bear trend. The bear trend is not over. The underlying sentiment is negative, and the S&P will fall further.

POSTSCRIPT: We wrote last week’s article about one share which we think will “buck the trend” on Wall Street – Tesla. At the time of writing last week, it was trading for around $700 per share. It closed on Friday at $816.73 – a gain of 16,7% in one week!

DISCLAIMER

All information and data contained within the PDSnet Articles is for informational purposes only. PDSnet makes no representations as to the accuracy, completeness, suitability, or validity, of any information, and shall not be liable for any errors, omissions, or any losses, injuries, or damages arising from its display or use. Information in the PDSnet Articles are based on the author’s opinion and experience and should not be considered professional financial investment advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Thoughts and opinions will also change from time to time as more information is accumulated. PDSnet reserves the right to delete any comment or opinion for any reason.

Share this article: