PDSNET ARTICLES

AngloGold Ashanti

It is no secret that precious metals prices have been running. Most of the best-performing shares on the Winning Shares List (WSL) are mining companies with interests either in gold or platinum group metals (PGM). Gold in particular has dominated the investment world. The metal has risen 145% in US dollars since it broke up through resistance at $2060 at the beginning of March 2024, as reported in the Confidential Report of th...

Hudaco Latest Financials

In their latest financials for the year to 30th November 2025 Hudaco describes itself as “...a South African group specialising in the importation and distribution of a broad range of high-quality, branded automotive, industrial and electronic consumable products, mainly in the southern African region”. It has long been one of our favourite shares on the JSE and we have written two articles extolling its virtues th...

Datatec

Many private investors shy away from IT shares because they can be difficult to understand. Their business models are often highly complex making it problematic to accurately assess their fundamental risk. Datatec is an international IT and telecommunications company with operations in more than 50 countries world-wide which makes it even more challenging as an investment. My response to this type of complexity is to loo...

Clicks Oversold

Technical analysis is the study of investor perceptions as they are reflected in the price and volume patterns of a security. It is also true that shares move in cycles which take them from being overbought to being oversold and back again. This is especially true of the blue chip shares which are heavily traded and patronised by the big institutions (pension funds, unit trusts and insurance companies). The fund managers...

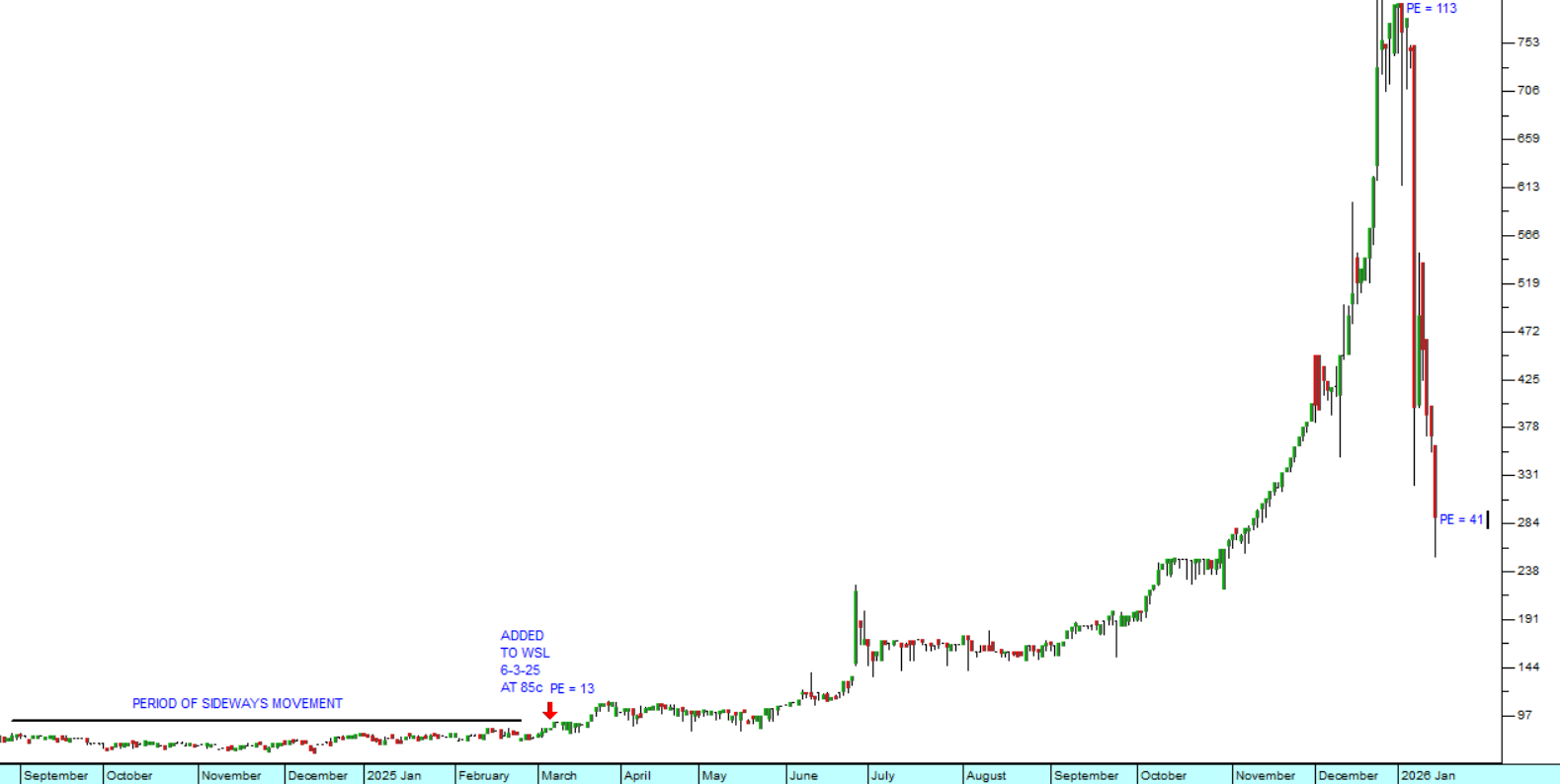

The Collapse of Choppies

The fall in the Choppies share price from 795c on 2nd January 2026 to last Friday’s close at 290c is a great example of the volatility of markets, especially in shares which are relatively thinly traded. It demonstrates the importance of investor sentiment and the potential for popular shares to rapidly become over-priced once they attract the investing public’s imagination. Choppies represents an unusual investmen...

Thoughts on 2026

At the start of a new year, we always give our view of what we think is to come. Since our last article, published on 22nd December 2025, there have been some notable developments in the international arena which are potentially important for South African investors. (1) As expected, the rand has strengthened further, continuing the trend of the last nine months and breaking convincingly below R16.50 to the US dollar. What is ...

Year-end Overview

The Rand 2025 has been a year of solid progress for South Africa. The government of national unity (GNU) has held together despite dire predictions and the country has implemented a number of notable economic reforms. At the same time, international investment sentiment has shifted firmly towards “risk-on” and the US dollar has lost significant ground against other first-world currencies. The effect of these develo...

The Demise of Bitcoin

Why is the Bitcoin price falling when the price of gold is rising?Cryptocurrency doyens always claim that Cryptos are somehow a hedge against the impending weakness of paper assets – and especially the US dollar. But our observation is that Bitcoin is more of a risk-on asset than a risk-off asset. When risk-averse investors run for cover, they don’t switch to Bitcoin. Rather they switch out of Bitcoin and into gold...

The Collapse of the Dollar

The currency of a country is like the shares of a company. If a company is expected to do well and make profits, then its shares will rise and vice versa. The same is true of a currency. If the country’s economy is expected to do well and create strong growth, then its currency will appreciate against the currencies of other countries – and vice versa. The problem is, of course, that because the US dollar (US$) is ...

Gold Fields

For the past month, the US dollar price of gold has once again encountered some resistance – this time at around $4000. Despite this, in our view, the gold price is in a strong upward trend which should continue. One of the major factors is the steady decline in the US dollar value against a trade-weighted basket of currencies, but the main reason for the upward trend in gold is that large international investors and cen...

Top Winning Shares

Last Thursday, the JSE reached a new all-time record high of 114046. This, combined with the fact that the rand went below R17 to the US dollar for the first time since the beginning of 2023 suggests that emerging market investors are increasingly bullish. Consider the chart: The chart shows the effect of Trump’s Liberation Day announcement on 2nd April 2025 and the low point that followed. Since then, the JSE has recove...

Overview - 10th November 2025

Wall Street Two weeks ago we suggested in an article that a stock market bubble was developing in AI and predicted that a significant correction was imminent. We repeated that view in the Confidential Report published on Wednesday, 5-11-25 last week [link]. The S&P500 index is now in the midst of another mini-correction which has already taken it down 2.5%. That is about average for the mini-corrections that we have seen o...

Bubble

Last Friday the S&P500 reached another new all-time record high, closing at 6791 and reaching a new intra-day record high of 6807. This is obviously an exciting time for private investors, but with each new record high the systematic risk of a bear trend or crash increases. Consider the chart: Investors all over the world are committing rising amounts of capital to AI and in our view, there is a danger of substantial over-...

The PEG Ratio

Since the government of national unity (GNU) came into power in June 2024, there has been a definite improvement in the South African economy. Perhaps the improvement is not as dramatic as some people were expecting, but the progress cannot be denied. Possibly the best indicator of that is the 28% rise in the JSE Banking index which, before the GNU had been moving sideways for the previous two years. Banks are generally not ve...

Rare Earth Elements

Investors worldwide had been of the opinion that Trump’s ability to impact markets was on the decline. His erratic, on-again, off again tariff policies had either disappeared or had been mostly discounted into share prices. His attack on the second largest economy in the world, China, seemed to have been largely resolved, and a meeting with Xi Jinping was planned. After the sharp V-bottom lasting 4 months from February t...

US Shutdown

There has been much in the media recently about the US government shutdown and the fear among investors that it might begin to affect the stock market, depending on how long it lasts. A shutdown occurs when the US government reaches its budget limit and requires a bill to be passed through both Houses to extend the government’s spending limits. Shutdowns typically happen in October because the government’s fiscal y...

New Listings

Two new companies, ASP Isotopes and Greencoat Renewables, have recently come to the JSE. Both are developing companies that have recently made losses and have been funding those losses by raising capital and selling assets. They both have substantial “blue sky” potential but also carry substantial investment risk. This is probably truer of ASP Isotopes than Greencoat Renewables. In our view they both represent oppo...

Exponential Growth

The S&P 500 index is important because all the stock markets around the world tend to follow it. If the S&P is in a bull trend then London, Tokyo and the JSE will also be in a bull trend – and vice versa. The S&P500 index began 68 years ago on 4 th March 1957 with an initial value of 43,73. It took nearly 41 years for it to reach 1000 (3rd of February 1998) and another 16 years to get to 2000 (29th of A...

The US Jobs Market

International investors who trade on Wall Street are generally negative about any good news from the economy because it tends to make the monetary policy committee (MPC) more hawkish and less likely to reduce interest rates. The opposite is also true. But there comes a point where bad news is so bad that investors begin to fear that the US economy is heading into a recession. On Friday last week the US Monthly Jobs Report ...

Jackson Hole

Once a year in late August central bankers and academics congregate in Jackson Hole to discuss the state of the economy and consider the way forward. Traditionally, the Chair of the Federal Reserve Bank (“the Fed”) addresses the meeting and gives direction to its thinking on monetary policy in the US. This year, the comments of Jerome Powell resulted in the S&P500 index rising 1,5% on the day. The work of a cou...