All transactions on JSE listed shares have to take place through a stockbroker. So, before you can begin to buy and sell shares you will have to open a stockbroking account. This is fairly easy provided you are over 18 years old. Like any bank account, a stockbroking account requires that you prove your residential address in terms of the FICA legislation as well as provide proof of identification.

A stockbroking account is not like a bank account. For your security money coming out of the stockbroking account can only go into your bank account. Money in a stockbroking account cannot be used to pay bills or moved anywhere except to one specifically designated bank account. This means that even if someone were to get access to your stockbroking account they cannot steal your money. Your money is absolutely safe.

There are two types of stockbroking accounts – discretionary and non-discretionary. We would strongly urge you to choose a non-discretionary account because this means that you make all the decisions on the account and the broker does not have any discretion to buy and sell shares on your behalf without your express instructions. When you open a non-discretionary account, you will be required to sign a mandate – which is an agreement with your stockbroker.

These days, all the major banks (FNB, ABSA, Nedbank and Standard) have their own in-house stockbroking divisions – so the easiest way to open a broking account may be to do so with the bank that you already use. But this is not always the best option because some of the banks tend to treat a stockbroking account as if it was just another account – but it is not. For example, one of our students with a stockbroking account at his bank was due to receive some nil-paid letters (NPL) as a result of a rights issue on the shares which he held in that account. When the nil-paid letters did not appear in the account he contacted his bank and asked where they were. The bank staff had no idea what he was talking about. They said they would investigate and phone him back. But, of course, those nil-paid letters are effectively derivative instruments and they could have halved or doubled their value on the market in the next 30 minutes! The fact that the bank staff had never heard of nil paid letters put him at a significant disadvantage. A conventional stockbroker would certainly understand nil paid letters…

The benefit of opening a stockbroking account with your bank is that you will not need to go through the FICA process again and you will be able to transfer funds into and out of your broking account using the internet with relative ease. However, we feel that you are usually better off with a true stockbroking firm that understands the stock market and the needs of investors.

Once the account is open you can deposit (or transfer) some money into it from your bank account and your money will immediately begin to earn interest at the JSE trustee’s rate – which is slightly below the best “at call” interest rates available in South Africa. It earns this interest even if there is only R100 in the account. That can be another disadvantage of opening a stockbroking account with your bank. The big banks generally have their stockbroking firm as a separate corporate entity from the bank – so that means that the account which you open is not, in fact, a stockbroking account – it is often some kind of savings/investment account which earns less interest than the JSE Trustees rate. Before you open the account with a bank, make sure that it will pay you interest on any cash balance you may have at the JSE Trustees rate. If it does not, then you may be forced to close that account and shift your funds to another account with higher interest when you choose not to be invested in shares.

Until you buy some shares, a stockbroking account generally has none of the charges associated with a normal bank account – so it can be a very good place to save your money. The only cost is a monthly fee usually of about R40 or R50. You should save up about R10 000 before buying your first share, otherwise your dealing costs will be very high as a percentage of the value of the transaction – and that means that you will have to wait much longer to see a real return on your money. The dealing costs on R1000 are not much more than the dealing costs on R10 000.

To buy or sell shares on your broking account you simply need to log into the account through the internet and place your order – or phone your broker and tell him exactly what shares you want to buy or sell. Usually, if you are buying a free dealing share, the deal will be done within minutes after you have placed the order. It’s as simple as that.

These days, everything is done over the internet – so make sure that your broker has a good “trading platform” which shows the “depth of the market” for any share that you may be interested in. The depth of the market is the best five bids and the best five offers for any listed share at any moment during the trading day.

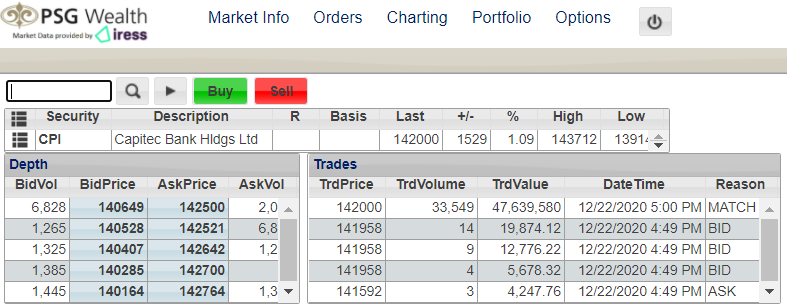

Consider the following example which is a “snapshot” from the new order screen of an investor with an account at PSG Online:

An Example of PSG Online Depth of Market on 22/12/20.

The left-hand side of the above table shows the depth of the market for Capitec (CPI) at the close of trade on 22nd December 2020. The top row shows a summary of the day’s trade so far. You can see that at the time that this snapshot was taken, the last trade on Capitec had taken place at 142000c – which is R1420 – because all share prices are always given in cents per share. Immediately to the right of that, you can see that this price was 1529c higher than the previous day’s closing price for Capitec – and that was a 1,09% gain on the trading day. Immediately next to that you can see that Capitec had traded in a range between 110700c (the high) and 109508c (the low) so far during the day. Consider the candlestick chart:

The candlestick for Friday 22nd December 2020 shows the range of trade on Capitec and it shows that the share opened and closed above the previous day’s close [if you are not sure about candlestick charts read modules 29 and 30].

So, the left-hand side of the table above shows the depth of the market as it was at the exact moment in time that this snapshot was taken. In the table below we have expanded that to show the figures more clearly:

|

BidVol |

BidPrice |

AskPrice |

AskVol |

|

74 |

142028 |

142193 |

123 |

|

200 |

142026 |

142194 |

133 |

|

54 |

142025 |

142196 |

550 |

|

140 |

142022 |

142206 |

34 |

|

37 |

142020 |

142316 |

100 |

You can see that, at that moment, there was an investor who wanted to buy 74 Capitec shares for 142028c (the best “bid”) and there was someone else wishing to sell 123 shares for 142196c (the best “offer”). The second-best bid was for 200 shares at 142026c (slightly less than the best bid price) and the second-best offer was for 133 shares at 142194c (slightly more than the best offer).

If and when the best bid and offer are at the same price, then the deal is automatically executed by the JSE computer – and that price becomes the “last” price in the top section. The third best bid and offer are shown below the second best and so on. If you want to buy or sell shares, this “depth of the market” for the immediately available bids and offers will give you a very good idea of the price at which you need to pitch your bid or offer at in order to trade successfully.

The right-hand table is enlarged below to enable you to see the details more clearly:

|

Trades |

||||

|

TrdPrice |

TrdVolume |

TrdValue |

DateTime |

Reason |

|

142028 |

16 |

22,724.48 |

12/23/2020 3:46 PM |

ASK |

|

142030 |

16 |

22,724.8 |

12/23/2020 3:46 PM |

ASK |

|

142030 |

29 |

41,188.7 |

12/23/2020 3:46 PM |

ASK |

|

142094 |

34 |

48,311.96 |

12/23/2020 3:45 PM |

BID |

|

141950 |

122 |

173,179 |

12/23/2020 3:43 PM |

BID |

So, this shows you the five most recent trades which have taken place. At 3:46pm 16 shares were traded for 142028c – giving the trade a value of R22724.48 – and so on.

You will also notice the two buttons for “buy” (green) or “sell” (red) at the top of the screen. When clicking on "buy", a box like the one shown below will appear.

The investor needs to then enter the quantity (volume) and price of the shares that they want to trade. The pricing instruction can be set at "Limit" or "Market". With a market order you are telling your broker to buy or sell the shares at the best available price – right now. With a limit order you are giving your broker a price at which he must trade for you. In other words, your instruction is “Buy the share if you can get it for this price or less”, or alternatively, “Sell the share if you can get this price or more”. The danger with setting a limit is the share could come very close to your limit (within a few cents) but never actually reach it – in which case your trade will not be executed. With a market order the trade will definitely be executed, provided the share is "free dealing" and there is someone else to trade with. Of course, if you are trading through a stockbroker’s trading platform (like the one shown above) you could effectively execute a market order by simply pricing it at the same price as the best bid or offer – then it would be immediately executed. To avoid the disappointment of not trading, we recommend that you always use market orders.

The following settings are available when placing an order:

- All Or None - The order will only be executed if the full number of shares at the specified price is available and will not be partially filled.

- Date - This is the particular date that the order will expire.

- Default Lifetime - The default setting within the trading platform means the order will remain in the market for 9 weeks or until the date specified, unless it trades in full during this time. Custom expiry dates cannot exceed the ASX 9-week order limit. If the order falls too far outside the market range, it will be removed from the market at the end of the day.

- End Of Day - The order will remain in the market until the end of the day. This is the default setting for options orders.

- Fill And Kill - The order will be processed immediately at the price specified, and remaining volume of the order which was not filled will be withdrawn, or “killed”.

- Fill Or Kill - The order is killed unless the total order volume can be traded immediately.

- Good For Day - The order remains in the market only for the day it is lodged.

- Good Till Cancel - The order will remain in the marked for the maximum amount of time allowed for the security type.

- Good Till Cancelled - There is no expiry date on the order, and it will remain in the market until traded fully or cancelled.

- Timed Order - Gives the option to set an expiry date and time so that an order can have a fixed expiration date.

Once these fields have been completed all that remains is to click on “Buy” and the order will be entered on the JSE system and then executed if there is an offer at the same price.

You will also notice that the system defaults to keeping the order open for today only – in other words, the investor would have to specify if he/she wanted the deal to remain on the JSE system for longer or until it is filled.

So, all through the day on the approximately 300 shares listed on the JSE, new bids and offers are being entered continuously – and being executed automatically whenever the bid and offer prices are the same. A share like Capitec typically trades a few hundred million Rands worth of shares every trading day. Other shares like Naspers or Sasol might trade ten times that amount. Some shares are very “thinly traded” and have many days on which they do not trade at all. We advise that you stay clear of such shares.

The price of a share is determined by the forces of supply and demand. If more people want to sell a share than to buy it the price will fall and vice versa.

FEES WHEN BUYING AND SELLING SHARES

DEALING COSTS

Brokerage costs vary from one stockbroking firm to another, so you may want to shop around before choosing a stockbroker. As a rule of thumb, you can expect your dealing costs for both purchase and sale (i.e. your “turnaround costs”) to amount to roughly 3% of the value of shares which you buy – approximately 2% on purchase and 1% on sale. Very small transactions (less than R10 000) will have higher costs while much larger transactions will have considerably lower costs.

The minimum fee is R125-00 per transaction for internet only and R150-00 for advisor (where the stockbroker gives advice) and internet.

A typical stockbroker might charge:

|

Transaction |

With Advice |

Internet Only |

|

Below R25k |

1.4% |

0.9% |

|

R25k to R100k |

1.0% |

0.85% |

|

R100k to R250k |

0.75% |

0.65% |

|

R250k to R1m |

0.5% |

0.5% |

|

Above R1m |

Negotiable |

Negotiable |

The minimum fee makes it unintelligent to trade with amounts below R10 000 because your dealing costs become excessive as a percentage of the transaction value.

SECURITIES TRANSFER TAX (STT)

This is a tax which is levied on every transfer of securities within the market, listed or unlisted. Implemented in 2008, the securities transfer tax is 0.25% of the value of the security traded and is generally payable by the purchaser.

STRATE SETTLEMENT COST

Strate (which originally stood for “Share TRAnsactions Totally Electronic”) is South Africa's Central Securities Depository. This means they process all trades and keep record of all issued shares and share certificates. In the year 2002, all share transactions were dematerialised, meaning records were computerised and no physical share certificates were exchanged. All shares became part of the Strate settlement system, where all trades were settled T+5 (five days after the transaction occurred). In 2016 trades became settled T+3. Dematerialisation involves replacing physical share certificates (called “scrip”) with a computerised record of the shares that you own. To find out more about Strate go to: https://www.strate.co.za/about-us/#journey.

So, basically, Strate is the company which provides the technology which facilitates trades on the JSE. The Strate Settlement Cost is a tiny percentage of the value of all transactions, at about 0,005787% of the value of transactions up to a value of R200 000, and a minimum fee of R10.71 and max of R70.02. It is this minimum fee and other costs which can make small transactions on the JSE expensive.

INVESTOR PROTECTION LEVY

This is a levy charged on all trades on the JSE. This is a set fee of 0.02% of the trade and ensures that the investor is protected against insider trading and other activities which could harm the investor.

VAT

Value Added Tax (VAT) is charged on all fees when trading at 15%.

BROKER ADMIN FEE

This varies from broker to broker and is important to consider when choosing which trading account to apply for. For example, in 2020, Nedbank was charging R250 to open a stockbroking account and brokerage of 0,7% on transactions of up to R250 000.

SOUTH AFRICA'S OTHER STOCK EXCHANGES

Since 2017, we have seen an additional 4 stock exchanges emerge in South Africa - A2X, ZARX, 4AX and BEE-focused Equity Express Securities Exchange (EESE). This is a significant development for investors, as the JSE has been the only exchange for the last 130 years, with a complete monopoly on fees charged. With the advent of A2X specifically, which specialises (for the moment) in secondary listings, fees are expected to reduce by as much as 50% for trades.

Click here to read an article on Daily Maverick which outlines the progress of these new exchanges in South Africa.

GLOSSARY TERMS:

Warning: mysqli_num_rows() expects parameter 1 to be mysqli_result, bool given in C:\inetpub\wwwroot\newage\onlinecourse\content\lecture_modules_content.php on line 21

List Of Lecture Modules