THE BASIC STOP-LOSS STRATEGY

When you buy a share, you are at your most optimistic about its prospects. You are making a prediction. You believe that you are buying a winner and that the share will go up – otherwise you wouldn’t be buying it. But, of course, you could be wrong. You might have made a mistake. You might have chosen the wrong share, or the right share - but at the wrong time. To protect yourself against that possibility, you should implement a stop-loss strategy.

The basic idea of a stop-loss strategy is very simple. Once you have decided to buy a certain share, you should mark off a price, say, 10% below what you will pay for the share and make that your stop-loss level. So, for example, if you intend to buy a share at 1000c, set your stop-loss 10% below that at 900c. If, instead of going up, as you expected, the share goes down, then, when it reaches the stop-loss price (900c), you must sell it, because clearly your original decision to buy was wrong – at least in its timing, if not in both timing and selection. You must acknowledge your mistake - by selling the share. In this way you limit the amount you can lose from any particular investment decision and protect 90% of your capital. Consider this golden rule:

If what you expect to happen does not happen, then you are always better off selling sooner rather than later.

Or, put more simply: It’s not going to get any better!

On the other hand, suppose the share does goes up, as you expected. Then you should maintain your stop-loss level 10% below the current market price. For example, if it rises to 1500c, then your stop-loss level would be 10% below that price at 1350c - and so on. The only rule is that you cannot move your stop-loss level down. So, stop-loss works like a ratchet that can only go up, but cannot come down. In this way, you will allow your profits to run, while limiting your losses.

To establish how big your stop-loss percentage should be, simply ask yourself this question:

“How much am I prepared to lose?”

If you are not prepared to lose anything, then you should not be in the stock market. Equity shares are risk investments, and this means that there is always going to be the possibility of a capital loss. Equity investors are prepared to take this risk because the potential returns are far better than in any other investment medium. In fact, we would go so far as to say that, unless you are prepared to take some kind of risk, you cannot make a real after-tax return. We don’t like risk-free investments because they are also invariably also return-free.

In general terms, a short-term or trading portfolio might have a stop-loss percentage of 7% – 10% while a medium-term portfolio might have a 15% stop-loss and a long-term portfolio as much as 25%. But it definitely does not make sense to lose 50% of any investment – ever. If you lose 50%, then you will have to make 100% just in order to return the investment to its starting value. This is the logic behind setting a definite limit on how much you are prepared to lose. And you should do that before you buy the share. Once you have bought the share you will find that you are not well-positioned psychologically to establish a stop-loss level.

So, if you are unwilling to lose 50% or more of an investment then we have established that you must have a stop-loss strategy. The only question that remains is, “At what percentage?”

MENTAL POSTURE AND VALUING YOUR SHARES

A stop-loss strategy helps you to achieve the correct "mental posture” to minimise losses. Good mental posture begins with the value that you place on your investment in your own mind. Most people value their shares at their market price or at their cost. In other words, if they hold 1000 shares which are trading for R10 each, they say to themselves that they have an investment which is worth R10 000. Alternatively, they say (if they are conservative, like accountants) that, considering that they paid R8 each for the shares, then their investment is worth what it cost – R8 000 – regardless of the current price.

The problem with both of these approaches is that they effectively place no limit on how much you could lose — and they actively prevent you from selling when you should. If you think that your shares are worth R8 or R10, then, when the share falls to R6, you will be unwilling to sell it. This is because no one sells something for R6 that he/she thinks is worth R8 or R10. The problem is that this opens the door for you to face unlimited losses on your investment.

As a general principle, once a share has fallen below the value which you place on it, strong mental habits will intervene to prevent you from selling it, almost irrespective of how low the share falls. In fact, the further it falls the less likely you will be to sell it! You will become a supporter of the oldest and most damaging investor fallacy when you say to yourself,

“I have not lost the money until I sell the shares” - or alternatively,

“I cannot sell the shares because then I will take a loss”.

The reality is, of course, that you have already incurred the loss – what you are still afraid to do is to admit it. This fear is entirely natural, but it interferes drastically with your decision-making process. Your decision to hold or sell is now dominated by the price which you paid for the share three or six months ago – which is completely and entirely irrelevant! The only thing that matters now is whether it will go up from here or down. The price that you paid for the share really does not matter – but you are allowing it to become the single most important factor in your decision to continue holding or to sell.

If you make an irrelevant factor the most important factor guiding your decision, you cannot hope to succeed.

You can test your objectivity by asking yourself whether your feelings would be the same if you were in profit on the transaction (for example, if you had made a 25% gain rather than a loss). You will find that your metal posture (how you feel) is entirely different when your shares are above what you paid compared to when they are below that level.

Once you have established your stop-loss percentage, you should therefore begin valuing your shares at their stop-loss value instead of their market value or their cost. In other words, when you are trying to determine how much your investment is worth, don’t use the market prices or what you paid – adjust their value down to the stop-loss levels that you have chosen and you will have a value which you can rely on, because this is the level at which you have made a firm, strategic decision to sell.

Of course, doing this means that you have to take an immediate loss on the share when you buy. But, if you do this, you will find it much easier psychologically to sell when your shares reach their stop levels.

Of course, this approach means that the act of buying a share means an immediate loss equivalent to your stop-loss percentage. The very act of buying a share becomes the act of taking a 10% (or whatever your stop loss percentage is) loss!

At first sight, this might sound a bit harsh, but remember, you have moved from cash, an asset with no short-term risk at all, to shares which are inherently a risk investment - and all we are recommending is that you “pay” for this risk in advance immediately. This has the added benefit that it will make you very, very careful about what you buy.

You need to get into the habit of setting and maintaining a daily stop-loss level for each of the shares that you hold or buy. Do this yourself. Don’t rely on a computer program or your stockbroker to maintain your stops. You need to be always aware of what is going on with your shares. If you implement a stop-loss strategy, you will save yourself a fortune! Think about this great truth:

Being successful in the share market is not so much a question of making money as it is of not losing it!

AN EXTRAORDINARY THOUGHT

Consider that, if you restrict your share selections to those which make up the JSE overall index, and choose them completely at random, then, over time, 50% of your choices should out-perform that index and 50% should under-perform it. This must be true, because the index is an average of the shares from which you are selecting.

Consider that if on the 50% that go down the worst you could lose is, say, 15% (your stop-loss plus your dealing costs), but on the 50% that go up you could make 100%, 200%, 300% or more... You can see that, so long as you have a strict stop-loss strategy, even if you choose your shares completely at random, mathematically, you must beat the JSE Overall index. That is something that about 80% of unit trusts seem incapable of doing!

Of course, you will not choose your shares at random. In fact, as this training program progresses you will become better and better at choosing the right shares.

Imagine if you could apply a stop-loss strategy on the roulette wheel at your local casino. The casino would go out of business overnight!

Yet here you have a stock market which, on average, goes up on average (approximately 13,8% per annum) so your statistical probability of choosing a winner is already higher than your probability of choosing a loser — and you can apply a stop-loss strategy!

We say that work is for people who don’t understand the share market! Yet here you have a stock market which, on average, goes up on average

A STOP-LOSS ANECDOTE

A well-known investment analyst tells this story about stop-loss:

Some years ago, I was lecturing down in Durban and part of my lecture was about stop-loss strategies. After the lecture, a man approached me and said,

“I have a problem”.

“What’s your problem”? I asked.

He replied, “I bought a large parcel of a shares a few months ago for 220c per share. Now they have fallen to 168c – so I see what you say about stop-loss and it makes perfect sense – but what should I do now?”

I said, “Your problem is that you are carrying that loss around with you like a great ball-and-chain. It is dominating your mind. You can’t sleep. It is paralyzing your ability to think objectively. The best way for you to get rid of that problem is to sell the share – because then you cannot continue to pretend that you didn’t make a mistake.”

But when I said that he buried his head in his hands and cried, “No, no. I can’t sell them now – not now!”

So, I said, “Well there is one other solution. Pretend that you bought the shares today for 168c, set your stop-loss from that level and go forward from here”.

About six months later I was down in Durban lecturing again and I met the same man. He still had not sold those shares, but by that time they were trading for just 68c!

Which just goes to show that some people must pay more school fees than others.

If you have decided that you don’t want to lose 50% or more of an investment you better have a strict stop-loss strategy.

What we have outlined so far is the simplest of all stop-loss strategies. This is where you should begin when you first start investing, but there are many refinements that you can make to your stop-loss strategy which will make it more effective. The best place to do this is in an Excel spreadsheet where you can adjust the formulae and experiment.

Stop-loss strategies can become really complex, but you should not lose sight of the fact that the only thing that really matters about your stop-loss strategy is that you execute the stop-loss sale when you are supposed to. It’s like the seatbelt that you put on when you get into a motor car. The brand of seatbelt doesn’t really matter, so long as you have it buckled up when you have an accident!

We will now consider a few of the refinements that you can make to the simple stop-loss strategy:

USING A TARGET PERCENTAGE GROWTH LINE

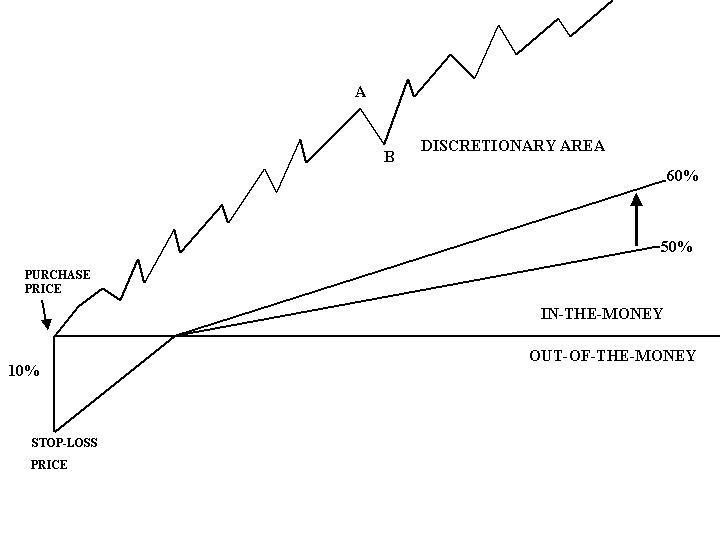

By now, you should be familiar with the idea of a simple stop-loss strategy. If not, please go back and re-read the first part of this module. The simple stop-loss is better than no stop-loss strategy at all, but it has some significant disadvantages, especially when applied to growth shares which typically rise rapidly but with considerable volatility. A simple stop-loss strategy can kick you out of such a share when it falls 15% on a sudden temporary cooling of market sentiment – despite the fact that it has already risen 300% and will rise a further 500%. To avoid this situation, we suggest that you could use a target stop-loss as illustrated in the following diagram:

You can see here that a share has been purchased at a certain price with a 10% stop- loss in place. If we assume that the share performs well, then the share price chart will rise in a series of oscillations from the purchase price.

The stop-loss level will rise in line with the highest market price reached to date until it reaches the purchase price. Once it has risen above the price paid for the share then we say the trade is “in-the-money” and we recommend that you change your simple percentage stop-loss to a target stop-loss from that point.

To do this you must decide what your goal is for the growth of your portfolio.

Suppose that you decide to strive for a 50% growth over the next year, then you must divide that 50% by the 250 trading days of the year. This will give you a fraction of a percent (0,2%) by which the share must rise on average every day if it is to conform to your target. This is shown on the above diagram as a straight line, annotated with “50%”. This line then becomes your stop-loss line. So long as the share stays above this level then you are happy. Even if it should fall 25%, you have discretion over whether or not to keep it so long as it remains above that 50% line. Obviously, as soon as it moves below your 50% target growth line, you must sell it – because it no longer meets your investment objectives. At the end of the year, you may decide that 50% was easy and you want to move your target to 60%.

The process of gaining knowledge and experience in the market should result in you steadily being able to move this line upwards until your portfolio reaches too large a size to sustain large percentage growth rates (i.e. you begin to experience the same constraints as institutional investors).

So, to sum up, the benefit of this approach is that, once your share is substantially in-the-money, you will not be kicked out on a sharp downward move of 15% or 20% such as the move from A to B on the diagram - so long as you remain within your “discretionary area”.

A SECOND REFINEMENT

Read this PDSnet article for another suggested refinement of your stop loss strategy - https://www.pdsnet.co.za/index.php/your-stop-loss-strategy-example-of-capitec/

ONE FINAL POINT

A stop-loss strategy is not a method of selling. It is the net under the trapeze artist. It is there to catch you when you get it wrong. Ideally, you always want to sell your shares well before they reach their stop level. But if all your clever analysis fails, then the stop-loss level is there to protect the bulk of your capital.

As your share approaches its stop level you have the option of “averaging down”. This means that, if you are still very positive about the share from a fundamental perspective, and you really believe in its future profit-generating potential, then you could buy more and so reduce the average price that you have paid for that share. So, for example, suppose you bought 1000 shares for 1000c each and your stop was set 10% below that at 900c. If the share fell to 920c you would be approaching your stop level and you could decide to “double down” by buying a further 1000 shares at 920c so bringing your average cost down to 960c. That would have the effect of reducing your stop level to 864c (960c – 10% = 864c).

The problem with this idea, of course, is that your exposure to the share and risk would almost double from R10000 to R19600. So, you need to be very certain that you are right.

It is a very difficult decision to take – and at the time you are bound to feel very scared – but it is the only alternative to selling out when the share is approaching your stop level, but you are sure of the share's fundamentals.

Always remember that your goal with stop-loss is to ensure that you never again lose more than about 15%, including your dealing costs, on any stock market investment ever – because, if you can maintain that rule, you will inevitably be very successful in the share market. You will have learned how to cut your losers and keep your winners – which is the mark of a professional investor.

GLOSSARY TERMS:

Warning: mysqli_num_rows() expects parameter 1 to be mysqli_result, bool given in C:\inetpub\wwwroot\newage\onlinecourse\content\lecture_modules_content.php on line 21

List Of Lecture Modules