A company’s profit (or “earnings” as it is known) is usually partly used to pay out a dividend (or “distribution”) to the shareholders. What is left is then ploughed back into the company to ensure future growth and therefore higher dividends in the future. The part that is kept in the company is known as the “retained earnings”. For most companies, it is true to say that:

Profit – Dividend = Retained Earnings

DIVIDEND POLICY

The exact size of the dividend is decided by the company’s directors once they know how much profit was made. The larger “blue chip” companies usually have an established dividend policy of paying out a specific percentage of their profits. Some, very conservative companies may pay out only 10% of their profits while others (like Coronation - CML) may pay out 75%. There are even companies which pay out all their profits and it is possible for a company to pay more than 100% of its profit, especially if it has received a “windfall” – such as a profit on the sale of a subsidiary.

In order to protect the rights of shareholders, the Companies Act rules that, under normal circumstances, a company may only pay out dividends provided it has passed a solvency and liquidity test. The test of liquidity is that the company must be able to pay all its expected expenses from its expected income over the next 12 months – after the dividend has been paid. The solvency test is that the company’s assets must exceed its liabilities. The board of directors is required to certify that the company passes both tests before paying out a dividend.

YIELDS

So, while the entire profit of the company belongs to the shareholders, only the dividend is actually paid out to them, and the retained earnings are kept in the company with the direct objective of ensuring higher dividends in the future. As we have seen, investors discount the future dividends of the company into the price that they are prepared to pay for the share today. For this reason, fundamental analysis begins by looking at a ratio of the future earnings or dividends to the share’s price. There are three such ratios that are commonly used in South Africa and quoted every day in the newspaper: the dividend yield, the earnings yield and the price:earnings ratio. Refer to module 8.

DIVIDENDS

Dividends are usually paid twice a year – an interim dividend after the results of the first six months are known to the directors and then a final dividend once the results for the full year are known. Sometimes, as suggested above, a company can also pay a special dividend if they have a surplus of cash which is not needed in the company – for example as a result of having sold a subsidiary for cash.

Each dividend payment has five important dates that you need to know and understand:

- Date of declaration:

The date that the directors of the company make a public announcement giving the details of the dividend and other important dates, is referred to as the date of declaration. Such declarations are usually given with the publication of the company’s results in the Stock exchange News Service (SENS). Once a dividend has been declared, the share is then said to be “cum div” – which literally means “with dividend”.

- Last day to register:

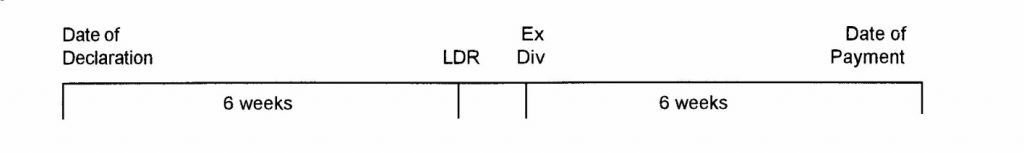

This date is given by the directors in their dividend announcement. Anyone who owns the shares at the close of trade on the JSE on this date will be entitled to get the dividend – even if the shares were purchased on that day. The Last Day to Register (the “LDR”) is usually a Friday and it usually comes about 6 weeks after the date of declaration.

- Record date:

This date is three days after the LDR to allow for all the transactions which happened on the LDR to be properly recorded so that people who held the shares at the close of trade on the LDR are eligible for the dividend. The record date has to be 3 days after the LDR because the JSE operates on “T+3” which means that transactions are only settled (i.e., payment is made, and the scrip is delivered) three days after they are made.

- Ex-div date:

Ex-div literally means “without dividend”. This is the next trading date after the LDR – usually a Monday. People who buy the shares on this day are normally not entitled to get the dividend. Because buying the shares no longer entitles the purchaser to the dividend, the share price generally falls by the amount of the dividend on the ex-div date. If you are holding the share on the ex-div date, you should adjust your stop-loss levels down by the amount of the dividend – otherwise when the share price falls by the amount of the dividend it may trigger a stop-loss sale.

- Date of payment:

About 6 weeks after the ex-div date, the dividend payments are made directly into the shareholders’ broking accounts.

Look at this on a timeline:

The record date is normally three days after the LDR and so in the same week as the ex-div date.

The size of the dividend depends on the size of the profits made by the company and the dividend policy of the company. Some companies have a policy of paying out half of the profits; others pay out only 10% and some pay out all the profit. Some pay out nothing (typically growth companies that need the cash to finance future growth) and others pay out more than 100%, especially if they are sitting on a large pile of cash. The dividend policy is determined by the directors, having consideration of the company’s need for funds and the size of the profits.

TAXATION

Dividends are subject to dividend withholding tax (DWT) which is 20% of the dividend for South African residents. This tax must be taken off at source by the company and paid directly to SARS, before the balance of the dividend is paid out to the shareholders.

The Companies Act (71 of 2008) describes a dividend as a:

“direct or indirect: (a) transfer by a company of money or other property of the company, other than its own shares, to or for the benefit of one more holders of any of the shares of that company or of another company within the same group of companies, whether in the form of a dividend, as a payment in lieu of a capitalisation share, as contemplated in section 47, is consideration for the acquisition by the company of any of its shares, as contemplated in section 48; or by any company within the same group of companies, of any shares of a company within that group of companies; or otherwise in respect of any of the shares of that company or of another company within the same group of companies, subject to section 164(19); (b) incurrence of a debt or other obligation by a company for the benefit of one or more holders of any of the shares of that company or of another company within the same group of companies; or (c) forgiveness or waiver by a company of a debt or other obligation owed to the company by one more holders of any of the shares of that company or of another company within the same group of companies, but does not include any such action taken upon the final liquidation of the company”.

Obviously, the intention here is to deal with all possible payments from the company which benefit shareholders. If a company buys back its own shares, the South African Revenue Service (SARS) regards this as a distribution or dividend because money goes out of the company to buy the shares in the market and then those shares (known as “treasury shares”) are usually cancelled which means that the company’ total issued share capital diminishes. This means that the remaining shareholders will each have a slightly larger share of the company and their shares will be worth proportionately more. Companies often undertake a share buy-back if the directors feel that the company is trading below its net asset value (NAV). For example, on 7th December 2020, Long 4 Life (L4L) announced on SENS:

“SHARE BUYBACK PROGRAM: Long4Life hereby announces the commencement of a share buyback programme (“the Programme”) in terms of the general authority granted to the Company by its shareholders at the Annual General Meeting held on Wednesday, 1 July 2020.The Company intends to purchase up to a maximum of 36 million Long4Life shares under the Programme which will be executed on the Johannesburg Stock Exchange (“JSE”) by an intermediary, Investec Securities (Pty) Ltd”

DWT applies to all companies, irrespective of whether they are private company or a public company, listed or unlisted. The DWT, if added to the company tax rate of 28%, means that owners of smaller companies cannot get any significant benefit by paying themselves a larger salary above the marginal rate of 45%, rather than taking the money out of the company in the form of dividends.

DISCOUNTING AND IRR

Fundamental analysts like to forecast the probable future dividends of a company and then discount them into today’s money to get an idea of whether the company’s shares are over-priced or under-priced at the current market price. To understand this, you need to accept that a dividend of, say, 100c which you will receive in a year’s time cannot be worth 100c in today’s money. Obviously not, because you could invest that 100c and at least earn interest on it over that year. But, it might well be worth a discounted amount of, say, 80c in today’s money.

Fundamental analysts discount their forecast of the future dividends of a company by their internal rate of return (IRR). An internal rate of return is the percentage by which you would need to discount a 100c income in one year to become indifferent between it and the discounted amount. So, if you are indifferent between getting 80c now and 100c in a year’s time then your IRR is 25% – because for 80c to become 100c it must grow by 25%.

Most big institutions (like pension funds, unit trusts or insurance companies) have an established IRR which they aim to achieve by their choice on investments. Private investors don’t usually bother with this, but it is sometimes useful to know what sort of percentage return you would like to achieve over time. The problem of course is that the level of risk inherent in different investments varies. Where the risk is higher, you would naturally want to be incentivised with a high potential return.

INFORMATION ON DIVIDENDS

Obviously, as a private investor you need to consider whether the share you are considering is a good payer of dividends or not. The easiest way to obtain this information is to look at the “Comment” feature of your software under the share itself. There you will find at the bottom of the page the dividends per share (DPS) paid out by the company over the past ten years (or more). The table also shows the earnings per share (EPS), headline earnings per share (HEPS) and the net asset value (NAV). From this information you can immediately see whether the dividend has been consistent, whether it is growing or falling and how much of the EPS and HEPS are being paid out as a percentage. That gives an idea of the company’s dividend policy.

For example, consider the table for Implats, the 2nd largest platinum producer in South Africa:

| F/Y | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 |

| EPS | 1105 | 689 | 168 | 1 | -603 | -10 | -1145 | -1486 | 205 | 2066 |

| HEPS | 1105 | 685 | 330 | 86 | 36 | 12 | -137 | -171 | 423 | 2075 |

| DPS | 570 | 195 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 525 |

| NAV | 7914 | 8270 | 8574 | 8626 | 8253 | 7877 | 6514 | 5178 | 5446 | 7961 |

Here you can see that Implats stopped paying dividends in 2013, because of the lower platinum group metals (PGM) prices and the cost of uncertain legislation and continuous union action. It resumed paying again in 2020 as PGM prices rose.

The HEPS information given here in your software can also be used to calculate the price:earnings growth ratio which we discussed in Module 10.

Now consider the dividend announcement made by Clicks, as part of its interim results for the year ended 31st August 2020:

FINAL DIVIDEND

The board of directors has approved a final gross ordinary dividend for the period ended 31 August 2020 of 450.0 cents per share (2019: 327.0 cents per share). The source of the dividend will be from distributable reserves and it will be paid in cash.

ADDITIONAL INFORMATION

Dividends Tax (DT) of 20% amounting to 90.0 cents per ordinary share will be withheld in terms of the Income Tax Act. Ordinary shareholders who are not exempt from DT will therefore receive a dividend of 360.0 cents net of DT

Shareholders are advised of the following salient dates in respect of the final dividend:

Last day of trade "cum" the dividend Tuesday, 19 January 2021

Shares trade "ex" the dividend Wednesday, 20 January 2021

Record date Friday, 22 January 2021

Payment to shareholders Monday, 25 January 2021

You can also see that to find out about dividends being paid by the shares in your portfolio, you should watch out for SENS (Stock Exchange News Service) messages, which give you the latest interim or final results of the company. In those results you should find an announcement similar to the one above which gives complete details of how much is being paid out and when. This also implies that you need to know the financial year-end of the companies that interest you. You can expect them to publish their financials within 3 months of the end of the interim period and their financial year.

Most private investors are more interested in capital gains than they are in dividends, but you should remember the point which we made in Module 7 where we discussed the relationship between fundamental and technical analysis – that a capital gain is really just the dividend in a different form.

GLOSSARY TERMS:

Warning: mysqli_num_rows() expects parameter 1 to be mysqli_result, bool given in C:\inetpub\wwwroot\newage\onlinecourse\content\lecture_modules_content.php on line 21

List Of Lecture Modules