Your Stop Loss Strategy - Example of Capitec

10 July 2019 By PDSNETIt has been well said that the secret of success in the share market is to cut your losers and keep your winners. And that implies some sort of stop-loss strategy (if you are not familiar with the concept of a stop-loss strategy, please read module 12 of the PDSnet Online Investment Course). We all tend to get emotionally involved with the shares that we buy and those emotions interfere with our objectivity, no matter how careful we are.

The logic of having a stop is contained in the question, “How much am I prepared to lose?” Shares are a risk investment and so you should have a clear idea of how much you are prepared to risk. Most investors do not want to lose more than 10% to 15% of an investment. Certainly no one wants to lose 50% - because then you have to make 100% just to get back to where you started! And, if you are unwilling to lose 50% or more of an investment, then you have to have a stop-loss strategy. It’s as simple as that.

The great benefit of a stop-loss strategy is that it eliminates emotion with a series of hard and fast rules which are there to prevent you from losing your shirt when you make a bad decision. The problem with stop-loss is that those rules have to be established before you invest, because otherwise you will be tempted to constantly adjust them as the market and the price of your share changes.

So what should those rules be? In our view, a simple 10% stop-loss is a good place to start.

If the share falls

On the downside of an investment, a stop-loss means establishing a level 10% below the price which you intend to pay for the share and then taking a firm decision to sell out at that level if the share price falls. In this decision, you should not use intra-day prices. Rather wait for the share to close below your stop and then, at the beginning of the next day, sell out for the best price you can get when the mrket opens. Do not be tempted to prevaricate. If you abandon your stop-loss, it is like abandoning your parachute – next stop is mother earth!

If the share rises

But what if you chose a winner and the share goes up from the day you buy it? How should you adjust your stop? Conventional wisdom says that you should move your stop upwards, always keeping it 10% below the highest price which the share has reached since you bought it. Our experience is that this is probably not the best solution and it will cause you to sell out of many good quality shares at the wrong time. We suggest that you keep your 10% stop until you go “in-the-money” (in other words, until your stop-loss level moves above the price you paid for the share). After that we suggest that you expand your stop steadily as the share climbs – so that when you are up 100% (i.e. you have doubled your money) your stop is set say 25% or even 30% below the highest price. In other words, as your risk in the investment declines, you can afford to take on more risk – but there still has to be a “bottom line”.

Obviously, high-quality blue chip shares sometimes go through “bad patches” where they are out of favour. In those situations you will have to decide whether to cash in your shares or buy more and “double down”. Obviously if you buy more you will be increasing your exposure.

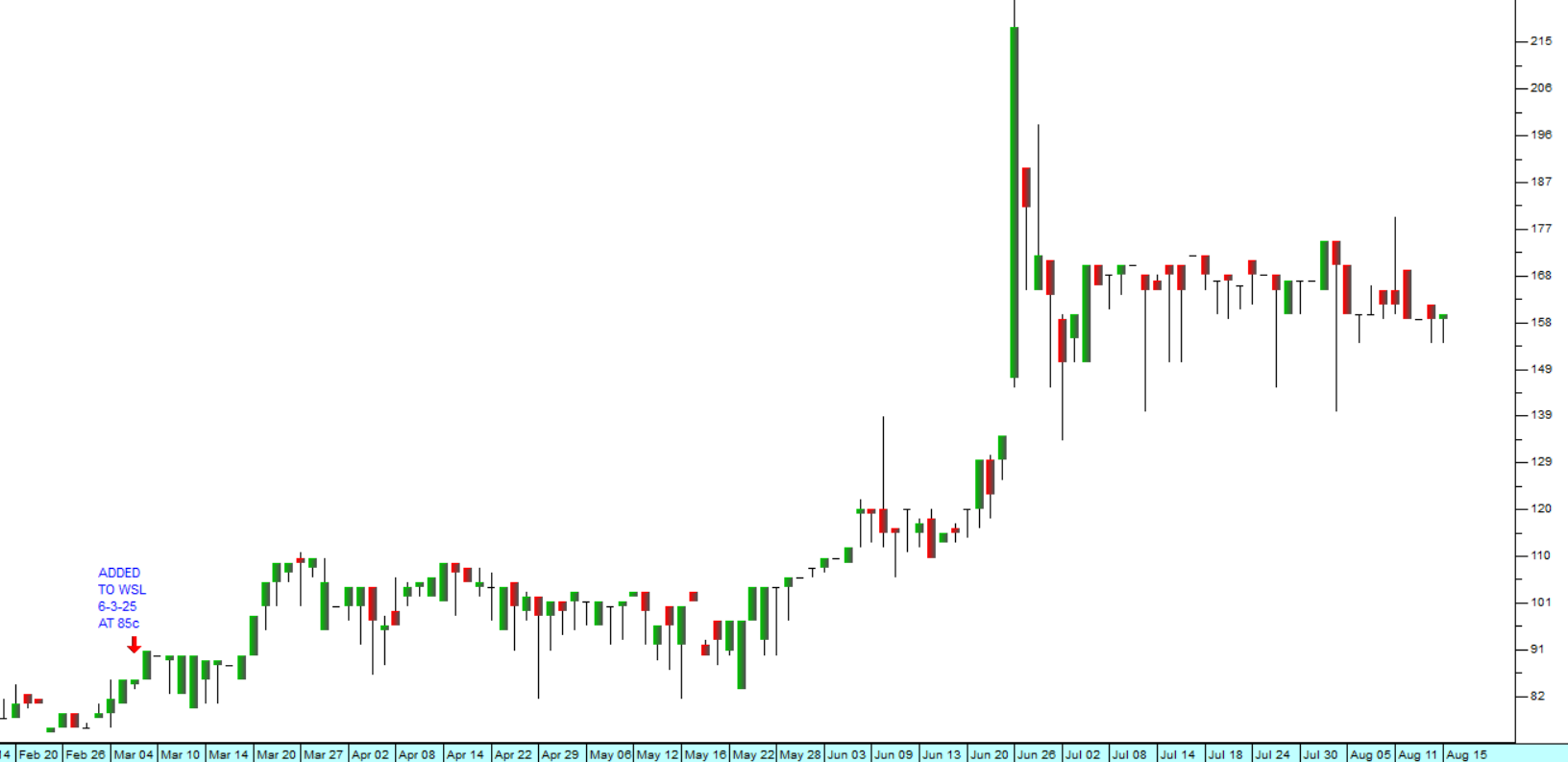

Consider the example of Capitec:

If you had been fortunate enough to buy this share for R210 in August 2014, you would have seen it rise by 174% in the next 8 months. By that time we suggest you should have widened your stop to around 30%. When the first correction happened between April and July 2015, you would have held onto your investment and maybe even bought more at lower levels. The same would have happened in the 3-month correction between the 4th November 2015 and the end of January 2016 (which took it down 28%). Then when the Viceroy report came out at the end of January 2018, you would have been unperturbed and held onto the share.

With a “diagonal” share like this, it pays to have a wide stop-loss once you are in-the-money.

DISCLAIMER

All information and data contained within the PDSnet Articles is for informational purposes only. PDSnet makes no representations as to the accuracy, completeness, suitability, or validity, of any information, and shall not be liable for any errors, omissions, or any losses, injuries, or damages arising from its display or use. Information in the PDSnet Articles are based on the author’s opinion and experience and should not be considered professional financial investment advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Thoughts and opinions will also change from time to time as more information is accumulated. PDSnet reserves the right to delete any comment or opinion for any reason.

Share this article: