The Discount to Tencent

21 January 2020 By PDSNETIt is commonplace for investment holding companies to trade at a discount to the value of their underlying assets. This discount is usually around 20% to 30% depending on the assets held. Efforts are often made to “unlock” this value into the hands of shareholders by “unbundling” the assets directly into the hands of those shareholders. Private investors can sometimes score a windfall by buying into an investment holding company which is trading at a significant discount and then benefiting from their efforts to release or unlock the value.

Naspers (NPN) has been increasingly undervalued in terms of its underlying assets for many years. For example, it has been recently estimated that the company’s shares are now trading at a 42% discount to the value of its indirect 31% holding of Tencent – the Chinese internet and social media giant. That discount has widened sharply in recent months as the Tencent share price on the Shenzhen stock exchange in China has risen by almost 30%.

In the case of Naspers, this discount has always been partly because of their cumbersome and archaic “N” share capital structure where it is dominated by its 907128 unlisted "A" ordinary shareholders. Each "A" ordinary share has 1000 times the voting power of the 438,3m "N shares" which are listed. So, the “A” shareholders effectively control the company with 67,4% of the vote even though they represent less than 1% of the contributed capital. Pyramid structures like this are generally frowned upon in international stock markets because they violate the principal that those who contribute capital to a business should be able to vote in direct proportion to the capital contributed.

Without changing their capital structure, the directors have been trying to unlock some of the value inherent in Naspers by unbundling some of its assets. So, for example, they released about $4bn into the hands of Naspers shareholders when they unbundled and separately listed Multichoice. They released a further $16bn when they created Prosus and listed it on the Euronext in Amsterdam. But even after those two massive releases, Naspers is still trading at a 42% discount to its underlying assets. And the newly-created Prosus is trading at a discount of about 30%.

The discount between Naspers and Prosus could, to some extent, be eliminated if Naspers sold some of its Prosus shares and then used the capital to buy its own shares back. This should have the effect of closing the gap between the two companies to some extent.

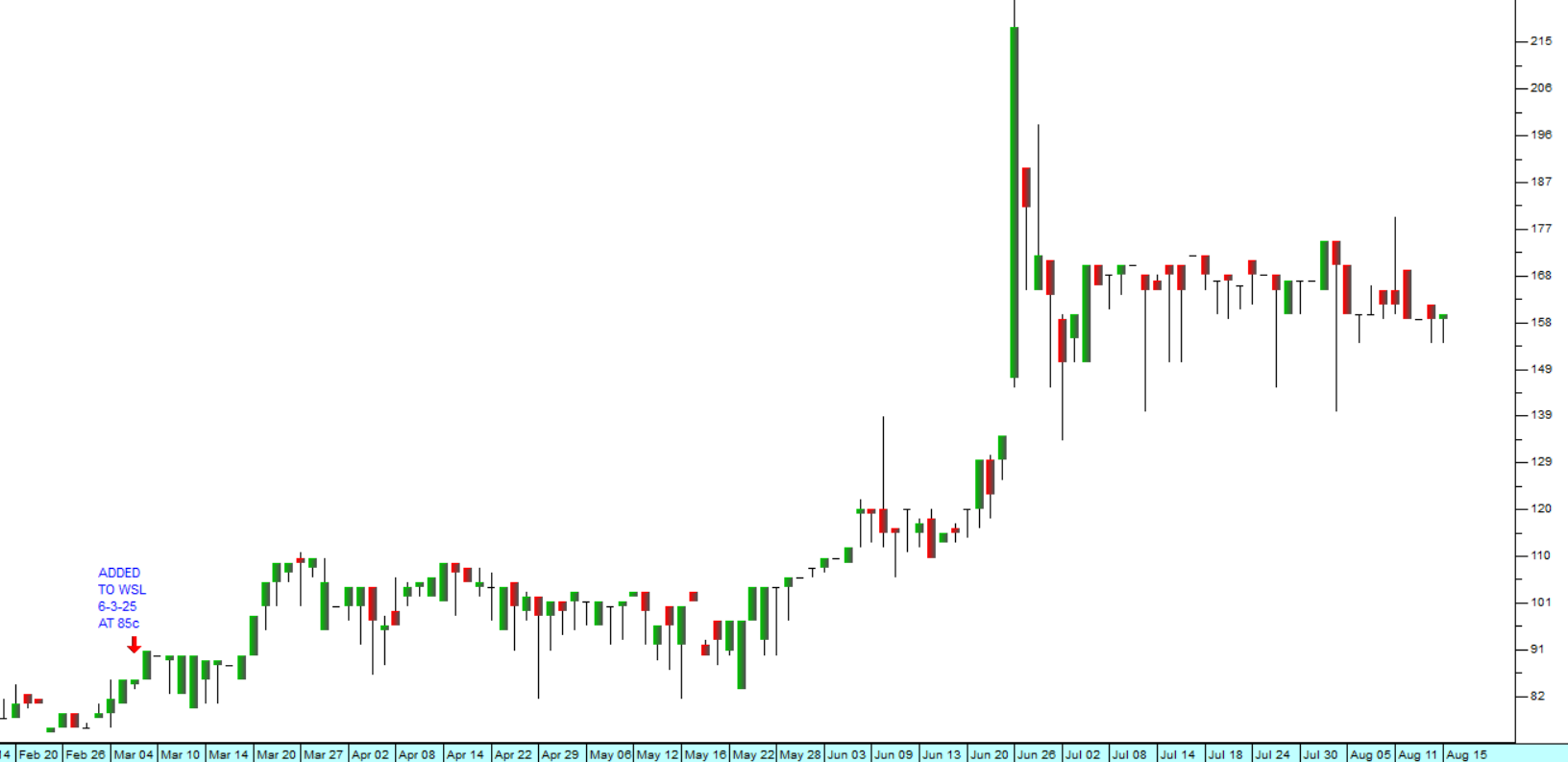

We have often stated that we believe that Naspers is worth at least R4000 per share (after the Prosus listing) – which compares with its current share price of R2510. We have no doubt that the directors of Naspers will continue to implement further unbundlings in order to pacify their numerous “N” shareholders – and this makes the share cheap for private investors at current levels. Prosus is also cheap relative to its holding of Tencent for no apparently good reason since it is internationally listed and not constrained by the JSE or the fate of the South African rand. Consider the chart of Naspers:

Naspers (NPN) August 2019 to January 2020 - Chart by ShareFriend Pro

Here you can see the impact of the separate listing of Prosus and the subsequent sell-off by institutional investors trying to re-balance their portfolios. Then in December of last year the share formed an “island” and began a new upward trend. We regard this share as cheap at current prices. It is an instutional favourite which will surely release even more value in the future. Certainly, it has a considerable distance to catch up with the value of its holding in Tencent.DISCLAIMER

All information and data contained within the PDSnet Articles is for informational purposes only. PDSnet makes no representations as to the accuracy, completeness, suitability, or validity, of any information, and shall not be liable for any errors, omissions, or any losses, injuries, or damages arising from its display or use. Information in the PDSnet Articles are based on the author’s opinion and experience and should not be considered professional financial investment advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Thoughts and opinions will also change from time to time as more information is accumulated. PDSnet reserves the right to delete any comment or opinion for any reason.

Share this article: