The Confidential Report - September 2024

At the beginning of 2024 private investors in South Africa faced three major areas of uncertainty:

- The outcome of the election here in South Africa.

- The outcome of the Ukraine war.

- The outcome of the US presidential elections.

In January 2024, all three of these were difficult to assess and could have been either positive or negative for investments.

Since January, all three have either been decided or become far easier to assess. Our elections resulted in the best possible outcome for the markets – a coalition between the ANC and the DA in the government of national unity (GNU). This combined with the rejection of populist extremism is a strong positive for markets.

The US presidential elections have been revolutionised by Joe Biden’s decision to step aside for Kamala Harris and it now looks probable that she will win in November. The Trump campaign does not seem to have a viable response, and he is losing ground right across the country.

Finally, the Ukraine invasion of Kursk has taken the initiative away from Putin and may even result in his demise before the end of the year. This will certainly remove one long-standing uncertainty from markets.

So, from an investment perspective, the outcomes of all three areas of uncertainty have become far more positive, making possible significant capital gains on JSE-listed equities.

America

The decision by the Federal Reserve Bank to hold interest rates unchanged on 31st July 2024 has been criticized because various economic indicators suggested that the economy could be headed into a recession. The surprisingly low creation of just 114 000 jobs combined with some negative manufacturing data made investors nervous and the market entered a correction which has so far taken the S&P500 index down 8,5%. But is the economy really in such bad shape? Wharton’s Professor Jeremey Siegel urged the Fed to do an emergency interest rate cut of seventy-five basis points – and then retracted that suggestion. In our view, the sharp fall in the S&P is a function of the fact that the index had gone up too far and too fast in the previous three months and was overdue for some sort of correction. As more economic data becomes available, we believe that the economy will be shown to be healthy – if a little cooler than it has been. The Fed is planning a 25-basis point cut in September and some are now calling for fifty basis points.

Jerome Powell’s remarks at the Jackson Hole conference were generally positive for the market. He indicated that the interest rate cycle was turning and that rates would now begin to fall – probably from the September monetary policy committee (MPC) meeting. The only discussion is whether the cut will be 25 or 50 basis points. Some analysts and economists, like David Rosenberg, are saying that the MPC has left it too late to begin cutting rates and that the US economy is headed into a recession next year. Our view is more optimistic. We believe that the economy will achieve a soft landing, and growth rates will come down, but not go negative – at least not for two successive quarters. Obviously, the negative sentiment is being caused by the rising unemployment rate, which is now at 4,3% - but that is still incredibly low historically.

The US economy grew by 2,8% in the second quarter of 2024 – above economists’ average forecast of 2,1%. Growth was boosted by strong consumer spending, government spending and companies building up stock levels. Personal consumption expenditures was up 2,3% - well ahead of the first quarter’s 1,5% while government spending rose by 3,9% including a 5,2% increase in defence spending.

Retail spending was up 1% in July – beating economists’ predictions of 0,3%, showing that consumers are still supporting the growth. Much of that growth came from big ticket items like motor vehicles. This does not look like an economy that is heading into recession any time soon. In our view, artificial intelligence (AI) shares especially rose too quickly and have now gone through a healthy correction to more realistic levels. The economy appears to be experiencing a productivity boom which will increase standards of living without impacting inflation. The Fed’s favourite inflation measure, the personal consumptions expenditures index (PCE), was up only 2,6% in the April-June quarter, substantially less than the 3,4% recorded in the first quarter.

There are only seven S&P500 companies left to report earnings for the second quarter and, so far, the quarter has shown a significant 13% growth in earnings on average while sales were up 5,5%. This was well ahead of earning expectations at 10,6% with the strongest sectors being tech shares, health care and financials. Nvidia’s results in the second quarter were well ahead of expectations leading to a recovery of the tech sector. At this point 80% of S&P500 companies beat their second quarter earnings forecasts and 60% were ahead of their revenue estimates. If there is a recession coming it has yet to impact corporate profits.

The level of government debt in America is alarming. In July 2024, the debt rose by $243,7bn in just one month – which takes the shortfall to $1,52 trillion for the year to date. The total government debt is now at $35,153 trillion. This is an enormous figure, and it seems impossible that it will ever be repaid by the usual means of reducing government spending or increasing government revenue. In the long term, it is our opinion that this debt will finally be resolved by either an inflationary or deflationary crash – most probably the latter. The 1929 crash was a deflationary crash, and it saw the Dow Jones industrial index fall by 89% over a period of about two-and-a-half years. We do not believe that such an outcome is imminent, however, but it is something that private investors need to keep in mind.

The US economy has been borrowing from its future to pay for the current economic boom. Basically, America has been living off its credit rating; it has a strong aversion to hard work; and it has a taste for expensive imported products that it can no longer afford. At some point the piper must be paid.

Because governments have control over their currencies and can use quantitative easing to increase the money supply to finance debt, the usual method of assessing a country’s debt is by expressing it as a percentage of their annual gross domestic product (GDP). Right now, America’s national debt is expected to be 99% of its GDP and it is expected to rise to 122% of GDP over the next ten years. You should note that as of March 2024 South Africa’s debt to GDP ratio, which is considered to be excessive, was 74,1%.

Of course, America has one enormous advantage over every other country in the world because their currency, the US dollar is used as an international reserve currency and for about 60% of all international trades. Some countries even use the US dollar instead having their own currency. This means that the US does not have to be as concerned about its debt-to-GDP ratio as other countries. It also means that they can print money using quantitative easing to get themselves out of trouble without having to worry too much about inflation – at least in the short term.

The problem is that recessions in America have become politically impossible. Reducing government spending or increasing taxes are inherently unpopular measures – so since 2001, no US government has generated a surplus. Every year they have spent more than they brought in. The US budget deficit is now well over 10 times as large as it was in 1987 and 3 times as large as it was in 2001.

In much the same way as the boom conditions of the late 1920’s were sustained by technological advances like the mass production of motor vehicles and the spread of telephone communications, the current boom is being sustained by advances in artificial intelligence (AI), humanoid robotics and the transition to cheaper solar power. A particularly good educational YouTube on government debt can be watched by clicking here.

Technically, the S&P500 has recovered almost all of the ground it lost during the current correction and closed on Friday last week just 0,33% below its all-time record high made on 16th July 2024. We tweeted on 14th August 2024 that the market would recover and go on to make further new record highs. We are now very close to that point. There is an outside possibility of a double top technically, but in our view, the S&P will be at new record highs very soon. Consider the chart:

In this highly annotated chart, it is important to note the 8-day upward trend between the 8th and 19th of August 2024. It is very unusual for the S&P500 index to go up for eight consecutive days – so when it does, you can be almost certain that it will pause for a breather before continuing up. We are now in that anticipated pause as the market consolidates before pushing to a new record high.

This correction has also been notable for its sharpness – the V-bottom followed by a rapid recovery indicates the continued presence of what we have described as the “excessive bullishness” which dominates markets. Once the previous record high has been broken and a new record high established, you should expect the market to take off again based on a new surge in optimism fuelled by the prospect of falling interest rates.

Ukraine

The incursion into Russia by Ukrainian forces appears to have been extremely well planned and executed. The Russians and NATO countries alike were taken by complete surprise. So far, the incursion has resulted in Ukraine penetrating about 35km into Russia in the Kursk region, taking control of more than eighty towns and villages and about 1500 square kilometres of Russian territory. The immediate goal is clearly to draw Russian troops away from other parts of the front line and force Russia to stretch its troops more thinly. Longer-term, the Ukrainians may be looking to give themselves a better position once the winter sets in and an advantage in any peace negotiations which may occur. They have effectively created a buffer zone inside Russia. The newly supplied armaments from NATO countries and especially America have certainly made this unexpected development possible – which means that it amounts to significant escalation in the war.

An important factor appears to be the Ukrainian’s control of the air war. They have been moving large numbers of vehicles across the Russian border into Kursk without any apparent concern about being attacked by Russian drones. This either means that they have established exceptionally good anti-drone technologies over the contested areas or perhaps that Russians do not have sufficient drones in Kursk yet. It remains to be seen whether the Ukrainians can hold on to what they have taken, but so far, there has not apparently been any significant Russian effort to dislodge them. There is no doubt that Putin will have to do everything possible to re-capture the lands taken, but he is reluctant to move too many troops away from other areas of the front line where he has been making slow progress. In our view, this incursion is definitely a significant escalation of the war and might lead to NATO countries committing their own troops to the fight. Already, some smaller NATO countries on the Russian border such as Latvia and Estonia are talking about sending troops to Ukraine.

It is becoming is becoming increasingly clear that the Ukrainian incursion into Russia is not going to be short-lived. The land which they have occupied is easy to defend because Ukraine destroyed the three bridges over the Seym River. Ukraine has established a buffer zone along the Russian border, inside Russia to protect their cities from being attacked and making it more difficult for them to be attacked with glide bombs or drones. The Ukrainians are intent on expanding the area which they control, West and South along the Russian border. At this point, the Russians appear to be incapable of stopping them or expelling them. They either do not have the troops, or they are unwilling to move their experienced troops away from other sectors of the conflict. So far, they have only been throwing inexperienced conscripts into the fight at enormous cost.

Ukraine has now captured about 2000 Russian soldiers in Kursk. As they clear the Russian defensive trench networks, many Russian soldiers are simply surrendering. These captured troops can now be used for prisoner exchanges with Russia. What is also notable is that there have been no protests in the eighty or so villages and towns that the Ukrainians have captured. There is no resistance to Ukraine similar to the resistance which developed in Crimea when the Russians invaded there.

In our view, aside from being a significant escalation of the war, the Kursk invasion has given Ukraine the initiative again and placed an enormous and almost unsustainable pressure on Putin. It has been a strategically brilliant move which exploits Ukraine’s superiority in the drone war. There is now evidence that Putin is facing some tough opposition from his own oligarchs and the Russian people. At the same time, the Democrat Party's decision to replace Biden with Harris means that Trump will almost certainly not win the November US election. putting an end to Putin’s hopes of some respite from the NATO and US support of Ukraine.

The Russian economy is teetering on the edge of collapse. Food inflation inside Russia is becoming a major problem. In a recent article, suppliers of bread, beer, dairy products, and chocolate said that prices could rise by as much as 40% next month due to high inflation, the cost of shipping and raw materials. This indicates that life inside Russia is becoming much more difficult for ordinary Russians. A 40% price hike on basic foods in a single month could easily result in food riots.

In other good news for Ukraine, the country has been able to export sixty-four million tons of goods through the Black Sea corridor in the last year including 43m tons of grain. Thousands of ships have now made the journey in defiance of Russia’s efforts to cut off this important export route. This shows the impact of Ukraine’s sea drone and missile attacks on Russia’s Black Sea fleet which has now lost about one third of its force and is no longer able to exert any pressure on Ukrainian sea exports.

Political

The newly appointed government of national unity (GNU) is facing its first major test over the controversial implementation of the ANC’s national health insurance (NHI). Business Unity South Africa (BUSA) has said that it will not sign the compact because of its opposition to the NHI in its current form. The President’s health summit was postponed as a result. The DA has long been opposed to the NHI and can be expected to insist on major changes. All the stakeholders appear to support the idea of universal healthcare but cannot agree on exactly how it is implemented. The current proposal is unaffordable for the country and could well result in lower standards of healthcare. The NHI, which has now been signed into law by the President to boost the ANC’s populist image before the election, is certain to face some serious legal challenges. Elements of it are seen as unconstitutional and already some aspects have been found to be unconstitutional. The problem is that politically the ANC cannot easily back away from the NHI without being considered a “sell-out” to the DA – but they may be forced to.

The National Party introduced the idea of prescribed assets in South Africa with the Pensions Funds Act in 1956. The idea is that institutional investors, like pension funds, are forced to invest about half of their available funds into specific government projects even if they do not want to. The ANC has been in favour of this idea, but it is opposed by the pensions industry generally because it interferes with their ability to choose the best and most profitable investments. Recently, the Financial Sector Conduct Authority (FSCA) has said that it opposes the concept of prescribed assets. The concept was removed from pensions legislation in 1989. The DA has always been opposed to prescribed assets so it could become a sticking point within the GNU.

The newly formed government of national unity (GNU) is already having a positive impact on foreign direct investment (FDI). In a recently conducted survey, Standard Bank found that as many as 95% of investors are expecting to increase their investments in South Africa. This enthusiasm for South African bonds and equities is having a positive impact on the strength of the rand and is consistent with a general shift to risk-on among international investors. The recovery of the S&P500 index from its recent correction means that investors world-wide are becoming more bullish and emerging markets like South Africa are benefiting.

The defection of Floyd Shivambu (formerly deputy president of the EFF) to MK indicates a general collapse of the EFF following its bad performance in the elections. It now seems probable that MK and the EFF will merge to form one consolidated party in opposition to the GNU. The problem with both of these parties is a lack of effective internal party structures and organization. We expect their combined performance to decline further in future elections. South African voters are not interested in the kind of populist policies which they espouse and fear that, if they got into power, they would bring more corruption.

Economy

The sharp drop in the inflation rate in July to 4,6% from June’s figure of 5,1% indicates that the South African economy is cooling rapidly. One cause of the lower inflation was the drop in food and transport prices due to the fall in the price of petrol. The producer price inflation (PPI) rate also dropped to 4,2% mainly as a result of continued falls in the price of petrol. This is a long way below the average PPI in 2023 which was 6,7%. The monetary policy committee (MPC) has set a goal of bringing inflation down to the mid-point of the target range of 3% to 6%. We are now very close to that goal. Interest rates can now be brought down to reduce the burden on consumers. We expect rates to fall by at least twenty-five basis points and fifty basis points in September 2024. The high level of interest rates is a major impediment to economic growth.

Citibank is predicting that GDP growth in South Africa will reach 2% next year due to declining interest rates, improved optimism with the new government of national unity (GNU) and the absence of loadshedding. They expect inflation to be 4,1% in the fourth quarter of 2024 and seventy-five basis point cuts in interest rates at the next three monetary policy committee (MPC) meetings. This compares with the International Monetary Fund (IMF), which is only expecting growth of 1,2%, Standard Bank which expects 1,8% next year and ABSA which now predicts 2%. We believe that 2% growth may actually turn out to be on the conservative side. The South African economy is like a light switch – it is either off or it is on – and, in our view, recent events have just flipped the switch to on. This can be seen by the on-going strength in the rand.

Retail sales increased by 4,1% in the year to 30th June 2024 – well ahead of economists’ expectations. The figure is also considerably better than May’s 1,1% growth and Aprils 0,7%. The general dealers’ sub-component, which includes supermarkets, rose by 7,3%. This shows that consumer spending is recovering as optimism increases following the falling petrol price, the end of loadshedding and the appointment of the new government of national unity (GNU). Interest rates are remarkably high at the moment but are expected to begin falling from September month which should further boost retail sales.

DebtBusters, the debt counselling company says that consumer disposable income has dropped in real terms (i.e., after inflation) by 44% in the last 8 years. This is due to the high level of interest rates, the petrol price, loadshedding and other negatives. The cost of electricity has tripled since 2016 and inflation over those 8 years has almost halved the purchasing power of the rand. Payday loans and other short-term finance are a feature of the finances of more than 80% of people applying for debt counselling. The interest charged on these types of loans is often more than 25% per annum, making them expensive.

The fintech company PayCurve says that about one fifth of salaried employees in South Africa are being forced to borrow against their next month’s salary to pay for higher costs, especially for transport, groceries, or airtime. DebtBusters reports that the average South African is spending about 62% of his/her net salaries just on the interest on their debts. This is partly because of the sharp rise in interest rates since the end of 2021. Consumers are struggling to survive and are using short-term, expensive credit to get through each month.

The BankServ take-home pay index shows that in July 2024 take-home pay surged by 5,9% over July 2023. Five months without loadshedding is clearly having an impact. The report stresses that the unemployment rate increased to 33,5% from 32,1% in the fourth quarter of 2023. So, salaries have increased, but the number of jobs available has decreased. Operation Vulindlela and the advent of the government of national unity (GNU) have boosted business confidence and helped sustain employment levels. But the drop in commodities prices has seen most platinum group metals (PGM) mining companies undertaking retrenchments.

Transnet has been given a guarantee by the Treasury to raise R25bn to upgrade its ports with particular attention to those which are used to export vehicles. The ports of Durban, East London and Gqeberha are affected. The motor industry exported almost 400 000 vehicles in 2023 despite the difficulties at major ports. Some of our ports have been ranked as the worst in the world for turnaround times and efficiency. The money will be spent over the next five years and should hopefully result in a big improvement in the export and import economies.

Transnet’s financial problems are reminiscent of Eskom. The CEO, Michelle Phillips, complains that the parastatal requires R1bn a month just to pay the interest on its debt. The solution has been to bring in the private sector to provide some of the financial muscle and management capability necessary to revamp the aging rail network and rolling stock. The final network statement is only expected to be available next month, and then private companies will be able to look at renting parts of the rail network and rolling stock. Transnet has proposed renting out part of its fleet as an interim measure. There have been some bureaucratic delays in getting the private sector involved, but applications for access to parts of the rail network are expected by September or October of 2024.

Eskom has said that there is unlikely to be any loadshedding in South Africa through the summer months. This is due to the improved performance of its fleet of coal-fired power stations. Unplanned outages averaged 12,4 gigawatts during the winter compared with last year’s figure of 16,4 gigs. The 4 gigs of additional power has enabled the company to give an uninterrupted supply which is a great benefit to the economy. The company expects to add a further 2,4 gigs as units at Medupi, Koeberg and Kusile come online.

Tax collections this fiscal year could be as much as R80bn less than was budgeted according to Investec. The bulk of tax revenue comes from personal taxes which account for almost 40%. Twenty-five percent comes from VAT and about 16% from corporate taxes. The total amount budgeted to be collected is R1860m. The increase in gross domestic product in the second half of the year, due mainly to elimination of loadshedding, may boost personal incomes and hence tax collections. The “two-pot” retirement regime may also boost taxes in the second half. Obviously, the excess of government expenditure over tax collected must be financed by borrowing.

The high level of government debt in South Africa is making it difficult to raise the money needed to expand the electricity grid sufficiently to bring renewable energy into the major centres. Eskom’s newly-formed transmission company needs to build about 14000km of transmission lines and that will require about R390bn – which the state cannot provide. Lenders are reluctant to extend further loans to Eskom which is already labouring under a R400bn debt and is unprofitable. Eskom is building new transmission lines, but very slowly at the rate of about 1400 km per annum. The solution would be to get the private sector to assist with the funding through public/private partnerships. Right now, the lack of sufficient transmission lines is the primary impediment to the building of further renewable energy in SA.

The level of unemployment in South Africa has always been difficult to measure with any accuracy because of the large informal sector which produces no records and pays no personal or company taxes. Officially, according to Stats SA, the economy has created 1,8m new jobs in the 32 months since the beginning of 2022. During that same time period, however, about 2,2m adults joined the workforce – mainly inexperienced school-leavers. The net result is that the number of people without jobs rose by about 400 000 to almost 8,4m in the second quarter of 2024. The economy’s inability to absorb the school-leaving population into the workforce has been an enduring feature of the past 15 years and has resulted in South Africa having one of the highest unemployment rates of any country in the world (33,5%). To create sufficient jobs, the economy needs to grow at 3% per annum or more and has only been managing about half of that. Hopefully, the advent of the new government of national unity (GNU) will begin to change those statistics as the bottlenecks to growth are removed.

Mining production declined by just under 1% in the second quarter of 2024. Iron ore production fell by 12% and coal production was down 2,6%. The general decline in commodity prices is impacting the SA economy which is primarily a producer and exporter of raw materials. There have been significant retrenchments, especially among the platinum group metals (PGM) mines and shafts have been closed. Obviously, lower mining production impacts negatively on gross domestic product (GDP) which fell by 0,1% in the first quarter despite the reduction in loadshedding. The Reserve Bank predicts that GDP will grow by 0,6% in the second quarter, but this forecast may be optimistic. In the year to 30th June 2024 mining production fell by 3,5% in total. Bottlenecks in rail transport and at ports have been a major impediment. Kumba had to revise its production guidance down because of logistics problems.

The Western Cape has had its budget from the central government cut by R7bn over the next 3 years. It is the third largest province by population and has the fastest growing population. However it ranks only fifth in terms of the government’s budget allocations. Limpopo receives more money than the Western Cape. The premier, Alan Winde, says that the province will initiate a dispute with the government if the situation is not resolved. The ANC government has consistently given the Western Cape less money, probably because the DA. has controlled it. This could become a major area of dispute in the newly formed GNU.

The report by the auditor general on the state of South Africa’s municipalities shows a significant deterioration from last year. Of the 257 municipalities, only thirty-four received a clean audit, while 120 have corruption investigations in progress. In addition, fruitless and wasteful expenditure rose to R7,4bn from R4,8bn last year. Of the eight metropolitan areas, only Cape Town received a clean audit. Corruption, systematic theft of resources and incompetence were rife. It is now proposed to focus Operation Vulindlela on reforming the municipalities after its great success with Eskom and Transnet. The poor level of service delivery in South Africa is a direct consequence of the mismanagement of local governments.

The Stats SA survey of crime in South Africa shows a significant deterioration from last year. The survey had a sample size of 30 000 across all demographics. Probably the most damning statistic to come out of the survey is the fact that only 28,5% of crimes were reported to the police. This shows how ordinary South Africans have completely lost faith in the ability of the police to deal with crime – which is their primary function. The reports extrapolates that there were 2,6m cases of housebreaking or burglary over the past 5 years including 67 000 murders. Two-thirds of the crimes involved the use of a firearm. These rampant crime statistics obviously have a deep impact on the level of foreign direct investment (FDI) and the level of emigration of skilled people from the country. In our view, the collapse of effective policing in South Africa under the ANC over the past 30 years is the primary cause.

The Rand

A while ago, we drew your attention to the fact that the rand was operating in a “triangle.” Triangles are periods where the chart is bounded by a descending upper trendline and a rising lower trendline. They indicate periods where the level of uncertainty in the market is decreasing steadily. From a technical perspective, the rule is that eventually the chart will break the pattern and that it will then continue in the direction of that break.

The rand is a barometer of the South African economy and the perceived stability of South Africa as an investment destination. On the domestic front, the economy has been benefiting from the end of loadshedding and more recently from the results of the recent elections which resulted in the government of national unity (GNU). These developments have had a significant impact on overseas perceptions of the country and resulted in a sharp inflow of investment funds.

At the same time, on the international front, investor sentiment has clearly shifted towards “risk-on” which benefits all emerging economies and especially the rand which is regarded as the premier emerging currency. While the equity markets of the world are continuing towards new record highs, we can expect the rand to benefit from “spillover” investment into our high-yielding but relatively risky government bonds and JSE-listed equities.

The rand broke the triangle in May 2024 and has been strengthening steadily ever since. We expect this pattern to continue. Consider the chart:

Commodities

OIL

The international price of oil is a critical element of the world economy. All products are transported at some point in their life cycle by a vehicle powered by oil – and many products have as a component an oil derivative. This means that the price of oil impacts directly on the prices of products – pushing inflation up when it rises and vice versa. The recent drop in the oil price has put more money into the hands of consumers throughout the world and that is resulting in an increase in consumer spending.

The oil price is directly impacting the presidential elections in America. The low price of “gas” feeds into the general perception that the economy is being well managed by the current administration – and so this is a positive for candidate Kamala Harris.

At the same time, because Russia is one of the world’s largest exporters of fossil fuels, the falling price of oil combined with Ukraine’s persistent attacks on oil production facilities is a major negative for their efforts to finance the war in Ukraine.

Here in South Africa, we have benefited both from the falling oil price and the strengthening rand. The combined effect has brought petrol and diesel prices down significantly in recent months. Consider the chart of North Sea Brent oil:

Here you can see that for the past two months, since early July 2024, the oil price has been in a downward trend. We expect low oil prices to continue at least until the end of the year.

GOLD

On Thursday last week (29-8-24) the gold price reached a new record high at $2526 per ounce. We drew your attention to the rising price of gold in our Confidential Report in March this year when it broke convincingly above resistance at $2060. The upward trend indicates that significant amounts of money are moving into this commodity throughout the world. International investors are becoming uncomfortable with the high prices of equities and other assets as markets move higher. The disadvantage of holding gold is that it pays no return. There is no dividend, rent or interest for holding gold. The only benefit it has is that it is the most secure investment available – but it has a zero return. This means that people investing in gold do so because they believe that other assets will fall in value at some time in the future. They are willing to forgo the 4% they could earn on US government treasury bills to have the security of holding gold. Consider the chart:

The chart shows the clear upside break in the gold price in March 2024 and the subsequent sharp upward trend. We expect that trend to continue.

Companies

CAPITEC (CPI)

As a private investor, you should always have a good proportion of your available funds invested in long-term blue-chip shares which have a track-record of performing consistently over a long period of time.

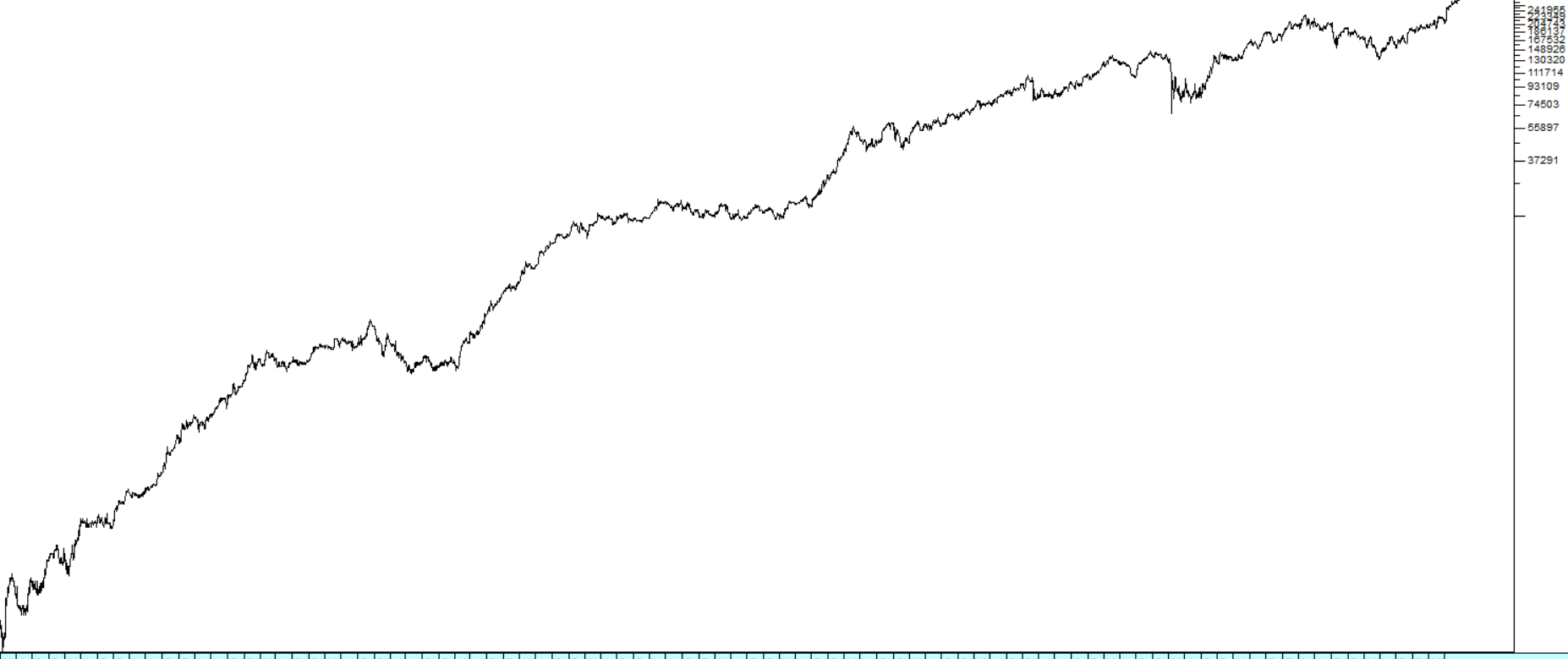

One such share is Capitec (CPI). On the 15th of March 2002, just over 22 years ago, you could have bought Capitec for 90c a share. On Friday last week the share closed at R2925.94c. Consider the chart:

And during that entire 22-year period, the company has paid regular dividends which have risen steadily each year. In the 2024 financial year the company paid 4875c in dividends. What an incredible investment! This is exactly what you are looking for – a “diagonal” that goes from the bottom left-hand corner of the chart to the top right-hand corner.

ADVTECH (ADH)

ADvTECH is a group of educational institutions divided into three divisions: 112 schools, thirty-three tertiary campuses and six resourcing brands. The operating margins of all three divisions have been improving steadily over the past few years. Their results were published on the 6th of August 2024, for the 6 months to the 30th of June 2024. Revenue was up 9% and headline earnings per share (HEPS) was up 16%. The company has very strong cash generating potential and a strong balance sheet. Technically, the share has been going up since May 2020 and we added it to the Winning Shares List (WSL) on 14th August 2023 at 1975c. Since then, it has risen to 3240c - a gain of 64% in just over a year. Consider the chart:

This share is particularly attractive to private investors because traditionally people pay in advance for education and parents are always willing to sacrifice to ensure that their children’s fees are paid. The business does have significant capital investment in schools and campuses, but it has little or no working capital which greatly reduces the investment risk. The company is extremely well-managed and a leader in its industry.

HARMONY (HAR)

The gold in South Africa is in conglomerate form. The reef is an ancient seabed that breaks the surface just south of Johannesburg and tilts downwards at an angle of about 20 degrees towards the south. Gold, being a very heavy metal, naturally settled in higher concentrations at the deeper levels – so grades tend to get higher as the mines get deeper. The deepest mine in the world is Mponeng which belongs to Harmony. The mine is over 3800 meters deep – which means that they are mining gold more than two thousand meters below sea level from the Highveld, 90km south-east of Johannesburg. Of course, at such depths the challenges of mining are enormous, but Harmony has managed to turn Mponeng into its best producer. In the year to 30th June 2024 the company increased production by 6% while all-in sustaining costs were up just 1%. The recovered grade also improved by 6% to 6,11 grams per ton. The result is that the company is expecting headline earnings per share (HEPS) to be at least 1852c per share compared to the previous year’s 800c. Technically, the share has been in a strong upward trend, and we added it to the Winning Shares List (WSL) on 16th November 2023 at 9920c per share. It closed on Friday last week at 17827c – a gain of 84% in 9 months. Consider the chart:

You can see that Harmony is benefiting from the steady rise in the US dollar price of gold – as well as its increasing productivity and grade. We believe that the gold price will continue to rise as more and more international investors seek to protect their wealth from potentially over-priced equity markets. Harmony is also a great rand hedge because its income is a function of the rand price of gold.

STADIO (SDO)

Stadio is a tertiary educational institution offering a variety of professional qualifications. It offers both face-to-face and distance learning. In the six months to 30th June 2024 the company increased student numbers by 9% to more than fifty thousand which resulted in a 16% increase in revenue and a 20% increase in headline earnings per share (HEPS). The company has no debt and cash balances of R98m which puts it in a very strong position. Most of its growth is organic and traditionally, people pay in advance for education – so like ADvTECH, Stadio has almost no working capital and is strongly cash generative. We added Stadio to the Winning Shares List (WSL) at the end of June 2024 at 525c per share. It has since moved up to 605c per share - a gain of 15,2% in 2 months. Consider the chart:

We expect that Stadio will benefit directly from the steady improvement of the economy under the new government of national unity. It is well positioned to grow by acquisition and continue its strong organic growth.

ITALTILE (ITE)

The tiling business is very competitive, and it requires significant working capital to operate. This makes it a relatively difficult business to operate, especially given the low levels of consumer spending in South Africa and high interest rates. These factors would normally make it less attractive as an investment because they add to its risk. However, Italtile has the great advantage of a very experienced and competent management which more than compensates for the difficulties of the business that it is in.

Italtile is extremely well-managed business and it is focused on controlling costs and maintaining its dominant position within the tiling industry. Now as the economy begins to improve, they are very well positioned to capitalise. In their latest results for the year to 30th June 2024 the company reported turnover unchanged while headline earnings per share (HEPS) fell by 7%. At first glance this might appear to be negative from an investment point of view, but the company has minimal debt and R1,8bn in cash in the bank. Clearly, the company remains profitable and financially stable so the only question must be “When will the share turn?” Consider the chart:

In our view it has already turned, and we have just added it to the Winning Shares List (WSL). We expect that it is well-positioned to benefit from the improvement in the economy now that loadshedding is behind us and we have the GNU in place.

← Back to Articles