Reshuffle

10 August 2021 By PDSNETThe announcement by President Ramaphosa of his cabinet reshuffle has received a mixed response from investors. On the one hand, it is clear that he has moved to consolidate his position within the government which should mean that his reform process should be less impeded than it has been. On the other he appears to have been obliged to lose Finance Minister Tito Mboweni either because Mboweni wanted to resign or because he was under pressure from the union movement – or perhaps a combination of both.

Whatever the reason, the new Minister of Finance, Enoch Godongwana, is being perceived as a step backwards and this is reflecting in the rand/US dollar exchange rate. Since the announcement, the rand has lost almost 3% of its value against the US dollar. Clearly, overseas investors do not rate Godongwana and are somewhat disturbed by rumours of his past involvement in corrupt activities.

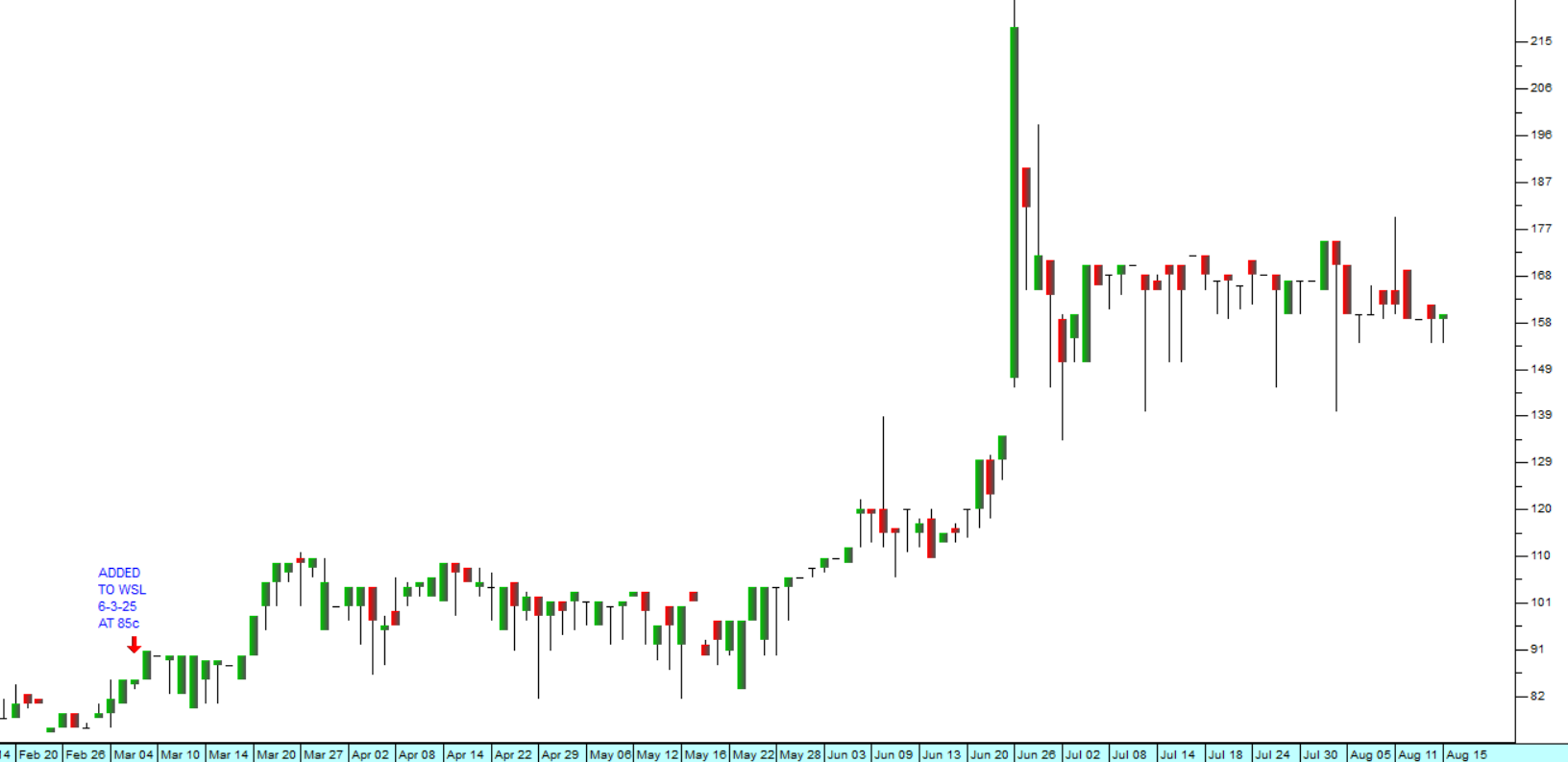

In any event, the rand which was recovering steadily from recent lows caused by the civil unrest is once again on a weakening path. Godongwana as Minister of Finance is a largely unknown force, but most are convinced that he will not be as disciplined as Mboweni was – and that probably means more taxpayer money going to state-owned enterprises and at least a slower reduction in the government debt. Consider the chart:

.png)

Here you can see the long-term strengthening pattern that was interrupted firstly by a shift to “risk-on” in international markets following the scare over the spread of the delta variant of the virus in America and then by the 9 days of civil unrest in Natal and Gauteng. Once the unrest was behind us, the rand began once again to strengthen. Then you can see the impact of the cabinet reshuffle and the loss of Mboweni. The rand has almost come back to touch the long-term trendline – and may still weaken further as international investors reassess the risks of investing here.

We believe that the rand is still fundamentally under-valued against first world currencies and remains in a long-term strengthening pattern. While we see the advent of Godongwana as a negative, unless he does something radical, the strong case for investing in South Africa will re-assert itself over time and the rand will continue to get stronger.

We also see a relationship between the strength of the rand and the new record highs on the S&P500. Confidence in the US economy equates to a general move towards “risk-on” in the international investment community – and that is always going to be good for emerging markets, especially South Africa. The high real rates of return which are available on our government bonds will lure investors away from the security of US and European T-bills, provided we can avoid shooting ourselves in the economic foot.

DISCLAIMER

All information and data contained within the PDSnet Articles is for informational purposes only. PDSnet makes no representations as to the accuracy, completeness, suitability, or validity, of any information, and shall not be liable for any errors, omissions, or any losses, injuries, or damages arising from its display or use. Information in the PDSnet Articles are based on the author’s opinion and experience and should not be considered professional financial investment advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Thoughts and opinions will also change from time to time as more information is accumulated. PDSnet reserves the right to delete any comment or opinion for any reason.

Share this article: