Murray & Roberts

24 June 2024 By PDSNETA company’s debt is critical in establishing the risk inherent when investing in its shares. High debt levels expose the company to high interest and capital payments and can swallow up a large part of whatever profits it makes. Low debt levels give the company the headroom to invest in further growth either organically or by acquisition.

At one time, Murray and Roberts (M&R) was one of South Africa’s largest construction companies and a favourite institutional share. On 29th October 2007 its share price reached a peak of R108.25 which gave it a market capitalisation of almost R360bn. On 31st August 2023 it shares were trading for just 58c and it had a market capitalisation of R257m.

The collapse of a blue-chip company can always present the private investor with an opportunity. The trick is to pick the right moment to buy in - and the danger is that you buy in too early, before all the bad news has been discounted. But whatever happens, you always have the comfort of knowing that in 2007 there were institutional fund managers filling their pockets with M&R at R108 per share – so buying in at these lower levels you are doing far better than them. And, of course, if your timing is off and the share falls further then your stop-loss will get you out with a minimal loss.

Technical analysis provides one of the best mechanisms to give you a reasonable assurance that the bottom is behind you. This is because the chart reflects that activities of the insiders in the company who will always know far more than you do about what is going on.

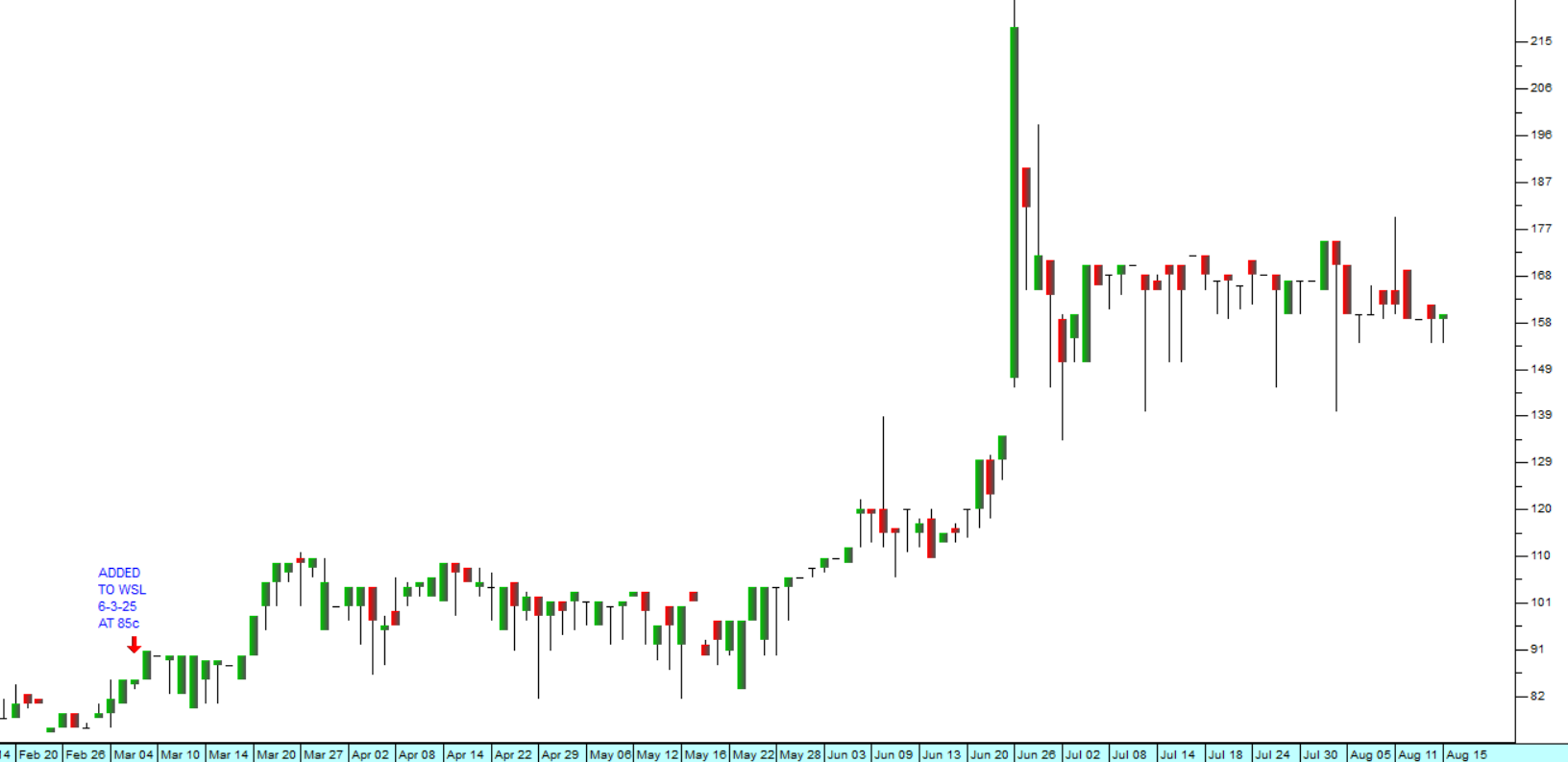

Consider the chart:

Here you can see that the M&R share price reached a bottom between September and December of 2023. There was an extended “island formation” which began and ended with low points (the red arrows) at 58c on 31st August 2023 and 59c on the 7th of December 2023.

A formation like this, followed by an upside breakout, shows that all the bad news has almost certainly been fully aired and discounted. It indicates that a point of “capitulation” has been reached where even the stale bulls have accepted that the company is hopeless. The upside breakout came a few days later when the share surged to 106c – and that was when we added it to the Winning Shares List (WSL).

Since then, it has more than doubled to close on Friday the 21st of June 2024, at 214c.

From a fundamental perspective, the company managed to sell off assets and so reduce its debt to manageable levels. This substantially reduces the risk for investors, making the share far more attractive.

On the 31st of December 2022, the company had debt of just under R2bn which compared to its market capitalisation of R1,311bn. A year later on the 31st of December 2023, it had managed to reduce that debt to just R247m and had a market capitalisation of R644m.

One final point. With the newly elected Government of National Unity (GNU) there is a significant opportunity for companies like M&R to win contracts to rebuild South Africa’s dilapidated infrastructure – so we believe that it is well positioned to take advantage of a flood of both local and international investment into this country.

DISCLAIMER

All information and data contained within the PDSnet Articles is for informational purposes only. PDSnet makes no representations as to the accuracy, completeness, suitability, or validity, of any information, and shall not be liable for any errors, omissions, or any losses, injuries, or damages arising from its display or use. Information in the PDSnet Articles are based on the author’s opinion and experience and should not be considered professional financial investment advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Thoughts and opinions will also change from time to time as more information is accumulated. PDSnet reserves the right to delete any comment or opinion for any reason.

Share this article: