Wall Street Steams Ahead

10 May 2017 By PDSNETAmerica is in the throes of a massive economic recovery. This recovery has been anticipated and discounted by the share market since the middle of 2009. The recovery is firmly based on the massive quantitative easing and record low interest rates which have existed since the sub-prime crisis of 2008. Last month the US economy created 211 000 new jobs and unemployment fell to a very low 4,4%. If anyone still thinks that the US economy is not in a recovery phase, they are not looking at the facts. That recovery will inevitably spread to the rest of the world.

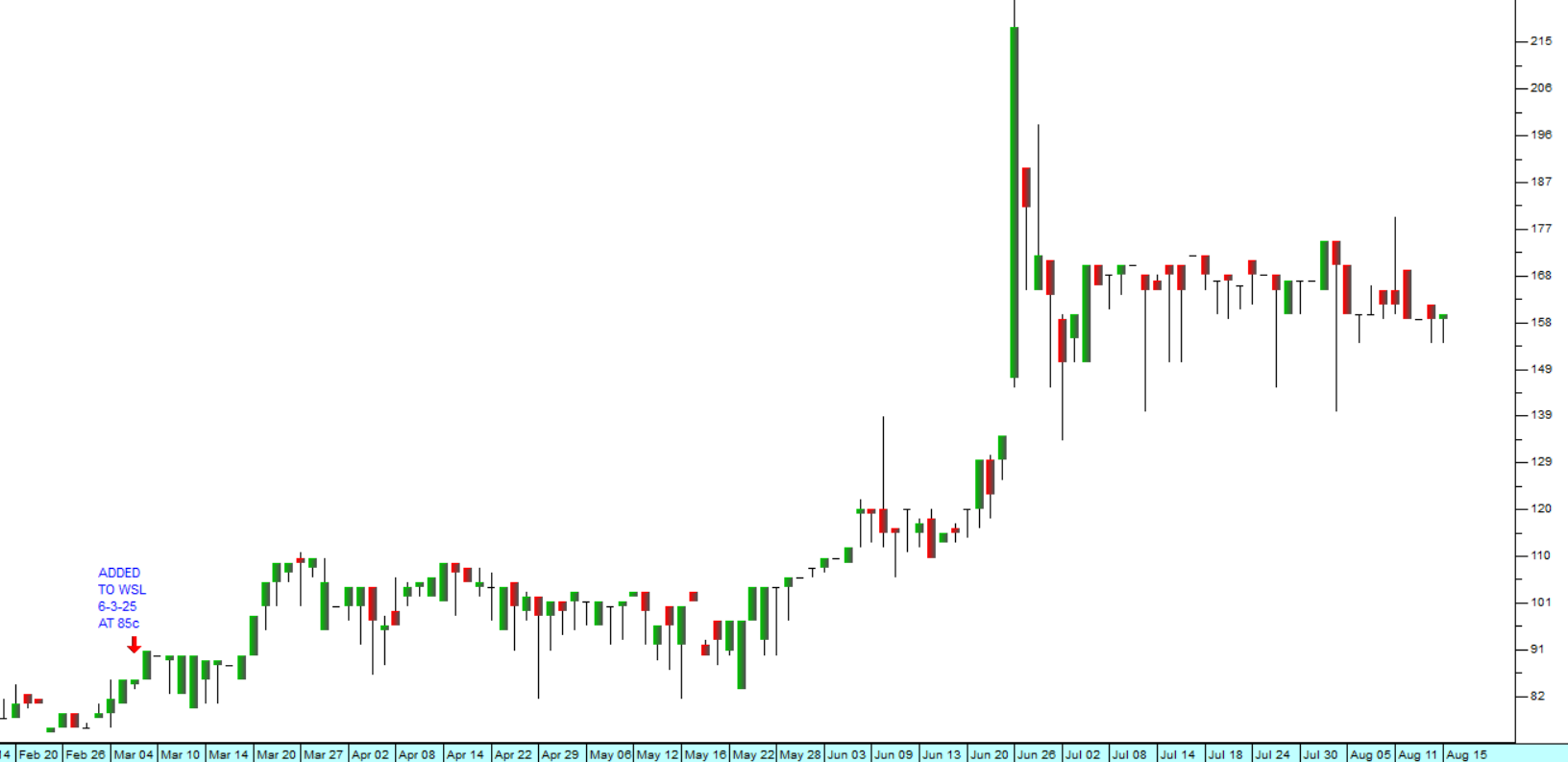

The S&P500, which is an average of the 500 largest companies on Wall Street, has been moving up steadily and made a new all-time record high on Friday last week. The implication is that there is still upside potential in this bull market. Consider the chart:

This chart should be considered in the context of the long-term bull trend shown below:

Looking at this 10-year chart, you can see the starting point for the bull trend on 6th March 2009 at 666 and the two major "touch points" in 2011 and 2016. Note the channel lines within which the bull trend is operating. Note also the fact that since the last touch point on 11th February last year, the S&P has been accelerating and looks set to reach the upper channel line in due course. Given this history it seems highly likely that the bull trend will continue for the foreseeable future.

What is interesting is to compare this with the JSE using a comparative relative strength (if you are not sure about how the relative strength works, go to the following lecture module - https://www.pdsnet.co.za/index.php/course-module/26) chart:

This chart shows the S&P in the top chart from the second touch point (11-2-16) up to date. During that period, the S&P has clearly been steadily out-performing the JSE. This is probably because of the mess which our government has been making of the South African economy, and the resultant perceived risk which is being discounted into our market. What it implies is that there is an opportunity to invest in shares on the JSE, which are almost bound to play "catch-up" with the S&P at some point.

DISCLAIMER

All information and data contained within the PDSnet Articles is for informational purposes only. PDSnet makes no representations as to the accuracy, completeness, suitability, or validity, of any information, and shall not be liable for any errors, omissions, or any losses, injuries, or damages arising from its display or use. Information in the PDSnet Articles are based on the author’s opinion and experience and should not be considered professional financial investment advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Thoughts and opinions will also change from time to time as more information is accumulated. PDSnet reserves the right to delete any comment or opinion for any reason.

Share this article: