Elimination of the Bears

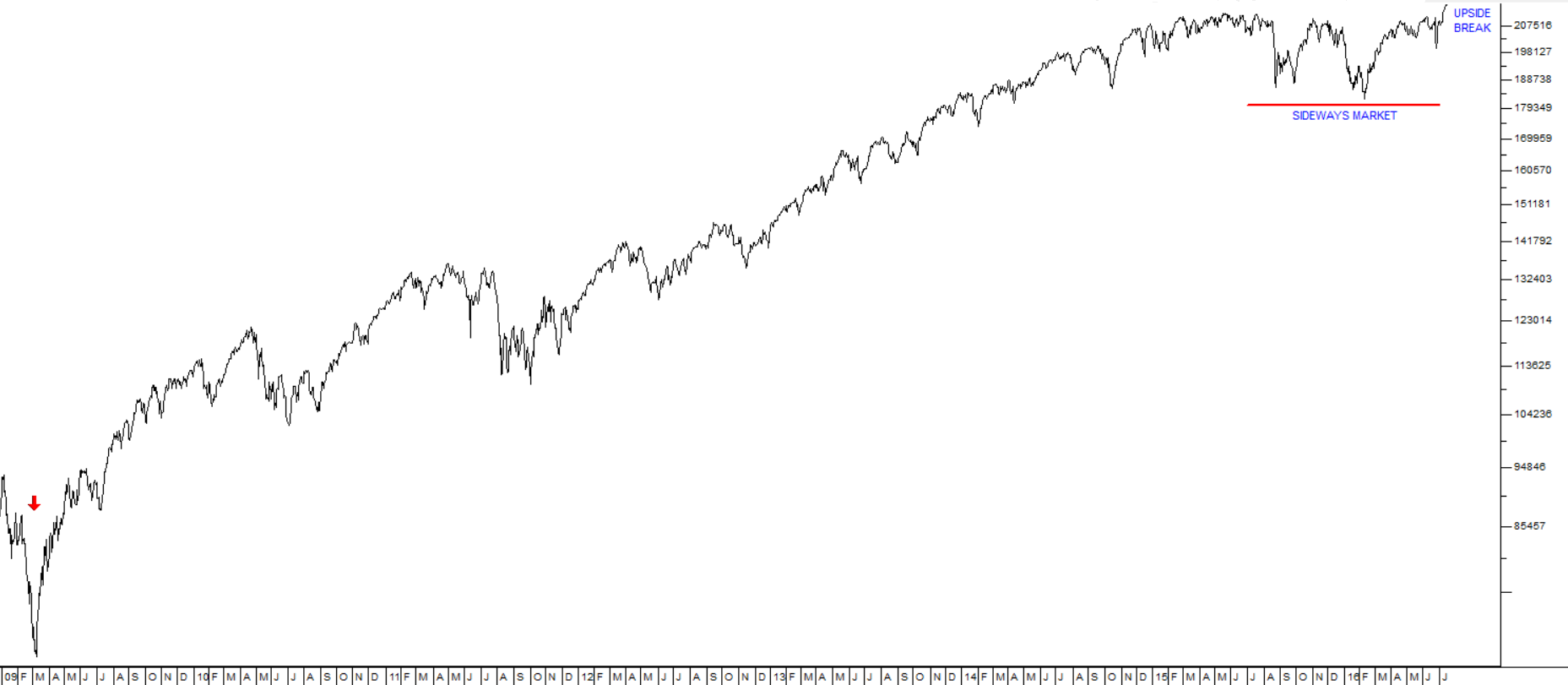

The surprising upside breakout of the S&P500 above its previous cycle high (2130 on 21-5-15) means that the bull trend which began in March/April 2009 (see the red arrow on the chart below) is now continuing. Consider the chart:

This great bull market, now more than 7 years old, looks set to break all records. Analysts in America point to the fact that the S&P500 is on a forward earnings multiple of 17 – which is a little higher than the average of around 15, but still nowhere near dangerous territory.

Technically, the extended sideways market over the past year lays the foundation for a strong upward move, now that there has been a clear up-side breakout. Generally, the longer the sideways market (or period of consolidation) the stronger the subsequent up-move. So we are expecting a vigorous and protracted continuation of this bull market.

The underlying driver will be the extraordinary monetary stimulation which has been applied to the world economy over the past five years. As confidence levels recover among consumers and businesses, we can expect the stock market to begin to discount massive increases in profit levels across every sector and industry.

And, as the bull gathers momentum, you can expect the bears to appear. These will be a variety of so-called stock market experts who for one reason or another decide to predict that the great bull market is at its end. They will publicly proclaim that a downward bear trend is imminent and that you should get out of the stock market now. However, a few weeks or months down the line, when the bull is making yet another new record high and everyone who followed their advice has lost a sizeable amount of money, they will be discredited and quickly forgotten. Then the next bear will appear with a similar story, perhaps based on different logic – and, in time, he too will be relegated to the scrap-heap. Eventually, no one will be willing to risk calling the top of the market. We call that process the elimination of the bears.

And here is the kicker. Once all the bears have been eliminated and there is no one left to call the market peak, that is the time to get scared and take your money out of the market. But while there are people still calling the top of the market in the media, you can be pretty certain that the great bull trend remains solidly in tact.

← Back to Articles