CA Sales Revisited

14 July 2025 By PDSNETRetailing in Africa is difficult with many of our leading retailers having attempted to open stores in countries to the North of us without notable success. These countries are often unstable and volatile politically. Getting adequate stock to branches has proved problematic and expensive.

It is not surprising therefore that a company has been formed which specialises in selling and marketing fast moving consumer goods (FMCG) on behalf of South African manufacturers into countries in Southern Africa. That company is CA Sales Holdings which listed on the JSE in June 2022.

CA Sales cooperates with local manufacturers to get their products into stores in a variety of African countries. About half of its business is conducted in Botswana, 20% in Namibia, 15% in Eswatini and 14% in South Africa and elsewhere. Any company which produces FMCG will certainly want to use CA Sales to get their products into Southern African countries directly without going through the traditional local retailers like Shoprite, Pick ‘n Pay and Spar.

CA Sales has specialised in the warehousing, distribution and marketing of FMCG, especially into rural areas and through the informal sector. The company is growing both organically and by acquisition.

In its most recent results for the year to 31st December 2024 the company reported that it had acquired 49% of Roots Sales for R70m. Roots specialises in selling and distributing into South Africa’s growing informal sector. The company also acquired the remaining shares of Macmobile which provides IT solutions to both formal and informal retailers.

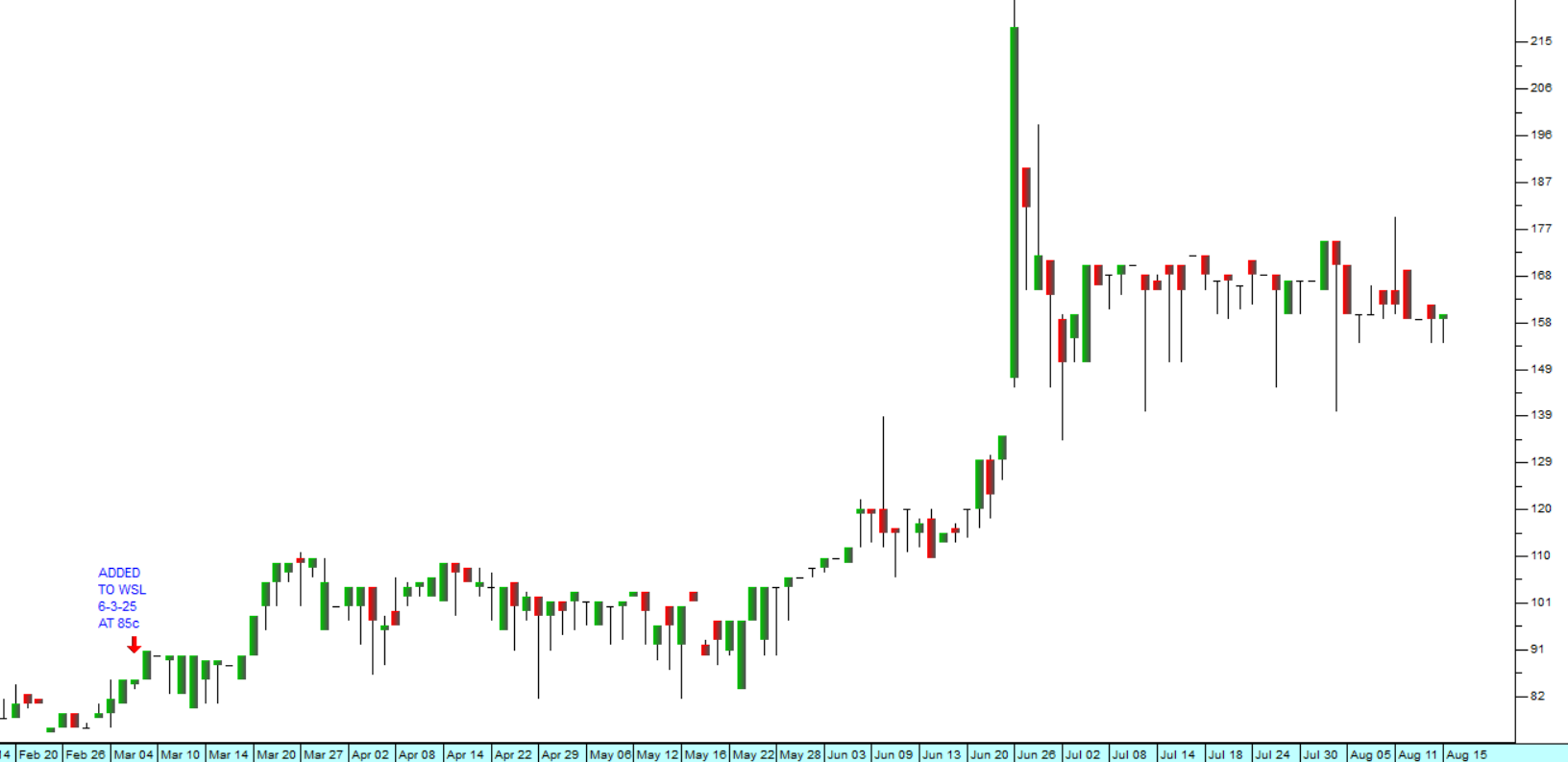

Consider the chart:

Following its listing the share was subject to considerable stagging, but eventually settled down into an extended sideways pattern in the first 8 months of 2023. It broke up out of that sideways pattern on 25th August 2023 at 775c and we added it to the Winning Shares List (WSL) on that day.

Four months later on 15th January 2024 we published an article about the company and gave the opinion that the share would continue to perform well, especially as it got more institutional awareness. At the time it had already moved up to 1150c. The upward trend has continued with the share rising steadily and closing last Friday at 1749c. Altogether, since we added it to the WSL it has risen 125%.

The company reported that in 2024, revenue was up 10,6% and headline earnings per share (HEPS) increased by an impressive 25,3%. The company is growing by expanding the range of products that it moves and by entering new markets deeper into Africa.

In our view, this is a company that will continue to take advantage of the growth in the African economy and the informal sector by solving the persistent distribution and marketing problems of FMCG producers.

DISCLAIMER

All information and data contained within the PDSnet Articles is for informational purposes only. PDSnet makes no representations as to the accuracy, completeness, suitability, or validity, of any information, and shall not be liable for any errors, omissions, or any losses, injuries, or damages arising from its display or use. Information in the PDSnet Articles are based on the author’s opinion and experience and should not be considered professional financial investment advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Thoughts and opinions will also change from time to time as more information is accumulated. PDSnet reserves the right to delete any comment or opinion for any reason.

Share this article: