Bluetel

7 July 2025 By PDSNETBluetel (BLU) is a company involved in pinless top-ups, prepaid electricity, ticketing and universal vouchers. As such it is a company with substantial repeat business from existing customers. This type of business model is attractive to investors because it implies minimal working capital and strong cash flows.

Bluetel’s purchase nearly 8 years ago of a 45% stake Cell-C on the 2nd of August 2017 for R5,5bn increased the company’s borrowings and hence its risk substantially. Cell-C was, at the time the fourth cell phone service provider in South Africa, battling to compete with Vodacom, MTN and Telkom.

At the time of making this acquisition, Bluetel was doing very well with its business model of selling various vouchers and its share price had been rising rapidly reaching a peak of 2145c in October 2016.

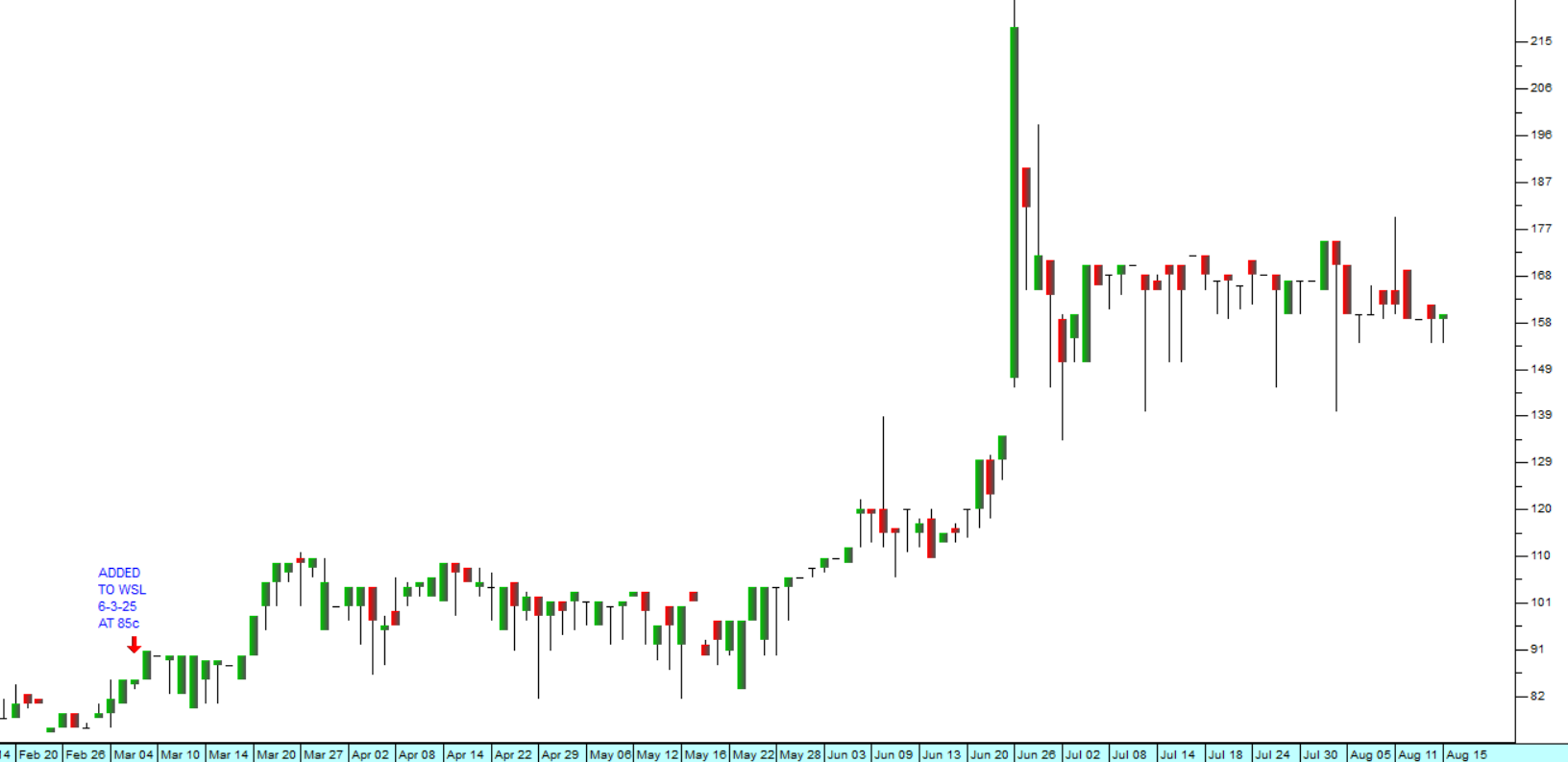

The decision to buy Cell-C was not well-received by the market and Bluetel’s shares fell steadily, especially with the additional impact of COVID-19. They eventually reached a cycle low of 161c in March 2020. From that point, company then staged a recovery, and the share climbed back up to a cycle high of 720c on the 25th of May 2022 mainly due to the general recovery of the markets after COVID-19. Consider the chart:

The management and integration of Cell-C into the Bluetel stable proved to be more difficult than expected and Bluetel shares continued to fall. At that time we advised clients to apply a downward trendline and wait for a significant upside break. That break came on 26th February 2024 when the share was trading for 360c.

There followed a period where the share recovered slowly moving sideways and upwards. The sideways movement was eventually broken and on the 23rd of January 2025, we added Bluetel to the Winning Shares List (WSL) at 610c.

What we did not know at that time was that Bluetel was busy with a major restructuring of its business centred on the idea of separately listing Cell-C on the JSE. That information was made public in a SENS announcement on the 16th of May 2025.

Since then, the share has moved up rapidly to reach a peak of 1440c at which point it was subject to some profit-taking.

At the current price of 1387c (on Friday 4-7-2025) the share has gained 127% since we added it to the WSL just under six months ago. This equates to a return of 283,5% per annum.

On 2nd July 2025 the company renewed its cautionary announcement and said, “The terms and conditions of the proposed restructure, as well as ancillary transactions, are still being developed in consultation with the Group's financial advisers.”

So, as yet, we have no details about exactly when the listing will take place or what form it will take. Obviously, when the company is listed, shareholders of Bluetel will probably receive some shares in the separately listed Cell-C, but in exactly what ratio and for what price remains unknown. A prospectus or pre-listing statement will have to be published for the new issue and the approval of both boards (Bluetel and Cell-C) must be obtained.

But the Cell-C brand is already very widely known in South Africa and the listing is likely to be a success, attracting significant institutional interest and participation. We can expect the listing to come to market on a price:earnings ratio (P:E) of around 10 so as to leave some value on the table for investors. This compares with Telkom’s current P:E of 11,5.

DISCLAIMER

All information and data contained within the PDSnet Articles is for informational purposes only. PDSnet makes no representations as to the accuracy, completeness, suitability, or validity, of any information, and shall not be liable for any errors, omissions, or any losses, injuries, or damages arising from its display or use. Information in the PDSnet Articles are based on the author’s opinion and experience and should not be considered professional financial investment advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Thoughts and opinions will also change from time to time as more information is accumulated. PDSnet reserves the right to delete any comment or opinion for any reason.

Share this article: