The Confidential Report - June 2024

5 June 2024 By PDSNETAmerica

As Wall Steet moves to new record highs and the greatest bull trend on record is extended, you can expect a parade of “experts” to pop up predicting an impending severe recession and/or the collapse of the stock market. These “bears” are saying the problems in the economy will begin to become visible before the end of this year. Some base their prediction on the yield curve which remains inverted. Some say that many American states are already in recession. In our experience, which goes back to the bear trend which began in 1969, strong bull markets are always marked by these periodic bearish predictions.

What happens is that, as the market goes up, someone decides to predict that it will definitely collapse on or about a certain date. When that date comes and goes without the threatened collapse the “expert” who predicted it loses credibility and is relegated to a growing collection of failed stock market “experts”. Then another expert decides to predict the top and again is found to be mistaken – and so on.

I call this process the “elimination of the bears”. Eventually, a point is reached where the market has risen so consistently and for so long that no one dares to predict the “top”. And that is precisely the point where you should begin to worry seriously. While you still regularly read dire predictions of financial and stock market collapse in the financial press, you are probably reasonably safe. When they begin to dry up, it is time for you to consider quietly moving back into cash.

And this raises the spectre of October 2024 which is now just five months away. October is never a good month for the stock market. For whatever reason, too many stock market crashes, notably those of 1929 and 1987, have begun in October month. This tends to make investors nervous in the run-up to October and until that month is safely behind them, the market will be nervous. In our view, October 2024 is going to be no exception. We anticipate a notable correction in October this year – but we believe it will still be too early for the start of a new bear trend.

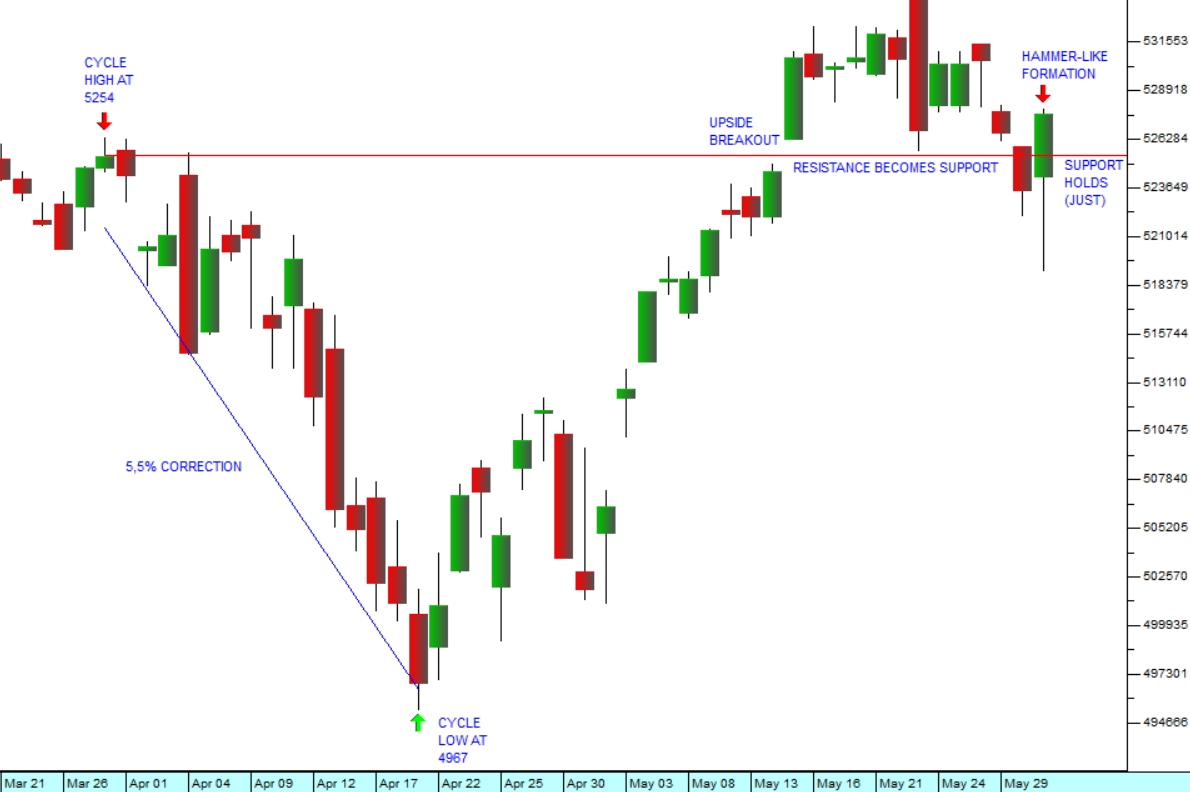

The S&P managed to break above its previous record close at 5254 and has been “backing and filling” since then. Last week, the previous record high of 5254, which is now a support level, was strongly tested. Following the positive personal consumption expenditure (PCE) figure on Friday, the index managed to close the week strongly above that level. Consider the chart:

The chart shows that the S&P is in the process of emerging from a correction. It is normal after an upside break, for the previous resistance level to become a support level – and this is what is happening. In our view, the S&P is in the process of bouncing off the 5254 level and should rise from here.

One major impending uncertainty is the outcome of the US presidential elections to be held on 5th November 2024. Donald Trump, the presumptive nominee for the Republican Party, has just been found guilty by a jury of his peers of 34 counts of falsifying business records with a view to unfairly influencing the 2016 election. In our view, this will make it more difficult for him to be nominated in July and it will damage his prospects if he is nominated.

And there may be further criminal trials before the election with the Georgia election interference case a distinct possibility. Some of the less ardent and more independent voters have already said that they will not vote for Trump if he is a convicted felon – which he now is. In the vital swing states, it will not take a great percentage shift to put Trump out of the running, especially if Biden and the Democrats continue to perform well. But there are still five long months before the election and anything can happen during that time.

A potentially major factor in this election is the fact that Trump’s rhetoric has been becoming progressively and noticeably more unhinged and extreme over the past two years. He seldom now talks about national issues like border control or the economy. Instead, his talks are mostly focused on painting himself as the victim of a “witch hunt”. He consistently attacks the prosecutors, witnesses, judges and juries of his various litigations. At the same time, it is apparent that, following the conviction and imprisonment of so many of those involved in the January 6th insurrection, he is not drawing the same crowds of supporters as he previously did. His conviction has not been characterised by massive country-wide protests as he hoped – and it seems unlikely now that, even if he is sentenced to incarceration, there will be any violent uprisings or disturbances in America.

On a more prosaic note, the US economy is showing signs that the high level of interest rates is beginning to have an impact. The economy does appear to be slowing somewhat – and that is fuelling optimism among investors about the possibility of future rate cuts towards the end of this year.

Non-farm payrolls in America rose by 175 000 in April 2024, well below the revised figure for March which was 315 000. Economists were predicting 243 000 new jobs in April – so the number was also well below expectations. The unemployment rate was slightly higher at 3,9% compared with March’s 3,8% and average hourly earnings declined by 3,9% compared with the average over the past year of 4,1%.

The decline in April 2024’s US consumer price index (CPI) to 3,4% from March’s 3,5% is another factor that has given the share market new life. Combined with last Friday’s announcement that the PCE came in at expected levels, the inflation picture appears benign. The Federal Reserve Bank’s objective is to get inflation down to 2% - so there is a distance to go and interest rates are not likely to begin falling before the third quarter. The current level of rates (5,25% to 5,5%) is considered to be restrictive and to be gradually cooling the economy and reducing inflation. Most analysts are now expecting rates to begin falling in September.

The seven high-tech shares on Wall Street - Microsoft, Apple, Alphabet, Amazon, Meta, Nvidia and Tesla - continue to dominate the market and take the S&P500 index higher. Together they produced a collective profit of $108,9bn in the first quarter of the year – more than 50% above the same quarter last year. This compares with the average gain in the S&P500 companies profits in the first quarter of 5,5%. Incredibly, Nvidia’s revenue was up over 500% and it generated a net profit of $15,24bn in the quarter.

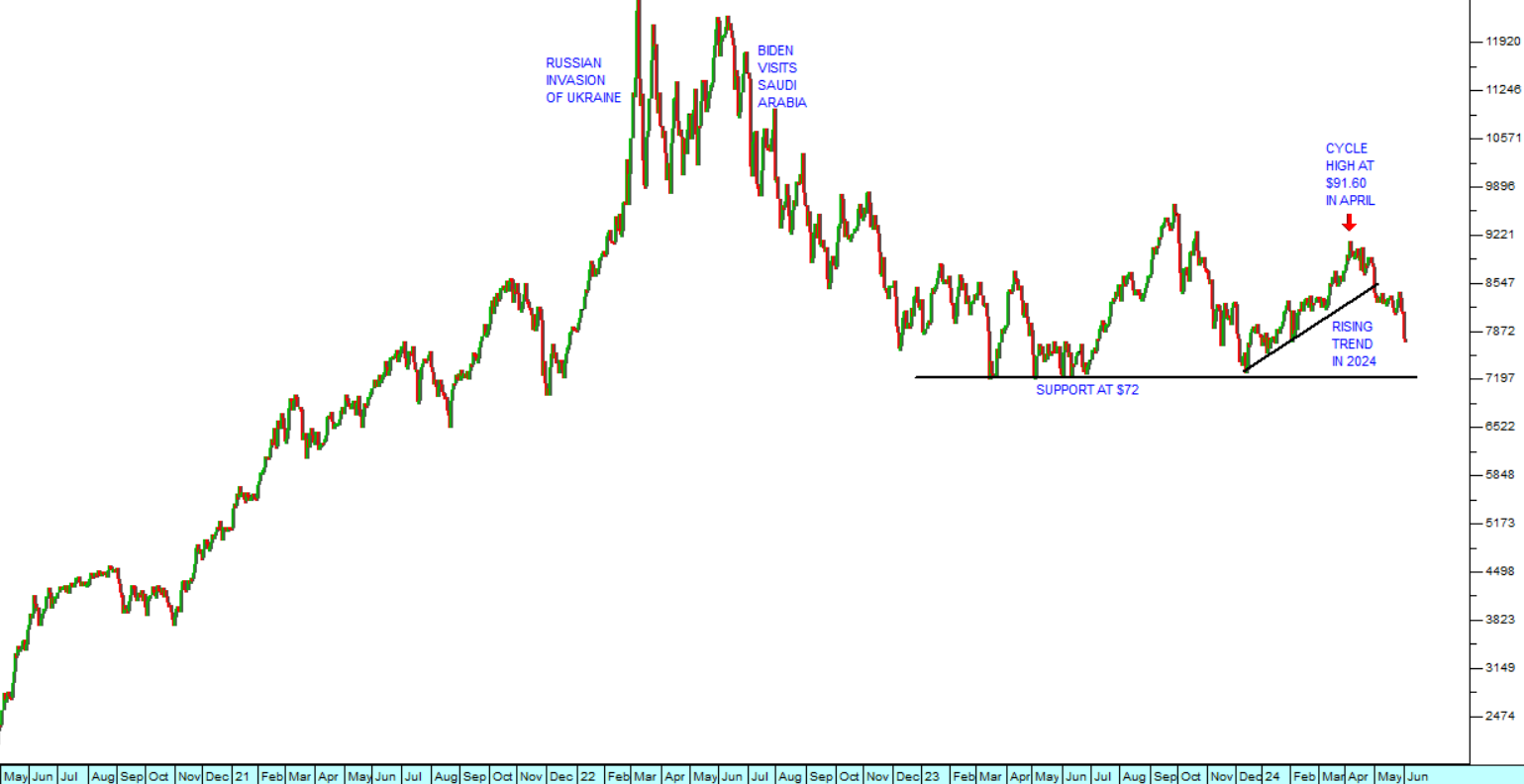

Of course, a major factor in the improved inflation picture is the fall in oil prices since April 2024. The worse-than expected jobs figure impacted oil prices causing a sharp drop in the price of Brent crude to $81. Consider the chart:

The chart shows the price of North Sea Brent oil going back to May 2020. After the Russian invasion of Ukraine in February 2022 and Biden’s visit to Saudi Arabia in June of that year, the oil price drifted down to find substantial support at $72 per barrel. Then in the first three months of 2024 the price rose again because the surprising strength of the US economy was seen as stimulating the demand for oil world-wide. In April it reached a cycle high of $91.60 and since then it has again been falling.

Obviously, the oil price is the algebraic sum of many factors, including pressure from the US to keep prices down. The Biden administration wants low oil prices to help their election prospects in November and also because of the damage low oil prices are doing to Russia in its desperate efforts to finance the Ukraine war effort. We believe that oil is also beginning to feel the impact of the steady increase in alternative energy installations and electric vehicles. We do not expect oil to rise significantly until after the US presidential elections in November.

Ukraine

Ukraine is rapidly recovering from the lack of ammunition caused by the Republican delays in agreeing the $61bn US aid package. The ammunition is flowing again, and the Russian offensive has effectively been stopped. Ukraine is now using drones to strike deep into Russia, destroying its oil infrastructure and other facilities. The arrival of US ATACMS and other long-range missiles combined with their impressive innovation in the production of long-range drones has given Russia an exceedingly difficult problem. At the same time, the first F16 fighter planes with trained Ukrainian pilots are becoming available which will severely limit Russia’s ability to deploy “glide bombs” anywhere near the front line.

Both sides are expanding conscription in order to overcome a severe shortage of manpower. There are reports that France has already deployed a small number of instructors from the French Foreign Legion to Ukraine. In our view, the deployment of NATO troops to Ukraine is an inevitable escalation in the conflict. NATO simply cannot allow Russia to win this war or to force Ukraine into an unsatisfactory peace accord. We see other NATO countries committing a growing number of troops – who will, of course, have to be fully equipped with NATO weapons.

Putin is becoming increasingly desperate and as usual, threatening NATO with nuclear war. Unfortunately, he and his government have made this threat so many times over the past two years that most NATO leaders “take it with a pinch of salt.” The sharp decline in Russian oil revenues is beginning to have a deep impact on their ability to continue financing a war which they must now realise they cannot win. There is growing evidence of internal revolt against Putin’s rule and the war. We believe that Putin’s only real hope now is that Trump wins the US elections in November and that Putin is just trying to hang on until then.

Political

The election is over and, as expected, the ANC has lost its majority in parliament. The final tally shows the ANC with just over 40%, the DA with just under 22%, MK with just less than 15% and the EFF with just below 10%. This means that the ANC will need to make an alliance with one of the other minority parties. The surprise performance of MK has made all pre-election predictions irrelevant. The EFF’s much lower support in this election means that they are not really in contention as an alliance partner. The DA’s Multi Party Charter alliance is also hamstrung by insufficient support. It now appears that the ANC will have to choose between uMkhonto we Sizwe (MK) and the DA.

In the run-up to the election, asset managers in South Africa were considering the possibility of various outcomes and in some cases taking steps to hedge against the worst of those outcomes. The most dangerous such possibility was always that the ANC would form an alliance with the EFF and that would be followed by the loss of the Reserve Bank’s independence and radical “land reform” without compensation. We think that such an alliance is now unlikely.

A far more concerning potential outcome would be an ANC alliance with MK. There are two factors militating against this. The first is the disarray within the uMkhonto we Sizwe (MK) party over Jacob Zuma’s involvement and the role of its founder, Jabulani Khumalo, where there is litigation pending. The lack of unity between Zuma and Khumalo certainly makes the party less attractive as an alliance partner. Zuma has said that an alliance with the ANC is possible provided President Ramaphosa and Pravin Gordhan are removed and populist measures like the redistribution of land without compensation are prioritised. We believe that it is unlikely that Ramaphosa would want to agree to a proposal which would force him to “fall on his sword” politically.

The best outcome, in our opinion, is that the ANC forms an alliance with the DA. This is a distinct possibility because the Ramaphosa administration’s policies are quite closely aligned with the DA and because the DA received far wider support than MK in this election. Indeed, this is what we have been hoping for since it became apparent that the ANC would lose its majority this year. Such an alliance would have about 63% of the total vote and would be politically unassailable. It is not clear whether Ramaphosa has sufficient clout within the ANC to pull this off, however.

Such an alliance would also probably enable Ramaphosa to remove his remaining detractors within the ANC and potentially replace them with DA appointments. Most notably, the DA will probably want to get control of the Ministry of Minerals and Energy and Ramaphosa would probably be happy to see the back of Gwede Mantashe.

Obviously, any major changes to the way in which the economy is run and managed will have a significant impact on foreign direct investment (FDI) and on the rand. In the longer term it will impact the value of listed shares. First prize for private investors on the JSE is an ANC/DA alliance. That will result in an inflow of FDI and a stronger rand while an alliance with MK will mean a much weaker rand and a significant outflow of investment funds.

To bolster their waning support before the election, the ANC touted the various social grants in South Africa as a great benefit to the country implemented by them. They promised that the basic income grant (BIG) which is R370 a month will be made permanent within 2 years. The truth is that South Africa’s 7,1m taxpayers are groaning under payment of social grants to more than 24 million people. About 60% of the country’s population live in poverty, mostly in squatter camps with poor service delivery. With unemployment at 32%, most families do not have a sufficient income to meet their most basic needs. The ANC sought to exploit this situation to their political advantage, despite the fact that it can be argued that, after 30 years in office, they are the ones who created it.

President Ramaphosa, no doubt under pressure from within the ANC, signed the National Health Insurance (NHI) bill into law, despite some very significant concerns by the medical insurance industry. The NHI is a populist attempt to provide all South Africans with the same level of healthcare which, on the face of it, is a laudable objective. However, the idea is simply unaffordable for this country and the ANC has not explained how it will be funded. If it were implemented it would require a substantial increase in taxes – probably VAT. This is clearly a desperate attempt by the ANC to attract votes immediately prior to the election. The bill is facing a barrage of legal challenges from many different sectors in the economy, beginning with Business Unity South Africa (BUSA), health care professionals and various political parties. Trade union, Solidarity, has already launched an application in the Pretoria high court to declare the NHI unconstitutional and invalid.

Economy

The burden of loadshedding has forced South African businesses to move rapidly towards the implementation of alternative sources of power. The government is expecting as much as 22 gigawatts of private sector renewable energy to come online in the next three years – mostly as a result of board decisions to move away from Eskom. This surge in renewables has come about as a result of the lifting of the cap on installations which President Ramaphosa agreed to about 18 months ago – and, of course, the fact that Eskom power has been increasingly expensive and until 2 months ago hopelessly unreliable. Loadshedding has also been sharply reduced as a result of improved performance by Eskom’s coal-fired generators and because of reduced demand. Notably, Eskom’s energy availability factor (EAF) has reached a record level of 70% in recent weeks. The effect of cheaper more reliable renewable energy has been to boost the local economy noticeably despite the high level of interest rates at the moment.

The monetary policy committee (MPC) of the Reserve Bank decided to keep interest rates unchanged at their meeting on Wednesday last week siting the high degree of uncertainty which existed immediately prior to the election. The MPC is expecting the inflation rate to fall to 4,5% in the second quarter of the year – somewhat earlier than previously expected. Inflation in 2025 is expected to average 4,5%. Gross domestic product is expected to be 1,2% in 2024, but could rise to as much as 1,7% if there is no more loadshedding. The inflation rate in South Africa is probably the ANC’s most valuable contribution over the past 30 years that they have been in control – and yet they have said almost nothing about it in their electioneering.

Growth prospects for 2024 are not looking good as consumers battle with high interest rates which are expected to remain higher for longer, in line with American rates. The Reserve Bank’s leading indicator fell 1,9 points in March 2024 and is 1,3 points lower than a year ago. Indications are that inflation will also remain above 5% this year despite the Bank’s efforts to bring it down to the mid-point of the target range at 4,5%. Gross domestic product (GDP) only grew by 0,6% in 2023 and is only expected to grow by 1,2% this year. We expect growth to come in higher than this because of the reduction in loadshedding, but still probably below 2%.

Standard Bank says that nearly R100bn worth of mortgage bonds in South Africa are at risk because mortgagors are behind on their payments. The 4,75% rise in interest rates since November 2021 is directly impacting bond holders’ ability to pay. Most home-owners are paying as much as 40% more in monthly instalments than they were before rates increased and many of them are first-time home buyers. Many have decided to go into debt review in order to try and meet their obligations. Being in debt review obviously means that their credit rating is impaired for future borrowing. The value of properties may fall after the elections, depending on exactly how the country is to be governed and by whom. Interest rates are expected to begin coming down in September 2024 which will reduce the pressure on homeowners.

In an article in Business Day on the 7th of May 2024, it was revealed that more and more consumers are falling victim to high interest rates and being forced into debt counselling. Debt counselling protects the consumer from his or her creditors, but also prevents them from taking on any additional debt. Debt levels, especially among middle income earners who have an income of around R35 000 a month, are becoming unsustainable with a debt-to income ratio of over 170%. Clearly, the high level of interest rates is taking a toll on the economy, forcing consumers to spend less and focus more on repaying debt. In our view the only debt which a private investor should have is the bond on their house – and even that should be paid off as quickly as possible to reach a debt-free situation. From there it becomes possible to build a capital base where you can earn an income from your investments and live on less than 100% of your income. This is the road to financial independence.

Manufacturing production slumped by 6,4% in March 2024 after five months of steady growth. The drop in production was due to the motor industry where output dropped 26%. Vehicle exports fell 27% in March 2024 compared to March 2023. The ABSA purchasing managers’ index (PMI) showed that manufacturing production was down by 2,2% in seasonally adjusted terms in March 2024. The drop in factory output may result in negative gross domestic product (GDP) growth in the first quarter. The improvement in electricity supply over the past 2 months should result in better production figures going forward.

Retail sales increased by 2,3% in March 2024 compared to February’s decline of 0,7% and January’s 2% decline. In the first quarter as a whole, retail sales fell by just 0,1%. The general dealers’ category, which includes supermarkets, increased sales by 6,4%. Sales have still not reached the levels they were at before COVID-19. Obviously, consumers are still battling with the high level of interest rates. Businesses are only just beginning to benefit from the end of loadshedding while unemployment remains high. We expect retail sales to improve later on in the year with the full impact of reduced loadshedding.

The ABSA purchasing managers index (PMI) increased to 54 in April 2024 from 49,2 in March. This shows a significant improvement in economic activity and optimism. Much of this optimism and renewed energy comes from the fact that loadshedding has been temporarily suspended in the run-up to the election and it demonstrates how important loadshedding has been as a depressing factor in the South African economy. Eskom has been able to suspend loadshedding because of a significant drop in demand as well as an improvement in the performance of its fleet of coal-fired power stations. Obviously, as we head back into winter the demand for electricity will increase and loadshedding will probably resume.

New vehicles sales in South Africa improved to just over 38 000 vehicles sold in April 2024 in according to the National Automobile Association of South Africa (NAAMSA). This is more than 2% above the year-on-year figure over April 2023. Year-on-year sales have been falling for 8 months – so this improvement in April could be a once-off aberration. Car sales were up 6% while light commercial vehicles sales fell 9%. Some of the improvement could be due to the fact that there were 3 additional selling days in April 2024 than in April 2023 because of how the public holidays fell. High interest rates and the uncertainty surrounding the elections have been a damper on car sales to individuals.

The government’s “Vulindlela” program which began in 2020 issued a report in which it claimed credit for achieving as many as 90% of its objectives to remove administrative and other bottlenecks to business. Its activities have impacted on telecommunications, transport, water, tourism and energy – but its biggest impact has been on electricity. The private sector has been freed up to massively invest in electricity generation resulting in 22 gigawatts of new power installations in progress. This, together with an improved performance by the existing fleet of coal-fired power stations has resulted in no loadshedding for two months – and that, in turn, is having a major impact on productivity throughout the economy. Work with Transnet to improve the country’s logistics is ongoing and expected to yield results once the private sector’s involvement becomes more effective. The backlog of water licences applications has been cleared and the water system has been improved. The visa system has also been streamlined to make tourism easier for foreign visitors.

At the beginning of 2021 the Department of Minerals and Energy had a backlog of over 5300 applications for mining rights. A further 2500 applications were submitted last year for approval, and none have yet been processed. The mining industry in South Africa is experiencing no growth as a result of bureaucratic inefficiency and incompetence. The country has enormous mining potential and mining could be contributing substantially to growth. Hopefully whatever new administration comes into power after the elections will be able to cut through the “red tape” and get the mining industry moving again.

The Reserve Bank has warned that the advent and spread of Carbon Border Adjustment Mechanisms (CBAM) such as are expected to be introduced in Europe between 2026 and 2034 could have a severe impact on South African exports. The European Union (EU) is projected to insist that imports are produced without excessive carbon emissions – a policy which is expected to spread to other countries in due course. The EU is South Africa’s largest trading partner and the Reserve Bank is concerned that as much as 10% of South African exports could be rejected by 2050. This would result in the loss of as many as 350 000 jobs by 2050, rising to 2,6 million jobs by the time the CBAM policy was fully implemented.

Rand

On 21st May 2024 the rand reached a cyclical strong point of R18.07 to the US dollar. We attributed that strength to a general shift in international investor sentiment towards “risk-on”. Consider the chart:

By 21st May 2024, bullishness was running rife with most world markets following Wall Street up to new record highs. Emerging markets like South Africa were benefiting directly as investors looked for assets which were relatively cheap and offering a high return.

Then international sentiment shifted back towards “risk-off” and Wall Street began to wobble. Bullish sentiment gave way to bearish, and the S&P fell back to test support at 5254. This bearish sentiment washed over into emerging markets and was immediately reflected in the rand which fell rapidly back to its current level at R18.81 to the UD$. This fall was not, as suggested in the financial press, a result of the impending elections in this country at the time. The simple fact is that when confidence fades in international equity markets, then investors pull their money out of the rand and look for more secure investments.

This is not to say that the election will not be a factor in the rand’s performance against first world currencies. It will, but the result of this election has been much anticipated and is already heavily discounted into the rand’s value. For about a year now it has been obvious that the ANC would lose their majority in parliament and the only unknown was who they would end up making an alliance with. That unknown is still out there, although the choices have been complicated by the surprisingly strong performance of MK.

In our view, the ANC’s choice of an alliance partner will have a significant impact on the rand. If they partner with the DA then the currency will strengthen and if they choose MK (or, less likely, the EFF), then the rand will weaken. In our view, predicting what they will do is almost impossible because it may well not be based on what is best for the country. In the meantime, the rand/US$ exchange rate will continue to reflect the thrust of international investor sentiment.

Commodities

PLATINUM

The latest report produced by Johnson Matthey predicts that there will be major shortfalls in platinum group metals (PGM) this year as a result of strong demand and falling supply. The price of platinum has been low for some time leading major producers like Amplats, Sibanye and Implats to close shafts and retrench workers. At the same time, Russian supply has reduced because it has over-sold its reserves of mined ore in 2023 to fund the Ukraine war. Johnson Matthey is expecting a 2% shortfall in platinum supply which is more than 500 000 ounces. At the same time the palladium market is expected to experience a shortfall of 360 000 ounces this year. The palladium price has been falling this year, partly because of the move to battery-electric vehicles (BEV) which is taking place in first world countries. Both metals could experience a rebound in the coming year which would be good for the JSE-listed mining companies.

IRON

The bottlenecks at Transnet are impacting the production of iron from the country’s largest producer, Kumba. Stats SA reports that iron ore production fell by 6,7% in the first three months of 2024 compared to last year. For example, Kumba has reduced its production guidance for the next 3 years to 35m tons from 37m tons. Before the problems at Transnet, it was expecting to produce around 40m tons in 2024. The report also shows coal production down 9,1% and platinum group metals production down 3,6%. Clearly, one of the greatest challenges to be faced by whatever administration takes over after the elections will be to revitalise the mining industry by getting Transnet back on track.

Companies

The markets of the world, led by Wall Street, are in correction within a bull trend. The JSE always tends to be more volatile than first world markets and so, as you would expect, it has fallen further in the correction and faster. Consider the chart of the JSE Overall index over the past two years:

You can see here that our overall index reached an all-time record high about 16 months ago on 26th January 2023. After that, it moved sideways and downwards, buffeted by both external and internal factors. About a month ago, on 20th May 2024 it came close to that record high, but then fell back as Wall Street began its current correction.

If you compare the JSE-Overall index with the S&P500 you will see that our market has fallen further and faster than Wall Street – as you would expect. This also means that we can expect it to recover more rapidly and more dramatically when the cycle turns. However, in the medium term, we can expect it to follow Wall Street up to new record highs.

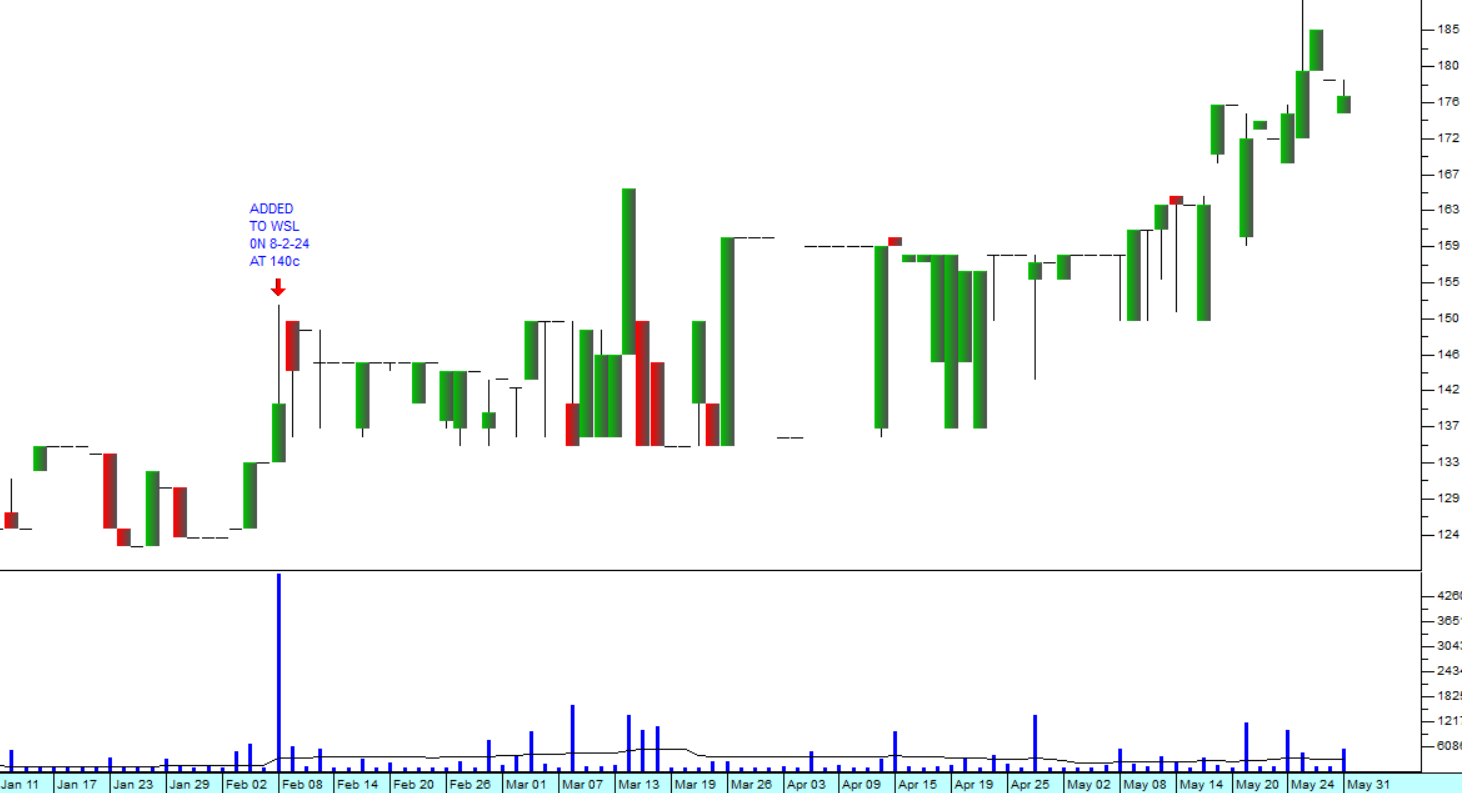

ISA HOLDINGS (ISA)

ISA is a technology company which specialises in selling and maintaining computer security systems. This type of security is a growing field which almost every large corporate has to have. As an investment, ISA is one of the best because it is highly profitable and receives about 88% of its revenue in the form of monthly debit orders for continuous services. In its results for the year to the 29th of February 2024 the company reported revenue up 33% and headline earnings per share (HEPS) up 35%. We added ISA to the Winning Shares List (WSL) on the 9th of February 2024 at 140c. It has since moved up to 177c. It is trading on a P:E of 9,37 and a dividend yield (DY) of 8,54%. The company said, “The high proportion of subscription derived turnover in the current reporting period is indicative of the trend in terms of which customers are showing a preference for subscribing to consumption-based security solutions which offer a heightened level of flexibility and scalability.” In our view, even at current levels, it still represents excellent value. Consider the chart:

We believe that over time this share will become an institutional favourite.

BALWIN (BWN)

We have frequently drawn you attention to this share in the past. It is a property developer that makes money by building and selling mostly residential units in secure complexes. The nature of its business is that there are long lead times between beginning with a “greenfields” project and realising the full value of that project. Much depends on the state of the economy and the market for residential property. This tends to make the company’s income and profits both volatile and unpredictable – which is something that investors generally do not like. Consider the chart:

As you can see here, the share has been falling steadily since the beginning of 2021 – because of its volatile revenue and earnings stream. To overcome this problem, instead of selling all the units which it completes, it is beginning to keep some of them and rent them out. This is giving the company a steadily increasing “annuity” income. If they continue down this path their revenue and profits will become far more stable and predictable – which will inevitably result in the share being re-rated by investors (especially institutional investors) at some point.

Right now, however, the share is trading for just 189c against a net asset value (NAV) of 858,49c – which means that it is trading for just 22% of what it is worth on paper. And this NAV mostly consists of very solid property assets. It includes little or nothing in the way of intangible assets.

In its financial statement for the year to 29th February 2024 the company showed the value of “Developments Under Construction” as R6,3bn and against that it had “Development Loans and Facilities” of just R1,1bn – which means that its balance sheet is strong and stable. Its finance cost was just R50,6m for the year – less than a quarter of its total comprehensive income.

We view this share as a bargain that should be accumulated at these low levels. At some point in the future the value of these shares will inevitably be realised and investors will make a substantial capital gain.

LEWIS (LEW)

Lewis is a well-known South African furniture and appliance retailer. It has a total of 869 stores, of which 138 are located outside South Africa. What makes this share attractive is that it is trading on a P:E of just 5 and a dividend yield (DY) of 8,5%. Even in the difficult economic environment with low consumer spending, it is managing to grow both its sales (up 4,7% in the year to 31st March 2024) and its headline earnings per share (up 7,1%). The company has very low gearing at 11,7% of the value of its assets and a very strong balance sheet. This has enabled it to take advantage of the difficult economic environment to acquire new retail space at low rates and to buy back its own shares in the market at bargain prices. During the year it opened 29 new stores and bought back R170m worth of its own shares at an average price of 4082c per share – which compares with their current price of 4706c. Consider the chart:

Lewis is a quintessentially South African company whose fortunes are a direct function of the economy. Interest rates in South Africa are expected to begin falling towards the end of 2024 and when they do “big ticket” retailers like Lewis will benefit.

We added them to the Winning Shares List (WSL) on 1st December 2023 at 4150c. They have since moved up to 4706c. In our view, their current DY and P:E combined with their very low gearing make them a bargain investment at these levels.

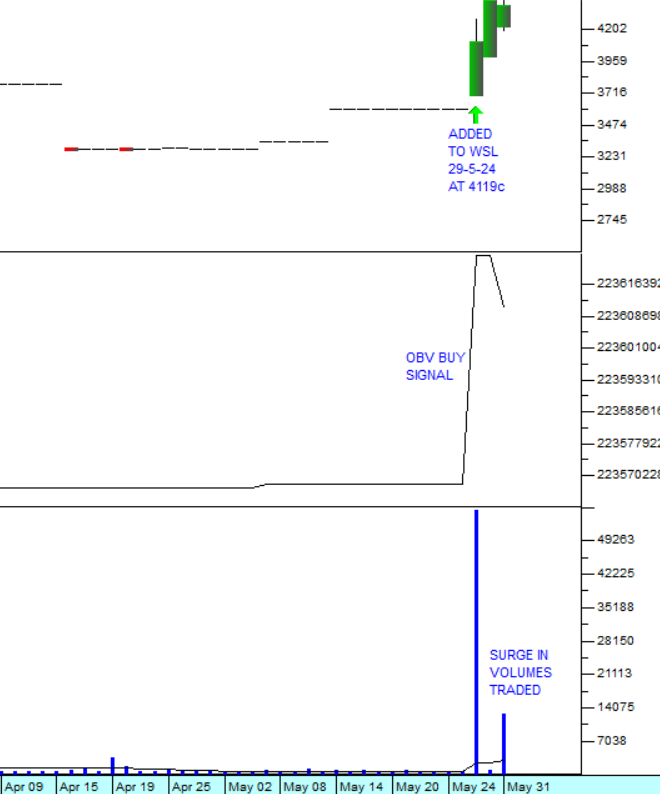

AFRICAN MEDIA ENTERTAINMENT (AME)

AME is a fledgling company which owns a variety of radio stations and other media outlets, including Moneyweb. It is in the service business and derives most of its revenue from advertising on its various platforms. Obviously, its performance is a function of the state of the economy. In its results for the year to 31st March 2024 the company reported revenue up 8% and headline earnings per share (HEPS) up 63,5%. This result has led to increased interest in the share and it gave a clear on-balance-volume (OBV) buy signal on 28th May 2024 which prompted us to add it to the Winning Shares List (WSL). Selling advertising in the modern world is difficult because there are so many on-line advertising options available. AME’s traditional radio broadcasts and web sites have been competing for subscribers and regular listeners with a variety of other options. Despite this, the company has managed to carve out a definite value proposition which advertisers find attractive.

As an investment the share is fairly thinly traded with just over R100 000 worth of shares changing hands each day. Volumes have been increasing in recent months, and especially after the publication of its 2024 results. Consider the chart:

The chart shows a candle stick chart at the top, and OBV chart in the middle and a volume histogram at the bottom. You can see the surge in volumes traded, combined with the rising price which resulted in a clear OBV buy signal.

DISCLAIMER

All information and data contained within the PDSnet Articles is for informational purposes only. PDSnet makes no representations as to the accuracy, completeness, suitability, or validity, of any information, and shall not be liable for any errors, omissions, or any losses, injuries, or damages arising from its display or use. Information in the PDSnet Articles are based on the author’s opinion and experience and should not be considered professional financial investment advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Thoughts and opinions will also change from time to time as more information is accumulated. PDSnet reserves the right to delete any comment or opinion for any reason.

Share this article: