The Confidential Report - April 2024

3 April 2024 By PDSNETAmerica

Core inflation and the consumer price index (CPI) in the United States were higher than expected in February 2024 on month-to-month basis and from the previous year. The CPI rose 0,4% in the month and 3,2% from February 2023. Core inflation was also up 0,4% on the month and 3,8% over the year. The monetary policy committee (MPC) is mostly concerned with core inflation (which excludes food and fuel) and it has proved to be very “sticky” and difficult to bring down to their objective of 2%. At its meeting on 20th March 2024 the MPC held interest rates unchanged and said that they still expected to reduce rates by 25 basis points three times before the end of 2024. The market took heart from the announcement and is pricing in the first rate cut at the MPC’s meeting on 11th June 2024. This means that they expect the committee to keep rates unchanged when they meet on 1st of May 2024.

On Good Friday when the markets were closed, Personal consumption expenditure (PCE) inflation, excluding food and energy for February 2024 was reported. The figure came in at 2,8% year-on-year and was up 0,3% in the month. The print was in line with the expectations of economists and hence should not impact the markets significantly. The PCE is the Fed’s preferred measure of core inflation, and their target is to bring it down to 2% in time. Consumer spending, on the other hand, was up 0,8% in February – well ahead of average predictions of 0,5%. Personal income rose by 0,3% - slightly less than the 0,4% which was predicted.

The presidential elections set for November this year are a repeat of what happened in 2020 with Biden up against Trump. Trump is facing four separate indictments in state and federal courts and is trying desperately to postpone the outcomes until after the elections. He hopes to be able to squash them if he wins. He also has massive financial problems with his attorneys informing the court in New York that he is unable to post a bond for the $454m which he has to pay to that state as a result of his civil fraud conviction. On 26th March 2024 the appeal court gave Trump ten days to post a reduced bond of $175m, giving him some breathing space and potentially allowing him to realise his shares in Truth Social. Biden is benefiting from reduced inflation rates and strong growth in the US economy and a stock market that is setting records. If the Fed begins reducing rates in June or July this year the economy will get a boost immediately before the November elections. Biden has lost some support, especially among younger first-time voters who see his failure to curtail the war in Gaza as a problem.

The S&P500 index ended the first quarter of the year at a new record high of 5254.35. It has gained 10,2% in the quarter which is the strongest growth in the first quarter for the past five years. Nvidia led the gains on the back of the excitement about artificial intelligence (AI). It climbed 82,5% in the quarter and 14,2% in March month alone. Tesla was the worst share in quarter falling 29% because of low demand, pricing pressure and fierce competition from Chinese EV manufacturers.

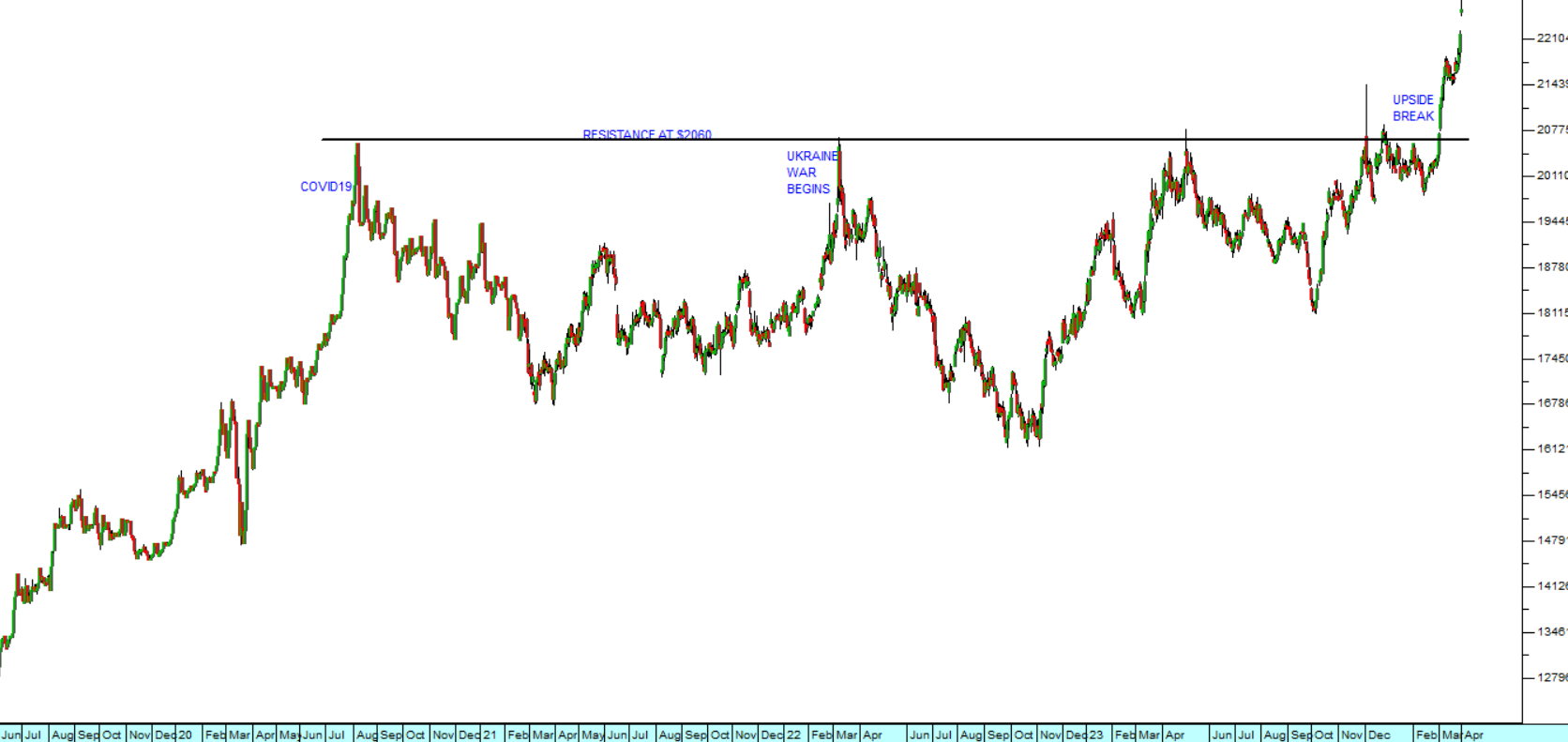

Consider the chart of the S&P500 index:

The chart shows the strong upward trend of the S&P500 index since its cycle low of 4117 made on 27th October 2023. After some “backing and filling”, the index broke up through its previous record high at 4796 and continued to accelerate upwards. On Thursday last week it reached a new all-time record high at 5254.35. At this level it is trading on a P:E of 28,52 – which is still well below the peak of 35,96 that it reached in January 2021, before COVID-19. In our view it can still rise substantially from current levels. Our calculations indicate that it will reach a high of 6458 sometime in the next two years.

One of the elements of rising inflation has been rising fuel prices since the start of 2024 – caused in part by the rising US dollar price of oil. North Sea Brent oil has found strong support at around $72 per barrel. This year the price has moved up off that support and it now trades for $87 a barrel. If this new upward trend develops further, it will have three consequences:

- It will impact the inflation rate in America and throughout the world.

- It will be negative for Biden’s prospects in the November elections.

- It will give Russia additional revenues to pay for their war against Ukraine.

Consider the chart:

This shows that initially the Ukraine war caused oil prices to spike and then, following a visit by President Biden to Saudi Arabia in June 2022 the price began to fall. Then during 2023 the price stabilised and repeatedly tested the $72 support level, before beginning to rise again in 2024.

Ukraine

The farcical re-election of Putin for a further 6 years in office was opposed by thousands of Russians who protested against the elections at polling stations across the country. There was no independent verification of the results, and Putin’s most serious opponent, Alexei Navalny, was murdered in an Arctic prison just before the election took place. It is clear that Putin cannot be removed from office by any democratic process and that the election was in no sense “free and fair”. The result was widely anticipated and expected. Clearly, Putin will eventually have to be removed by other means – probably killed by one of his own inner circle.

The attack on the concert hall near Moscow by the Islamic State Group comes at a difficult time for Putin. The attack resulted in 143 deaths and at least 350 were injured. Essentially, the attack can be seen as a failure in intelligence since it was completely unexpected. Putin’s reputation as a strong man who can protect Russians has been further undermined. The incursions by the Russian militants into Russia where they attacked the cities of Belgorod and Kursk have further undermined Putin’s reputation and forced the Russian army to divert resources away from the fight in Ukraine. At the same time, Ukraine has conducted drone attacks on at least 12 oil refineries deep into Russian territory. It is estimated that these attacks have cut oil production by as much as 12%.

At the same time, President Zelensky has told the US congress that if they don’t provide the promised aid, Ukraine will be forced to give up more territory to the Russian invaders. He says that even the big cities in Ukraine are now vulnerable due to a lack of ammunition and air defences. There is a possibility that the Speaker of the House, Mike Johnson, might agree to a pathway to approving aid for Ukraine if Democrats in the House support him so that he avoids losing the speakership. If he agrees to bring the $95bn aid package (which includes $61bn for Ukraine) to the House then he will receive the votes of many Democrat members. However, doing that will not endear him to the MAGA Republicans in the House.

In our view, the situation in Europe is now at a critical junction. Our perception is that in the unthinkable event that Ukraine loses the war, then it is more-or-less inevitable that NATO and Russia will be at war shortly thereafter. On the other hand, if Ukraine gets much-needed support from the US and possibly troops on the ground from countries like France, it could re-take Crimea quite easily - and that loss would almost certainly spell Putin’s political doom. Putin is close to the point now where he sees Russia as being at war permanently – which is quite similar to the point reached by Hitler in Germany in the second World War and even Trotsky’s ideas of perpetual war in Russia after the revolution in 1917. He has shifted the Russian economy over to a war footing and is conducting widespread conscriptions. The NATO countries have not yet reached anywhere near that point. There is certainly a move towards producing more military hardware and there is talk of committing their troops, but, as yet, NATO countries, and especially America, have not really committed fully to idea of beating Putin once and for all. Their lack of commitment, combined with the possibility that Trump could win in November is what gives Putin hope.

Political

President Ramaphosa has been given authority by the ANC’s National Executive Committee (NEC) to decided what to do with those ANC members on the party’s election lists who were accused of state capture by Chief Justice Raymond Zondo in his report. Those accused include Gwede Mantashe, Zweli Mkhize, Malusi Gigaba and David Mahlobo among other senior people in the ANC. Most have not yet been brought to trial, but apparently Mkhize is back on the list of candidates despite having resigned from his position over accusations of corruption. Obviously, if they are included, then the ANC’s “step aside” rule becomes farcical. Ramaphosa is facing criticism for being too lenient in dealing with corruption in the ANC. The ANC is fighting off a serious effort by the DA’s alliance to displace them as the ruling party. At the same time the new uMkhonto weSizwe party, with Jacob Zuma’s support, is taking a large slice out of the ANC’s support in Natal.

The raid on the home of the Speaker, Nosiviwe Mapisa-Nqakula, supported as it is by the testimony of a section 204 witness and other evidence, comes at a very bad time for the ANC immediately prior to the election. It is evidence that the ANC has been unable to control and manage endemic corruption within its ranks. All-in-all the ANC’s election prospects are becoming steadily worse as 29th May draws closer.

The latest polls by Brenthurst show the ANC’s support falling to 39%, while the DA’s coalition is at 33%. uMkhonto weSizwe under Jacon Zuma is at 13% and the EFF is at 10%. These results indicate that the ANC will be forced to compromise with the smaller parties to form a government, and that the DA alliance will not garner sufficient votes to unseat the ANC. What appears to be the theme of all polls so far, including the ANC’s is that they will get somewhere around 40% or less of the vote in the coming election. This is likely to have significant consequences for the management of the country and the economy in the next five years.

The Minister of Finance, Enoch Godongwana, unexpectedly announced on 13th March 2024 that the Social Relief of Distress grant would be increased by R20 to R370 per month. This will cost the fiscus an extra R180m a month or about R2,16bn a year. In our view, this is a thinly disguised attempt by the ANC to garner more votes in the up-coming elections. Nothing was said about this increase in the budget less than a month ago at the end of February 2024. The ANC is becoming more and more concerned about its showing in the polls, especially after the desertion of Jacob Zuma to the newly-formed uMkhonto weSizwe party. We should expect more government expenditure aimed at improving the ANCs popularity as the election draws closer.

The water crisis in Johannesburg and eThekwini (Durban) is becoming a major election issue for voters. Both cities have recently experienced major and persistent water outages which are rivalled only by electricity loadshedding at its worst levels. In these major centres, where the ANC is already at a significant disadvantage in the coming elections, the provision of water will certainly impact the results. The water system in both metros is dilapidated and falling to pieces maintained only by crisis management moving from one water outage to the next without sufficient planned maintenance. The lack of water affects both consumers and those businesses which have to have water to function. The quality of water is also in question with as much as 46% of the water provided considered unsafe by water experts.

Economy

The monetary policy committee kept rates unchanged at their March meeting, as expected, and said that rates would probably remain high for longer than expected. The MPC said that they only expect headline inflation to fall below the 4,5% mid-point of the target range at the end of 2025. Interest rates are now only expected to begin falling from November 2024 and there are only expected to be two 25 basis point cuts before the end of the year. The MPC now predicts that inflation will be 5,1% for the whole of 2024 with growth in gross domestic product (GDP) of 1,2%.

Retail sales fell 2,1% in January 2024 when compared with January 2023. This shows that consumers are taking strain from the raised level of interest rates combined with loadshedding and the low growth rate of the economy. December 2023’s retail sales figure was upwardly revised to 3,2% growth showing that Christmas sales were relatively good. Consumers appear to have over-spent at Christmas and not allowed sufficient funds to get through January month. Interest rates are expected to begin falling in July 2024, provided that the US Federal Reserve Bank reduces rates in June as expected. The price of fuel has been rising in line with the rising oil price which has also put further pressure on consumers.

Business confidence as measured by the RMB/BER business confidence index fell 2 points in the 4th quarter of 2023 and is down a further point in the first quarter of 2024. The business environment is becoming more difficult with loadshedding, escalating crime, high interest rates and the logistics problems at Transnet. The global environment is also making it more difficult to export products to the rest of the world. The index fell to 30 in the first quarter, which is well below the neutral level of 50. As many as 70% of businesses say that they are unhappy with the business environment and their level of profitability. In the run-up to the general election on 29th May 2024, there is also considerable political uncertainty.

Gross domestic product grew by just 0,1% in the last quarter of last year – compared to the 3rd quarter’s negative growth of 0,2%. This means that the economy narrowly avoided falling into a technical recession. The growth was also less that the 0,3% that economists were predicting. For the whole of 2023 the economy grew by 0,6% - a significant drop from 2022’s 1,9% growth. High interest rates and falling commodity prices combined with loadshedding and the logistic problems at Transnet are constraining growth. Growth in 2024 is only expected to come in at about 1%. This growth level means that the economy will not be able to absorb the huge numbers of school-leavers entering the work market and thus unemployment will continue to be a problem. The low growth does not bode well for the ANC in the coming elections.

Negatively affected by the trade deficit, the current account fell to a massive R165,5bn deficit in the final quarter of last year - up from a deficit of R34bn at the end of the previous quarter. For the whole of 2023, the deficit was 1,6% of gross domestic product (GDP) up from 2022’s 0,5%. The problem of falling commodity prices has negatively impacted the receipts of mining companies. In 2021, when the boom in commodities was still going, the country achieved a surplus equal to 3,7% of GDP.

Government departments collectively owe the municipalities just over R22bn – the age analysis of this debt is R1,6bn on 30 days, R730m on 60 days, R780m on 90 days, R695m on 120 days, R650m on 150 days and R960m on 180 days. The municipalities, in turn, owe huge amounts to Eskom and the water boards. The Public Finance Management Act (PFMA) stipulates that all these debts should have been paid within 30 days. These figures show the extent of financial mismanagement present in almost all government departments.

The Building and Construction sector is taking strain with building plans down in the 3 months to 31st December 2023. Confidence levels (measured by the FNB/RMB index) fell by 16 points to 27 – which means that more than 70% of the people surveyed in the industry said that they were unhappy with conditions. The sector employs thousands of semi-skilled and unskilled workers so its decline will have a direct impact on employment levels and consumer spending.

The ABSA results for the year to 31st December 2023 showed that its credit loss ratio had increased to 1,18% - up substantially from the 0,96% in the previous period. This shows that consumers are taking strain due mainly to the very high level of interest rates at the moment. Following its first world trading partners, South Africa raised interest rates rapidly by 4,75% in order to keep the return on its government bonds competitive and continue to attract to international investors. Inflation is hovering around 5%, but the economy is barely showing any growth and the higher interest rates are eating into consumers’ disposable income. The ratings agency Standard & Poors says that the banking sector in this country will face rising levels of debt defaults and expects losses of as much as R74bn across the sector. Our view is that while consumers are certainly taking considerable strain, banks are benefiting from the high levels of interest sufficiently to mostly compensate them for higher credit losses.

Stats SA reported that mining production fell by 3,3% in January 2024 from January 2023 and by 0,8% month-on-month. Manufacturing production grew by 2,6% year-on-year in January, despite a fall in the purchasing managers index (PMI). Both sectors have been impacted by high levels of loadshedding and on-going logistics problems at Transnet. High interest rates have also impacted directly on consumer spending and reduced demand for some manufactured products. Mining production has also been adversely affected by falling international commodity prices.

The decision by President Ramaphosa to re-appoint Reserve Bank Governor, Lesetja Kganyago and his team of deputy-governors, for a further five-year term in 2029 comes immediately before the elections on 29th May 2024. The appointments remove one of the great uncertainties inherent in this election – the possibility that a new coalition government might appoint persons less capable and responsible to handle this critical function in government. The Reserve Bank has arguably been the ANC’s greatest achievement during its 30 years in power. The governors have consistently adopted a conservative approach to monetary policy and resisted pressure to debase the currency for short term gains. With this move, Ramaphosa has entrenched the rand’s stability at least until 2029 irrespective of who wins the election. The move has been unanimously welcomed by big business.

The surprise prediction by Bank of America that South Africa’s rating would actually be improved by the international ratings agencies is based on a perceived improvement in the country’s fiscal position and anticipation of a period of declining interest rates. In our view, this prediction is probably too optimistic. The budget deficit has been steadily increasing for several years and is now at critical levels. This has to be added to an environment with endemic loadshedding and very debilitating logistics problems on our rail system and at our ports.

The South African cement industry is steadily losing ground to cheap imported cement products, mostly from Vietnam. Cement imports increased by 18% in 2023 and most of it came into the country in the six months ending on 31st December. In that six month period imports rose by 43% when compared to the same period in 2022. This is surprising given the problems being experienced at South African ports and on our rail system. The local cement industry has been begging the government to implement import tariffs. South Africa has the capacity to produce up to 20 million tons of cement a year, but it is currently producing only 12 million tons. Cement is a high bulk, low value product so it seems strange that our cement producers cannot compete with those in Vietnam who have to carry the cost shipping their product to this country. Local producers say that the imported products do not have to comply with the stringent local requirements for production - but they are clearly being bought locally despite that.

Stats SA reported that the formal sector lost 194 000 jobs in the 3 months to 31st December 2023. There were 10,7m jobs in the formal sector at the end of December, compared with 10,9m at the end of September 2023. Most of the lost jobs were in the mining sector where the drop in commodity prices has caused a rash of layoffs. A significant number of the jobs lost were also part-time jobs, but full-time employment saw 5000 fewer jobs. Overall, the unemployment situation in South Africa is grim with millions of adults out of work. Many of these generate an income in the informal sector or rely on the various government social grants such as the “Social Relief of Distress” (SRD) payments.

Drought conditions are likely to result in a much smaller maize crop this year with white maize production down 25% and yellow maize down 20%. The total crop is expected to fall by 20% to just over 13m tons. There was a 2,3m ton surplus of maize from 2023 which means that there still should be some maize available for export after all domestic requirements have been met. Despite this, the price of white maize, which is mostly used for human consumption, has increased by 25% from last year. The price of maize has a significant impact on the inflation rate over time.

Eskom

The Minister of Electricity, Kgosientsho Ramokgopa, says that loadshedding will be almost over by September 2024. He bases this amazing assertion on the return to service of about 6 gigawatts of power from various power stations, including Medupi, Matimba and Tutuka. He says that his services as Minister of Electricity will soon be no longer needed. This statement, coming as it does, on the eve of the election can only be seen as electioneering. It is well known that the ANC is polling very badly in the run-up to the election with several polls suggesting that it will be returned with less than 40%. South Africans who have been enduring loadshedding for 16 years are unlikely to believe what Minister Ramokgopa is saying.

The passing of the Electricity Regulation Amendment Bill is a step in the direction of creating a market-related price for electricity in South Africa and removing Eskom’s monopoly. The bill will see the establishment of a Transmission Systems Operator who will be independent of Eskom. Eskom will, in effect be reduced to just another electricity generator competing with the private sector. The objective is to create an environment where electricity generators will compete on price so that electricity prices come down. Eskom’s monopoly has made electricity increasingly expensive in South Africa. The bill was supported by the ANC and the DA and opposed by the EFF.

The Rand

In the March Confidential Report we spoke of the triangle that was building in the rand/US dollar exchange rate chart. At the time the rand was mid-way between the upper descending trendline and the lower rising trendline. Since then, the rand strengthened back to touch the lower trendline and then weakened back to its current position.

Consider the chart:

Here you can see that the oscillations in the rand are becoming progressively smaller and smaller. Since the beginning of last year these two converging trendlines have provided a good mechanism for anticipating where the rand will go next. But as you can see the triangle is narrowing steadily towards an inevitable break out that will determine its future direction.

As we mentioned last month, our view is that it will break through the upper trendline and move to more than R20 to the US dollar. The rand is a direct reflection of how South Africa is perceived by international investors. The fact that the ANC is widely expected to lose its majority in parliament at the election on 29th May creates an uncomfortable level of uncertainty which has seen some of these investors selling out of both our bonds and shares.

On the other hand, the rapid rise of the S&P500 index indicates that sentiment is definitely in a state of “risk-on” – and that is always good for emerging markets.

General

There is mounting evidence that the world is making progress in its move towards renewable energy and away from fossil fuels. In 2023 global additions to wind and solar power were 540 gigawatts – 75% more than in 2022. At the same time the sales of electric cars rose 35% to about 14 million. Carbon dioxide emissions rose 1,1% compared with a 1,3% increase in 2022 and would have fallen if it were not for the drop in hydro-power due to droughts in countries like America and China. In first world economies, emissions dropped to a 50-year low with the EU down 9% and the US down 4%. China’s CO2 emissions rose 5% and India’s rose by 7%. South Africa has seen its emissions drop by 0,8% between 2000 and 2020.

At the end of last year there were just under 10 000 senior management staff (SMS) running the various government departments. Of these, 1780 could not establish that they had the required qualifications for the jobs which they held. The requirement only came into force in 2017, so most of them had been employed prior to that date. The ANC’s policy of “cadre deployment” has meant that people have been employed because of their affiliation to the ANC rather than their suitability for the position. This has led to poor service delivery across the country.

The Treasury’s report on the performance of South Africa’s 257 municipalities is very concerning and shows massive and unsustainable mismanagement. Until 31st December 2023 they had collectively spent less than half the amount that they budgeted for operating and capital expenses. Their collections were dismal at about 50% of what was budgeted and capital expenditure was 31% of budget. Collectively they are owed R104bn, up nearly R3bn from the previous year, and collection rates are hovering around 58%. This means that most of them effectively run at a loss and are unable to provide and maintain critical services to their communities. The general lack of service delivery is becoming a major issue for the elections on 29th May this year.

A recent report produced by UCT suggests that climate change will have serious consequences in South Africa, especially for the poorest people. The expected increase in the frequency of droughts and floods is seen as the most serious problem for millions of South African’s dependent on subsistence farming to obtain sufficient food. Crop failures and a reduction in tourism will have a direct impact on the income of many families that are already in extreme poverty, especially in the rural areas. Indirect consequences like rising levels of crime and violence are also anticipated, together with more service delivery protest action.

Gold

Last month in the March 2024 Confidential Report we drew your attention to the fact that the US dollar price of gold was in the process of breaking up through an important and long-standing resistance level at $2060. Since then, gold has risen 7,8% to $2220.

This upward move is the result of increased global uncertainty from many different sources – most notably:

- The deteriorating situation in Ukraine in the absence of the US support package.

- The concern that equities are now over-priced and due for a major correction.

- The difficulty that first world central banks are experiencing bringing down inflation.

Many commentators are saying that there is now an increased probability of war between the NATO countries and Russia, especially now that some countries are discussing putting troops on the ground in Ukraine.

We have been warning for some time that equity markets have risen too far too fast and that some sort of correction is probably inevitable.

Inflation, especially in America is proving stubborn and there is a possibility that the Fed will delay reducing interest rates beyond June 2024.

Consider the chart of the US dollar price of gold over the past six months:

Companies

NEW LISTING

African Bank is expected to list its ordinary shares on the JSE in 2025. The bank is owned 50% by the Reserve Bank, 25% by the government employees’ pension fund (GEPF) and 25% by a consortium of commercial banks. The company expects to conduct an initial public offer (IPO) when it lists and is in the process of implementing an employee share option scheme that will enable its employees to participate in and benefit from the listing. In 2014 African Bank came close to collapsing, but was rescued by the Reserve Bank resulting in the current ownership structure. We expect that the listing of this share will offer private investors an opportunity despite the fact that the banking sector in South Africa is very crowded.

QUANTUM (QFH)

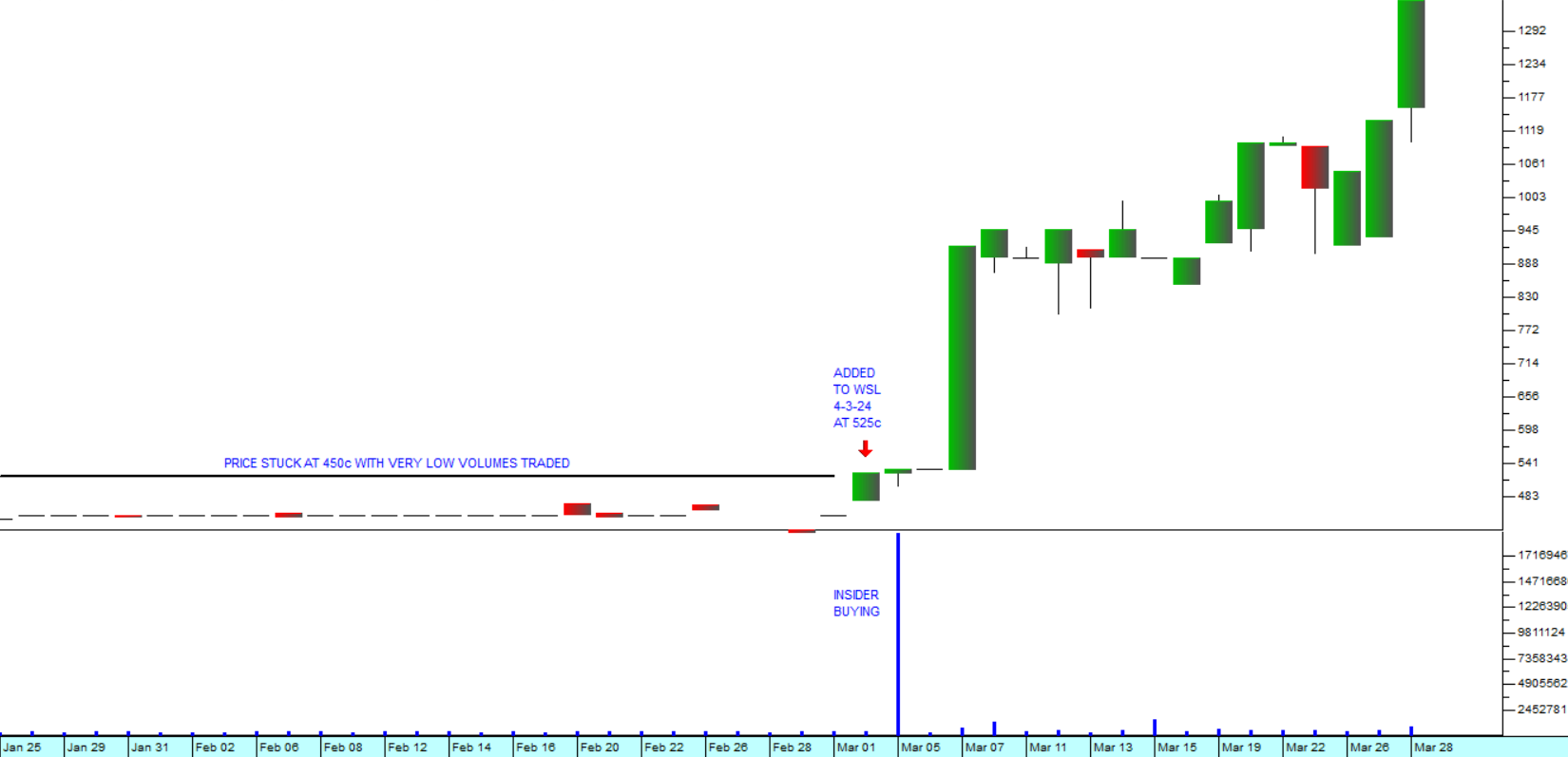

On the 5th of March 2024 we added quantum to our Winning Shares List (WSL) at a price of 525c. Our reason for adding the share was the sudden uptick in the share’s price from around 450c to 525c combined with a massive increase in the volume traded. Until that day, Quantum had traded for around 450c on volumes of around 3500 shares each day for months and months.

On Thursday (29-2-24) and Friday (1-3-24) there was a definite uptick in the volumes traded with 17 900 and 12 000 shares traded respectively.

On 4th March more than 100 000 shares changed hands and the share closed at 525c. Clearly, someone knew something important and was buying up all the shares they could lay their hands on. We call these buyers the “strong hands” because they knew that the share was about to rise sharply and they were buying from the “weak hands” who, ignorant of what was about to happen, were just happy to sell for a slightly better price. Consider the chart:

If you read through the messages on the Stock Exchange News Service (SENS) it is clear that something momentous is happening – but exactly what it is has not yet been clarified. And it does not really matter who is accumulating these shares so aggressively. The point is that in a matter of 18 trading days the share has risen by 157% and you would have benefited from that if you acted when the share was added to the Winning Shares List.

As a private investor it is important for you to recognise the presence of insider trading in a share as and when it occurs.

Under normal circumstances we would not advise investing in a share like Quantum because the chicken business is probably the most difficult business in South Africa. It is plagued by stiff competition both from local producers and the dumping of chicken onto our market by overseas producers, it is very capital and labour intensive and it is subject to unpredictable outbreaks of diseases like avian flu.

MIX TELEMATICS (MIX)

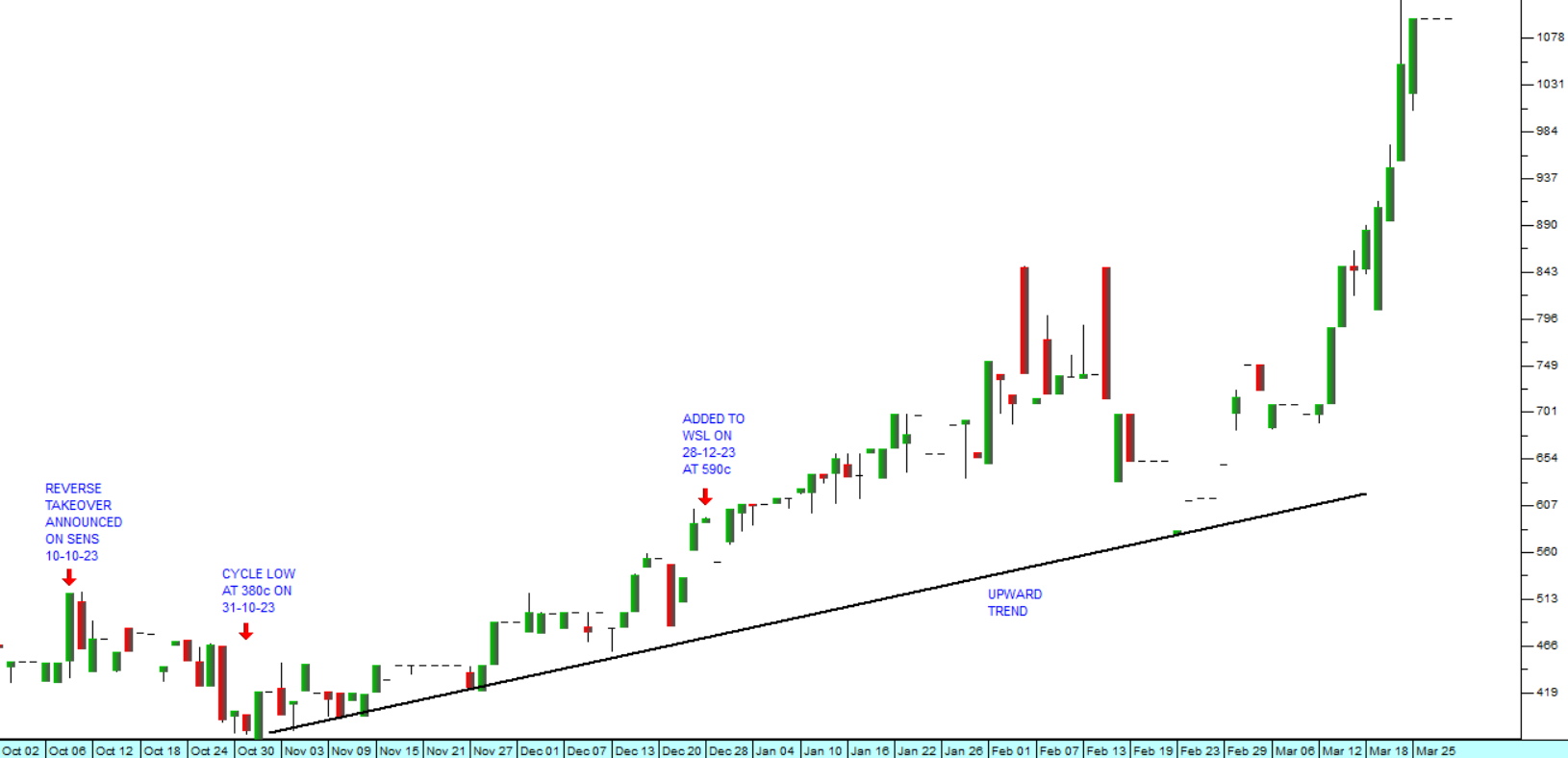

Mix is a small vehicle tracking company that has been listed on the JSE and the NASDAQ in America since 2007. Because of its small size, it has struggled to attract the interest of institutional fund managers and other investors. To overcome this problem the company decided to execute a reverse takeover of a competitor company also listed on the NASDAQ called “Powerfleet”.

A reverse takeover occurs when one company buys another for shares in such a way that the shareholders of the company being acquired end up controlling the combined entity. We say that Mix was reversing in to Powerfleet, and taking over its listings on both on the NASDAQ and the JSE.

The decision to do this reverse takeover was contained in a SENS announcement published on 10th October 2023. At the time we did not pay much attention because while the takeover would certainly increase the company’s size it would still be much smaller than its main competitor Karoo (KRO).

However, in the succeeding months it became clear that the new larger merged company was attracting some attention from institutional investors. After making a cycle low on 31st October 2023 at 380c, the share was moving up nicely on increased volumes. We decided to add it to the Winning Shares List on 28th December 2023 at a price of 590c. Consider the chart:

As you can see from the chart above, Mix’s shares have now risen sharply to 1100c which is an 86% gain from when they were added to the WSL just 3 months ago.

Reverse takeovers of this sort do happen occasionally on the JSE, but they are not common, and they do not always result in the share rising like Mix has done. Like all takeovers, the outcome depends on how good the company being taken over is as a fit. In other words, does it bring significant economies of scale and new marketing opportunities? The Mix/Powerfleet takeover was obviously very effective and has created a new larger and more powerful business with good growth opportunities.

HARMONY (HAR)

Earlier we talked about the fact that the US dollar price of gold has broken strongly up through its long-term resistance at $2060. The reasons for this include an increase in the political risk associated with various conflicts around the world such as Gaza and Ukraine. The perception among international investors that the risks of holding paper assets like currencies, equities and bonds are increasing is also causing the gold price to rise.

To capitalise on this development we added Harmony to the Winning Shares List on 16th November 2023 at a price of 9920c. Harmony is an interesting gold mine because it has traditionally been a marginal operation (i.e. one where the cost of extraction is relatively close to the spot price of gold) but with the higher grades being obtained at Mponeng gold mine has become more of a “heavyweight”.

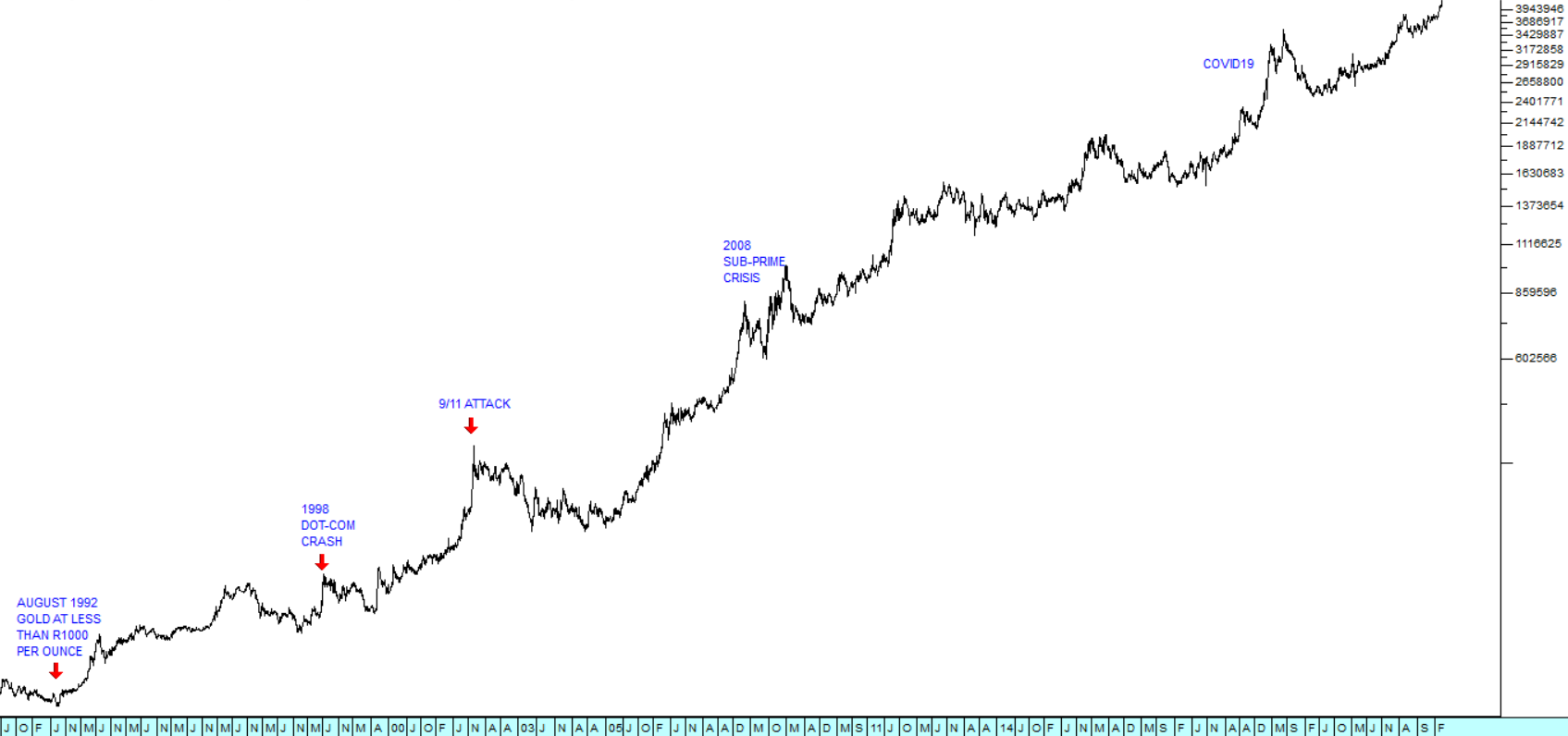

Of course, Harmony receives the rand price of gold for its production – so it benefits directly from any weakness in the rand/US dollar exchange rate. The rand price of gold has gone up much more quickly than the dollar price. In fact, over the long term gold in rands has performed extremely well. Consider the chart:

As you can see gold has risen from less than R1 000 per ounce in 1992 to current levels around R42 000. It has protected investors from various international financial problems like the dot-com crash in 1998, the 9/11 attack on the World Trade Centre in 2001, the sub-prime crisis in 2008 and COVID-19 in 2020.

Harmony has performed extremely well since we added it to the WSL rising to its close last Thursday at R158 per share – a gain of 59% in just over 4 months. Consider the chart:

We expect the dollar price of gold to continue rising and the rand to continue weakening against the dollar. So, Harmony’s shares should continue to perform well. The benefit of buying a gold share rather than gold itself is that the share will generate dividends if the company is profitable.

BELL (BEL)

Bell Equipment is a manufacturer and distributor of heavy equipment, earth-moving equipment to the mining construction, agriculture, and waste management industries. Bell's articulated dump trucks are exported world-wide from South Africa and Germany. Bell also has dealerships for a number of other global manufacturers, giving it a product range of over 120 products. Roughly 60% of its business comes from outside South Africa. In its financials for the year to 31st December 2023 the company reported revenue up 32% and headline earnings per share (HEPS) up 69%. The company’s net asset value (NAV) increased 21% to 5527c per share. This means that this highly profitable business is now trading at just 45% of its NAV. The company’s balance sheet is solid with interest bearing liabilities of R157,5m and bank balances of 251,8m. Only 40% of its business is generated in South Africa which makes it a rand hedge. Consider the chart:

As you can see in the chart above, Bell made a cycle low on 24th March 2020 during COVID-19 of 250c. Since then, it has been in a strong upward trend. We added it to the Winning Shares List (WSL) on 27th October 2023 at 1875c. Since then, it has climbed to 2480c – a gain of 33% in five months. Because it is still trading well below its NAV and is highly profitable, we continue to regard it as a bargain.

BALWIN (BWN)

This company is a property developer that is in the process of moving into the rental business in order to provide it with a steady annuity income. At just 188c per share, it is trading at a massive 78% discount to its net asset value (NAV), which makes it a bargain in our opinion. The property development industry is very volatile and impacted by the current high level of interest rates and constrained consumer spending. That difficult environment is expected to change later this year when interest rates begin to come down. The company is focused on increasing its rental income and that part of the business is expected to have contributed roughly 5,5% to its revenue in the year to 29th February 2024. As that side of the business grows the company’s profitability will become less volatile and the share price should improve. In addition, the share is trading on a very attractive dividend yield (DY) of 6% which is far above the JSE average of 4%. Its P:E ratio is at 2 which is way below the JSE’s average of 13. Given that its assets consist primarily of properties, by buying this share you would be getting 824c worth of property assets for just 188c. Consider the chart:

You can see that Balwin shares, in line with many property shares, have been trending down for the past three years. They have now reached a point where we believe that they represent exceptional value. If you are a value investor, then this probably represents the best value on the JSE right now. If you are very conservative you would wait for the share to break up through its downward trendline before buying, but, if you are not that risk averse, you could begin to accumulate it at these very low levels.

DISCLAIMER

All information and data contained within the PDSnet Articles is for informational purposes only. PDSnet makes no representations as to the accuracy, completeness, suitability, or validity, of any information, and shall not be liable for any errors, omissions, or any losses, injuries, or damages arising from its display or use. Information in the PDSnet Articles are based on the author’s opinion and experience and should not be considered professional financial investment advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Thoughts and opinions will also change from time to time as more information is accumulated. PDSnet reserves the right to delete any comment or opinion for any reason.

Share this article: