Bear Pick - Balwin

29 August 2022 By PDSNETAfter Friday’s bloodbath on Wall Street, we believe that most investors now understand clearly that world stock markets are in a primary bear trend which is still far from over. Federal Reserve Bank Governor, Jerome Powell’s 10-minute speech at the Jackson Hole symposium left very little room for doubt.

Powell said that it would take some time to bring America’s inflation rate back down to 2% from current levels around 8,5%. He said that the Federal Reserve Bank would not reduce interest rates prematurely and that consumers and businesses would feel some pain as inflation was brought under control. The S&P500 fell 3,37% to 4058.

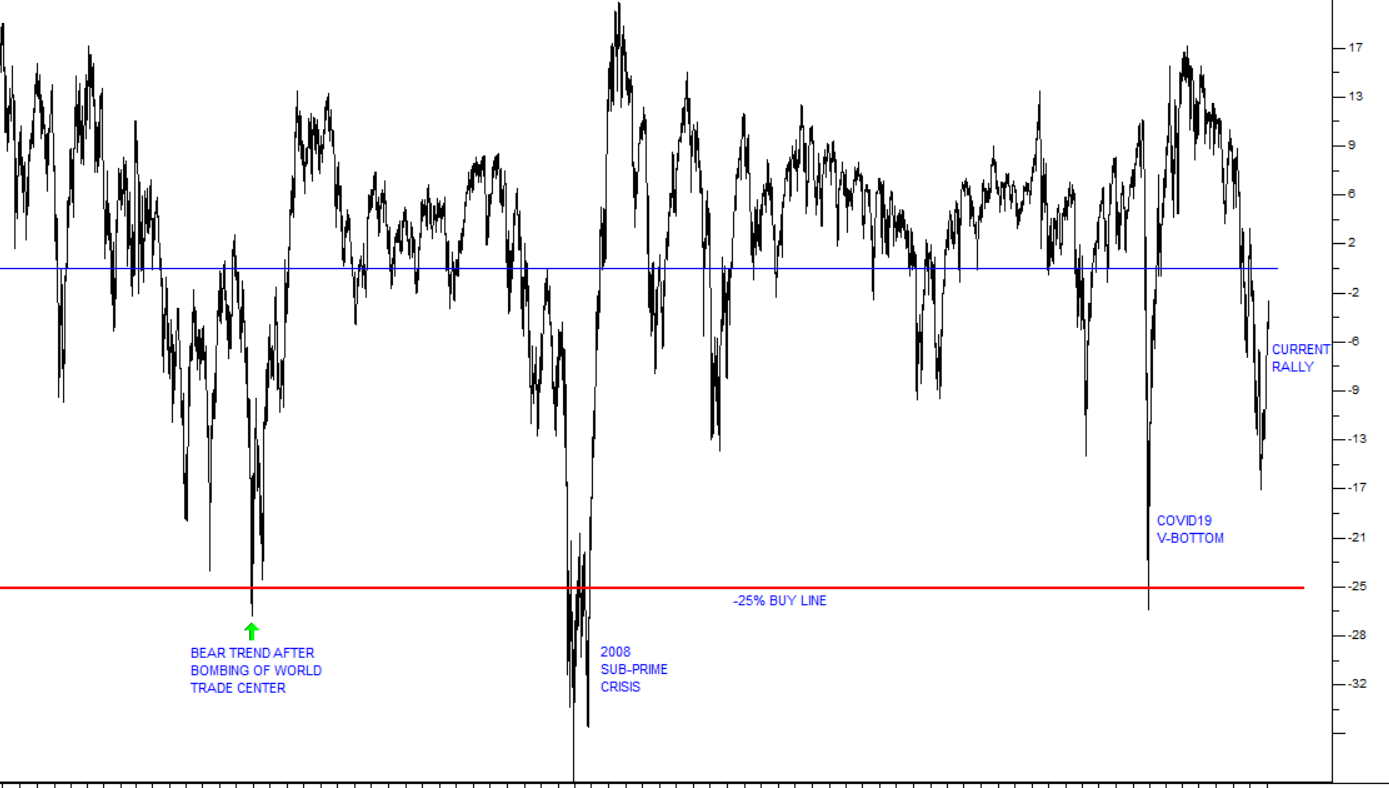

On 20th June 2022 we published an article “Bear Trend” in which we stated that Wall Street’s 13-year bull trend had come to an end, and it was firmly in a bear trend. Since then, and throughout the rally of the last 2 months, we have repeatedly warned that the bear trend was still in place and that the rally would come to an end. That has now happened. Consider the following chart of the S&P500:

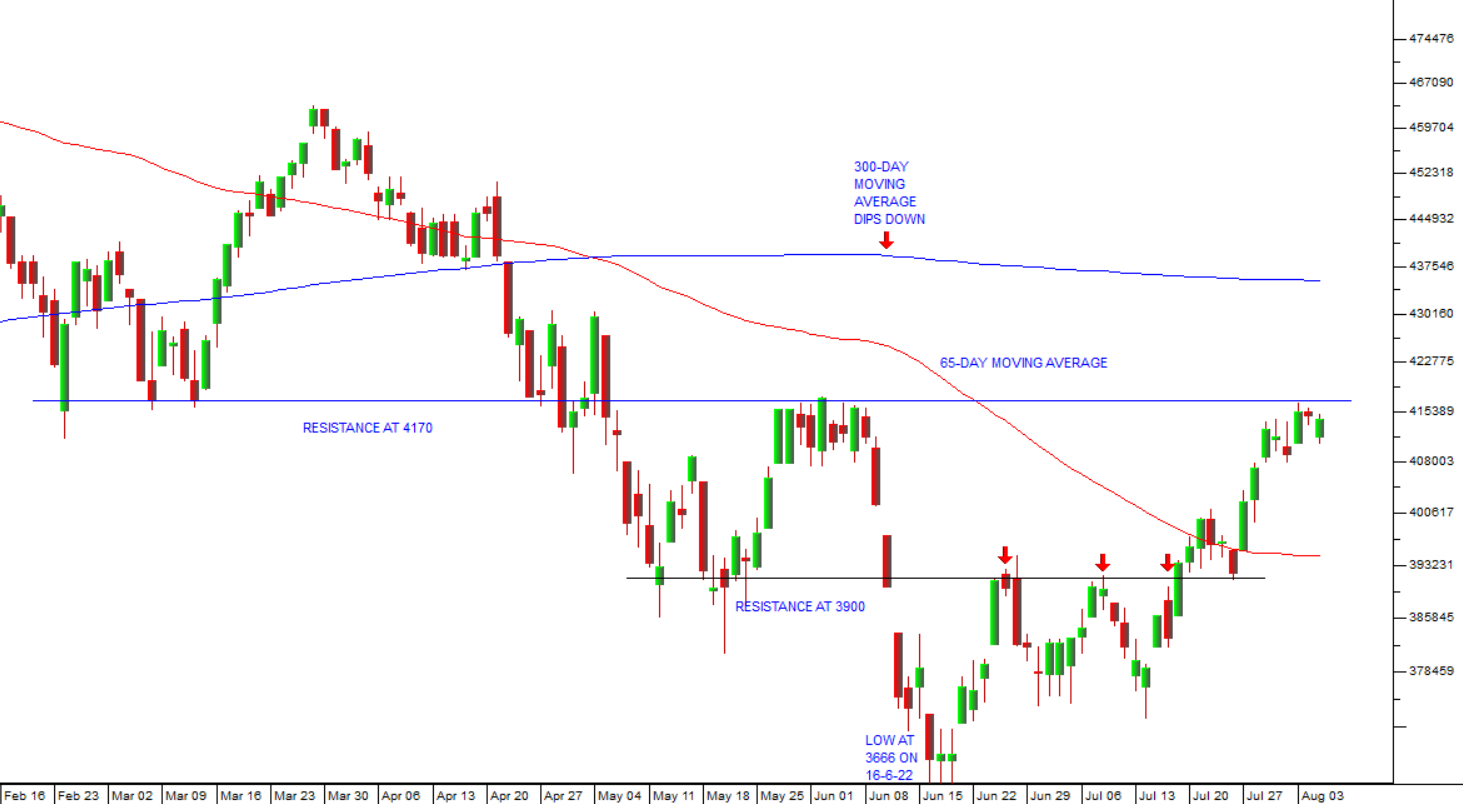

This chart shows the anatomy of the bear market rally from the low of 3666 on 16th June 2022 to its high two months later on 16th August 2022. The importance of the 4170 support/resistance line is clearly visible – as is the impact of the Jackson Hole symposium and Jerome Powell’s remarks. We expect this index to fall further and break below the low at 3666 in time.

A bear trend can, however, be an exciting time for the private investor because high quality shares are getting cheaper and cheaper. The trick now is to look for shares that represent exceptional value - and begin accumulating them judiciously.

In our view, Balwin Properties (BWN) is such a share for a number of reasons. Balwin is the largest secure sectional title developer in South Africa. It develops properties for the low-to-middle income population. Even during the current economic difficulties, there is a strong demand in South Africa for this type of accommodation.

At the same time, Balwin is developing an annuity income by installing high-speed fibre into its homes. In the year to 28th February 2022, the company connected a further 2001 homes - a 45% increase over the previous year.

From an investor’s perspective the interesting aspect of this share is that it is trading in the market for 250c per share, but it has a net asset value (NAV) of 749c per share. This means that you can buy these shares for about one third of the value of their net assets – and those assets are primarily property assets which means that their values are very reliable.

Furthermore, the share is now trading on a price:earnings ratio (P:E) of 3,29 and in its most recent trading statement for the six months to 31st August 2022 (published on Thursday last week), it estimates that headline earnings per share (HEPS) will increase by between 40% and 50%. It is also trading on a dividend yield of 6,69%. This makes it a highly profitable company which is offering investors exceptional value with a very good dividend return.

Obviously, the share could fall further because of the bear trend, but at the current price of 250c it is already a steal. If it falls further, then it will surely become even better value. Of course, you do not want it to fall through your stop-loss level – so you should “keep some of your powder dry” and accumulate it over a period time, averaging down if it falls further.

It trades about R250 000 worth of shares on average each day – so there is sufficient volume for private investors, but not enough yet for big institutions. We predict, however, that sooner or later this company must begin to attract institutional attention.

DISCLAIMER

All information and data contained within the PDSnet Articles is for informational purposes only. PDSnet makes no representations as to the accuracy, completeness, suitability, or validity, of any information, and shall not be liable for any errors, omissions, or any losses, injuries, or damages arising from its display or use. Information in the PDSnet Articles are based on the author’s opinion and experience and should not be considered professional financial investment advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Thoughts and opinions will also change from time to time as more information is accumulated. PDSnet reserves the right to delete any comment or opinion for any reason.

Share this article: