Remgro

14 August 2023 By PDSNETSix weeks ago, on the 3rd of July 2023, we started the Winning Shares List (WSL) as a mechanism to help clients with their share selections. The idea of the list is that we add shares as our analysis shows that they have potential to go up by at least 30% per annum, excluding their dividends.

Our analysis, as always, is both fundamental and technical with a view to broader economic trends. Since no one can be 100% accurate in their share selections, we urged clients to maintain a strict stop-loss strategy so as to eliminate those shares where we got it wrong.

By the end of last week, we had thirty shares on the WSL, of which twenty-three were up and 7 were down. In order to achieve at least a 30% per annum capital gain, we require that shares go up by at least 0,082% (30/365) per calendar day. The WSL is available to clients on our web site (www.pdsnet.co.za) and on the Data Center.

On the day that we started the WSL (3/7/23) one of the shares we added was Remgro at a price of 14908c. On the previous trading day, 30th June 2023 we had updated our opinion on Remgro in response to the Mediclinic results and said of Remgro, “We think it remains good value at current levels”.

Remgro is a diversified investment holding company with the following shareholdings at 31st December 2022: Mediclinic 44.6%, OUTsurance 30.6%, Community Investment Ventures Holdings Proprietary Limited (CIVH) 57.0%, Distell 31.7%, RCL Foods 80.2%, Siqalo Foods 100.0%, FirstRand 2.2%, Discovery 7.8%, Air Products 50%, Total Energies 24.9% and Kagiso Tiso 43.5%.

Like most investment holding companies, Remgro trades at a significant discount to its intrinsic net asset value (INAV). Last Friday (11-8-2023) the share closed at 15799c – a 29,4% discount to its INAV of 22386c per share. This discount makes it immediately attractive, because it has already shown its propensity to release shareholder value by unbundling various assets, especially in RMIH (now OUTsurance).

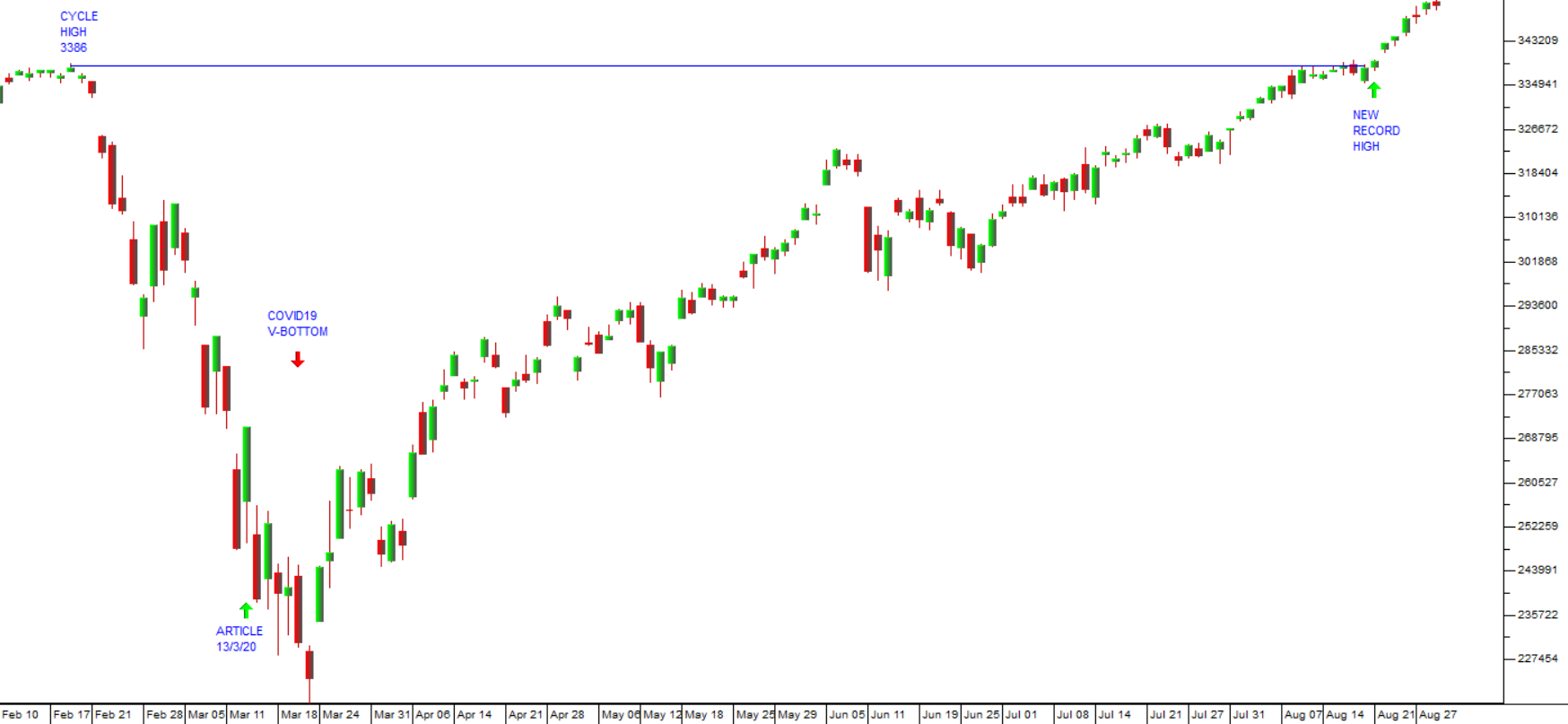

Technically, after its recovery from the impact of COVID-19, the share moved sideways from June 2022 until June 2023. Then it staged an upside breakout on the 3rd of July 2023 – which is when we added it to the WSL. Consider the chart:

It is well known that when a share moves sideways for a protracted period and then has an upside break as you see in chart above, the longer the sideways move, the stronger the subsequent upside move will be.

Using the low point in the sideways move (12573c on 14-7-2022) we can calculate the potential upside of the current move in Remgro. Our calculations indicate that Remgro could go as high as 25000c. Such “horizontal count” methods of determining the potential upside of a move are approximately 80% accurate in our experience and often under-estimate the potential.

Since we added Remgro to the WSL it has risen by about 6% in 40 days – which is the equivalent of 54,75% per annum (365/40 X 6%). We expect it to continue to perform strongly and certainly to remain at our benchmark of 30% per annum.

DISCLAIMER

All information and data contained within the PDSnet Articles is for informational purposes only. PDSnet makes no representations as to the accuracy, completeness, suitability, or validity, of any information, and shall not be liable for any errors, omissions, or any losses, injuries, or damages arising from its display or use. Information in the PDSnet Articles are based on the author’s opinion and experience and should not be considered professional financial investment advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Thoughts and opinions will also change from time to time as more information is accumulated. PDSnet reserves the right to delete any comment or opinion for any reason.

Share this article: