The Future of Inflation

13 February 2020 By PDSNETThroughout the world, especially the first world, inflation is subdued. In the G7 countries, inflation remains stubbornly under 2% despite the efforts of central bankers. At the same time, in most first world economies, unemployment rates have fallen below the level that most economists consider to be “full employment”. Central banks world-wide are all focused on getting inflation back above 2% and so their policies are typically “dovish” and none of them are at all concerned about any kind of resurgence in inflation.

Of course, world inflation has been held down by two major parallel trends – the on-going fall of energy prices and the spread of new technologies which have brought massive productivity gains. These two trends have obscured the gathering of inflationary pressures in the world economy.

The world has just come through a decade of the most intense monetary policy stimulation in history. In their scramble to avert the fall-out from the 2008 sub-prime crisis, the central banks of the world maintained interest rates at close to zero for ten years and injected more than US$12,5 trillion into their economies through quantitative easing. Where has all that cash gone? Nobody seems to be asking that question. Its as if that massive injection of funds never happened.

And yet that cash is still there. The non-financial companies of the world are sitting on at least $7 trillion in cash – which until now they have been too frightened to spend. Indeed, it is their renewed spending which is now driving the US economy towards and beyond full employment. And we believe that they will not only spend that $7 trillion, but they will ultimately borrow five times as much and spend that too.

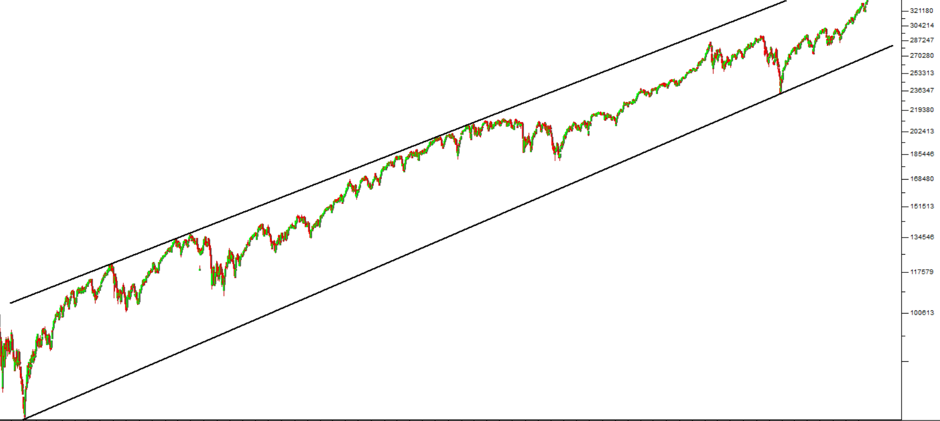

The stock market continues to power upwards with the S&P500 index making new record highs continuously. Consider the chart:

The great bull market, which began on Friday 6th March 2009 when the S&P touched 666 has been in progress for almost 11 years – longer than any previous bull trend.

Clearly, investors see a continuation and even strengthening of the boom conditions in America; they see this prosperity spreading to the rest of the world; and they see it gaining momentum. This too is reflected in commodity prices which have been in a strong bull trend since the start of 2016.

Here at PDSnet, this is the fulfillment of what we have been writing about for many years – an economic boom which is gaining momentum and the inexorable rise of the S&P500 index together with all the markets of the world. We see the resurgence of world inflation as an inevitable next step in this great bull market. Although the signs of renewed inflation are still muted, they are there for those who care to look. The sharp rise in commodity prices and a growing shortage of skilled workers as the economies of the world reach full employment.

But perhaps the most telling sign is the fact that central bankers are looking the other way. They are totally unprepared for a sharp rise in inflation. Ken Griffin of Citadel makes this point as does Ethan Harris of BoFA Securities and others. We feel certain that this decade of the twenty-twenties will be characterised by rising inflation and boom conditions world-wide. The smart investors of the world already know this – which is why the S&P500 keeps making new record highs. You should understand that while the JSE has been a comparatively poor performer because of local factors, it will almost certainly catch up at some point.

DISCLAIMER

All information and data contained within the PDSnet Articles is for informational purposes only. PDSnet makes no representations as to the accuracy, completeness, suitability, or validity, of any information, and shall not be liable for any errors, omissions, or any losses, injuries, or damages arising from its display or use. Information in the PDSnet Articles are based on the author’s opinion and experience and should not be considered professional financial investment advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Thoughts and opinions will also change from time to time as more information is accumulated. PDSnet reserves the right to delete any comment or opinion for any reason.

Share this article: