Grit

17 February 2020 By PDSNETPrivate investors in 2020 are faced with a domestic economy that is performing badly. South Africa is missing out on the world-wide boom in commodities because of our penchant for “shooting ourselves in the foot” economically.

In this environment it is quite natural for investors to seek solid safe investments that offer a decent return – preferably in a hard currency.

One of the best options at the moment is Grit – a real estate investment trust (REIT) which specialises in investing in African property outside of South Africa and which is listed on the JSE and in London. It owns a variety of properties in Ghana, Botswana, Morocco, Kenya, Mauritius, Zambia and Mozambique with a weighted average lease expiry of 6,5 years and annual escalations of 3,1%.

Grit recently acquired an 80,1% stake in the Acacia estate in Maputo for $23m. This estate has long-term tenants in the form of the US embassy in Maputo with a 12-year lease and Anadarko which is busy with the exploitation of natural gas in Mozambique. This is an excellent low-risk acquisition which will improve the quality of Grit's portfolio. On 25th October 2019, Grit announced that it had a pipeline of 7 properties that it was in the process of acquiring - 2 in Ghana, 2 in Kenya, 2 in Mauritius and 1 in Mozambique. The cost is just over $100m.

In its results for the year to 30th June 2019, the company reported a loan to value (LTV) ratio of 40,6% with assets worth US$825,2m. 95,4% of their income is in hard currencies and they have a 97,1% occupancy rate. The company delivered a yield of 8,5% in US dollars and is targeting a yield of 12% for the 2020 year. Headline earnings per share (HEPS) was up 27,4%. In its results for the six months to 31st December 2019, the company reported net property income up by 15,7% and HEPS up by 1,1%. The company's net asset value (NAV) decreased by 1,1%. The company says it is on track to deliver an attractive 12% return in US dollars to investors in the year ended 30th June 2020.

The share is trading on a dividend yield of 5,18% and an earnings multiple of just over 14. The share is relatively thinly traded, but over the past 30 trading days has averaged 23 300 shares traded with a share price of around R16.50 – which gives a value of R384 000 changing hands. This makes it practical for investors to consider investments of up to at least R100 000 in our view.

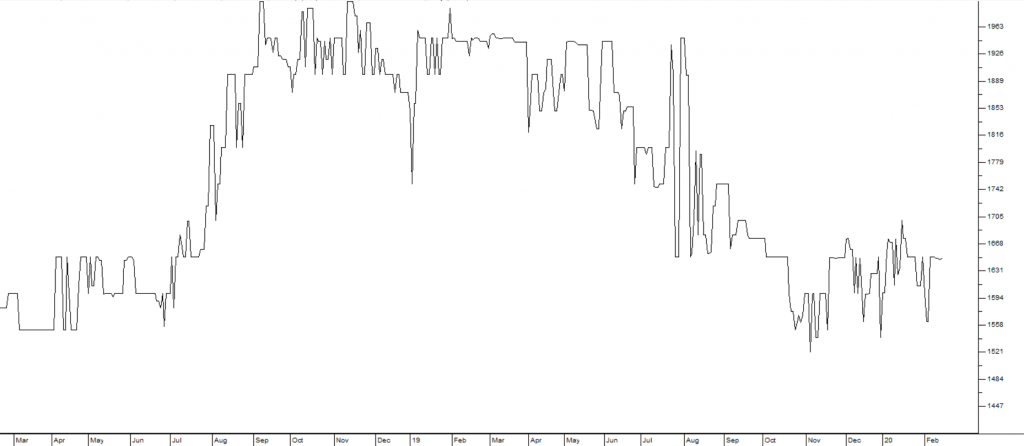

Clearly, this is not a share which the big institutions (pension funds, unit trusts and insurance companies) follow or invest in – but it has an excellent track record and pays good dividends. Sooner or later it is bound to attract institutional interest both in South Africa and in London – then the share should be re-rated upwards. Consider the chart:

The slightly square and “blocky” shape of the chart indicates its relatively thin volumes traded – and on many days there are no trades, but we think that in the relatively near future it will begin to be better traded as institutions appreciate its merits and as it gains in size.

DISCLAIMER

All information and data contained within the PDSnet Articles is for informational purposes only. PDSnet makes no representations as to the accuracy, completeness, suitability, or validity, of any information, and shall not be liable for any errors, omissions, or any losses, injuries, or damages arising from its display or use. Information in the PDSnet Articles are based on the author’s opinion and experience and should not be considered professional financial investment advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Thoughts and opinions will also change from time to time as more information is accumulated. PDSnet reserves the right to delete any comment or opinion for any reason.

Share this article: