WeBuyCars - Follow-up

WeBuyCars (WBC) was spun out of Transaction Capital (TCP) and separately listed on the JSE on 11th April 2024 – just over three months ago. Before the listing we published an article on the 8th of April 2024, in which we suggested that the share would be a solid blue-chip share favoured by the big institutions (pension funds, unit trusts and insurance companies).

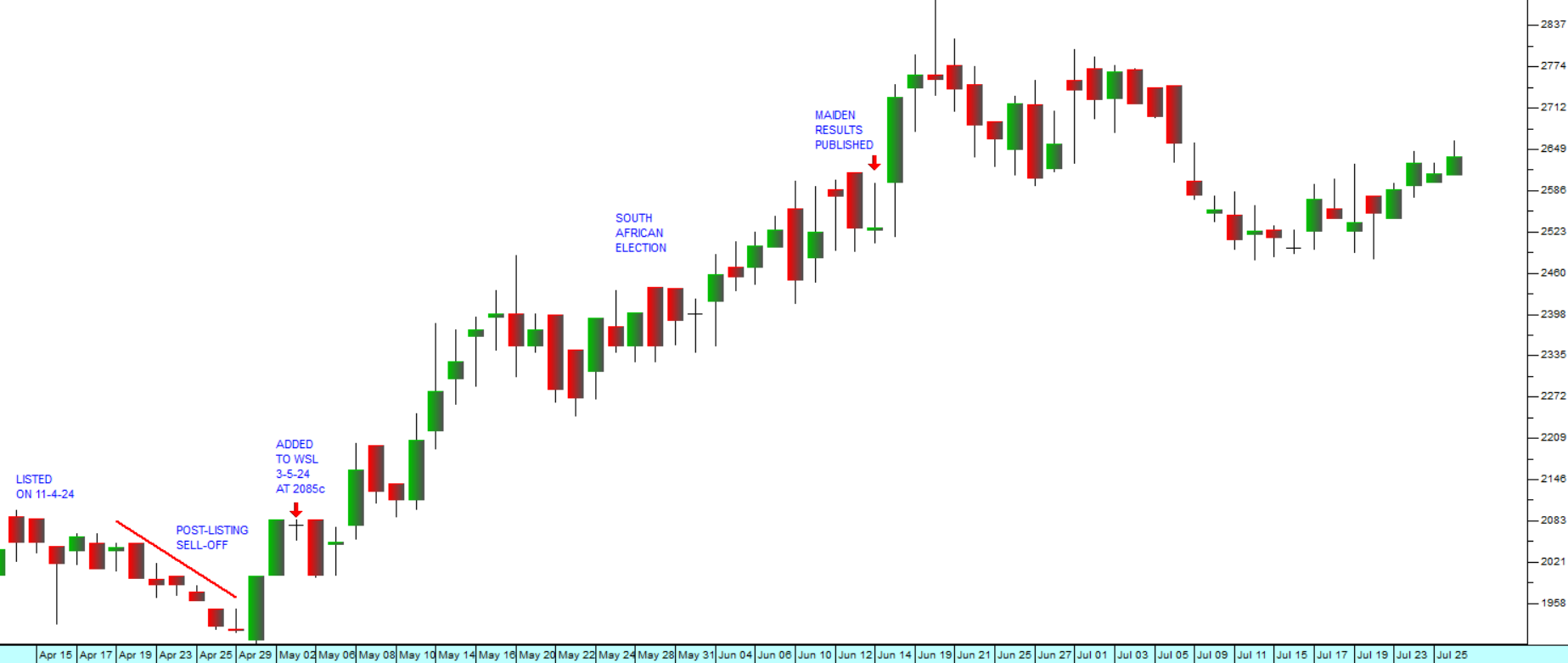

In most new listings some of the people who received the shares as part of the unbundling do not want them and so sold them on the open market shortly after they began trading on the JSE. This caused a post-listing sell-off which saw the share fall to a low of 1918c on 29th April 2024.

Once the selling stopped, the share began to rise and it has been rising ever since. Consider the chart:

The chart shows the post-listing sell-off and the subsequent upward trend. A major factor in the timing of the listing was the impending elections on 29th May 2024 which added a significant degree of uncertainty. As it happens, the election result and the subsequent appointment of the Government of National Unity (GNU) has worked in WBC’s favour noticeably improving investor sentiment towards South Africa.

After the elections, WBC published its maiden interim results for the six months to 31st March 2024. As expected, these results were very good with revenue increasing by 15,9% and headline earnings per share (HEPS) up 26,1%. Once the results were out, there was a second sell-off which lasted until 16th July by those investors who had just waited for their publication in the hopes of getting a better price.

It is safe to assume that those shareholders who still hold the share are long-term investors who see the potential of this company and its ability to benefit directly from the post-election South African economy.

The published financials revealed some interesting facts about the company. Firstly, it has debt of R1176m which is made up of R726,3m in mortgage bond finance for the various motor car show rooms which it owns and R449,7m in working capital used to finance its stock of used cars. During the six months WBC bought and sold over 80 000 used cars – which means that the 10509 parking bays which it has on its dealership floors were actively and continuously utilised. Its stock turnover shows that vehicles do not remain for long in its show rooms.

The balance sheet also shows that the company had R914m in cash, debtors of R300m and stock of R2127m – a total of R3341m to fund current liabilities of R2455m. Given the strong cash flows in the business, this makes the balance sheet very strong.

The company has been growing rapidly over the past three years. In 2021 it was selling 7000 vehicles a month and it is now selling double that number. It intends to increase sales to 23000 a month by 2028 and it has secured prime locations in the Eastern and Western Cape for new show rooms.

In our view this is an excellent blue-chip investment with a well-proven business model that will benefit directly from any improvements in the economy and the anticipated reduction in interest rates expected to begin from September this year.

We added WBC to the Winning Shares List (WBC) on 3rd May 2024 at 2085c per share. It has already risen to 2640c – a gain of more than 25% in under three months. We expect it to continue appreciating steadily.

← Back to Articles