The Gold Price

Gold has been known and prized since the dawn of history. Soft, malleable, heavy, corrosion-free, and very rare – it is the ultimate store of value. All the gold ever mined throughout human history would not fill a cube 27 meters on a side. One ounce of gold will buy you roughly the same number of chickens today as it would have bought you in Egypt 5000 years ago. The purchasing power of gold has not changed significantly throughout history. So, when the announcer on TV says that the price of gold went up, it is probably not true – the dollar or the rand or both went down. Currencies go up and down against gold, but the purchasing power of gold hardly ever changes. It is the one over-arching constant in a financial world of volatile fiat currencies and increasingly complex derivative instruments.

The gold in South Africa is unusual in that it is in “conglomerate form” – not alluvial. In geological terms, our gold is contained in the compressed silt of an ancient sea bed. That layer of silt is called the “reef” and still contains the shells of ancient molluscs and other creatures that fell to the bottom of that sea. Known as the Witwatersrand Basin, it is one of the largest gold deposits in the world. The elliptical basin stretches over an area of over 400 kilometers through the Free State, North West and Gauteng provinces and goes as deep as 5 kilometers below the surface. The only problem is that today the remaining gold is mostly too deep to be mined economically. The reef breaks the surface just south of Johannesburg and tips towards the south at an angle of about 20 degrees like a cracked plate which varies in thickness and the grade of the gold which it contains.

Obviously, because gold is so heavy, the deeper you go the higher the grade tends to become. For that reason, the deepest mines in the world are here in South Africa. Mponeng gold mine, near Carletonville and owned by Harmony (HAR), is the deepest at over 4000 meters. At that depth, the rock temperature is well over 60 degrees Celsius – far too hot for human beings to exist. So, the mine has a large crushed ice plant which produces a constant flow of crushed ice which is pumped down to the working areas – where it melts and the water is pumped back up and turned back into crushed ice. The cycle goes on 24 hours a day.

Mponeng is so deep that to reach the bottom you must take three separate lifts. And Mponeng is planning to go deeper. The grade is even better at 5000 meters!

In the late 1930’s it was widely believed that the gold mining industry in South Africa was reaching the end of its life. The mines were getting too deep to mine profitably. And then the “heap leaching” method of extracting gold was discovered. This method greatly reduced the cost of extracting the gold and gave the mining industry in South Africa a new lease of life.

Today, the South African mining industry is again under threat. From mining over 1000 tons of gold in 1970 (which was more gold than all the other countries of the world together) South Africa only produced 110 tons in 2022 and is now the world’s 12th largest producer.

Demand for gold comes from two sources:

- As a hedge against inflation for both central banks and individuals, and

- To supply the jewellery market.

Its rarity makes it an ideal reserve asset for central banks, but it has the enduring problem that it does not generate a return. It pays no interest, dividends or rent and it does not increase its weight by 5% per annum – so central banks always have to consider the option of swapping their gold for US treasury bills where they can at least earn some interest.

Historically, the price of gold responds positively to political and economic instability - and especially to wars and the threat of wars. During a war, fiat currencies are typically debased as governments strive desperately to finance a massive destruction of wealth. Gold provides an ideal hedge against this because it can be easily transported and stored, and it is in demand and accepted throughout the world.

Today there is rising concern about the future of the world economy with many economists predicting a serious recession beginning towards the end of 2023 or in 2024. This recession will be a direct result of the rising interest rates and quantitative tightening (Q/T) being applied by central banks to constrain and reduce inflation. The inflation that they are worried about is a result of the extended period of ultra-low interest rates and massive quantitative easing (Q/E) that followed firstly the sub-prime crisis in 2008 and then subsequently COVID-19 in 2020. Consider the chart of the US dollar price of gold over the last 7 years:

Here you can see the progress of gold since the beginning of the current boom in commodity prices in December 2016. COVID-19 had a very short term negative impact which quickly turned positive when investors realized that the universal central bank reaction to the pandemic was to engage in even more Q/E.

From August 2020 the gold price in US dollars moved sideways and downwards until September 2022. Between September and November it then completed a “triple bottom” at $1630. A triple bottom is perhaps one of the most bullish technical signals that you can see on a chart and the price immediately began to rise. Today gold is trading for just under $2000 and looks set to break above the key resistance level at about $2050. If it does that, we expect a strong upward trend to follow.

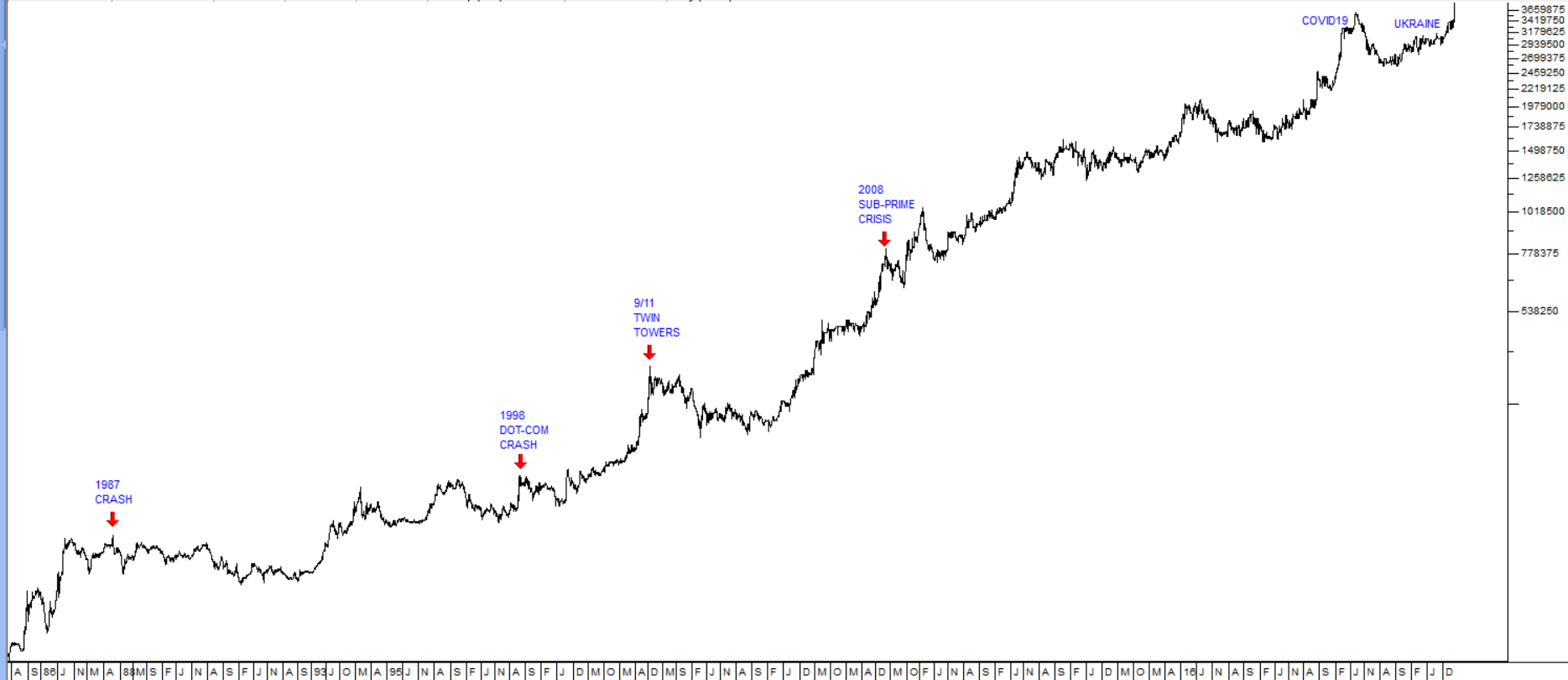

Of course, as a South African private investor, you need to be aware of the rand price of gold. Consider the long-term chart of the 1-ounce krugerrand:

This shows the krugerrand price going back to 28th February 1985. On it we have marked the 1987 crash, the 1998 dot-com crash, the 9/11 Twin Towers attack, the sub-prime crisis of 2008, COVID-19, and the Ukraine war.

A single 1-ounce krugerrand would have cost you R595 on 28th February 1985. On Friday last week they closed at R39000 each. So, you can see how gold coins would have protected your wealth from all market collapses and other developments over the past 38 years. And krugerrands have the added advantage that they are accepted in every major city throughout the world. We have always said that, given the relative political instability in this country, South Africans should keep about 10% of their wealth in gold.

← Back to Articles